Abstract

This study aimed to measure the impact of the Russian-Ukrainian war on the value of wheat imports to the Gulf Cooperation Council, using the Herfindahl-Hirschman coefficient and the (t) test, estimating the demand functions for wheat imports, and predicting the quantity of imports. The study showed that the Arab Gulf countries imported wheat from the Russian Federation and Ukraine in varying proportions. The Kingdom of Saudi Arabia followed a policy of economic diversification in wheat import sources, followed by the Sultanate of Oman, Qatar and the United Arab Emirates. As for the States of Kuwait and the Kingdom of Bahrain, their wheat import policy was characterized by geographical concentration. There was also a significant difference between the average global wheat import price and its counterpart for Bahrain, Kuwait and Qatar. 10 % increase in wheat import prices for Bahrain, Oman and the United Arab Emirates leads to a reduction in the quantity of wheat imports by rates of 5.49%, 8.13% and 5.34%, respectively. To mitigate the negative effects of the Russian-Ukrainian war, the Gulf Arab countries need to raise food security by increasing the stock of strategic commodities, to ensure the flow of goods to the markets and stabilize their prices, in addition to expanding local production and increasing its contribution to meeting local consumer needs.

Keywords: The Russian-Ukrainian war; Wheat; Import prices; The import bill; The Gulf Cooperation Council

Introduction

The Russian-Ukrainian war began on February 24, 2022, causing several effects whose impact does not limit to the Russian Federation and Ukraine but extends to the global system, especially the countries that have interests and partnerships with them. Together, Russia and Ukraine dominate wheat production with 110.81 million tons representing 14.56% of the total global wheat production from 760.93 million tons in 2020. The total exports of Russia and Ukraine of wheat amounted to 55.32 million tons, representing 27.9% of the total amount of world exports of 198.53 million tons from wheat in 2020. At the level of the Gulf Cooperation Council, the Russian Federation is the main source of wheat imports for the State of Qatar (38.49%), the United Arab Emirates (39.18%), and the Sultanate of Oman (35.42%) during the period 2010-2020. The State of Qatar also depends on Ukrainian wheat (6.24%) during the period 2010-2020 [1].

Ghanem et al. [2] studied the impact of the Russian-Ukrainian war on consumer prices of food products. This study showed that a 10% increase in both the global food price index and the total population of the Kingdom of Saudi Arabia leads to an increase in the consumer price index for food products by 1.22% and 4.95% for each, respectively. The consumer price index for food products was expected to increase to 137.7 in 2022, with an increase of 12.2% from its counterpart of 122.78 in 2021. Also, Ghanem et al. [2] in second research addressed the repercussions of the Russian-Ukrainian war on the value of imports and the food trade balance of the Kingdom of Saudi Arabia. The study showed that increasing the global food price index by 10% led to an increase in the value of food imports by 6.98%, and thus an increase in the value of the deficit in the food trade balance by 7.87%. As for increasing the food production index by 10%, it led to a decrease in the value of food imports by 1.88%. Also, increasing the value of food exports by 10% led to a decrease in the value of the deficit in the food trade balance by 5.24%. The increasing in the food price index to 145.8, the value of both food imports and the deficit in the food trade balance exceeds their counterparts in the current situation for the year 2021, by a rate of 37.1% and 44.5% for each, respectively. Ghanem et al. [3] also studied the impact of the Russian-Ukrainian war on food security in the Kingdom of Saudi Arabia. This study relied on published data and food security index measures, in addition to standard economic analysis. The study showed that increasing both the estimated food production index and real per capita income by 10% leads to an increase in the food security index by 2.72% and 6.55% for each, respectively. As for increasing the estimated consumer price index for food by 10%, it leads to a decrease in the food security index by 1.74%. Despite the repercussions of the Russian-Ukrainian war, the food security index will be good for the Kingdom of Saudi Arabia, as it is expected to increase from 72.4 in 2024 to 75.6 in 2030, due to the state adopting a policy of Saudi agricultural investment abroad and directing local agricultural investments towards vertical expansion, protected agriculture and good agricultural practices, in addition to achieving huge financial surpluses, which leads to increasing the state’s ability to import from abroad.

Since the outbreak of the Russian-Ukrainian war, the Moscow and Saint Petersburg stock exchanges have suspended trading, and thus wheat and oil prices have risen. Wheat prices on the Forex market rose from 1206.3 dollars/ton on 4/3 2022 to 1342.3 dollars/ton on 8/3 2022 and then decreased to 1005.6 dollars/ton on 1/4 2022. The Food and Agriculture Organization reports that the index for cereal prices increased from 103.1 in 2020 to 170.1 in March 2022 [4]. There is no doubt that the increase in import costs has an impact on food security and the import bill of nations who are net food importers. The Arab Gulf states rely on imports to meet their needs for food security and consumption due to the lack of water resources in the region. The study addresses the following query in this regard: What effects does the war between Russia and Ukraine have on the cost of wheat imported by the members of the Gulf Cooperation Council?

There is no doubt that this study and other economic studies are of great importance, especially those related to measuring the impact of wars and international crises on supply chains and imports of strategic goods, most notably wheat. The importance of this study increases in light of the GCC countries’ clear reliance on imports to meet consumer needs and achieve food security for wheat, in addition to the fact that some countries, including the Kingdom of Saudi Arabia, have reduced wheat cultivation in accordance with Resolution No. (335), due to the scarcity of water resources. This study is also important because it sheds light on the repercussions of the Russian-Ukrainian war on prices and thus the increase in the value of the import bill.

Research Objectives

The following objectives were analyzed in order to assess how

the Russian-Ukrainian War affected the value of wheat imports for

the countries of the Gulf Cooperation Council:

i. the relative importance of the Ukrainian and Russian

Federations in regards of wheat exports and production.

ii. The relative importance of wheat imports sources for

the Gulf Cooperation Council countries.

iii. Comparative economic analysis of wheat imports prices

for the Gulf Cooperation Council countries.

iv. estimation of the demand function for wheat imports by

the countries of the Gulf Cooperation Council from 1990 to 2020.

v. calculating the effect of the rise in wheat import costs

on the value of imports for the gulf corporation Council countries.

Materials and Methods

This study used secondary data from the World Bank and

the Food and Agriculture Organization (FAOSTAT) to achieve its

objectives. Also, rely on econometric analysis represented by:

i. The United Nations Organization for Trade and

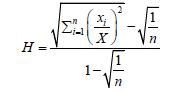

Development (UNCTAD) used the normalized Herfindahl

Hirschman Index, and the Hirschman coefficient was given by the

following equation [5,6]:

Where: H represents the Herfindel-Hirschmann coefficient as an indicator of diversification in wheat import sources, N represents the number of countries, xi represents the quantity of imports from a country, and X represents the total imports of wheat for the Gulf Cooperation Council countries. The value of the Herfindel-Hirschmann coefficient ranges from zero to one, i.e. (0≤H≥1). If the value of the Herfindel-Hirschmann coefficient is zero, there is complete diversity in the import sources of wheat. If the value is equal to one, then the diversity is zero.

ii. The (t) test was used to determine the significance of the difference between the average world import price for wheat during the period 2010–2020 and the average import price for wheat for the Gulf Cooperation Council countries. The value of (t) was calculated through the following equation [7]:

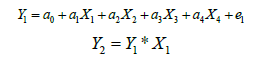

iii. The proposed methodology for analyzing how the Russian-Ukrainian war affected the value of wheat imports into the Gulf Cooperation Council countries. The proposed model consists of the following equations:

The proposed model includes the following variables: (i) Endogenous Variables, and their number is two variables: the quantity of wheat imports in thousand tons (Y1), the value of wheat imports in million dollars (Y2), (ii) Exogenous Variables, which are four variables: Average price import in dollars/ton (X1), domestic production of wheat in thousand tons (X2), the total population in million people (X3), GDP in billion dollars (X4).

Results

First: Russian Federation and Ukraine’s specific roles in the production and export of wheat

The information in Tables (1 & 2) and (Figure 1) makes it evident that the total wheat production of the Russian Federation and Ukraine throughout the period of 2010–2020 is significantly increased from 58.36 million tons, representing 9.11% of the total global wheat production of 640.8 million tons in 2010, to 110.81 million tons, represents 14.56% of the total world wheat production of 760.93 million tons in 2020. The total amount of wheat exports to the Russian Federation and Ukraine increased from 16.15 million tons, representing 11.08% of the total amount of world exports of 145.74 million tons in 2010, to 55.32 million tons, representing 27.87% of the total amount of world exports of 198.53 million tons in 2020. It is clear from the data in the Table (3) that the ratio of wheat exports to production in the Russian Federation increased from 28.5% in 2010 to 43.4% in 2020 and in Ukraine increased from 25.5% in 2010 to 72.5 % in 2020. At the global level, the ratio of the quantity of exports to wheat production increased from 22.7% in 2010 to 26.1% in 2020.

Second: The relative importance of wheat imports sources for the Gulf Cooperation Council countries

The information in Table 4 and Figure 2, which analyzes the

range of wheat import sources for the Arab Gulf countries from

2010 to 2020, leads to the following findings:

i. The most important suppliers of wheat to Saudi Arabia

were Germany, Poland, Lithuania, Canada, Australia, Latvia, and

the United States of America. The total relative importance of

these countries reached 87.16%, while the relative importance

of the rest of the countries does not exceed 12.84%. The largest

important exporters of wheat to the Kingdom of Bahrain were

Australia, Canada, Lithuania, Argentina, and Germany, where the

total relative importance of these countries reached 92.65%,

while the relative importance of the rest of the countries does not

exceed 7.35%.

ii. The State of Kuwait mostly imports wheat from Australia

and Canada, with a combined relative importance of 98.96% for

these two countries, while the relative importance of the rest of

the countries does not exceed 1.04%. The State of Qatar imports

wheat from several countries, the most important of which are the

Russian Federation, Canada, Australia, Romania, Ukraine, Pakistan,

and India. The total relative importance of these countries reached

91.65%, while the relative importance of the rest of the countries

does not exceed 8.35%.

iii. The United Arab Emirates imported wheat from several

countries, the most important of which are the Russian Federation,

Canada, Australia, India, and Romania. The total relative

importance of these countries reached 87.13%, while the relative

importance of the rest of the countries does not exceed 12.87%.

The Russian Federation, Australia, Canada, Germany, India, the

United States of America, and Argentina are the main importers of

wheat to the Sultanate of Oman. The total relative importance of

these countries reached 90.11%, while the relative importance of

the rest of the countries does not exceed 10.0%.

iv. Wheat import diversification factors for the Arab Gulf

countries ranged between a minimum of 0.21 for the Kingdom

of Saudi Arabia and a maximum of 0.85 for the State of Kuwait

during the period 2010-2020. It is evident that the Kingdom of

Saudi Arabia, the Sultanate of Oman, Qatar, and the United Arab

Emirates have all used a strategy of economic diversification

when purchasing sources of wheat. In the states of Kuwait and the

Kingdom of Bahrain, their wheat import policy was characterized

by geographical concentration.

v. The Gulf Arab countries imported wheat from the

Russian Federation and Ukraine in varying proportions. The

percentage of wheat imports from Ukraine ranged between a

minimum of 0.02% for the Kingdom of Bahrain and Kuwait and a

maximum of 6.34% for the State of Qatar. The Russian-Ukrainian

war may affect the availability of wheat in those countries, in

addition to all countries being impacted by the increase in wheat

import prices, as the Russian Federation is also the main source

for importing wheat for Qatar, the United Arab Emirates, and the

Sultanate of Oman.

Source: Food and Agriculture Organization (FAOSTAT), 2010-2020.

Source: Food and Agriculture Organization (FAOSTAT), 2010-2020.

Source: The data in my (Tables1,2).

Source:Compiled and calculated from the Food and Agriculture Organization (FAO) for the period 2010-2020.

Third: Comparative economic analysis of the cost of wheat imports for the Gulf Cooperation Council countries

It is clear from the information in (Tables 5 & 6) that the

difference in wheat import prices for the Arab Gulf countries

between 2010 and 2020 was that:

i. The average import price of wheat for the Arab Gulf

countries ranged between a minimum of $269.6/ton for the

Kingdom of Saudi Arabia and a maximum of $350.8/ton for the

Kingdom of Bahrain. By comparing the wheat average import price

to the Kingdom of Saudi Arabia of $269.6/ton with the average

world wheat import price of $273.3/ton, it was discovered that the

average cost of importing wheat into the Kingdom of Saudi Arabia

is $3.7/ton less than the equivalent price globally, i.e. decreased

by 1.4% during 2010-2020 period. The difference between the

average wheat import price for the rest of the Arab Gulf countries

and its international counterpart ranged between a minimum of

$21.7/ton for the United Arab Emirates and a maximum of $77.5/

ton for the Kingdom of Bahrain.

ii. The average import price of wheat increased from its

international counterpart in Bahrain, Kuwait, Oman, Qatar, and

the United Arab Emirates at rates of 28.4%, 13.5%, 9.1%, 15.9%,

and 7.8%, respectively. Between 2010 and 2020, the average price

of wheat imported into the Kingdoms of Bahrain, Kuwait, Oman,

Qatar, and the United Arab Emirates increased compared to the

Kingdom of Saudi Arabia at rates of 30.1%, 15.1%, 10.6%, 17.5%,

and 9.3%, respectively.

iii. By studying a significant difference between the average

world import price of wheat and its counterpart in the Arab Gulf

countries, the calculated value (t) found more than its tabular

counterpart of 2.764 at the 1% probability level for each of the

Kingdom of Bahrain and the State of Qatar. Also, the calculated

value (t) is more than its tabular counterpart of 1.812 at the

5% probability level for the State of Kuwait, which confirms the

significant difference between the average world import price of

wheat and its counterpart for the Kingdom of Bahrain, Kuwait,

and Qatar. Regarding the other countries (the Sultanate of Oman,

the United Arab Emirates, and the Kingdom of Saudi Arabia),

there was no variation between the average import price of wheat

and its comparable on a global scale. As for a significant study of

the difference between the average import price of wheat to the

Kingdom of Saudi Arabia and its counterpart to the rest of the

Arab Gulf countries, the difference between the average import

price of wheat to the Kingdom of Saudi Arabia and its counterpart

to the Kingdom of Bahrain, Kuwait and Qatar was shown, while

the difference between the average import price of wheat to

the Kingdom was found to be insignificant. Saudi Arabia and its

counterpart in the United Arab Emirates and the Sultanate of

Oman.

Source:Compiled and calculated from the Food and Agriculture Organization (FAO) for the period 2010-2020.

Fourth: Functions of the demand for wheat imports for the Gulf Cooperation Council countries

Stepwise multiple regression analysis was used to estimate

the functions of the demand for wheat imports for the Arab Gulf

countries between 1990 and 2020 in linear, logarithmic, and semilogarithmic

forms [7], showing the preference for the estimated

models shown in (Table 7), as it is clear from the following:

i. The Kingdom of Bahrain: The relative impact (elasticity)

of wheat import price and GDP is estimated at -0.549*, and 0.726

for each, respectively. This means that an increase in the import

price of wheat by 10% leads to a decrease in the quantity of wheat

imports by 5.49%. As for the increase in GDP by 10%, it encourages

an increase in wheat imports to the Kingdom of Bahrain by 7.26%.

The Kingdom of Bahrain does not produce wheat, and therefore,

to meet consumer needs and food security, wheat purchases

continue even in light of high prices.

ii. State of Kuwait: It was found that an increase in GDP of

10% causes an increase in the quantity of wheat imports to the

State of Kuwait of 6.28%, making GDP one of the most significant

factors that affect wheat import.

iii. Sultanate of Oman: A 10% increase in wheat import

prices results in an 8.13% decrease in wheat import volume. The

amount of wheat imported into the Sultanate of Oman would

increase by 7.71% with a 10% growth in GDP.

iv. The State of Qatar: With a relative impact (elasticity)

estimated at 0.476*, GDP is one of the most important factors that

affect wheat import. This leads to an increase in wheat imports to

Qatar of 4.76% for every 10% growth in GDP.

v. United Arab Emirates: A 10% increase in wheat import

prices results in a 5.34% decrease in wheat import volume. The

amount of wheat imported into the United Arab Emirates would

increase by 10.51% for a 10% growth in GDP.

vi. Kingdom of Saudi Arabia: Since the beginning of 2008,

the Kingdom of Saudi Arabia has been importing wheat. Since the

GDP’s relative importance (elasticity) is estimated to be about

0.666, an increase in GDP by 10% results in an increase in the

amount of wheat imported into the Kingdom of Saudi Arabia by

6.66%. This makes the GDP one of the most significant factors

affecting wheat imports.

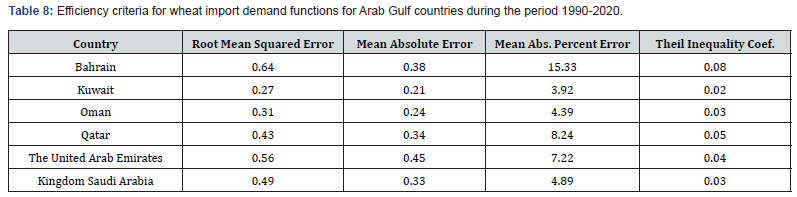

vii. It was found that the relative impact of the import price

of wheat is not substantial on the amount of imports for Kuwait,

Qatar, and Saudi Arabia through the functions of the demand for

wheat imports estimated for the Arab Gulf countries. This is a

result of the oil wealth incomes of these countries, which allow

them to purchase wheat despite the high cost of imports (Table 8).

** Significant at the 1% probability level, *Significant at the 5% probability level.

Source: The data provided in (Table 5).

**Significant at the 1% probability level, *Significant at the 5% probability level.

Source: Calculated from data provided on the website of the Food and Agriculture Organization (FAO) and the World Bank.

Source: Demand functions estimated in (Table 7).

Fifth: The value of wheat imported by the Gulf Cooperation Council countries as a result of rising import prices

It is necessary to predict the amount of wheat imports and then estimate the value of imports by multiplying the amount of expected imports by the average import price of wheat before and after the spread of the Russian-Ukrainian war. This will enable researchers to study the effects of rising import prices on the value of wheat imports for the Gulf Cooperation Council countries. The quantity of wheat imports was predicted, using the price and income elasticities of demand and annual growth rates in wheat import prices and GDP [8] in (Table 9), after ensuring the efficiency of the general trend equations estimated according to the criteria provided in (Table 10). The equations used to predict the quantity of wheat imports for the Arab Gulf countries could be expressed as follows:

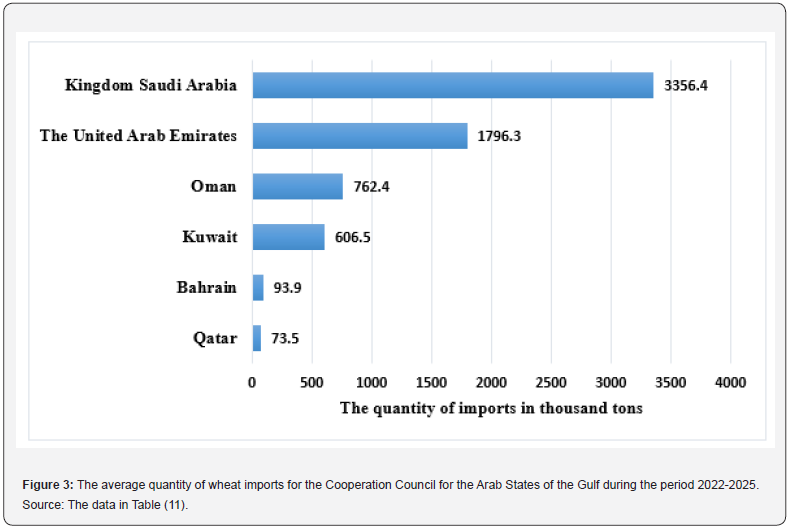

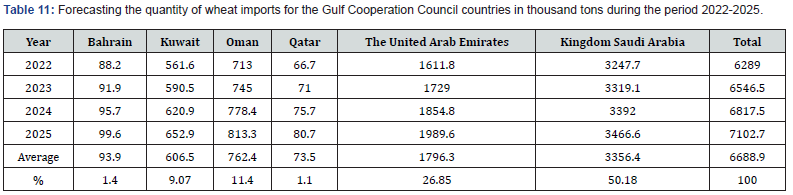

It is clear from the data in the (Table 11) that the total wheat imports of the Gulf Cooperation Council for the Arab States increased from 6.29 million tons in 2022, to 7.10 million tons in 2025, with an annual average estimated at about 6.69 million tons during the period 2022-2025. And Saudi Arabia ranks first in importing wheat, as the average quantity of imports expected for it represents about 50.18% of the average quantity of wheat imports for the Gulf Cooperation Council for the Arab States during the period 2022-2025, followed by the United Arab Emirates with 26.85%, then the Sultanate of Oman with 11.40 %, then Kuwait with 9.07%, then the Kingdom of Bahrain and Qatar with 1.4%, 1.1% each, respectively.

Through contracts to purchase wheat from international markets, it was found that the Kingdom of Saudi Arabia imported a quantity of wheat amounting to 2959 thousand tons, with a value of $884.95 million, with an average price estimated at about $299.07 / ton in 2021. The Kingdom also imported a quantity of wheat that amounted to 2582 thousand tons, with a value of 994.35 million dollars, with an average price estimated at 385.11 dollars / ton in 2022. From the above it is clear that the average import price of wheat in 2022 is higher than its counterpart in 2021, at a rate of 28.8% [9].

**Significant at the 1% probability level, *Significant at the 5% probability level.

Source: Calculated from data provided on the website of the Food and Agriculture Organization (FAO) and the World Bank.

Source: It was calculated from the equations in (Table 9).

Source: It was calculated from the equations in my (Tables 7, 9).

Source: The data in (Table 11) and the average closing price of the global stock exchanges.

The value of wheat imports was estimated for 2022 based on the average import price of wheat into the Kingdom of Saudi Arabia and the variations in wheat prices between it and the other countries of the Gulf Cooperation Council. The average import price of wheat for the Gulf Cooperation Council (GCC), starting in 2023, is not less than the average closing price on global stock exchanges of $1063.2/ton due to the difficulty of speculating about the end of the Russian-Ukrainian war and the extent of the outbreak of other international wars. It is expected that the value of wheat imports for the Gulf Cooperation Council will increase from 6.96 billion dollars in 2023 to 7.55 billion dollars in 2025, with an annual average estimated at 6.08 billion dollars during the period 2022-2025 (Table 12).

Discussion

The global economic system has been subjected to successive economic crises, as after the Coronavirus crisis, the Russian- Ukrainian war broke out, causing several negative effects, the most important of which are the rise in energy prices (oil and natural gas) and the costs of producing strategic food and nonfood commodities, which led to an increase in food prices and an increase the import bill and the amount of the balance of payments deficit. The countries that have trade relations with Russia and Ukraine, especially the net food-importing countries, including the Gulf Cooperation Council countries, were also affected because many countries that monopolize the production of food commodities have imposed restrictions on exports, which led to a rise in prices and the import bill and the search for other markets to import food goods.

Through the geographical distribution of wheat import sources for the Gulf Cooperation Council countries, it was found that the Russian Federation is the main source of wheat import for Qatar, the United Arab Emirates, and the Sultanate of Oman, and therefore the Russian-Ukrainian war may affect the availability of wheat in those countries, in addition to All countries were affected by the rise in import prices for wheat. As for Saudi Arabia, it may not be affected significantly by wheat supplies, due to its diversification of import sources, followed by the Sultanate of Oman, Qatar, and the United Arab Emirates. As for the states of Kuwait and the Kingdom of Bahrain, their wheat import policy was characterized by geographical concentration.

In light of the difficulty of speculations about the end of the Russian-Ukrainian war and the extent of the outbreak of other international wars, the average import price of wheat for the Gulf Cooperation Council countries, starting in 2023, is not less than the average closing price on global stock exchanges of 1063.2$/ ton. The value of wheat imports for the Gulf Cooperation Council countries would be expected to increase from 6.96 billion dollars in 2023 to 7.55 billion dollars in 2025, with an annual average estimated at 6.08 billion dollars from 2022-to 2025. In the event of the continuation of the Russian-Ukrainian war, which may lead to the outbreak of a third world war, the issue of food security becomes one of the most important problems that the net foodimporting countries suffer from it. The most important of which is the Gulf Cooperation Council countries which suffer from a scarcity of water resources, which is an obstacle to expansion in local production and increase its contribution to meet local consumer needs.

Conclusion

The Russian Federation and Ukraine are among the most important wheat-producing and exporting countries in the world. Their production represents 14.56% of the total global wheat production of 760.93 million tons in 2020. The total wheat exports to Russia and Ukraine represent 27.87% of the total global wheat exports of 198.53 million tons in 2020. Given the significance of the Russian Federation and Ukraine in the production and export of wheat, the start of a war between them on February 24, 2022, has adverse effects that are reflected in the increase in import prices and the value of imports as well as the restriction of food supply chains, especially for net wheat importing countries like the Gulf Cooperation Council countries. Due to its implementation of a policy of economic diversification in the sources of importing wheat, the Kingdom of Saudi Arabia is considered as being the least affected by the problem of wheat supply in the Gulf states, followed by the Sultanate of Oman, Qatar, and the United Arab Emirates. As for the states of Kuwait and the Kingdom of Bahrain, their wheat import policy was characterized by geographical concentration.

In light of the elasticity of price and income demand and the annual growth rate of both import prices and GDP, the amount of wheat imports for the Gulf Cooperation Council countries is expected to increase from 6.29 million tons, with a value of 2.55 billion dollars in 2022, to 7.1 million tons, with a value of 7.55 billion dollars in 2025. The Arab Gulf states are known to be oilproducing countries that have benefited financially from the high price of oil, allowing them to purchase wheat despite the high cost of imports. In order to mitigate the negative effects of the Russian-Ukrainian war, it is necessary for the Arab Gulf states to raise the level of food security by increasing the volume of stocks of strategic goods to ensure the flow of goods to markets and the stability of their prices, in addition to expanding local production and increasing its contribution to meeting local consumer needs.

References

- Food and Agriculture Organization (FAOSTAT), 2010-2020.

- Ghanem AMK, Khalid NA, Sharafeldin BA, Nageeb MA, Al-Nashwan IO, et al. (2023) Effects of the Russian-Ukrainian war on the value of imports and the food trade balance for the Kingdom of Saudi Arabia, Arab Gulf Journal of Scientific Research.

- Ghanem AMK, Saad Al-Nashwan O; Sahar AMK, Azali Ahamada S (2023) The impact Russian-Ukrainian war on consumer prices of food products in Saudi Arabia, International Journal of Food, Nutrition and Public Health (IJFNPH) 13(1-2): 67- 79.

- Ghanem AM, Khalid NA, Othman SA, Al-Duwais AAM, Sharaf al-Din BA (2024) The impact of the Russian-Ukrainian war on the food security of the Kingdom of Saudi Arabia, Journal of experimental biology and agricultural Sciences 12(4): 606- 615.

- Food and Agriculture Organization (2022) FAO Food Price Index, 6 May.

- Hirschman A (1964) The Paternity of an Index, American Economic Review 54(4-6), pp. 761-762.

- Lapteacru I (2012) Assessing Lending Market Concentration in Bulgaria: The Application of a new measure of Concentration. The Journal of Comparative Economics 9(1): 79-102.

- William HG (2003) Econometric Analysis, Fifth edition, New York University, USA.

- Almellah, Jalal Abdel-Fattah (2001) The Economic Entrance to the Study of the Market, Analytical Tools for the Study of Supply, Demand and Prices, Center for Translation, Authoring and Publishing, King Faisal University.

- General Grain Corporation (2022) Wheat import platform.