Abstract

In early 2010, Greece’s financial condition was unsustainable, necessitating the implementation of ambitious economic adjustment programs. The fiscal austerity measures launched by the Greek government in agreement with its official creditors ( IMF, ECB and European member states) led to a rather deep recession as GDP dropped by 25% and unemployment peaked at 25%. Households’ income, corporations’ profit, as well as their debt-paying ability decreased significantly leading to a huge amount of non-performing loans (NPLs). This paper provides a complete analysis of the measures introduced by the Greek government to stabilize Greek banks and reduce NPLs ratio at single digits.

Keywords:Non-Performing Loans; Securitizations; Hellenic Asset Protection Scheme

Introduction

Τhe impairment of economic conditions in Greece from 2009, the adoption of fiscal austerity measures and the launch of three economic adjustment programs by the Greek state caused reduction in credit provision from Greek systemic financial institutions (FIs) as they were forced to deleverage and to implement restructuring plans in order to recover [1].

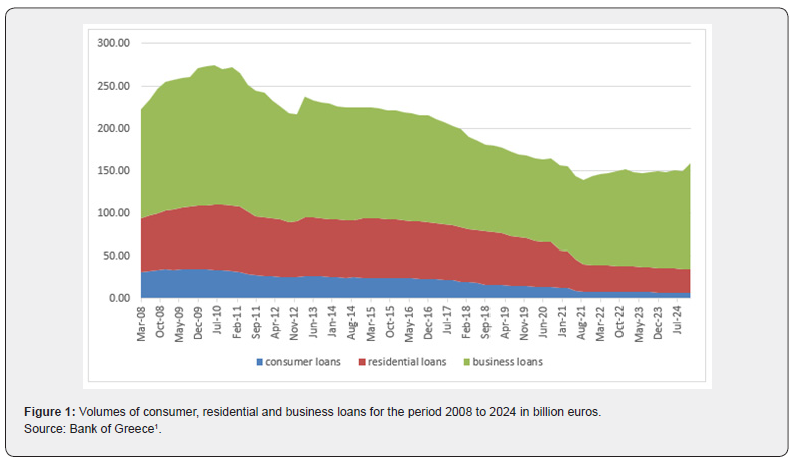

As shown in figure 1 The volume of consumer, residential and business loans decreased significantly in the aftermath of Greek sovereign debt crisis started in 2010.

The economic recession and the worsening of macroeconomic conditions had also severely affected the capacity of Greek firms and households to service their debt [2-4]. Also, opportunistic behavior of strategic defaulters increased NPLs [5]. Furthermore [6] showed that unemployment and inflation were key determinants of NPLs in Greece while [7,8] found that the public debt exerts a strong positive impact on NPLs. [9] supported that bad bank management affects NPLs as well as the level of concentration in banking industry [10]. [11-13] proposed economic policy uncertainty as a key factor of Greek NPLs. According to [14,15] NPLs affected negatively the stock prices of four systemic Greek FIs.

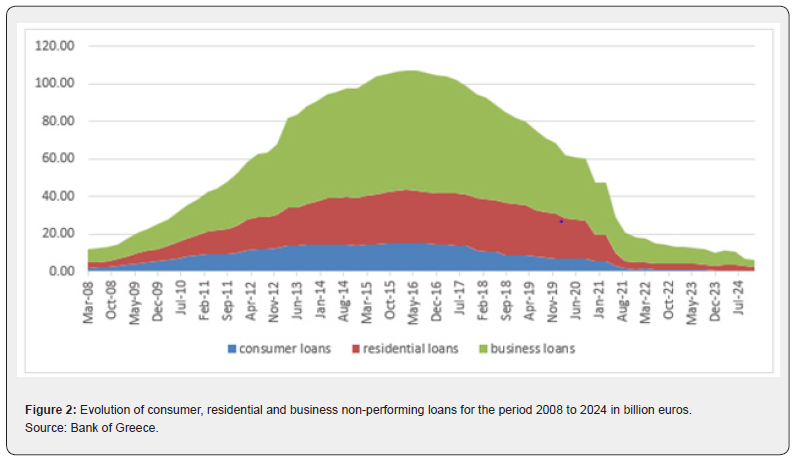

As presented in figure 2, NPLs increased up from EUR 12 billion euros in the first quarter of 2008 to a peak of EUR 107 billion in second quarter of 2016, then decreased to below 80 billion euros in the first quarter of 2019.

In an attempt to minimize the large amount of NPLs Greek government established an effective secondary NPL market. Greek FIs were able to clean up their financial statements and re-finance the real economy by selling NPLs using the secondary NPL market, either directly or via securitizations [16].

Credit Servicing Firms (CSFs) combine data

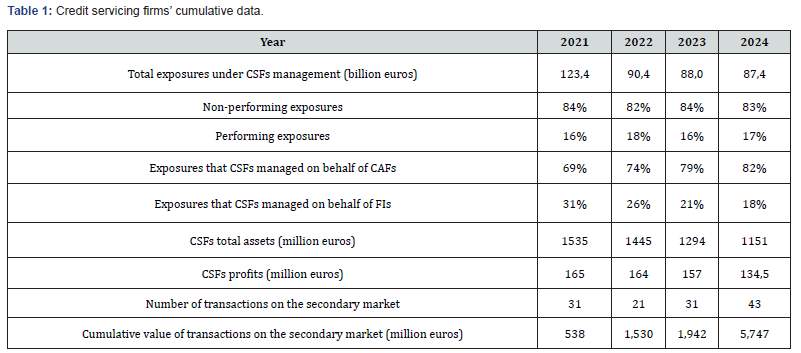

Based on law 4354/2015 the Bank of Greece (national central bank) has approved a total of 26 credit servicing firms (CSFs) to provide servicing management of non-performing loans and loan receivables. Under the revised framework of law 5072/2023, 18 CSFs are operating in Greek market. The activity of CSFs varies considerably, with the 3 largest firms having a market stake of 85.9% based on the aggregate amount of loans under management (i.e. Intrum, Cepal and Dovalue). CSFs managed loan exposures on behalf of credit acquiring firms (CAFs) and on behalf of financial institutions (FIs). Table 1 presents CSFs’ aggregate financial data.

At the end of 2023, the total assets and profits of CSFs decreased compared to previous year and amounted to 1.29 billion euros and 157 million euros respectively. In 2024 both total assets and profits presented slight reductions.

In 2023, CSFs’ total exposures under management totaled 88 billion euros, with 79% of those exposures serviced on behalf of CAFs and the other 21% on behalf of FIs. A large percentage of the overall exposures under management were non-performing exposures (84%), with performing exposures comprising a smaller portion of the portfolio (16%). No significant changes are presented in 2024. Between 2021 and 2024 transactions on the secondary market involved 126 loan portfolios, with a total receivables value of 9.6 billion euros.

Source: [16-19]

Source: [16-19]

Source: [16-19]

Source: [16-19]

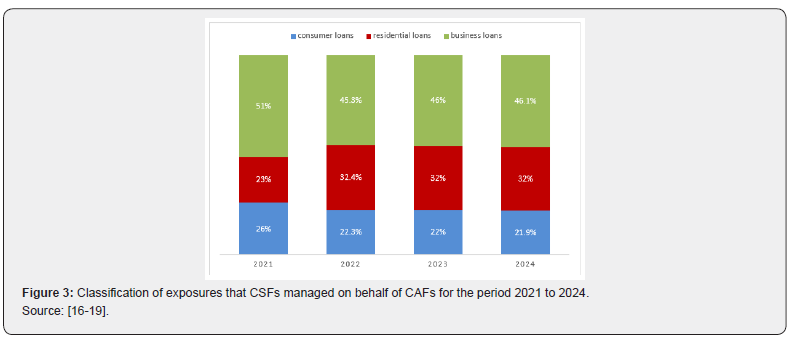

Exposures managed by CSFs on behalf of CAFs

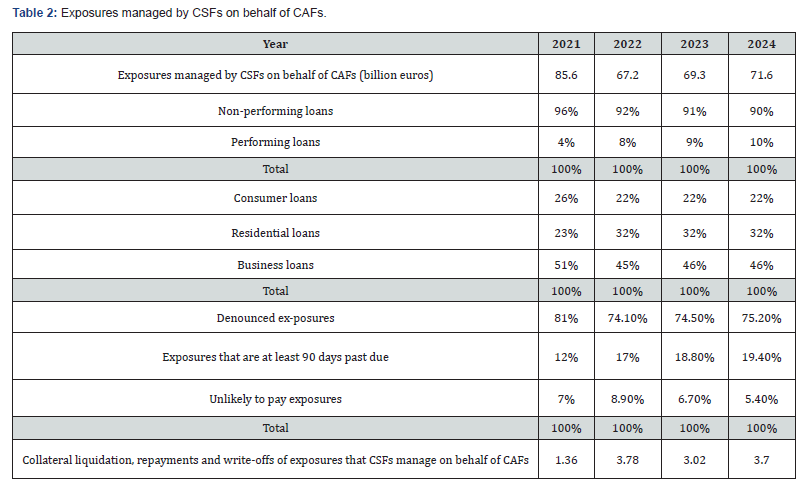

Table 2 presents data regarding exposures managed by CSFs on CAFs’ behalf. At the end of 2023 exposures increased by 2.1 billion euros and stood at 69.3 billion euros. Next year exposures increased by another 2.3 billion euros and rose to 71.6 billion euros. The bulk of exposures serviced by CSFs on behalf of CAFs were shifted to them over the last few years as part of the FIs’ NPL reduction program.

As figure 3 shows, between 2021 and 2024, the portfolio of exposures includes mostly business loans, followed by residential loans and consumer loans ( i.e. 46.10%, 32% and 21.90% respectively in 2024). The exposures that CSFs managed on behalf of CAFs during the period 2021 to 2024 were of poor credit quality, with more than 90% classified as non-performing exposures. The majority of those non-performing exposures are denounced exposures followed by exposures that are at least 90 days past due and then unlikely to pay exposures. Over the last four years, repayments, collateral liquidation, and exposure writeoffs cumulated to 11.86 billion euros.

Exposures managed by CSFs on behalf of FIs

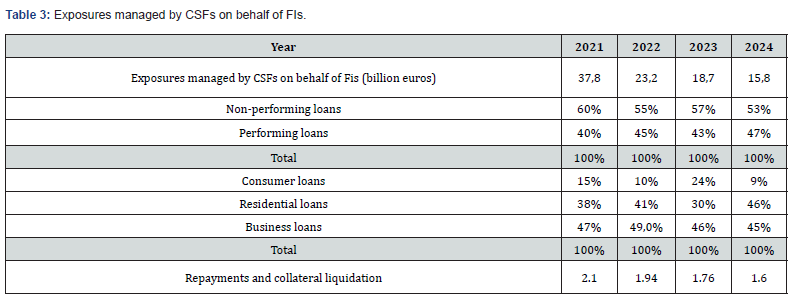

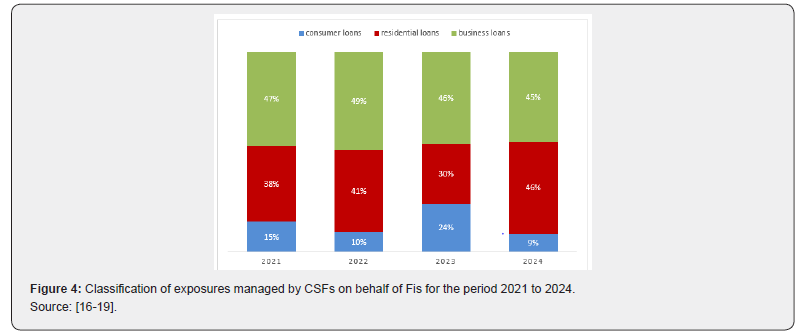

Data regarding exposures that CSFs managed on behalf of FIs are presented in table 3. At the end of 2023 exposures decreased by 4.5 billion euros to 18.7 billion euros. Next year exposures decreased by another 2.9 billion euros and formed to 15.8 billion euros.

As figure 4 shows during the period 2021 to2024 the portfolio of exposures on behalf of Fis includes mostly business loans while the participation of consumer loans is smaller compared to exposures on behalf of CAFs.

By comparing data of table 3 with those of table 2, we observe that exposures on behalf of FIs are of greater credit quality as performing loans have higher rates.

Last four years collateral liquidation and repayments of exposures that CSFs managed on behalf of Fis cumulated to 7.4 billion euros.

Hellenic Asset Protection Scheme (HAPS)

The Hellenic Asset Protection Scheme (HAPS) known as Hercules was introduced in December 2019 through Greek law 4649/2019 in order Greek banks further reduce the amount of their NPLs. Under this scheme a special purpose vehicle (SPV) purchases NPLs from the banks and disposes of senior, mezzanine and junior notes to third party investors [20]. The Greek government provides guarantee only for the senior, less risky notes with minimum credit rating BB-low. In exchange for such guarantee, the Greek State receives a fee at market terms. The EU Commission considered Hercules scheme as “free of state aid” as the guarantee fee was based on market conditions [21-23]. The first program (Hercules I) was designated to guarantee an amount up to 12 billion euros for 18 months. In April 2021, Hercules was extended by 18 months until October 2022 (Hercules II), with a new guarantee amount up to 12 billion while at December 2023 Hercules was reintroduced till the end of 2024 (Hercules III) [20].

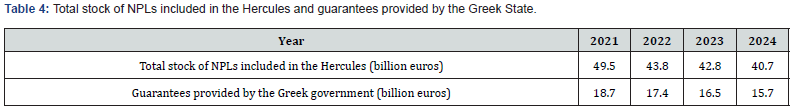

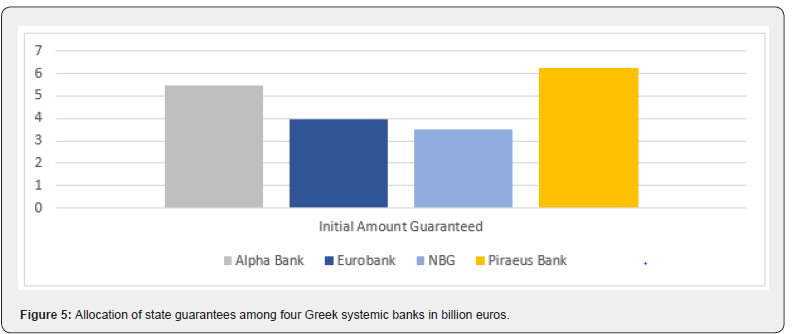

Table 4 presents the total volume of FIs’ NPLs included in the Hercules scheme and the amount of guarantees provided by the Greek government at the end of each year. According to Greek Ministry of Finance and [20] the higher amount of state guarantees was 19.2 billion euros. Figure 5 shows the allocation of state guarantees among four Greek systemic financial institutions (i.e. Piraeus bank; 6.2 billion euros, Alpha bank; 5.5 billion euros, Eurobank 4.0 billion euros and NBG 3.5 billion euros). The reduction of guarantees by an amount of 3.5 billion euros (19.2- 15.7) is due to the gradual repayment of securitization notes.

1Data for figures 1,2 and 6 are available at https://www.bankofgreece.gr/en/statistics/evolution-of-loans-and-non-performing-loans

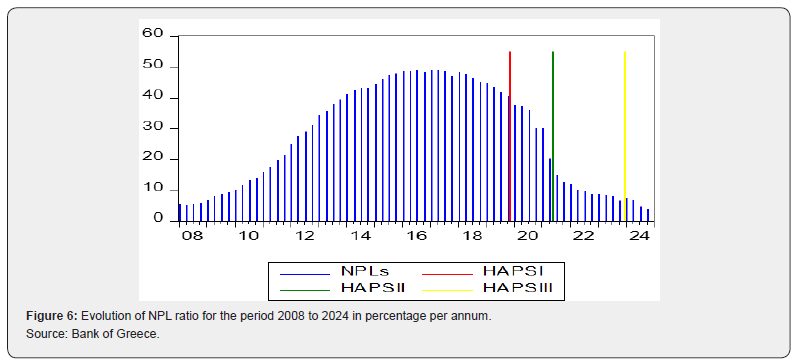

By combining the secondary NPL market, securitizations, and the Hercules Asset Protection Scheme, Greek FIs have significantly reduced their NPLs. According to data from the Bank of Greece, the NPL percentage of Greek FIs on a solo basis reached a peak of 49.1% in the first quarter of 2017. Although a slow decrease occurred afterwards, it was not until the implementation of HAPS, at the end of 2019, that the NPL ratio began to fall significantly [20]. At the beginning of the HAPS the NPL ratio was 40.6% while the second HAPS started with a ratio of 20.4% (see figure 6). NPL ratio achieved single digit in the third quarter of 2022. At the end of 2023 the NPL ratio dopped to 6.7% (gross NPLs of 9.95 billion euros) and at the end of 2024 at 3.8% (gross NPLs of 5.99 billion euros) approaching the EU average.

Conclusion

During and after the sovereign debt crisis, Greek banks operated in a stressed national economy which was in recession over a long period of time (i.e. from 2010 to 2017). Greek government needed to implement three fiscal adjustment programs to avoid exiting the eurozone. The launched of fiscal austerity measures led to a rather deep recession as GDP dropped by 25% and unemployment peaked at 25% affecting negatively the capacity of Greek households and corporations to service their debt. Consequently, the ratio of non-performing loans to total gross loans (NPL ratio) of local banks rose significantly.

In order to stabilize local banks and reduce their NPLs ratio Greek government established an effective secondary NPL market allowing transactions on non-performing loans either directly or via securitizations. Also, it introduced the Hellenic Asset Protection Scheme to grant guarantees only for the senior, less risky notes of NPL securitizations. By combining the secondary NPL market, securitizations, and the HAPS, Greek banking system has significantly reduced its NPL ratio from the highest 49.1% at the beginning of 2017 to the lowest 3.8% at the end of 2024. The reduction of NPL ratio to single digit (even more under 4%) boost banks’ capacity to finance the real economy at more favorable terms.

References

- Petrakis N, Lemonakis C, Floros C, Zopounidis C (2024) The impact of the ECB’s non-regular operations on bank credit: cross-country evidence. Operational Research an International Journal 24(3): 51.

- Anastasiou D, Louri H, Tsionas M (2016) Determinants of nonperforming loans: Evidence from Euro-area countries. Finance Research Letters 18: 116-119.

- Louri H, Migiakis P (2019) Financing economic growth in Greece: Lessons from the crisis. Bank of Greece, working papers series, No.262.

- Anastasiou D, Louri H, Tsionas M (2019) Nonperforming loans in the euro area: Are core–periphery banking markets fragmented? International Journal of Finance and Economics 24(1): 97-112.

- Asimakopoulos I, Avramidis P, Malliaropulos D, Travlos N (2016) Moral Hazard and strategic Default: Evidence from Greek Corporate Loans. Bank of Greece, working papers series, No. 211.

- Charalambakis E, Dendramis Y, Tzavalis E (2017) On the Determinants of NPLs: Lessons from Greece. In: Bournakis I, Tsoukis C, Christopoulos D, and Palivos T (Eds.), Political Economy Perspectives on the Greek Crisis. Palgrave Macmillan pp: 289-309.

- Konstantakis K, Michaelides P, Vouldis A (2016) Non-performing loans (NPLs) in a crisis economy: Long-run equilibrium analysis with a real time VEC model for Greece (2001–2015). Physica A, 451: 149-161.

- Ari A, Chen S, Ratnovski L (2021) The dynamics of non-performing loans during banking crises: A new database with post-COVID-19 implications. Journal of Banking and Finance 133: 106140.

- Louzis D, Vouldis A, Metaxas V (2012) Macroeconomic and bank-specific determinants of NPLs in Greece: A comparative study of mortgage, business and consumer loan portfolios. Journal of Banking and Finance 36(4): 1012-1027.

- Karadima M, Louri H(2020) Non-performing loans in the euro area: Does bank market power matter? International Review of Financial Analysis 72: 101593.

- Hardouvelis G, Karalas G, Karanastasis D, Samartzis P (2018) Economic policy uncertainty, political uncertainty and the Greek economic crisis. SSRN Electronic Journal.

- Karadima M, Louri H (2021) Economic policy uncertainty and non-performing loans: The moderating role of bank concentration. Finance Research Letters 38: 101458.

- Papadamou S, Pitsilkas K (2025) Policy uncertainty and non-performing loans in Greece. American Journal of Economics and Sociology 84(2): 231-252.

- Petrakis N, Lemonakis C, Floros C, Zopounidis C (2022) Greek banking sector stock reaction to ECB’s monetary policy interventions. Journal of Risk and Financial Management 15(10): 448.

- Petrakis N, Lemonakis C, Floros, C, Zopounidis C (2022) Eurozone stock market reaction to monetary policy interventions and other covariates. Journal of Risk and Financial Management 15(2): 56.

- Bank of Greece (2022) Financial Stability Review. May 2022.

- Bank of Greece (2023) Financial Stability Review. May 2023.

- Bank of Greece (2024) Financial Stability Review. April 2024.

- Bank of Greece (2025) Financial Stability Review. May 2025.

- Morningstar DBRS (2024) Greek NPL Market Update: Almost Five Years into HAPS.

- European Commission (2019) State Aid SA.53519. Greece. Hellenic Asset Protection Scheme (“Hercules”). Brussels, 10.10.2019.

- European Commission (2021) State Aid SA.62242(2021/N) – Greece Prolongation of the Hercules scheme. Brussels, 9.4.2021.

- European Commission (2023) Commission approves re-introduction of market conform asset protection scheme for banks in Greece. Press release, Brussels, 28.11.2023.