U.S.-China Trade War: Regional Implications

Muhammad Ali Baig1* and Hassan Tariq2

1Ph.D. candidate and a distinguished graduate of National Defence University (NDU), Islamabad, Pakistan

2Researcher, Institute of Strategic Studies Research and Analysis (ISSRA), National Defense University (NDU), Islamabad, Pakistan

Submission: March 17, 2023; Published: April 17, 2023

*Corresponding author: Muhammad Ali Baig, Ph.D. candidate, National Defence University (NDU), Sector E-9 Islamabad, 44000, Pakistan

How to cite this article:Muhammad Ali B, Hassan T. U.S.-China Trade War: Regional Implications. Ann Soc Sci Manage Stud. 2023; 8(3): 555740. DOI: 10.19080/ASM.2023.08.555740

Abstract

According to the conventional wisdom, trade is not a zero-sum game, but a positive sum game. Same is the case of US-China trade relationship. Both countries developed decade’s long trade relations on the basis of mutual economic interests. Both countries United States and China, in past have been each other’s extensive partners, on economic trading and political cooperation. Continuous Chinese development and high growth rate, with the largest trade surplus challenged United States supremacy in the world. Therefore, United States made China liable for its unfair trade practices and initiated trade war. This study provides an assessment of US-China trade war and its regional and global implications including its economic implications for Pakistan. In this paper, American role in Chinese Economic development is also highlighted. This paper contends that full understanding of trade war requires close attention to the importance of power competition among two global powers.

Keywords: U.S.; China; Trade war; International Economy; Political; Economic

Abbreviations:USCBC: US-China Business Council; MFN: Most-Favoured Nation; PNTR: Permanent Normal Trade Relations; WTO: World Trade Organization; ECO: Economic Cooperation Organization; EU: European Union; GCC: Gulf Cooperation Countries; CPEC: China Pakistan Economic Corridor; IMF: International Monetary Fund

Background: US- China Economic Relations

The United States and China have a long and storied history of trade relations. Trade relations among both states were reinitiated in 1972 after more than two decades long trade embargo on China. In 1972, bilateral trade between US and China was less than 100 million USD. Two-way investments in each other market was close to zero. Only a handful of American jobs relied on trade with China. Today, more than a billion dollars of goods and services flow between both countries every day. More than 800,000 jobs depend on producing goods and services sold to China. China is now world’s second largest economy and the third largest market for American-made products, but situation wasn’t always this way as it is today [1]. Back in 1973, US and China laid the foundation of economic relations under the umbrella of National Council for US-China Trade, later on it was renamed as US-China Business Council (USCBC), which led the first American business delegation to China since the inception of People Republic of China in 1949. All this was just because of American president Richard Nixon’s efforts and historic visit to China in 1972 [2]. At the time, there was very little business between both countries, so one of the reasons behind (USCBC) was to figure out how China could do business with the US and how could US do business with China, because at the time there was very little China had to sell to US [1].

Initially both China and the US didn’t want to do trade, and economic relations were just minor part of process of normalization, that was started between United States and China. Initially Chinese were also reluctant in doing trade with United States and people of United States were also not encouraging trade with China because of its poor economic conditions. Later on, in 1980’s diplomatic relations between United States and China developed and trade between both countries improved. In initial years, trade balance was in favour of United States as compared to China, and at that time no one had predicted that in very short time China will be second largest economy of the world. With the passage of time bilateral cooperation among both states was increased but June 1989 was proved to be turning point for US-China trade relations. In response US government suspended military sales to Beijing and freeze relations [3]. These developments in China sparked negative reaction in United States and members of congress began to question whether we should continue expanding trading rights with China or not. In 1980, Untied States gave status of Most-Favoured Nation (MFN) to China, which was also altered. Congress members had strong reservations on Chinese attitude. However, in 2000, congress made a fateful decision and allowed permanent normal trade relations (PNTR) with China, and permanence of trade relations made an enormous difference as with PNTR there was always danger that China’s favourable access to market would be revoked; that resultantly deterred American firms from increasing their reliance over Chinese suppliers. With PNTR floodgates of investment were opened [4].

The U.S. multinationals worked with Beijing to develop new China centric supply chains. Once China secured status of PNTR it greased the wheels for its accession to World Trade Organization (WTO). When Clinton became the President of US, he signed the trade bill, and it paved the way for China’s accession to World Trade Organization (WTO) in 2001. China’s trade with World increased manifold after it became member of WTO. With WTO membership, China could trade more reliably with the world. It was considered to be a big milestone for China in economic terms. If China wasn’t member of WTO Chinese trade would not progress as much rapidly as it is today. Now China was the third largest buyer of US exports, trailing only Mexico and Canada. China was a 250 billion USD market for American companies. The growth in trade and investment was reciprocal before 2008 and Chinese investment in America was less than 1 billion USD every year, and by 2010 it was grown up to 5 billion USD [1].

After Chinese membership of WTO, trade had been a bone of contention between China and United States, as till 2000 US exports which grew at rate of more than 500 percent were reduced and bilateral US trade deficit reached to record level. America’s traditional imports suppliers from other economies in Asia shifted their export production to China, consolidating the United States’ long-standing trade deficit in region with China. According to Chinese opponents, China unfairly boosts its exports through subsidies or unfair practices, and it promoted foreign investor to do foreign investment in China. Therefore, in response to that Obama administration filed cases against China in WTO to take actions against illicit Chinese trade practices. Even it continued after Obama administration during the time period of Trump administration, as American President Donald Trump took actions to reduce bilateral American trade deficit and imposed high tariffs and sanctions to reduce American trade deficit against China. Along with imposing high tariffs on China, Trump administration has been increasing diplomatic and regional pressure to curtail China from its mal trade practices. In current scenario, it seems to be very difficult for Trump administration to curtail China from its trade practices, as US multinationals have invested billions of dollars in the expectation that transpacific trade will never face serious disruptions. Even if Trump administration remains successful with perfect strategy for compelling China to end its trade abuses, it will be very difficult obstacle to overcome [4].

Rising US-China Trade Tensions

Today the US and China are the world’s two largest economies. Relations between these two countries are crucial to the future development of the World Economy. Unfortunately, economic relations among both countries are troubled. History of trade battle among both countries began after joining WTO in 2001. China joined WTO under United States-China Relations Act 2000. President Bill Clinton pushed Congress to approve US-China trade agreement and China’s accession to WTO, saying that more trade with China would advance America’s economic interests. Soon after, Clinton administration accused the Chinese of failing to comply with global trade rules and demanded that China first resolve a list of outstanding trade grievances with Washington, including opening its market and protecting copyrights and patent. Among the key issues were that China was a major source of pirated musical compact disks and video laser disk, along with virtually all the computer software sold in China. On intellectual property rights, there was no enforcement of Chinese written law and in result of that it was costing 1 billion USD a year by 1994 and till 2019 it increased up to 1.73 billion USD [5].

As a new member of WTO, China lowered tariffs and opened its markets for trade, simultaneously China continued to steal US Intellectual Property and forced American companies to transfer technology to access the Chinese markets, which were the violations of WTO rules. By 2005, China lowered its imports tariffs to 10 percent from 40 percent that it maintained in 1990s. In 2005, Chinese exports to US increased 31 percent and American imports rose to 16 percent. In 2000, US trade deficit with China was 90.2 billion USD and in 2019 it was increased to 130 billion USD [6]. The growth in trade and investment have been two way. Prior to 2008, Chinese investment in United States amounted to less than 1 billion USD each year. In 2010, the number had grown to 5 billion USD annually. But since China joined the WTO, trade has remained bone of contention among both countries. US bilateral trade deficit with China has reached record levels. American traditional import suppliers from other countries in Asia had shifted their export production to China, consolidating the United States long-standing trade deficit with China in the region. Opponents say that China has unfairly boosted its exports through subsidies or other unfair trade practices. In response to that Obama administration in 2010 filed WTO cases against China in industries including auto parts, rare earth, and credit card payments [1]. In 2010, the US trade deficit with China grew up to 273.1 billion USD and furthermore it was increased up to 295.5 billion USD in 2011. In March 2012, the United States, the EU and Japan filed a request for consultations with China at the World Trade Organization (WTO) over its restriction on exporting rare earth metals. The United States and its allies contended China’s violates international norms of trade, forcing multinational firms that use metals to relocate to China. China considered it unfair and defended its rights in trade disputes (“A Timeline of U.S.-India Relations,” 2022).

Chinese economic rise raised concerns for US hegemony in the world; consequently, it further heightened trade tensions between US and China. In 2013, China initiated Belt and Road Initiative and emerged as US competitor who challenged US hegemony in the world. BRI was signature project of Chinese President Xi Jinping, it was firstly announced when he visited Central and South-East Asia. It seeks to connect Asia, Africa, and Europe. It will also integrate all regions and would provide opportunity to China to expand its trade. According to China, BRI will play role in regional and international development, and it will interconnect different countries under one platform. The BRI will also play its role in economic and social development of those countries which are participating in it. Hence Beijing contends that BRI is a great undertaking that will benefit people around the world. BRI currently includes almost 140 countries across the globe. Linking countries with BRI would directly mean that it will expand Chinese trade in those countries as well as it will expand Chinese influence in those countries. United States number of times criticized BRI. On one side it will reduce American influence in those countries and on other side it will give set back to American Economy. China has also formed Asian Infrastructure Investment Bank (AIIB) to provide support for investment and development. Launch of AIIB represents China’s major financial initiatives that could rival US-led multilateral institutions. China is an emerging economic hegemon, and it is unacceptable by US. China’s initiatives of BRI, AIIB and “Made in China 2025,” demonstrate its long-term goals of reshaping global economic order. All these developments are unacceptable by political and economic hegemon United States [7].

A new phase of trade war between US and China started just after Donald Trump elected as President of US in January 2017. Since 1980s, Trump advocated tariffs to reduce US trade deficit and promote domestic manufacturing. Later in 2016, imposing tariffs became a major plank of his presidential campaign. Although some economists and politicians argue that US trade deficit is problematic, many economists argue that it’s not important and others advocates tariff as a solution. President Donald Trump in 2018 began setting tariffs and other trade barriers on China with the goal of forcing it to make changes to what the US continued saying “unfair trade practices” [8]. On July 7, 2018, Trump administration imposed a 25 percent tariff on imports of 34 billion USD of Chinese goods, following already tariffs imposed on steel, washing machines, aluminum, and solar panels.

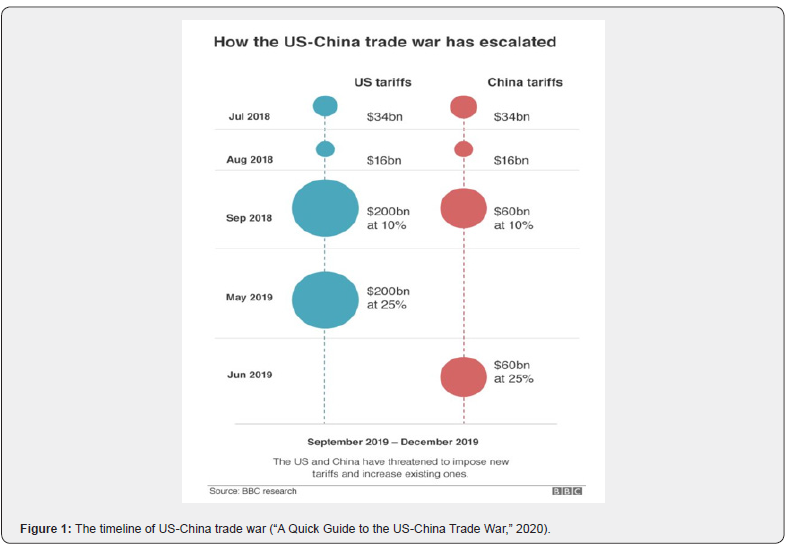

The Chinese government immediately retailed with a 25 percent tariffs on imports of US soybeans, other agricultural products and automobiles. On September 24, 2018, the US escalated its trade war with China by imposing 10 percent tariff on about 200 billion USD worth of Chinese products and that was increased to 25 percent till the end of 2018. China again responded with tariff on about 60 billion USD worth of US goods [7]. Trump’s tariff policy aimed to encourage consumers to buy American products by making imported goods more expensive. In total, US has imposed tariff on more than 360 billion USD of Chinese goods and China in retaliation-imposed tariff of more than 110 billion USD on US products. Washington delivered three rounds of tariff in 2018 and fourth round of tariff was imposed in September 2019. Beijing hit back with tariffs ranging from 5 percent to 25 percent on US goods. Trade war initiated by Trump continued for almost two years between both countries. It raised severe economic rifts among both countries and damaged both countries equally but damage to Chinese economy was greater as compared to American economy. This condition brought both countries on knees and American business community pressurized Trump administration to reduce tariffs on products imported from China [9]. Finally in last month of 2019, both states decided to negotiate and reduce tariffs on each other’s products and a trade agreement signed on January 15, 2020. United States warned China if it did not follow the guidelines, tariffs would be re-imposed [10]. Following flowchart depicts the chronology of imposed tariffs (Figure 1).

Impacts of US-China Trade War on Globalization

China with the high growth rate and trade surplus has emerged as highest competitor of United States. China is the primary target of US trade war efforts. Trade tensions among both states have seriously injured global economy and economic integration. Recent globalization has peaked after Chinese accession to WTO in 2001 and the global financial crisis in 2008. After the crisis, China and large emerging economies fuelled the international economy, which was thus spared from global depression. It continued for almost one decade until 2017. In 2017, global trade recorded its strongest growth in six years. But due to rising trade tensions and economic uncertainty, WTO warned that global trade growth is losing momentum and downside risk is hiked in global economy. Resultantly, Trump’s tariff war injured trade recovery that had taken a decade to materialize. In future, adverse conditions can fuel serious global recession in upcoming years [5].

US-China trade war is leaving imprint not only at global level, but it has also slowdown economic progress at regional level. Though partially trade war among both countries is halted by the agreement signed on January 15, 2020, but same year will face imminent consequences of global trade war. At regional level, Asia will also suffer from economic slowdown, and economic recovery might be very slow. Trade war will also negatively impact Chinese Belt and Road Initiative (BRI). Asian economic growth is typically tied to global industrial cycle, which has been dampened as a result of deteriorating business investment itself, a consequence of uncertainty brought up by the US- China trade war. Fixed asset investment growth in the region has already slowed significantly on a year-on-year basis from 5.1 percent at the start of 2018 to just half a percent in mid-2019. Notably, cumulative impact of trade war has yet to be fully reflected in economic data so far [11]. These trade war trends have threatened to the interconnected global economy. As a consequence of trade war, investors are threatened and flocking to safe heaven bonds. Currently after the global trade war, global economy is travelling on the narrow track. Trade tensions among both states not only affect global economy and globalization but will also increase political tensions among both states in future [12]. According to economists, trade war is a net economic loss of the world. May be some industries and countries may benefit from US-China trade war but at larger level if global trade war hits out, the economic hit will approach to economic recession. Tariffs imposed for negotiations purpose essentially upend the global trading system established by World Trade Organization (WTO). A global trade war that broke out in 2019 would lead to a decline in global gross domestic product of nearly 2 percent about 1.75 trillion USD and a 17 percent drop in the value of exports by 2022. Real income would fall 2.25 percent. In short, global trade war will impact every sphere of economic and political circle and would hurt Chinese vision of globalization and economic integration with slowing down of overall growth rate [13].

Economic Implications for Pakistan

Global climate has been stained with the impacts of trade war, but Pakistan remains far from this battle. According to economists, Pakistan exports very little number of products to the United States that are target of the tariffs. Pakistan shares a very small volume of trade with US with no trade in steel and aluminium. In short run, Pakistan will not face any impact as other countries are facing but if it continues in long phase and causes global economic recession that will have implications for Pakistani economy as it happened in economic crisis of 2008. Currently, US is not using any Pakistani products which are in surplus. Pakistan’s total trade with US is just 4.5 billion USD, which doesn’t matter in overall trade relations with rest of the world [14]. According to some economists, Pakistan can even get benefit from ongoing trade war between global powers, as like the goods being refused by the US will start knocking on the doors of other markets, undermining their domestic manufacturing in the same way they were affecting domestic production in the USA. In the wake of Trump’s enhanced tariffs on Chinese goods the European Union (EU) immediately slapped their own protection measures to ensure that the goods originally meant for the US markets do not find their way in the EU markets.

Being the first neighboring country, Pakistan is in better position to buy Chinese goods. Xinjiang is developing as new production powerhouse and its convenient access will lower shipping costs for Pakistan. With the development of CPEC, mobility of goods across the border will also improve. But in all this situation, Pakistan must keep close eye on ongoing international trade developments. Though Pakistan’s economy is least integrated in global supply chain, but Pakistan has shifted its economic resilience towards China. If confrontation continues among both countries in long run, it will impact Pakistan as well because of CPEC. Adverse developments among both countries in future will cause adverse impacts on CPEC developmental projects. It can delay in infrastructure development projects (particularly hydropower projects). Significant increase in input prices may pose risk to the future profitability growth of this sector. Pakistan should also identify various avenues of investments from other countries other than United States and China. So that reliance over US and China can be reduced [15].

Pakistan needs to improve economic outlook by enhancing its economic cooperation with those countries having lower trade barriers, higher consumer assurance and potential for supply chain integration by revisiting its trade policy and using Economic Cooperation Organization (ECO) to further advance bilateral and economic relations with Gulf Cooperation Countries (GCC), Iran, Turkey, and Central Asian Republics [15].

Recommendations

Both US and China are considered to be leading global economies and market economy is strongly dependent upon their behavior. Their behavior has strong global impacts on global politics and global economy. US is a hegemonic power and China is emerging as a competitor of United States in the world and challenging its hegemony. Both states consider each other responsible for political and economic rifts. This situation is not only hurting both states but causing negative global impacts as well. Current phase of trade conflict has reduced significant global growth. Recently, a trade deal has been signed among both states in second week of January 2020. It has provided leverage to both states to resolve their disputes. Both countries are hopeful for normalization of relations after this trade deal. But in future such trade conflicts will re-emerge as soon as China challenges the US hegemony. Long persistent trade conflict among both states can cause global recession and it will impact every state of the world, but third world countries will be more vulnerable to negative trade developments as most of third world countries rely on developed countries for their economic growth and development. They will be ignored. Both states should address each other concerns so that dispute resolution can be made possible. US should change its behavior towards China and China should also avoid illicit trade activities that are a major bone of contention among both states. It will be necessary for the peace and development of world.

Being a part of China Pakistan Economic Corridor (CPEC), Pakistan will also suffer from their trade conflicts. Pakistan is in cooperation with China and US collectively. We have no capacity to ignore any one of them. As for annual aid from International Monetary Fund (IMF), we heavily rely on US for its vote of support in IMF and on the other hand, for developmental projects we heavily rely on China. Pakistan and all other depending countries on both states should learn lesson from this trade war and reevaluate their policies and should find alternative markets and countries so that in case of trade conflict among both states loss can be minimized. Both countries should re-evaluate their policies as being dominating states of the world, it is in their mutual as well as global interest to avoid such conflicts so that global development and peace can be maintained.

Conclusion

Integrating large, rapidly emerging countries into the international order is always problematic. In the case of China, it is more difficult due to differences in political values, and its large bilateral surplus with the US. As a consequence, one must expect that China will be involved in irregular trade conflict with the US and others for the foreseeable future. Undoubtedly, US has been a global hegemon since the end of Second World War and enjoyed global dominance for more than seven decades. It is unacceptable for them to see China as their competitor that has grown into their hands. Though China has claimed many times that China is not interested to be a future global hegemon, but Chinese moves show its intentions. Current international economic and trade order is created and maintained by US. Trump’s slogan of America’s first shows their fear towards their hegemony. US blames China for illicit trade practices against the rules of WTO and both countries retaliate on each other’s actions. Current trade conflict is ample example of it.

Currently both US and China are engaged into trade war but if we see the driving forces and parameters of trade war are more political rather than economic. US knows that development of Belt and Road Initiative (BRI) will reduce its influence at global level that US maintained for more than seven decades it will be unacceptable for US. That’s why US is lobbying against China at regional and global level either it is Asia Pacific region, or it is in South Asia. As China’s economic, technological, military, and political rise continues down the road, the U.S. will try to contain it in order to maintain its global hegemony. The obvious consequence of this seesaw game will be the intensification of the Sino–US competition over global hegemony. The U.S. and China, the two most powerful states in the world, appear as if they were on a collision course. What this means is that so far as US fears about China’s overtaking US hegemony persists, a similar type of conflict between the two hegemonic powers is likely to occur in the future even if the current trade war is over.

References

- Baden B (2013) 40 Years of US-China Commercial Relations.

- Liua T, Woo WT (2018) Understanding the U.S.-China Trade War. China Economic Journal 11(3): 319-340.

- A Timeline of U.S.-India Relations (2022).

- Salam R (2018) Normalizing Trade Relations With China Was a Mistake.

- Steinbock D (2018) U.S.-China Trade War and Its Global Impacts. China Quarterly of International Strategic Studies 4(4): 515-542.

- China accused of trade “rape” by Trump (2016).

- Kim M(2019) A real driver of US–China trade conflict: The Sino–US competition for global hegemony and its implications for the future. International Trade, Politics and Development 3(1): 30-40.

- Hedrick-Wong Y (2018) The U.S.-China Trade War and Global Economic Dominance.

- Boylan BM, McBeath J, Wang B (2021) US–China Relations: Nationalism, the Trade War, and COVID‑ Fudan Journal of the Humanities and Social Sciences 14(1): 23-40.

- A quick guide to the US-China trade war (2020).

- Chay KK, Chan P(2019) Latest tariff threat could derail a U.S.-China trade deal.

- Robinson S (2019) US-China Trade War: Both Countries Lose, World Markets Adjust, Others Gain.

- Merrefield C (2019) US-China trade war: Global consequences edition.

- Kamani S (2018) Pakistan unlikely to feel impact of global trade war.

- Ali SM (2020) The U.S.-China Strategic Rivalry and its Implications for Pakistan.