A Review of The ECB’s Non-Regular Monetary Policy Interventions

Nikolaos Petrakis1*, Christos Lemonakis11

1Hellenic Mediterranean University, Department of Management Science and Technology, Greece

Submission: November 27, 2024; Published: December 03, 2024

*Corresponding author: Nikolaos Petrakis, Hellenic Mediterranean University, Department of Management Science and Technology, P.C. 72100 Agios Nikolaos, Greece. Email: nickpetran@yahoo.gr

How to cite this article: Petrakis N, Lemonakis C. A Review of The ECB’s Non-Regular Monetary Policy Interventions. Ann Soc Sci Manage Stud. 2024; 002 11(2): 555807. DOI: 10.19080/ASM.2024.11.555807

Abstract

When the economic crisis struck financial and other funding markets in mid-2007, ECB introduced new non-standard monetary policy measures to calm down capital markets, stimulate real economic activity and boost credit growth. These new tools, launched by other major central banks, were a turning point in global monetary policy, having significantly led to the recovery of the global economic system. This paper provides a chronology of the ECB’s non-standard tools and discusses related literature. Eurozone substantially benefited from non-conventional measures, but the impact of these measures was weaker for the member states that were more affected by the economic crisis and faced fiscal problems.

Keywords: European Central Bank; Global Economic Crises; Non-Conventional Measures

Introduction

Responding to the turmoil in capital markets, the global economic and the european debt crisis, the European Central Bank (ECB) implemented conventional and non-conventional policy tools to revive macroeconomic and financial conditions in the eurozone. Traditional measures concern regular open market operations and the management of the main interest rates. Non-conventional measures are all other interventions launched by central banks in irregular periods and extreme economic conditions (e.g. large-scale asset purchases and liquidity provision at extended maturities and for targeted purposes) [1,2]. In the next subsections I present the evolution of the ECB’s non-conventional policy tools from 2007 to 2021 and analyze related literature.

Pre-economic Crisis Period

The pre-global financial crisis period (2000 -2007) was characterized by price stability, an expansion of economic activity, reduction in unemployment and steady growth in bank credit supply [3]. The ECB’s standard monetary policy was mainly focused on steering the short-term interest rate by utilizing regular monetary policy operations.

In this period, developments in risk sharing securities (such as credit default swaps, asset back securities and collateralized debt obligations) allowed monetary financial institutions (MFIs) to expand their balance sheets and take on more risks. But when the value of the collateralized assets of these complex risky securities declined, MFIs (mainly in the US) suffered from significant losses.

3.2. Market financial turmoil and global financial crisis

The turmoil in capital markets emerged in the third quarter of 2007 due to the collapse in the US market of subprime mortgage loans causing erosion to the MFIs assets as these risky securities were packaged and sold to the global financial system. The ECB reacted rapidly by offering liquidity to MFIs via fine-tuning operations and 6-month longer-term refinancing operations (LTROs) [4].

At the end of 2008, the ECB launched the fixed interest rate with full allotment procedure for MROs and LTROs to enhance liquidity provision in eurozone MFIs [5]. In addition, the ECB expanded the list of accepted collateral by reducing the threshold rating from A- to BBB-, extended the maturity of LTROs to 1 year and provided liquidity in US dollars through currency swap agreements. ECB also introduced the first covered bond purchase programme (CBPP-I) to acquire 60 billion euros in bank bonds from June 2009 to June 2010 [6]. According to [7] first CBPP boosted banks to expand credit in the eurozone.

We should underline that since 2008 the ECB has used its conventional policy to boost credit operations and stabilize financial markets. As shown in Figure 1 ECB lowers its main refinancing rate several times, from 4.25 percent in October 2008 to 1.0 percent in May 2009. The same path followed deposit facility rate (DFr) and marginal lending facility rate (MLFr).

European sovereign debt crisis

The global economic crisis caused great imbalances in public finances of peripheral euro area countries as their governments launched expansionary fiscal measures to recover from recession and stabilize the local financial system. In early 2010 Greek government bonds faced massive sale orders with no buy orders and their yields approached unsustainable levels. There were investors’ concerns about a potential Greek sovereign debt default that could affect Italy, Portugal, Spain and Ireland. To overcome market dysfunctions and support vulnerable eurozone countries, ECB implemented the Securities Markets Programme (SMP). Under the SMP, the ECB intervened in the secondary bond markets to purchase a portfolio of 218€ billion euros of public debt securities (102.8 billion euros for Italy, 44.3 billion euros for Spain, 33.9 billion euros for Greece, 22.8 billion euros for Portugal, and 14.2 billion euros for Ireland) [8].

According to literature, the SMP has a beneficial impact of sovereign bond spreads of distressed eurozone member states (see among others [9-16]). Furthermore, in the last two months of 2011, the ECB activated the second program of covered bond purchases (CBPP-II) [6] and announced two Very Long-Term Refinancing Operations (VLTROs). The beneficial impact of 3 years VLTROs on bank lending has been studied by [17-21].

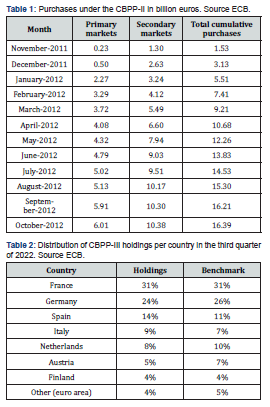

Also, ECB reduced the minimum required reserves ratio from 2% to 1%, offering an additional amount of 100 billion euros in MFIs liquidity [4]. Table 1 presents monthly cumulative purchases under CBPP-II from primary and secondary markets. The share of secondary and primary market purchases to total cumulated purchases is 63.30% and 36.70% respectively at the expiration of the program.

In 2012, the ECB launched the outright, open market, monetary transactions program (ΟMTs) in order to replace the SMP, but finally the new program was not activated. Only the OMT announcement, which included purchases of sovereign bonds of vulnerable countries under a European Stability Mechanism economic and adjustment program, resulted to a significant narrowing of government bond spreads of distressed countries [12, 13, 15, 22-24]. Also, after slight increases, the ECB cut its key interest rates towards to the effective lower bound see (Figure 1).

The low inflation period

From mid-2013, the eurozone got into a low inflation period and the ECB responded by launching measures to address the risk of deflation. The ECB’s measures included the first tranche of targeted LTROs scheduled to enhance bank lending to firms and households, forward guidance for its upcoming monetary policy objectives, the outright purchases of asset backed securities (ABSPP) and the third program of covered bank bond purchases (CBPP-III) [3].

Tables 2 and 3 present distribution of CBPP-III and ABSPP holdings per country in the third quarter of 2022. The Eurosystem conducted net purchases of eligible securities from primary and secondary markets for both programs till the end of 2018 and then reinvested the principal payments. From November 2019 net security purchases for both programs restarted.

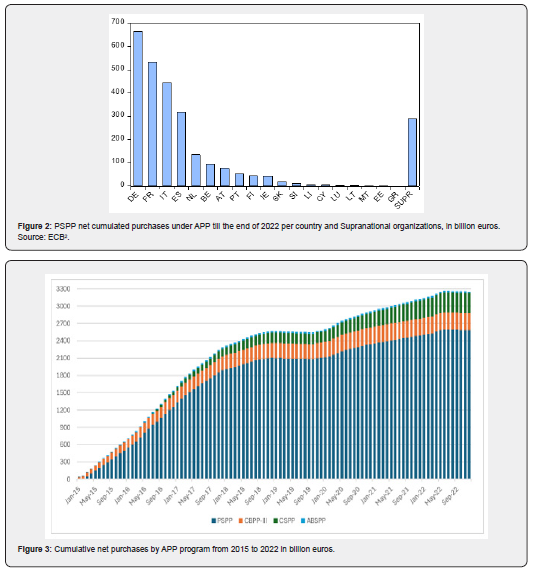

On January 22, 2015, the ECB established the expanded Asset Purchasing Programme (APP) by adding the Public Sector Purchasing Programme (PSPP) to the existing two programs2. PSPP includes purchases of bonds from recognized authorites, national, regional and local governments and international organizations. Figure 2 presents PSPP net cumulated purchases at the end of 2022 per country (and supranationals) with the largest shares coming from Germany, France, Italy, Spain and Supranational organizations.

As we can see vulnerable eurozone countries (Greece, Portugal, Ireland and Cyprus) as well as Slovenia, Slovakia, Lithuania, Latvia and Estonia present very low cumulative purchases. Especially Greek sovereign bonds were ineligible for PSPP. The total monthly purchases of private assets and public bonds at the beginning of the expanded APP were 60 billion euros. The monthly asset purchases reached 80 billion euros in March 2016, while a new program of corporate sector security purchases (CSPP) was included in APP, and a second tranche of targeted LTROs was operated. The ECB established several extensions and recalibrations of the APP (60 billion euros net purchases from April to December 2017, 30 billion euros from January to September 2018 and 15 billion euros between October and December 2018) till the expiration of the program at the end of 20183.

In March 2019 the ECB announced the third tranche of targeted LTROs [26] and, in September, the reactivation of APP with 20 billion euros monthly purchases. Figure 3 presents cumulative net purchases by APP program for the period 2015 to 2022 in billion euros. At the end of 2022 cumulative net purchases were 3,253.65 billion euros of which 2,584.67 billion euros (79.44%) concerns the PSPP, 344.19 billion euros (10.58%), the CSPP, 301,97 billion euros (9.55%) the CBPP-III and 22.89 billion euros (0.70%) the ABSPP.

An extensive amount of research on the impact of the ECB’s unconventional policy measures on financial assets, macroeconomic variables, credit expansion and sentiment has been conducted in the last few years. Regarding the positive effect of the ECB’s non-conventional policy decisions on equity markets, researchers used either event studies and regression analysis [12, 27-37] or vector autoregressive (VAR) models [38-40]. [41,42] showed that market indices of distressed euro area member states did not respond significantly to ECB’s non-conventional interventions.

Several surveys investigated the impact of the ECB’s monetary interventions on macroeconomic variables (mainly in output and inflation) using various VAR models (see among others [38, 43-48]). Recent pioneer papers explored the efficiency of the ECB’s unconventional operations on credit expansion using either VAR models [38, 48-51] or regression analysis [6, 52-57]. [38, 46] found no cross country homogeneity in the impact of unconventional measures on output and [54,55,57] on credit expansion with weaker effects for distressed eurozone countries.

Also, some papers analyze ECB’s specific non-regular liquidity provision measures. [58,59] focused on the first tranche of targeted LTRO and [60] on the second. In addition, other researchers studied the influence of unconventional policy on sentiment [48, 61,62].

The covid-19 pandemic crisis

In the first few months of 2020 the coronavirus pandemic had a detrimental effect on the financial markets and economies of the eurozone. In March 2020, the ECB attempted to strengthen credit provision, restore confidence in capital markets, and facilitate monetary policy transmission by announcing the pandemic emergency purchase program (PEPP) to acquire a portfolio of 750 billion euros of public and private securities and also announced a temporary envelope of 120 billion euros for APP [3]. Shortly PEPP was expanded to an overall amount of 1,850 billion euros. Additionally, in May 2020, the ECB established a new series of pandemic LTROs and recalibrated the third series of targeted LTROs.

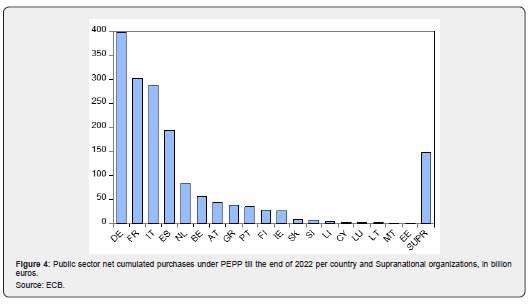

Figure 4 presents public sector net cumulated purchases under PEPP at the end of 2022 per country (and supranationals). In comparison with Figure 3, public purchases under PEPP are higher for distressed eurozone member states, as PEPP purchases were extended to securities that are not eligible under the APP while eligibility requirements were full waived for Greek government bonds. [63] found that ECB’s security purchases during the coronavirus pandemic were effective in decreasing sovereign bond spreads in the eurozone particularly for lower credit rating countries while [64] analyzed the different effects of PEPP and PSPP on bond spreads and inflation swaps.

Conclusion

European economies, capital markets and financial institutions experienced significant shocks from the onset of economic crisis to the coronavirus pandemic. In this paper I present the ECB’s monetary policy interventions aimed at managing the risks stemming from the turmoil in capital markets, the financial and european debt crisis, the deflation period and the covid-19 pandemic. The review of related literature showed that the ECB managed to boost credit provision, enhance economic activity, stabilize inflation and revive capital markets in the eurozone by introducing non-conventional measures when its main interest rates approached the effective lower bound. Nevertheless, the transmission of non-regular measures was not homogeneous between eurozone member states. Distressed member countries benefited the least from non-regular measures in terms of credit expansion, output growth and recovery of their capital markets. This revelation carries significant implications for policymakers as they should design more effective policy measures taking into account national characteristics to limit country heterogeneity in the transmission of non-regular measures.

References

- Borio C, Disyatat P (2016) Unconventional monetary policies: an appraisal. Bank for International Settlements No. 570.

- Fiorelli C, Meliciani V (2019) Economic growth in the era of unconventional monetary instruments: A FAVAR approach. Journal of Macroeconomics 62: 1-20.

- Hobelsberger K, Kok C, Mongell FP (2022) A tale of three crises: synergies between ECB tasks. ECB occasional paper series No 305.

- Cour-Thiman P, Winkler B (2013) The E.C.B.'s nonstandard monetary policy measures. The roll of institutional factors and finance structure. Oxford Review of Economic Policy 28(4): 765-803.

- Falagiarda M, McQuade P, Tirpak M (2015) Spillovers from the ECB's nonstandard monetary policies on non-euro area EU countries: evidence from an event study analysis. ECB working paper series No.1869.

- Burietz A, Picault M (2023) To lend or not to lend? The ECB as the ‘intermediary of last resort’. Economic Modelling 122: 106228.

- Beirne J, Dalitz L, Ejsing J, Grothe M, Manganelli S, et al. (2011) The impact of the Eurosystem’s covered bond purchase programme on the primary and secondary markets. ECB Occasional Paper No 122.

- Petrakis N, Lemonakis Ch, Floros Ch, Zopounidis C (2022) Greek banking sector stock reaction to ECB’s monetary policy interventions. Journal of Risk and Financial Management 15(10): 448.

- Falagiarda M, Reitz S (2015) Announcements of E.C.B. unconventional programs: Implications for the sovereign spreads of stressed euro area countries. Journal of International Money and Finance 53: 276-295.

- Szczerbowicz U (2015) The ECB unconventional monetary policies: Have they lowered market borrowing costs for banks and governments?. International Journal of Central Banking 11: 91-127.

- Eser F, Schwaab B (2016) Evaluating the impact of unconventional monetary policy measures: Empirical evidence from the ECB’s Securities Markets Programme. Journal of Financial Economics 119(1): 147-167.

- Fratzscher M, Lo Duca M, Straub R (2016) ECB unconventional monetary policy actions: Market impact, international spillovers and transmission channels. IMF Economic Review 64: 36-74.

- Jäger J, Grigoriadis T (2017) The effectiveness of the ECB's unconventional monetary policy: comparative evidence from crisis and non-crisis euro-area countries. Journal of International Money and Finance 78: 21-43.

- Ghysels E, Idier J, Manganelli S, Vergote O (2017) A high frequency assessment of the ECB Securities Markets Programme. Journal of the European Economic Association 15(1): 218-243.

- Krishnamurthy A, Nagel S, and Vissing-Jorgensen A (2018) ECB policies involving government bond purchases: impact and channels, Review of Finance 22(1): 1-44.

- Trebesch C, Zettelmeyer J (2018) ECB interventions in distressed sovereign debt markets: The case of Greek bonds. IMF Economic Review 66(2): 287-332.

- Darracq Paries M, De Santis R (2015) A non-standard monetary policy shock: the ECB’s 3- years LTROs and the shift in credit supply. Journal of International Money and Finance 54: 1-34

- Garcia-Posada M, Marchetti M (2016) The bank lending channel of unconventional monetary policy: The impact of the VLTROs on credit supply in Spain. Economic Modelling 58: 427-441.

- Andrade P, Cahn C, Fraisse H, Mésonnier JS (2018) Can the provision of long-term liquidity help to avoid a credit crunch? Evidence from the Eurosystem’s LTRO. Journal of the European Economic Association 17(4): 1070-1106.

- Crosignani M, Faria E, Castro M, Fonseca L (2020) The (Unintended?) consequences of the largest liquidity injection ever. Journal of Monetary Economics 112(C): 97-112.

- Carpinelli L Crosignani M (2021) The design and transmission of central bank liquidity provisions. Journal of Financial Economics 141(1): 27-47.

- Altavilla C, Giannone D, Lenza M (2016) The financial and macroeconomic effects of OMT announcements. International Journal of Central Banking 12(3): 29-57.

- Acharya V, Eisert T, Eufinger C, Hirsch C (2019) Whatever It Takes: The Real Effects of Unconventional Monetary Policy. The Review of Financial Studies 32(9): 3366-3411.

- Mody A, Nedeljkovic M (2024) Central bank policies and financial markets: Lessons from the euro crisis. Journal of Banking and Finance 158: 107033.

- European Central Bank (2019) Taking stock of the Eurosystem’s asset purchase programme after the end of net asset purchases. ECB Article, Economic Bulletin, Issue 2.

- European Central Bank (2021) TLTRO III and bank lending conditions. ECB Article, Economic Bulletin, Issue 6.

- Rogers J H, Scotti C, Wright JH (2014) Evaluating asset-market effects of unconventional monetary policy: a multi-country review. Economic Policy 29(80): 749-799.

- Fiordelisi F, Galloppo G, Ricci O (2014) The effect of monetary policy interventions on interbank markets, equity indices and G-SIFIs during financial crisis. Journal of Financial Stability 11: 49-61.

- Ricci O (2015) The impact of monetary policy announcements on the stock price of large European banks during the financial crisis. Journal of Banking and Finance 52: 245-255.

- Georgiadis G, Graab J (2016) Global financial market impact of the announcement of the ECB's asset purchase programme. Journal of Financial Stability 26: 257-265.

- Haitsma R, Unlamis D, de Haan J (2016) The impact of the ECB's conventional and unconventional monetary policies on stock markets. Journal of Macroeconomics 48: 101-116.

- Fiordelisi F, Ricci O (2016) "Whatever it takes" An empirical assessment of the value of policy actions in banking. Review of Finance 20: 2321-2347.

- Fausch J, Sigonius M (2018) The impact of ECB monetary policy surprises on the german stock market. Journal of Macroeconomic 55: 46-63.

- Fiordelisi F, Galloppo G (2018) Stock market reaction to policy interventions. The European Journal of Finance 24(18): 1817-1834.

- Pacicco F, Vena L, Venegoni A (2019) Market reactions to ECB policy innovations: A cross-country analysis. Journal of International Money and Finance 91: 126-137.

- Chebbi T (2019) What does unconventional monetary policy do to stock markets in the euro area? International Journal of Financial Economics 24(1): 391-411.

- Ferreira E, Serra AP (2022) Price effects of unconventional monetary policy announcements on European securities markets. Journal of International Money and Finance 122: 102558.

- Boeckx J, Dossche M, Peersman G (2017) Effectiveness and transmission of the ECB’s balance sheet policies. International Journal of Central Banking 13: 297-333.

- Weale M, Wieladek T (2022) Financial effects of QE and conventional monetary policy compared. Journal of International Money and Finance 127: 102673.

- Zwan van der T, Kole E, Wel van der M (2024) Heterogeneous macro and financial effects of ECB asset purchase programs. Journal of International Money and Finance 143: 103073.

- Vortelinos D, Gkillas K (2019) Reaction of E.U. stock markets to ECB policy interventions. International Journal of Banking Accounting and Finance 10(1): 39-66.

- Petrakis N, Lemonakis Ch, Floros, Ch, Zopounidis C (2022) Eurozone stock market reaction to monetary policy interventions and other covariates. Journal of Risk and Financial Management 15(2): 56.

- Peersman G (2011) Macroeconomic effects of unconventional monetary policy in the euro area. ECB Working Paper series No. 1397.

- Gambacorta L, Hofmann B, Peersman G (2014) The effectiveness of unconventional monetary policy at the zero lower bound: A cross-country analysis. Journal of Money, Credit and Banking 46: 615-642.

- Kucharcuková OB, Claeys P, Vasicek B (2016) Spillover of the ECB's monetary policy outside the euro area: How different is conventional from unconventional policy? Journal of Policy Modeling 38(2): 199-225.

- Burriel P, Galesi A (2018) Uncovering the heterogeneous effects of ECB unconventional monetary policies across euro area countries. European Economic Review 101:210-229.

- Fiorelli C, Meliciani V (2019) Economic growth in the era of unconventional monetary instruments: A FAVAR approach. Journal of Macroeconomics 62: 1-20.

- Evgenidis A, Papadamou S (2020) The impact of unconventional monetary policy in the euro area. Structural and scenario analysis from a Bayesian VAR. International Journal of Finance and Economics 26(4): 5684-5703.

- Evgenidis A, Salachas E (2019) Unconventional monetary policy and the credit channel in the euro area. Economics Letters 185: 108695.

- Boeckx J, de Sola Pereira M, Peersman G (2020) The transmission mechanism of credit support policies in the euro area. European Economic Review 124: 1-31.

- Sleibi Y, Casalin F, Fazio, G (2023) Unconventional monetary policies and credit co-movement in the eurozone. Journal of International Financial Markets Institutions and Money 85: 101779.

- Gambacorta L, Marques-Ibanez D (2014) The bank lending channel: lessons from the crisis. Economic Policy 49: 1737-1759.

- Salachas E, Laopodis N, Kouretas G (2017) The bank-lending channel and monetary policy during pre- and post-2007 crisis. Journal of International Financial Markets, Institutions and Money 47: 176-187.

- Martins LF, Batista J, Ferreira-Lopes A (2019) Unconventional monetary policies and bank credit in the Eurozone: An events study approach. International Journal of Finance and Economics 24: 1210-1224.

- Grandi P (2019) Sovereign stress and heterogeneous monetary transmission to bank lending in the euro area. European Economic Review 119: 251-273.

- Gibson H, Hall St, Petroulas P, Tavlas G (2020) On the effects of the ECB’s funding policies on bank lending. Journal of International Money and Finance 102: 1-11.

- Petrakis N, Lemonakis Ch, Floros Ch, and Zopounidis C (2024) The impact of the ECB’s non-regular operations on bank credit: cross-country evidence. Operational Research an International Journal 24(3): 51.

- Andreeva D C, García-Posada M (2021) The impact of the ECB’s targeted long-term refinancing operations on banks’ lending policies: The role of competition. Journal of Banking and Finance 122: 105992.

- Benetton M, Fantino D (2021) Targeted monetary policy and bank lending behavior. Journal of Financial Economic 142(1): 404-429.

- Laine OM (2021) The Effect of targeted monetary policy on bank lending. Journal of Banking and Financial Economics 1(15): 25-43.

- Galariots E, Makrichoriti P, Spyrou S (2018) The impact of conventional and unconventional monetary policy on expectations and sentiment. Journal of Banking and finance 86: 1-20.

- Baker B, Ungor M (2024) Effects of Quantitative easing on economic sentiment: evidence from three large economies. Comparative Economic Studies.

- Blotevogel R, Hudecz G, Vangelista E (2024) Asset purchases and sovereign bond spreads in the euro area during the pandemic. Journal of International Money and Finance 140: 102978.

- Hubert P, Blot C, Bozou C, Creel J (2024) Same actions, different effects: The conditionality of monetary policy instruments. Journal of Monetary Economics 147: 103596.