Product Literature of Ritonavir and Lopinavir, Conclusion of Overview of Literature and Approvals Relating to Selected Fixed-Dose Combinations Arvs (Such As Ritonavir And Lopinavir Etc.)

Krishnasarma Pathy*

IPL Research Centre, India

Submission: December 11, 2018; Published: March 19, 2019

*Corresponding author: Krishnasarma Pathy, IPL Research Centre, Lucknow, India

How to cite this article: Krishnasarma Pathy. Product Literature of Ritonavir and Lopinavir, Conclusion of Overview of Literature and Approvals Relating to Selected Fixed-Dose Combinations Arvs (Such As Ritonavir And Lopinavir Etc.). Adv Biotech & Micro. 2019; 13(2): 555857. DOI: 10.19080/AIBM.2019.13.555857

Abstract

The short review based on ritonavir and lopinavir evaluation, conclusion of Overview of patents and licences relating to selected fixed-dose combinations ARVs (such as atazanavir, dolutegravir, elvitegravir, etravirine, lopinavir, raltegravir and rilpivirine) expiration dates of the patents we identified to build a patent-related market exclusivity model for ritonavir and lopinavir/ritonavir. The patents of ARVs (such as zidovudine, emtricitabine, lamivudine and nevirapine) are off patent. The main patents for these products, where they had been granted, have now generally expired or are close to expiry. Markets for these products tend to be competitive and there are several quality-assured manufacturers that are in a position to supply most (if not all) developing country markets. Nevertheless, patents or patent applications on some formulations (e.g. extended release nevirapine) or fixed-dose combinations with other ARVs (e.g. TDF/FTC/RPV or ABC/3TC) may exist in certain countries and could delay competition in countries for which licences are not currently available. Newer ARVs, including those that are currently in the development pipeline, tend to be more widely patented in developing countries, though there is wide variation between ARVs. Patents on some of these ARVs (such as atazanavir, dolutegravir, elvitegravir, etravirine, lopinavir, raltegravir and rilpivirine) have been filed in a significant number of developing countries and, where they have been granted, will likely remain in force for several years before they expire.

Keywords: ARVs; Atazanavir; Dolutegravir; Elvitegravir; Etravirine; Lopinavir; Raltegravir and rilpivirine; Patent; Evaluation; License

Discussion

Patent-Related Market Exclusivity Model

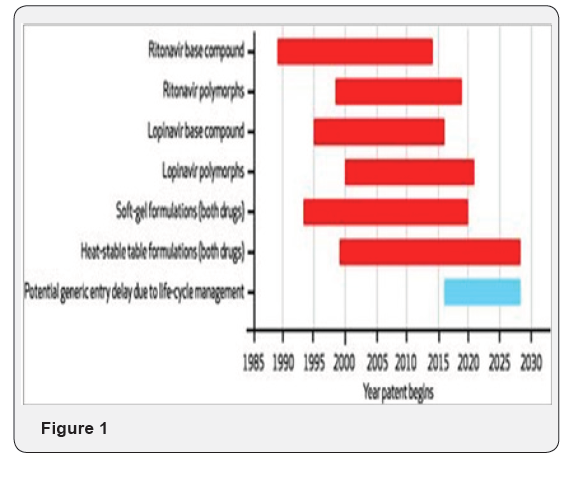

We used the expiration dates of the patents we identified to build a patent-related market exclusivity model for ritonavir and lopinavir/ritonavir EXBIT-2. In general, we found that most of the patents extending past the expiration date of patents on the original base compounds SOURCE Authors’ analysis. NOTES Timeline represents patents and patent clusters held by Abbott Laboratories. Dates shown are subject to future patent extensions and reexamination of patents at the request of parties who may have evidence of lack of inventiveness. The blue bar represents potential delay in generic entry as a result of life-cycle management, and not a patent duration. Polymorphs are defined in the text (Figure1).

The final patent covering lopinavir/ritonavir that was in force at the time of this study is scheduled to expire in 2028, twelve years after the expiration of the patents on the underlying base compounds. Currently pending applications on the modified heat-stable formulations may extend this expiration date even further.

On further examination, we identified signs of quality concerns-particularly overlapping patenting-among the patents within the four identified categories. For example, we identified nine overlapping patents related to the soft-gel capsule formulation of ritonavir and lopinavir/ritonavir. The earliest of these patents expires in 2013 and the latest in 2020. Although these patents remain in force, the overlapping nature of their subject matter may serve as a basis for challenging their validity in court.

These nine patents also claimed variations of excipientspharmacologically inactive substances used as a carrier for the active ingredients of a drug-that could be challenged for lacking novelty and for being obvious. For example, patent number 6,911,214 used excipients covered in earlier patents, but with the addition of flavoring systems such as peppermint, vanilla, and cotton candy that would probably be used in the lopinavir/ ritonavir oral solution for pediatric use.

Another patent cluster-patent numbers 7,364,752 and 8,025,899 and pending patent application number 2005/0143404-involved the heat-stable tablet version of lopinavir/ritonavir. Nine other pending applications covered variations of the heat-stable formulation technique as well. These patents also raised potential quality concerns. For example, we found patent number 8,025,899 to be similar to patent number 7,364,752.

The latter uses the synthetic water-soluble polymer polyethylene glycol as the key excipient; by contrast, the former uses the synthetic water-soluble polymer polyvinylpyrrolidone. However, pharmaceutical scientists have suggested in earlier scientific articles and patent documents the benefits of using such excipients for formulating pharmaceutical products, which calls into question the non-obviousness of these patents. Indeed, in an earlier 1996 publication, Abbott reported using polyvinyl pyrrolidone and other excipients with ritonavir alone for the purposes described in patent numbers 7,364,752 and 8,025,899.

Similarly, pending application number 2007/0249692 covered a combination of the water-soluble polymers used in patent numbers 7,364,752 and 8,025,899, while two additional applications (numbers 2008/0181948 and 2009/0220596) contained claims similar to those in patent 8,025,899. If approved as written and listed in the Orange Book, these various applications could delay a generic drug’s entry into the market, extend the expiration date of the currently marketed formulation, or protect a new version of lopinavir/ritonavir that claimed improvements over the current form [1].

Patents covering polymorphic forms also raised concerns of patent validity. One of the controversies around the patenting of polymorphs is that they are not “invented” but exist in the base chemical compound and are merely discovered as part of compound screening. In the case of Abbott’s patent on the amorphous form of ritonavir (number 7,148,359), it is notable that a publication from scientists at Abbott discloses that the company had already discovered an amorphous form of ritonavir in 1996. If this earlier publication were raised in a reexamination or post-grant opposition process before the US Patent and Trademark Office, or in litigation in the courts, it could negate the novelty in these subsequent polymorph patents. As a result, the rights obtained through these patents could be revoked.

For such ARVs, it is likely that market competition will take place only in countries where there is no patent or where licences have been issued. In addition, the conditions in voluntary licences can vary significantly and may determine whether and where generic ARV manufacturers are able to supply. In light of the above, the likelihood of competition is very countryand product-specific. From the preceding analysis, it can furthermore be noted that O With respect to the ARVs that have been recommended by WHO for first-line adult treatment in the 2013 consolidated treatment guidelines, market competition is likely to be possible in the vast majority of developing countries. The few exceptions are cases where tenofovir or efavirenz are patented and are not covered by licences, and/or where there are patents pending or granted for the combinations of tenofovir with emtricitabine or tenofovir with emtricitabine and efavirenz. As concerns second-line adult treatment, the situation is more complex, with patents granted in several developing countries for atazanavir, lopinavir and ritonavir, and licences issued for atazanavir. Third-line medicines etravirine and raltegravir are widely patented, including in key countries of manufacture, and there are some secondary patents on darunavir; licences appear to be limited (raltegravir) or non-existent (etravirine). With respect to pediatric treatment, a number of recommended ARVs could face patent-related delays to competition. Given the need for the development of and widespread access to better adapted pediatric formulations, more extensive licensing would be important [2].

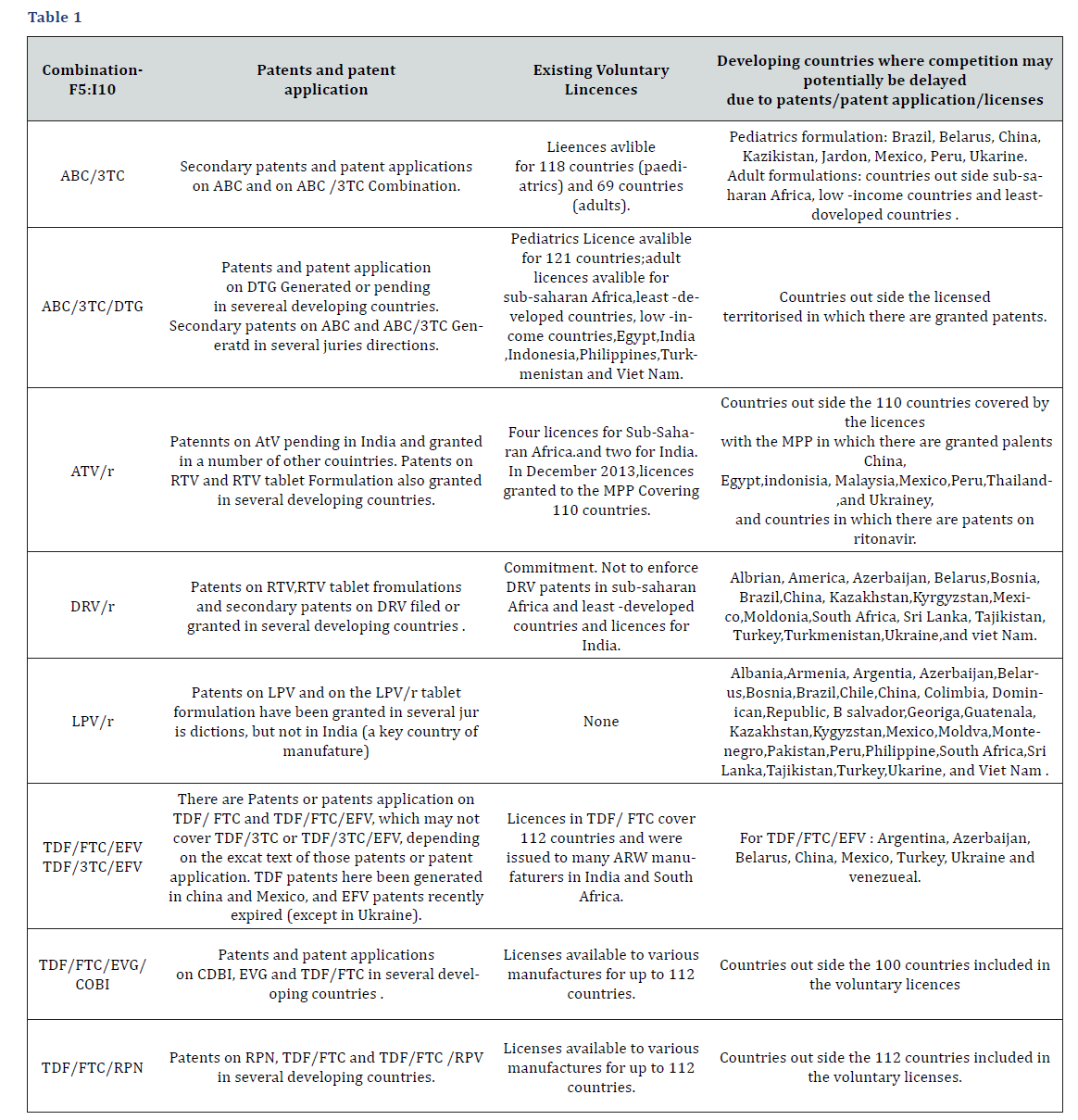

As concerns ARVs that are in late-stage clinical development or have only recently received regulatory approval (such as cobicistat, dolutegravir, elvitegravir, rilpivirine and tenofovir alafenamide fumarate), patents appear to have been granted or are pending in several developing countries, including most countries with ARV manufacturing capacity. Overview of patents and licences relating to selected fixed-dose combinations (Table1).

Exclusivity of ritonavir and lopinavir/ritonavir

In this study we sought to describe the array of patents held by Abbott that cover two protease inhibitors used widely in the treatment of HIV infection. The 108 patents we identified could extend the market exclusivity of ritonavir and lopinavir/ ritonavir to at least 2028-twelve years after the expiration of the patents on their base compounds and thirty-nine years after the first patents on ritonavir were filed.

Our data provide some insight into the practice of life-cycle management. Abbott received or has applied for a complex patchwork of patents covering all aspects of the drug production process. Some of these patents were filed before key patents for the drugs’ base compounds were officially listed in the Orange Book, which suggests an early start for secondary patenting in the product life cycle. Because our data were derived from patent searches, we did not have insights into the manufacturer’s intent in seeking the patents.

The rationale is somewhat obvious for the initial patents on the underlying active ingredient, and even for the patents on updated formulations such as the heat-stable version. Some patents-for example, combination patents protecting ritonavir’s use with other drug compounds, such as saquinavir, that are used against HIV-may have been seen as protecting potential future products. However, the substantial number of later-issued patents, particularly those related to intermediate compounds and manufacturing processes, force prospective generic entrants to spend considerable time and resources mapping the patent landscape, evaluating the reach and strength of each patent they identify, and possibly seeking to have some patents overturned in court [3]. Such steps make it more difficult and costlier to develop and market a generic product once patents on the base compounds have expired.

The concept of life-cycle management has been controversial, in part, because later-issued drug patents may indeed encompass beneficial improvements over a prior version of the drug. 7 For example, the currently marketed heat-stable tablet formulation of ritonavir and lopinavir/ritonavir has no additional therapeutic benefit over the soft-gel version, but it is considered an improvement because it ensures the drug’s potency in suboptimal storage conditions and allows patients to take two fewer pills each day 30.

As a first step in this direction, the Patent Reform Act of 2011 established a post patent grant opposition proceeding-known as Post Grant Review-in which third parties can challenge a patent’s validity by submitting any additional information bearing on the patentability3 of the claimed invention. However, once a patent is granted, there is a strong presumption of validity, and generic manufacturers are blocked from production until the patent is ultimately revoked. We believe that the window of nine months within which to file a Post Grant Review should be extended, because it can sometimes take a few years after a patent is granted before its relevance and importance to a generic producer are known. In addition, the projected costs of a postgrant opposition, which could be up to $339,000, are prohibitive for many potential interveners.

We further believe that patent opposition procedures would be more effective if there were also an opposition procedure prior to the granting of patents, involving lower petitioning fees so as not to limit potential interveners. This would allow patent applications for new formulation compositions and polymorphsapplications that are common obstacles to the timely market entry of generic drugs4-that are not of high quality to be challenged and weeded out ahead of time. Such a measure could help reduce the need for expensive litigation after patents are granted, although managing such cases might require increased resources for the US Patent and Trademark Office [4,5].

The current rules under which third parties can submit information before a patent is issued restrict both the amount of information and the way in which the information can be submitted. The US Patent and Trademark Office has sought to improve these rules by increasing the time period within which third parties may submit a patent from two months to six months from date of publication of the patent. A pre-grant opposition process also could allow the party submitting the information to participate in the examination of a patent application-for example, by permitting responses to evidence supporting the patent application provided by an applicant.

In addition to an improved pre- and post-grant opposition system, inappropriate patenting practices might be reduced if manufacturers were required to publicly identify all patents relating to a compound, perhaps in a readily accessible online database. Of the 108 patents we identified relating to ritonavir, lopinavir, and lopinavir/ritonavir, only 20 are currently listed in the Orange Book. 17 Requiring all patents, including applications, to be listed in a public database would provide greater transparency into patenting practices and provide generic entrants with a clearer picture of the potential obstacles. The database might be organized along the lines of ClinicalTrials. gov, which provides information about ongoing clinical research studies.

Furthermore, the Food and Drug Administration could be permitted to audit the eligibility of patents listed in the Orange Book, based on information received by third parties. Patents are listed in the Orange Book for the purpose of informing potential competitors about the relevant patents protecting the brand-name version of a marketed product that would need to be overcome and about their expiration dates, only after which can approval of a generic equivalent be granted.

This would be similar to the current practice in Canada. Health Canada’s Office of Patented Medicines and Liaison accepts information on the eligibility of a listed patent, including its validity, from interested parties. If a patent is alleged to be improperly listed, the office will undertake a review of the patent and may delist it. Of course, the most effective method to counteract inappropriate extensions of market exclusivity resulting from improper life-cycle management would be to raise the bar for patentability. For instance, the threshold for no obviousness could be raised [6,7]. A number of developing countries-including Argentina, India, and the Philippines-have introduced more stringent patentability standards that make polymorphs, formulations, and additional uses of existing compounds more difficult to patent.

In India, for example, patents claiming improvements over existing compounds currently need to provide evidence of added clinical benefit. This requirement, along with higher standards of proof required to show that inventions are not obvious, has resulted in the subsequent rejection by the Indian Patent Office or voluntary withdrawal by Abbott of several of the US patents identified in this study. In part as a result, generic versions of lopinavir/ritonavir are already available in India.

In the United States, a 2007 Supreme Court case redefined one aspect of the test for no obviousness. The case, KSR International v. Teleflex, concerned a patent on the combination of an adjustable vehicle control pedal with an electronic throttle control. In ruling that the combination of the two elements was unpatentable, the Supreme Court opted for a more expansive and flexible approach to nonobviousness, which could make invalidating a patent less difficult. Although the case did not relate to a drug, it could have relevance to future cases of pharmaceutical combination products, such as lopinavir/ ritonavir.

Firmer statements about standards for nonobviousness by the US Patent and Trademark Office or the courts, specifically addressing aspects of pharmaceutical chemistry such as polymorphs or new formulations, are needed to help ensure that only true innovations in this field are protected by twentyyear market exclusivity, and that changes based on common pharmacological experimentation and knowledge are not similarly rewarded.

Conclusion

However, we found that some of the patents in our analysis were of questionable inventiveness, using techniques and excipients already known in the field. Nevertheless, these are only signals of potential validity questions, not legal conclusions. Our exploratory study has important implications for pharmaceutical policy related to drug patents. The burden of cutting through the array of patents surrounding drugs like ritonavir and lopinavir/ritonavir now falls on manufacturers of generic drugs seeking to introduce a competing product. This process usually involves protracted litigation, which in recent years has also been characterized by settlements between brand-name and generic manufacturers that keep potentially invalid patents in force in exchange for payments to a generic challenger. As a result, patients and health insurers continue to pay high prices for drugs long after the initial patents on the underlying base compounds expire.

Alternative options are needed that restrict inappropriate life-cycle management strategies, while not preventing manufacturers from seeking and earning legitimate patents on worthwhile improvements to their drug products. For example, if the US Patent and Trademark Office permitted outside experts to provide opinions about individual patents during the pharmaceutical patent evaluation process, the introduction of duplicative or otherwise invalid patents might be reduced as a result, licences are likely to be important in providing the conditions for the competitive procurement of new regimens containing those ARVs. On the basis of the available data, the likelihood that market competition can take place for patented ARVs appears to be lowest in certain upper- and lower-middleincome countries outside sub-Saharan Africa. It is highest in low-income countries, least-developed countries, certain other middle-income countries, and countries in sub-Saharan Africa, where licences are more widely available. However, it is important to reiterate that patents in manufacturing countries, such as India, can affect the availability of ARVs in importing countries, even in the absence of local patents in the importing country.

References

- Nguyen BY, Isaacs RD, Teppler H, Leavitt RY, Sklar P, et al. (2011) Raltegravir: the first HIV-1 integrase strand transfer inhibitor in the HIV armamentarium. Ann NY Acad Sci 1222: 83-89.

- Wills T, Vega V (2012) Elvitegravir: a once-daily inhibitor of HIV-1 integrase. Expert Opin Investig Drugs 21(3): 395–401.

- Krishnan L, Li X, Naraharisetty HL, Hare S, Cherepanov P, et al. (2010) Structure-based modeling of the functional HIV-1 intasome and its inhibition. Proc Natl Acad Sci USA 107(36): 15910-15915.

- Engelman A, Cherepanov P (2012) The structural biology of HIV-1: mechanistic and therapeutic insights. Nat Rev Microbiol 10 (4): 279- 290.

- Hazuda DJ, Felock P, Witmer M, Wolfe A, Stillmock K, et al. (2000) Inhibitors of strand transfer that prevent integration and inhibit HIV-1 replication in cells. Science 287(5453): 646-650.

- Serrao E, Odde S, Ramkumar K (2009) Raltegravir, elvitegravir, and metoogravir: the birth of “me-too” HIV-1 integrase inhibitors. Retrovirology 6: 25.

- Malet I, Delelis O, Valantin MA, Montes B, Soulie C, et al. (2008) Mutations associated with failure of raltegravir treatment affect integrase sensitivity to the inhibitor in vitro. Antimicrob Agents Chemother 52(4): 1351-1358.