Free-Of-Charge VI Product Can Ensure Attachment to Loyalty in E-Banking Services: Seeking Bank-Management’s Attention for Boosting Customers’ Psychological Engagements

Akim M Rahman1* and Rownak Tahmina2

1Ahsanullah University of Science and Technology (AUST), Social & Economic Research Institute (SERI), Bangladesh and Research Project Affiliation with The Ohio State University, USA

2Bangladesh Telecommunications Company Ltd. (BTCL), Bangladesh

Submission: November 11, 2022; Published: December 02, 2022

*Corresponding author: Akim M Rahman, Ahsanullah University of Science and Technology (AUST), Social & Economic Research Institute (SERI), Bangladesh and Research Project Affiliation with The Ohio State University, USA

How to cite this article: Akim M R, Rownak T. Free-Of-Charge VI Product Can Ensure Attachment to Loyalty in E-Banking Services: Seeking Bank-Management’s Attention for Boosting Customers’ Psychological Engagements. Psychol Behav Sci Int J. 2022; 20(1): 556026. DOI: 10.19080/PBSIJ.2022.20.556026.

Abstract

In the 21st Century banking-services, customers compete for comparative time-saving-options and banking-service-providers compete for maximizing profits. In this setup, many factors are unpredictable. Perceived-risk-factors (PR) have been undermining the progression of using bank-led digital-banking-services country-wise such as Bangladesh. Banks can offer an incentive-program, which can positively influence psychological engagement for signing up for the VI product, which can ensure absolute risk-free bank-led digital-banking-services. Under the program, since digital-banking can be operated effectively with smaller workforce, the free-of-charge-VI will be attached to customer’s account where banks will be able to recover the incurred cost, which will require for running the proposed incentive program. Thus, psychological engagement for using absolute risk-free digital banking can attract more users by improving customer’s satisfaction, customer-base, banks benefits including reduction of operational-cost, which can be a win-win ensuring cashless society country-wise such as Bangladesh. Future study can be conducted on how the customers and probable customers feel about the proposed incentive program in bank-led digital-banking.

Keywords: Incentive; Psychological engagement; Voluntary insurance as a product; Digital- banking services; cashless society

Introduction

In today’s technology-driven human-society, service sector has been expanded and modernized vigorously. Here people rationally behave without emotion. In this transformation, the growth trend of using digital-banking (DB) services, particularly mobile-led banking has been redefining customers’ relationships with their financial institutions. Today customers are eased using digital banking particularly mobile-led digital-banking and bank-led digital-banking no matter where they live.

However, the growth trend of bank-led digital has been struggling more than that of mobile-led digital [1]. This is because it faces serious pitfalls being it riskiness [2]. Customers compete for time-saving options. Banks compete for marginalizing its operating costs then enhance revenues. Most cases, customers do not read terms & conditions of services and they do not save contract-copy. These weaknesses cause abuses. Customer faces psychological risk and perceived-risk-factors such as hidden charges, extra fees, account hacked etc. Addressing the issues, Voluntary Insurance (VI) as a new product in digital banking is proposed by Akim Rahman [2] in multifaceted literatures [3,4]. However, it has not yet been in practice in economy country-wise such as Bangladesh.

It has led to ongoing concerns – how can financial institutions make it up for diminishing interpersonal time and meaningfully build consumer engagement? Can the bank-management positively influence psychological engagement of banking-customers for using digital-banking services in today’s human-society country-wise? This study takes on the challenges to answer the questions posed. And so, it begins with elaboration the concepts relate to the proposed VI product in digital-banking services [1,2].

Concepts Relate to VI as a Product in Digital-banking Services

For clarity on VI as a product proposed by Akim Rahman [2], this section briefly incorporates elaboration of concepts as follows

Digital Banking: What is it?

Bank-led payment or mobile-led payment or a combination of the two is known as digital-banking in today’s world of businessmentality where people behave rationally without emotion.

Benefits of using digital-banking services

Digital-banking-services is one of the many ways technologies has made humans’ lives easier. At least three ways mobile banking have simplified a lot of life-things along with saving time.

a) Instant banking – Possible to instantly control accountholder’s banking

b) Comfort of banking – Easier to deal with payroll, payments, and transfer funds

c) Checks & Balance – No need to be worried about being overdrawn

Risks in using Bank-led Digital-banking Services

The concept “risk” is shaped around the idea that customers’ behaviors involve risks in the sense that any customers’ actions may create consequences that they cannot expect anything approaching with certainty [5]. “Perceived risk (PR)” is powerful in explaining customers’ behaviors because customers are more often motivated to avoid mistakes than to maximize utility using e-banking [2,3,6]. Risk is often present in choice-situation as customers cannot always be certain that a planned-use of digitalbanking will achieve absolute-satisfaction. Online shoppers perceive greater risk when paying online-bills even though goods are non-standardized [1,3]. Underpinning this reality in today’s competitive markets, perceived risk is regarded as being a composite of several categories of risks [2,7]. They are

a) Financial risk

b) Performance risk

c) Time risk

d) Social risk

e) Psychological risk

f) Security risk and

g) App-based banking trojans

Psychological risk: It is a kind of threat when something goes wrong with Internet banking transaction and customer feels frustrated. Also, sometime customer feels shamed to be.

Trust factor: Despites huge investment in the progression of bank-led digital, “lack of trust” stays a barrier in the widespread adoption of Internet banking both in the context of the bank and the overall online environment [8]. The magnitudes of the trust issue are more in rural and urban areas than that in city areas. These are common scenarios no matter what country we talk about [2].

PIN fraud risk: As alternative delivery channels, customers use Credit card or ATM card or Dual currency card etc., which requires password, or PIN. However, it can be stolen or misused.

Security / privacy risk: It is a kind of threat where a fraud or hacker may get unauthorized access to online-bank-users’ accounts and get sensitive information such as username, password, credit card / debit card information and then misuse it. Overall, system reliability is a critical issue.

Financial risk: It is a kind of threat where monetary loss could take place due to transaction-error or bank account misuse.

Performance risk: It is a kind of annoying issue where unexpected breakdown or disconnection from the Internet can take place.

Customer dispute: It refers to the possibility of getting into dispute with digital-service-providers or Online seller or with individual or group that has caused the problem. It may call for legal cases.

Social risk: It refers to the possibility that using Internet banking may result disapproval of one’s family, friends, or work group. It happens when family member or friend signed on as guarantor.

Time risk: When using “Internet & completing transaction” it may take unexpected longer times, or the server can be down. With these causes & delays, customers may become frustrated losing time. On scheduled payment issues, customers may be penalized for late transaction completion.

App-based banking trojans: Fraudsters conceal malware in seemingly normal gaming and utility apps. Once user launches his/her legitimate banking app, it triggers trojan on customer’s device to create a false version of bank’s login page and overlays it on top of the legitimate app. Once the user enters the false login page, the trojan sends user back to real banking app login page.

Voluntary Insurance (VI): What is it? How does it work?

Addressing issues that undermine the usages of digital-banking progression country-wise such as Bangladesh, Akim Rahman [2] proposed Voluntary Insurance as a product in e-banking services. Financial sector can introduce it as a product in operation where bank or third-party can collect premium ensuring secured services. The way it would work is that customer’s participation will be voluntary. Insurance will be attached to customer’s account if customer wants it for digital services. Since the program will be designed in a way of transferring the risk away from its premiumpayers, it will ensure premium-payers with a sense of certainty.

Here premium-receivers will take extra measures for ensuring risk-free digital-banking services. For example, ATM Card or Credit Cards can be protected by setting two identifications such as password and a finger-scan. Suppose a customer wants to use ATM card where to access his account, the customer will have to use two identifications namely own setup password and previously chosen finger-scan say his thump or forefinger scan. Here finger scan in addition to password can be connected to the ATM system, which will make digital banking to be enhanced secure. Overcoming the risk of heist or hacker’s access to bank accounts, under the proposal, similar own set up identifications can be used. In global banking cases such as remittances, the program can ensure risk-free on-the-go or digital banking services. This is because, it is well recognized that perceived-risk plays an influential role in setting the stage for the VI option in e-banking services [2,3,4].

Customers’ Psychological Engagements for Using DB-services

In today’s world, a new field of psychology has taken center stage - behaviorism. Rather focusing on the internal happenings of the body and mind, today psychologists look at external sources of motivation where external factors can motivate people to behave in certain ways or take certain actions [9]. These external factors are also known as “incentives.” It is no different in case of attracting people for using DB-services.

But these incentives are not just rewards. It motivates inexperienced users as well as DB users to sign up for the VI product in DB-services. Incentives also cover punishments that discourage customers performing certain behaviors when it comes account PIN. The incentive theory of motivation suggests that rewards and punishments can motivate us in addition to intrinsic forms of motivation [10]. Besides this, the bank-management should have policies for further promoting digital-payment activities. It is important to run marketing campaigns under a limited budget by providing incentives such as coupons, commissions to merchants. As a result, incentive optimization is the key to maximizing the commercial goal of the marketing campaign.

Akim Rahman [1] re-emphasized the policy proposal of the VI as a new product for effectively addressing the trust issues that have been undermining the expected progression of e-banking in Bangladesh. Now the question is: can the proposed incentive for signing up VI product positively influence customers’ psychological engagements for using DB-services?

Free-of-charge-VI Product can be an Incentive for Psychological Engagement Using DB-services

The incentive theory of enthusiasm or engagement is a behavioral theory that suggests that people are engaged by a drive for incentives and assurance thru actions. The incentive theory also proposes that people behave in a way they believe will result in a reward and avoid actions that may entail punishment.

Since digital banking services are not risk-free [1] and when an individual or bank customer plans to sign up for using it, s/ he wants assurance of each banking transaction. So that the customer does not need to face the dilemma of perceived riskfactors including the psychological risk. Only having VI product in digital-banking operation can ensure it to its fullest. It can boost customers’ psychological engagements using digital-banking services where charges for the VI will be refunded as incentive to customers who signed for the VI and use digital banking services.

It raises question: how does psychological engagement impact in digital-banking service-market?

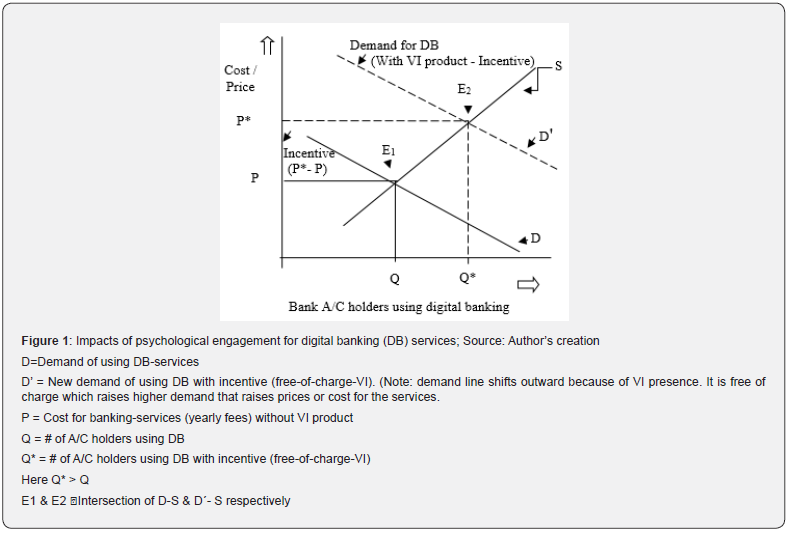

Bank-accountholders pay account maintenance fees in economy country-wise such as Bangladesh. Let us assume that account maintenance fee is P when the number of accountholders is Q. In this case there is no VI product in digital banking services. Thus, customers face perceived risk-factors, particularly psychological risk, which undermines the progression of using DB services in market-economy.

Let us assume Bank-management has introduced VI product in digital-banking services with provisions of offering incentive to customers who sign up for the VI. Here account maintenance added cost reaches to P* where P* – P = cost for signing up VI product. Under the provision, banks offer incentive with amount (P* – P) to each bank accountholder who signed up for the VI and uses DB services. Since DB-services require smaller number of service-providers than that of no DB services, banks cover (P* - P) cost, which will be an incentive to customer, by having now small number of employees for operating banking services without interruption. Figure 1: shows that number of DB-users increases from Q to Q* because of offering incentive (P* - P) to customers thru VI product using in DB-services [11].

Prospects of Incentive for Boosting Psychological Engagement Using DB-services

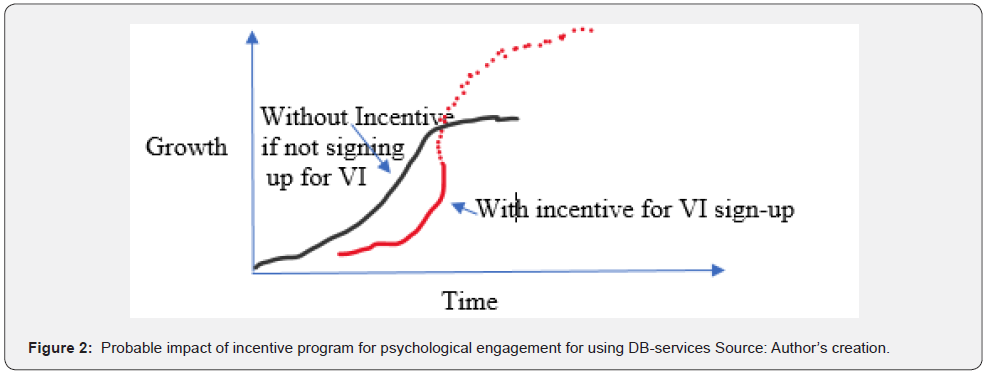

Once a bank introduces incentives for signing up for VI, it may be spread from bankers to customers. This process of life cycle of psychological engagement can be described using the “S-curve’ or diffusion curve. This S-curve maps the growth engagement against time. In the early stage of this progression, engagement-growth will be slow as new product establishes itself. At some point customers will begin to demand for using DB-services and the DB usages growth will increase more rapidly. These new incremental changes can allow the growth using DB-services to continue. Toward the end of its life cycle, the growth will slow-down and may even begin to decline [11]. In later stages, no amount of new investment for enhancing psychological engagement will yield a normal rate of return. However, it will establish a secured bank-led e-banking through the bankers who introduce this new incentive program through VI product.

This successive S-curve will come along to replace the traditional banking and will continue to drive growth upwards where motivation of using DB-services will likely have “a life” i.e., a start-up phase, a rapid increase of using BD-services and eventual decline. But it will never get off the bottom of the curve and will never produce normal returns. In this progression, it will play important roles presenting a secured bank-led digitaltransaction system, which is mostly needed to attract today’s probable customers. Overall, this progression will welcome cashless society sooner than delaying in the economy countrywise [12]. In Figure 2, the first curve shows a growth evolved from today’s mixed of traditional & e-banking services. The second curve shows, with introducing incentive program underpinning VI-product in DB-services, which may yield lower growth but will eventually overtake the current growth rate and will lead to even greater levels of growth of using DB-services. This progression can someday present cashless society country-wise [13].

Direction for Future Study

The findings of this study show that free-of-charge-VI, which serves as incentive, which can positively influence psychological engagement of bank-customers for using DB-services in economy country-wise such as Bangladesh. But it raises question: how do customers feel about it? On this aspect statistical analysis including hypothesis testing can be conducted for better understanding on the proposed incentive program vs. psychological engagement for using DB-services. So, the expected findings can be instrumental to management of banking-services in economy country-wise.

Conclusion

In the 21st Century banking-services, customers compete for comparative time-saving-options and banking-serviceproviders compete for maximizing profits. In this setup, many factors are unpredictable. Perceived-risk-factors (PR) have been undermining the progression of using bank-led digital-bankingservices country-wise such as Bangladesh. Banks can offer an incentive-program enhancing psychological engagement for signing up for the VI product, which can ensure absolute riskfree bank-led digital-banking-services. Under the program, since digital-banking can be used effectively with small workforce, the free-of-charge-VI will be attached to customer’s account where banks will be able to recover the incurred cost, which will require for running the proposed incentive program. Thus, psychological engagement for using absolute risk-free digital banking can attract more users by improving customer’s satisfaction, customerbase, banks benefits including reduction of operational-cost. If incentive program is in practice of digital-banking services, it will be observed that customers are deriving several benefits from the digital banking over their traditional way of banking. It can be a win-win ensuring cashless society in country-wise economy such as Bangladesh-economy. So, this effort is to bring the findings to the attention of the management of banking-services so that proposed free-of-charge-VI as incentive program can be introduced in digital-banking-services in country-wise economy such as Bangladesh-economy. On future study, it is reasonable raising question: how do customers feel about it? On this aspect statistical analysis including hypothesis testing can be conducted for better understanding on the proposed incentive program vs. psychological engagement for using the DB-services.

References

- Rahman Akim (2020b) bKash vs. Bank-led Option: Factors Influencing Customer’s Choices – Does it Warrant Voluntary Insurance-policy for Rapid Growth Digital-banking in Bangladesh-economy? The Journal of Banking and Financial Economics 1(13): 44-62.

- Rahman Akim (2018) Voluntary Insurance for Ensuring Risk-free On-the-Go Banking Services in Market Competition for Bangladesh. The Journal of Asian Finance, Economics and Business 5(1): 17-27.

- Rahman, Akim, Saadi Islam (2021c) Can Voluntary Insurance Ensure Risk-free Digital-banking in Chinese-economy: Seeking Attentions. Journal of Chinese Economic and Business Studies 19(2): 121-136.

- Rahman Akim (2022e) An Empirical Study on Customers’ Views of Having Voluntary Insurance as a New-product in bank-led Digital-banking Ensuring Risk-free Services. Noble International Journal of Economics and Financial Research 7(2): 32-40.

- Bauer RA (1960) Consumer behavior as risk-taking, In: RS Hancock (Ed.), Dynamic marketing for a changing world, American Marketing Association, Chicago, USA, Pp. 389-398.

- Mitchell V (1999) "Consumer perceived risk: conceptualizations and models". European Journal of Marketing 33(1/2): 163-195.

- Littler D, Melanthiou D (2006) Consumer perceptions of risk and uncertainty and the implications for behavior towards innovative retail services: The case of Internet Banking'. Journal of Retailing and Consumer Services 13(6): 431-443.

- Yousafzai S, Foxall, Pallister J (2010) Explaining Internet Banking Behavior: Theory of Reasoned Action, Theory of Planned Behavior, or Technology Acceptance Model? Journal of Applied Social Psychology 40(5): 1172 – 1202.

- Anderson RE, Srinivasan SS (2013) E-satisfaction and e-loyalty: a contingency framework. Psychology and Marketing 20(2): 123-138.

- The Incentive Theory of Motivation (2021) The Psychology Notes Headquarters.

- Rahman Akim (2019a) Microeconomics Basics- New Way Learning Microeconomics in the 21st Century era. Academic Textbook, Print Your Books Academic Publishing, Dhaka 1000, Bangladesh.

- com (2022) Research Shows Consumers Desire Embedded Insurance Offers from Their Financial Institutions.

- Rahman Akim (2022d) Can Voluntary Insurance Be a New Product in Bank-led e-banking: Statistical Analysis of Customers’ Preferences in Bangladesh-economy? Journal of Corporate Governance, Insurance, and Risk Management (JCGIRM) 2022 9(S1):215-228.