Clarifying the Nature of Physician’s Independent Personal Services for Income Tax Policy Considerations

Neni Susilawati*

Department of Fiscal Administration Science, Faculty of Administrative Sciences, Universitas Indonesia, Indonesia

Submission: November 20, 2023;Published: November 28, 2023

*Corresponding author: Neni Susilawati, Department of Fiscal Administration Science, Faculty of Administrative Sciences, Universitas Indonesia, Indonesia

How to cite this article:Neni S. Clarifying the Nature of Physician’s Independent Personal Services for Income Tax Policy Considerations. Psychol Behav Sci Int J. 2023; 21(3): 556062. DOI: 10.19080/PBSIJ.2023.21.556062.

Abstract

Physicians’ diverse incomes make it difficult to define the status of independent personal services, especially in non-employee hospitals or clinics. To ensure that the income tax policy for physician independent personal services is consistent with the philosophy of independent personal services and presumptive tax, defining the concept of independent personal services for physicians is crucial. This research examines key independent personal service criteria to define independent personal service for physicians. Qualitative data was collected through literature reviews, in-depth interviews, and observation. The results indicated that the criteria for physicians who are eligible to be referred to as a class of independent personal services are doctors who practice independently, as well as doctors who practice in hospitals or clinics with non-employee status and receive patient payments for their services. In addition to these criteria, there are physicians with employee requirements and physicians who engage in business activities. After this, further research is required to determine whether the income of physicians derived from hospitals or clinics as non-employees qualifies for the application of the presumptive tax policy in determining net income as the basis for imposing income tax.

Keywords: Presumptive Tax; Income Tax; Physician; Withholding Tax; Independent Personal Services

Abbreviations: IPS: Independent Personal Services; HTT: Hard-to-Tax

Introduction

The physician and medical team profession has been in the spotlight since the outbreak of the COVID-19 pandemic in early 2020, as 86% of 1000 respondents to a survey conducted by The Sunday Times (Singapore) ranked physicians / nurse as the most important profession [1]. Physician’ status as the highest-paid occupation in Indonesia in 2023 [2] is also indicative of the quantity of tax revenue that could be generated by the profession [3]. Due to the high potential for income tax revenue, it is vital to study the medical profession for purposes of income tax policy. A doctor is a classic profession because he or she is always in demand. During the era of digitalization and innovation, it is anticipated that many professions will be rendered obsolete by technology. There are, however, occupations that will remain secure and promising for at least the next two decades, one of which is health services, including physicians, nurses, physician assistants, and anaesthetic nurses (Sugiono, para. 10). Additionally, the number of human resources for physicians tends to increase annually.

In the context of the tax system, physicians are classified as independent contractors or independent personal services (IPS). IPS is work performed by a private individual (independent contractor) with specialized knowledge in an endeavor to earn a non-employee income (self-employed) [4]. IPS are employed to perform work according to their own methods and are not subject to the employer’s control other than the outcomes of their work. Individuals with income from business activities and IPS are classified as hard-to-tax (HTT) taxpayers with low compliance characteristics. Even though these HTT taxpayers register themselves, they are typically unable to record their income and expenses accurately, are unable to file accurate tax returns, and have tax arrears [5]. The implication is that, in the context of taxpayers in the medical profession, it is problematic that the increase in the number of physicians is not proportional to the trend of income tax revenue from the medical profession. Thus, the conceptual problem and the factual problem in this investigation are consistent.

To address the issue of low tax compliance resulting from the IPS of physicians, a presumptive tax policy was enacted, which is an indirect method of determining tax liabilities that differs from the general regulations. The term “presumptive” is used to indicate that there is a legal presumption that the taxpayer’s income is not less than the amount resulting from the application of the indirect method; therefore, it is also referred to as the minimum tax [6]. In practice, there are numerous sources of income for physicians, including independent practice, hospital practice, pharmacy business activities, and others. Are all taxpayers with a physician’s profession considered to perform IPS? Perhaps not necessarily.

Physicians who engage in business activities with revenue below the threshold for gross income are unquestionably classified as taxpayers eligible to utilize presumptive tax, in this instance deemed net income. However, this is not the case with independent physicians. According to the facts, a doctor can provide medical services through either independent practice or hospital or clinic practice. Independent medical practitioners regulate themselves and are not constrained by hospital or clinic regulations. Depending on the nature of the doctor’s employment relationship with the hospital or clinic, physicians who practice in hospitals or clinics will be bound by the hospital’s or clinic’s provisions. The existence of a working relationship or agreement between the physician and the hospital or clinic can lead to confusion or differences of opinion as to whether the physician can still be classified as performing IPS. The purpose of this article is to clarify the confusion surrounding the theoretical nature of IPS by elucidating it through discussion. Given that most physicians in hospitals are typically non-permanent employees or independent contractors. It is necessary to consider how the characteristics of IPS affect the evaluation of a physician’s employment status and source of income to determine whether they are performing independent contractors. The following review of the characteristics of IPS focuses on the professional status of physicians who practice in hospitals or clinics to demonstrate whether doctors who practice in hospitals or clinics can still be included in the category of IPS. Ultimately, the clarity of the concept of a doctor’s independent work might assist the tax authority in the formulation of a presumptive income tax policy for doctors who work independently.

In the global tax literature, independent work is referred to as self-employed laborers, independent contractors, and independent personal services, among other variations. Independent contractors or self-employed laborers are distinguished from employee status [7]. The issue of classifying workers as either employees or independent contractors is significant because it affects both employers’ and workers’ tax obligations. If the laborer is an employee, the employer is responsible for social security, health insurance, retirement plans, and income tax. In contrast, if the worker is an independent contractor, he or she is responsible for covering these expenses [7]. IPS is work performed by a private individual (independent contractor) with specialized skills in an endeavor to earn a non-employee income (self-employed) [4]. Independent contractors are employed to perform work according to their own methods and are not subject to the employer’s control other than the outcomes of their work. This distinguishes an autonomous contractor from an employee or a temporary worker. Another term for independent work is professional services, which are defined as services performed independently by members of liberal professions (e.g., doctors, lawyers, accountants, etc.) and other activities of an independent nature [4].

According to the tenth edition of Black’s Law Dictionary, an independent contractor is entrusted with a specific project but is free to perform the allotted work and choose the method of completion [8]. For employers, employing independent contractors can save up to 30% of costs compared to traditional workers (employees). There are costs for employee income taxes, health insurance, pensions, and other forms of compensation. These requirements and insurances are the responsibility of the IPS [8]. Pearce II & Silva also explained that, according to tax authorities, employees are independent contractors if they are “in an independent trade, business, or profession where they offer their services to the general public.” Doctors, veterinarians, attorneys, accountants, and subcontractors in the construction industry are examples of self-employed employees. Whether a laborer is an independent contractor, or an employee depends on the specific circumstances of each case. Typically, a worker is an independent contractor if the payer has no control over the worker’s actions or methods. A worker is not an independent contractor, however, if the employer has the legal right to control the details of how the services are performed, including what the employees will do, how they will do it, and even when it will be [8]. This is referred to as the right to control. It is necessary to distinguish between employees and independent contractors for the sole purpose of assessing compensation for tort liability under the respondent superior (master-servant rule), i.e., an employer’s liability for torts committed by subordinate employees. If an employer can regulate the work of its employees, then it should also be responsible for the severity of the rules that its employees experience in their activities or jobs [8].

Research Methods

This study employs qualitative research methods and collects data through literature reviews, in-depth interviews, and observations. A literature review was conducted on several journal articles discussing the income and independence of physicians. As one of the qualitative data collection methods, in-depth interviews were conducted with various stakeholders, representing institutions or experts, based on their expertise (purposeful). This study was approved by the Ethics Committee of Faculty of Public Health Universitas Indonesia, with ethics approval reference 48/ UN2.F10/PPM.00.02/2022. All informed consent signed by the source person was also obtained for this research. Interviews are conducted so that researchers can develop exhaustive research instruments by gaining an understanding of the nature of the doctor’s profession from the perspective of entities in the doctor’s work environment and the implementation of the imposition of income tax on physicians’ income. An exhaustive and targeted instrument will be able to effectively dissect the issue. Additionally, in-depth interviews were used to determine the elements of the system and structure. Hospital management, several physicians, professional associations, independent practicing physicians, tax academics, health policy academics, tax consultants, tax authorities, and health social security organization were interviewed in depth. In addition to using in-depth interviews as a method for collecting qualitative data, the researchers also made observations. The researcher’s observations were made during the interview. The researcher observed the condition of the practice site, the location of the practice site, the number of patient visits, practice equipment, medicines, and supplies (consumables), and the number of employees, among other things. As a means of triangulating the survey data, the researchers adjusted the items observed based on the responses of the interviewees.

Results

There are several criteria that can be used to determine

whether an employee qualifies as an IPS:

i. The test of “right-to-control” This examination consists

of “order, control, and direction.” Since the late 19th century, the

right-to-control test has been the standard for distinguishing

employees from independent contractors [8].

ii. The test of economic reality. Early in the 20th century,

a change occurred in the classification of these categories of

workers. The classification became essential for determining the

employer’s rights and benefits. Each employee became eligible for

benefits and protections. In contrast, an independent contractor

has no such rights from their employer because they are deemed

capable of fulfilling them on their own [8].

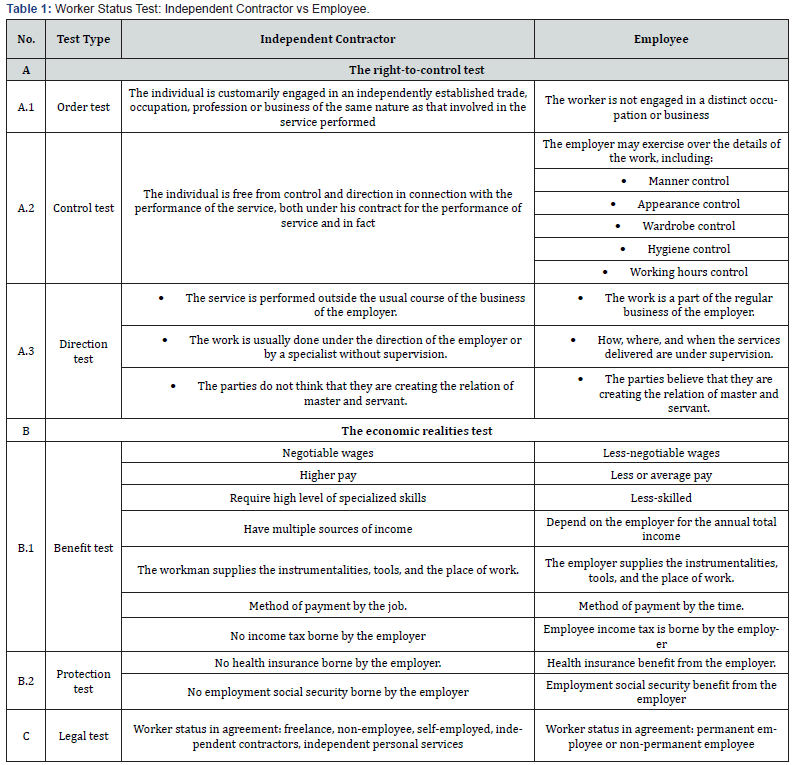

To be more detailed and practical, the author extracts the essence of several journal articles discussing employees, independent contractors, and autonomous personal services and displays it in Table 1 below. Source: [7-13]Processed.

Emina Jerkovic explains in her article that this income from

independent personal services (IPS) is derived from:

i. Income derived from trade and with trade equaled

services

.

ii. Income derived from independent profession such as:

a. Independent professions of health care employees,

veterinarians, lawyers, public notaries, engineers, auditors,

bankruptcy managers, arhitects, tax consultants, interpreters,

translators, tourist employees etc.

b. Independent profession of scientists, inventors, authors

and other similar profession

c. Independent profession of lecturers and educators and

other similar profession

d. Independent profession of journalists, artists and

athletes.

iii. Income derived from agriculture, fishery and forestry.

iv. Income of other independent services which are not

main service of taxpayer but are occasionally performed for

gaining income [9].

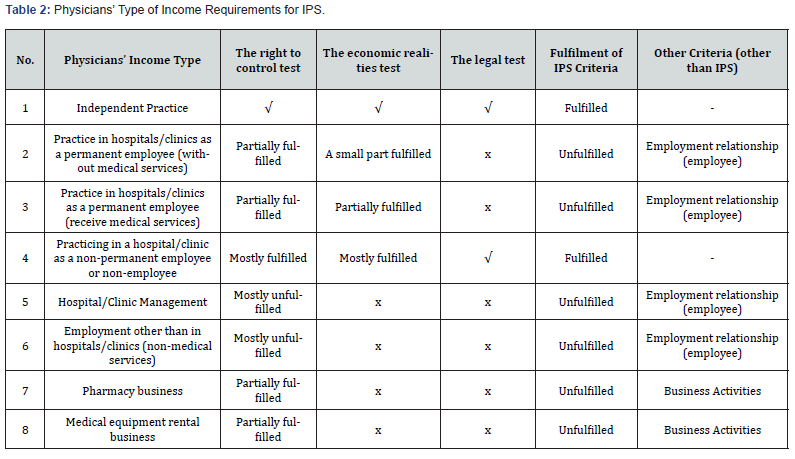

Based on the description of the analysis sof the nature of IPS, the researcher seeks to identify the classification criteria for physicians’ income that is classified as income from IPS, business activities, or employment relationships, as shown in the Table 2 below. Although the regulation lists physicians as one of the professions eligible to use deemed net income, the use of deemed net income is not limited to the type of profession but also considers the type of income. The income a physician earns from independent practice or private practice satisfies all criteria for IPS. Income from independent practice satisfies the right to control test because the doctor provides medical services or services consistent with his expertise as a doctor (expertise test), has his own control over how he will provide medical services (control test), and performs work without direction or supervision from an employer or a specialist (direction test). The self-employed doctor also satisfies the economic realities test because he requires a specialized level of expertise, provides his own supplies, equipment, and workplace, receives payment based on work items, and is responsible for paying income tax on his own earnings (benefits test). Doctors who practice independently are responsible for their own health and employment insurance contributions (protection test) due to the absence of an employer.

Doctors who practice in hospitals or clinics as permanent employees and receive no other income from medical services do not meet the criteria for IPS and instead meet the criteria for employment (employee-employer relationship). Regarding test orders, there is no distinction between physicians who are permanent employees of hospitals or clinics and independent doctors, both of whom provide services based on their medical expertise as doctors. However, doctors practicing in hospitals or clinics are under more control over their service performance than independent doctors because hospitals or clinics will strive to maintain the quality of their services as medical institutions (control test). There may be little difference between doctors practicing in hospitals or clinics and independent doctors in terms of direction and supervision, but doctors practicing in hospitals or clinics will perceive a master-servant relationship between themselves and their institutions (direction test). In accordance with the economic realities test, physicians practicing in hospitals or clinics typically receive income tax benefits, health insurance, and employment insurance from the hospital or clinic, unlike independent doctors who do not receive these benefits. If the doctor is appointed as a permanent doctor (legal test), the employment contract between the doctor and hospital or clinic will typically also specify the doctor’s employment status as a permanent employee of the institution.

Doctors who practice in hospitals or clinics as permanent employees and receive income from their status as permanent employees as well as additional income from medical services, where the additional income is contingent on the number of patients served, do not meet the criteria for independent work. The income of physicians classified as income from independent work is income from medical services obtained based on the number of patients and outside of income from permanent employees; therefore, income tax is withheld using an income tax withholding slip. Doctors who meet these criteria partially satisfy the right to control and economic tests for the category of IPS because, as permanent employees, they are subject to the control and supervision of their institutions and receive tax benefits, health insurance, and employment insurance from their institutions. Due to its status as a permanent employee under a work contract, it undoubtedly does not meet the legal requirements for unpaid labor. Thus, physicians who work in hospitals or clinics as permanent employees and receive medical services for which payment is contingent on the number of patients cannot meet the criteria for IPS, also called quasi-IPS.

Doctors who practice in hospitals or clinics as non-permanent employees or as independent contractors meet the criteria for IPS. The only criterion that is not met is the control and direction test, as doctors who practice in this hospital or clinic, despite not being permanent employees, will typically still receive supervision and direction from the institution in which they practice (control and direction test). This type of physician will also have access to hospital or clinic facilities in the form of equipment, tools, and work areas; however, many physicians bring their own equipment because not all is provided by the hospital or clinic (economic test). In terms of legal tests, this type of doctor is classified as an independent contractor because the cooperation contract between the doctor and the hospital or clinic does not specify the doctor’s employment status. Doctors who work in hospital or clinic management and doctors who work for institutions other than medical institutions, such as hospitals and clinics (nonmedical services, such as experts at international organizations with concerns in the health sector), have a job character that is nearly identical to employment and therefore do not meet the criteria for independent work. This type of physician only fulfils a small portion of the right to control test, namely the order test, because the work performed remains within his area of expertise. Physicians who run pharmacies and medical equipment rental companies do not meet the criteria for independent work, as they are more closely associated with business activities. Both the pharmacy business and the medical equipment rental business are not service businesses, as they are trading and rental businesses, respectively.

Discussion

Analysis of The Right-to-Control Test for Physician as Independent Personal Services

The right-to-control test is a criterion used to distinguish between employment and self-employment. This criterion evaluates the extent to which the employer has the right to control the worker’s manner of work and output. Identifying whether a doctor works independently or is subject to an employment agreement with a particular organization or agency will help apply the right-to-control test in the context of independent personal services.

This right-to-control-test analysis consists of an order test, a control test, and a direction test, as demonstrated in Table 1 [7- 13] In accordance with the order test, a person is classified as an independent contractor if he or she engages in an independently established trade, occupation, profession, or business of the same character as the services or services performed or rendered. Thus, a physician meets this order requirement when he provides medical services or services consistent with his expertise as aphysician. Typically, based on the function of the service, the category of physicians can be divided into general practitioners and specialists, while based on their relationship with the hospital, they can be divided into permanent and nonpermanent doctors (Suwignyo, 2022). Consequently, from the perspective of the order test, every hospital-based physician typically meets this requirement.

/p>In accordance with the control test, a person is classified as an independent contractor if he or she is free from control and direction regarding the performance of services. Thus, a doctor is considered to meet this control criterion when, while providing medical services, no one controls or directs the performance of his services. The physician has discretion over how he will provide medical services. In terms of control over the provision of medical services, hospital-based physicians are overseen by medical committees. However, this does not imply that independent physicians have no control, as they are not under the medical committee’s supervision. Additionally, independent practitioners are required to submit reports to the health office through the local health center.

Therefore, from the perspective of the control test, this characteristic of IPS is not completely satisfied. All physicians must be subject to control or supervision when providing medical care. The only distinction may be that hospital-based physicians are subject to stricter oversight that resembles official evaluation. In the meantime, physicians who practice independently engage in greater self-evaluation. This oversight or control mechanism is applicable to other independent professions, including accountants and consultants. Under the direction test, an individual is classified as an independent contractor if he or she performs work under the direction of the employer or a specialist without supervision and the parties do not believe they are establishing a master-servant relationship (employersubordinate). Thus, a physician is deemed to meet this direction requirement if, while conducting his duties, he receives direction from his employer but is not supervised. And there is no thought or presumption from either the doctor or the hospital or clinic about the existence of a master and servant relationship, which exists as a partner or cooperation relationship.

Typically, physicians who practice in hospitals or clinics receive direction and supervision from management. This aims to maintain the caliber of services provided by doctors on behalf of the institution (affiliated hospitals and clinics). There is no notion of a master-servant relationship between the hospital or clinic and the physician. Regarding the status of the working relationship, the prevalent mindset is that of collaborators. Doctors who practice in hospitals or clinics are designated partner doctors in the hospital or clinic due, in part, to the prevalent profit-sharing system. In light of this direction test, doctors who practice in hospitals or clinics do not completely exhibit the characteristics of IPS. Because physicians receive direction from the institution, even though the resulting relationship is not one of master and servant but rather one of partnership, although it was discovered that some hospitals consider doctors who practice in their institutions to be employees, this is typically in the form of efforts to establish a comfortable work environment.

According to the preceding description, the physician

profession (particularly hospital- or clinic-based physicians)

does not completely satisfy the right-to-control test. Independent

practicing physicians are also subject to supervision and control,

albeit to a lesser degree than hospital- or clinic-based practitioners.

Given that the services provided by physicians are essential health

services for the public, the researcher also believes that medical

service providers must be subject to surveillance and control.

There must be control mechanisms in place to ensure that the

provision of health services does not harm the public. Additionally,

a variety of stakeholders can conduct supervision using a variety

of tools. In the context of the right-to-control test, the following

factors can be evaluated to determine whether a physician is IPS:

i. Physicians’ level of control over their medical practices.

If the doctor has complete control over their medical practice,

including patient scheduling, pricing of medical services, and

medical decisions, then they can be working independently.

ii. The level of autonomy physicians has in making medical

decisions If the physician is free to choose the medical action to be

performed without interference or influence from the institution

or medical institution where he or she works, then the physician

is working independently.

iii. The nature of the physician’s employment contract with

the medical institution or agency. If the doctor has an employment

contract stating that they work as an employee of the institution or

medical institution and are subject to the institution’s or medical

institution’s rules, policies, and procedures, they are considered

to have an employment relationship with the medical institution.

In practice, the right-to-control test analysis can assist in determining whether a physician is an independent contractor or an employee of a medical institution or agency. However, the final decision should be carefully considered and take into consideration any additional factors that may impact the physician’s employment status.

Analysis of The Economic Realities Test for Physician as Independent Personal Services

According to Table 1, previously outlined, the economic realities test analysis consists of a benefit test and a protection test [7-13]. In terms of the benefits test, the characteristics of IPS include the ability to negotiate wages and salaries, obtaining higher-than-average compensation, requiring a high level of specialized skills, having multiple sources of income, providing their own equipment, tools, and workplace needs, payment methods based on work items, and the absence of employer provided income tax benefits. A hospital-based physician can typically negotiate wages and salaries, and to work in a hospital or clinic, he or she must possess a high level of expertise.

Doctors typically receive a higher salary than other professions [14,15]. This is primarily due to the high level of education, training, and certification necessary to become a doctor, as well as the high level of risk and responsibility associated with medical practice. However, doctor salaries also vary by specialty, years of experience, and geographic location. Even though doctor salaries in Indonesia are relatively higher compared to other professions, it is important to consider that becoming a doctor requires a substantial investment of time, effort, and money. In addition, it requires specialized medical skills and knowledge, as well as a significant amount of responsibility for the health and safety of patients. Most doctors who practice in hospitals or clinics do not provide their own equipment, supplies, or workplace necessities. The doctor’s cooperation with the institution provides physicians with access to various existing facilities. Doctors provide benefits to their institutions, typically in the form of prescriptions, which patients typically redeem at the hospital or clinic pharmacy. If a patient is referred for additional testing, he or she will typically utilize the hospital’s facilities for the examination. There were also some physicians who brought their own equipment to the hospital or clinic because it was not supplied by the institution. The method of payment for physicians is also typically based on the quantity of work performed, although there are some doctors who receive a type of “sitting money” or “guarantee fee” that considers the number of patients served.

The final indicator of this benefit test relates to income tax exemptions for physicians. In practice, most physicians working in hospitals or clinics earn the gross income specified in their employment contracts, and they are responsible for paying income tax in accordance with the applicable rules and regulations. Typically, income tax is deducted directly from the physician’s compensation by the hospital or clinic and remitted to the local tax authority. Based on the description of the indicators for the benefits test, it can be concluded that the profession of hospital- or clinic-based physicians meets the majority of the benefits test for IPS. Regarding the protection test, the nature of IPS encompasses the conditions under which employees obtain health insurance and unemployment insurance from their employer. The protection test determines whether labor laws, such as those governing the minimum wage, occupational hazard protection, and the right to a fair dismissal, adequately protect employees. This measure can be used to ensure that the state and employer adequately protect employees.

However, in the context of physicians’ independent work, this protection test analysis can be more complicated, as doctors frequently work as independent professionals and are not considered formal employees. As independent contractors, physicians typically have greater control over their work schedules and pay rates, but they are not always protected by labor laws like traditional employees. In certain circumstances, doctors may be deemed employees if they meet certain criteria, such as being bound by a written employment contract, being supervised by the hospital, and having a work schedule determined by the hospital. However, in some nations, such as the United States, the definition of employee is frequently the subject of debate and legal issues, particularly in the context of physicians’ independent contractors [16]. Like the policy for income tax allowance, the policy for health insurance premium coverage and employment insurance is an internal hospital/clinic policy for physicians. In general, however, hospitals and clinics only cover the health and employment insurance premiums of hospital-based physicians who are permanent doctors (permanent employees) and not partner physicians. Overall, the analysis of the protection test for the independent personal services of physicians can be more complicated due to the frequently flexible and diverse nature of their work. To ensure that doctors receive adequate protection from labor laws, however, the hospital or employer must have clear and transparent rules and policies to safeguard doctors’ rights.

Analysis of The Legal Test for Physician as Independent Personal Services

The legal criteria are based on the worker’s status as specified in the employment contract (agreement). A person is said to perform unpaid labor if the worker’s status in the employment contract (agreement) is freelance, non-employee, self-employed, independent contractors, or independent personal services [7- 13]. In the context of doctors’ independent practice, the contract between the physician and hospital or clinic will serve as the legal litmus test. Other than being listed as a permanent employee of the hospital or clinic, the doctor is self-employed. In general, physicians who practice in hospitals or clinics have one-year contracts with hospitals or clinics that are renewed the following year if an extension is granted. Examining the characteristics of the physician profession in Indonesia, particularly hospital-based physicians, the researcher concludes that the physicians do not meet all the characteristics of IPS. In certain instances, hospitals continue to regulate how hospital-based physicians provide health services to the public, also known as clinical pathways. Therefore, when calculating income tax on the income of hospitalbased physicians, it is necessary to first consider the physician’s employment status and category of income.

Conclusion

The scope of IPS for physicians is comprised of doctors who practice independently (in their own clinics or hospitals) and doctors who practice in hospitals or clinics as non-permanent employees or non-employees who earn medical service income, according to the above conceptual analysis of independent work. As for doctors who do not provide independent personal services, they are not included as subjects in this study. This includes doctors who only do management work in clinics or hospitals, doctors who only work as permanent or non-permanent employees in institutions other than clinics or hospitals (non-medical services), and doctors who only earn income from non-medical services and business activities (e.g., pharmacies, medical equipment rental).

Recommendation

The author suggests a conceptual review of physicians’ income from hospitals or clinics despite their non-employee status for further research; is it appropriate to apply the presumptive tax policy in determining their net income? If a doctor who practices in a hospital or clinic but has a status as a non-employee of the hospital can be classified as providing independent personal services, is his income worthy of being used as an income object that is calculated with presumed net income? Even though it is not difficult to calculate the hospital’s net income, the income tax policies of several countries apply presumed net income to this category of income, even though the hospital has also deducted employment income tax.

Acknowledgements

The authors would like to thank Universitas Indonesia for the PUTI Q2 Research Grants 2022 Batch 1 with agreement number NKB-559/UN2.RST/HKP.05.00/2022. We are also grateful to Dr. Mahlil Ruby and Dr. Inayati, M. Si for their fascinating discussion of physician income tax regulation.

References

- Tan A (2020) Sunday Times survey saying artist is topmost non-essential job sparks anger in community. The Sunday Times.

- Best Paying Jobs in Indonesia (2023).

- Ataguba JE, McIntyre D (2018) The incidence of health financing in South Africa: Findings from a recent data set. Health Econ Policy and Law 13(1): 68-91.

- Glossary of Tax Terms (2020) OECD.

- Alm J, Vasquez JM, Wallace S (2004) Taxing the Hard-To-Tax Lessons from Theory and Practice (Jorgenson DW, Tinbergen J, Baltagi B, Sadka E, Wildasin DE (Eds.), Elsevier.s, Netherlands.

- Thuronyi V (1996) Presumptive taxation. In Tax Law Design and Drafting, IMF elibrary 1: 531.

- Carlson RR (2017) Employment by Design: Employees, Independent Contractors and the Theory of the Firm. SSRN Electronic J 71(1): 68.

- Pearce II J, Silva J (2018) The Future of Independent Contractors and Their Status as Non-Employees: Moving on from a Common Law Standard. Hastings Business Law J 14(1): 1.

- Jerkovic E (2017) Advantages and disadvantages of models of personal income taxation concerning employment income and independent personal services income, Pp: 13-14.

- Sarah Leberstein, Ruckelshaus C (2016) Independent Contractor vs. Employee: Why independent contractor misclassification matters and what we can do to stop it. Policy Brief, pp: 1-10.

- Kwak JP (2013) Employees versus Independent Contractors: Why the State Should Not Enact Statues That Target the Construction Industry. Journal of Legislation 39(2): 295-316.

- Fudge J, Tucker E, Vosko LF (2011) Employee or Independent Contractor? Charting the Legal Significance of the Distinction in Canada. Canadian Labour and Employment Law J 10(2): 193-230.

- Moran JA (2009) Independent Contractor or Employee? Misclassification of Workers and Its Effect on the State. Buffalo Public Interest Law J 28(1): 105.

- Badan Pusat Statistik (2019) Survei Sosial Ekonomi Nasional (SUSENAS).

- (2022) Payscale.

- US Bureau of Labor Statistics. (2020) Occupational Employment and Wages, May 2020: Physicians and Surgeons.