International Trade and Economic Growth Nexus: A Review

Agnieszka Wójcik-Czerniawska1* and Elroi Hadad2

1Department of Economics and Finance of Local Government, College of Management and Finance, Warsaw School of Economics, Poland

2Department of Industrial Engineering and Management, Shamoon Collage of Engineering (SCE), Israel

Submission: October 19, 2022; Published: November 02, 2022

*Corresponding author: Agnieszka WÓJCIK-CZERNIAWSKA, Associate Professor, Department of Economics and Finance of Local Government, College of Management and Finance, Warsaw School of Economics, Warsaw, Al Niepodległości 162, 02-554 Warsaw, Poland

How to cite this article:Agnieszka W-C, Elroi H. International Trade and Economic Growth Nexus: A Review. Ann Soc Sci Manage Stud. 2022; 8(1): 555727. DOI: 10.19080/ASM.2022.08.555727

Abstract

The relationship between international trade and economic growth has been the focus of controversy in trade and development economics. Global trade is critical to the growth process, as mainstream economists Adam Smith and David Ricardo originally emphasized. On aggregate, trade between countries significantly has a higher growth rate, which has now been linked to trading in part. Nevertheless, almost all of the rises cannot be attributed to economic and commercial liberalization.

In this paper we study long-term relations between international trade and economic growth. Using qualitative analysis from several economic sources, we show that international trade and economic growth are intertwined, but also that monetary policies stability helps to improve the relationship, as negative financial drivers like inflationary pressures can stymie progress. The results suggest that international trade has only positive effects on economic growth, and that international trade has a large positive impact on economic prosperity, and capital and labor output elasticities have had both pro and con impacts on economic growth. Trade openness is also regarded to be significant, as lowering and removing trade barriers encourages trade growth and, as a result, economic growth.

Keywords: International trade; Development; Economic growth; Comparative advantage

Abbreviations: GDP: Gross Domestic Product; APEC: Asia and Pacific Economic Cooperation; FDI: Foreign Direct Investment

Introduction

The influence of international trade on economic growth has sparked heated debate amongst scholars and practitioners, mainly in developing nations. The purpose of trade liberalization is to create an environment that supports the development of high-quality items that help the economy flourish. As a result, global trade is seen as a key engine of global economic development. Despite the fact that global trade flow has varied and been delayed by recurring trade barriers, many governments actively desire global commerce because of the enormous, societal benefits that it brings. As a result, trade’s position as something of a primary driver for economic advancement is increasing in importance, particularly so because area is rich in natural resources but lacks firms to turn them to consumer products and other intermediate products. As nothing more than a result, overseas trade in these commodities is necessary to support economic growth by supplementing domestic processing industries [1]. To boost international trading activities, developing markets, particularly in Africa, have used trade strategies such as import substitution policies, currency exchange, taxes, and quantitative controls. The financial indirect consequences of international trade, including such gains in productivity, intellectual resources, improved management of the economy, better distribution of resources and utilization, tariffs and non-tariff volatility, and technology diffusion, are driving these trade agreements [2].

Since Adam Smith’s conversation of specialization talks around export-led growth vs. import substitution, economists studying the drivers of the standard of existing have been attentive to the potential of trade on economic development and growth. The connection between international trade and economic growth seems to have been a hot question in the development industry for a long time. Despite this, there is little evidence suggesting trade and income growth are intertwined. The importance and elusiveness of resolving the disputed concerns from both a theoretical and empirical standpoint are demonstrated by the potency and increased attention in development economics arguments about the connection between trade and growth.

In these debates, the fundamental issue of argument seems to be whether economic and commercial policies are causal or otherwise. These arguments are driven by the statistic that determining the ceteris paribus influence of trade on economic development is challenging because the direction of causality cannot be ascertained just by looking at the two. Trade can affect incomes by causing specialization due to comparative advantage, misuse of economies of scale returns, knowledge exchange owing to better-quality communication stations and travel, and science and technology spillovers due to investment opportunities and experience to new products and services, novel approaches of production, and novel organizational structures.

Trade, given to traditional trade theory, endorses economic development for the reason that it grounds capital redistribution, and nations that trade are likely to also have a comparative advantage meanwhile they specialize in producing and trading to their trade agreements, resultant in amplified economic growth. This has sparked a heated dispute among scholars and practitioners and other scholars regarding whether or not global commerce helps to increase economic growth. As a result, scholars have conducted an amount of research to measure the influence of global trade on the remainder of the continent’s economic advancement. On the one pointer, several empirical research has found that international commerce has a favorable influence on economic growth.

On the other side, some studies say that international commerce has an undesirable or unclear impact on countries and the remainder of the world’s economic advancement. These contradictory (inconclusive) conclusions continue to happen, signaling that further investigation is warranted to address the knowledge gap. In new years, digitalization has been recognized for its contribution to long-term growth in the economy. Economic growth will undoubtedly be spurred by the digitalization of the economy. Digitalization allows for better utilization of human resources and environmental assets, and also the building of economic output in the extractive sectors.

Economic growth is one of each economy’s and company’s major goals. Different measures are used to analyze economic growth and performance at both the macroeconomic and microeconomic levels. Their problem is that all of their metrics are based on value-added. International trade has an impact on both the country’s revenue and how firms operate. The global trade balance is frequently used as a starting point for assessing competitive advantages within a country’s economic structure, particularly at the industry and sectorial level.

Although the link between commerce and growth has already been recognized theoretically in economic literature, practically establishing the link has proven problematic. In this regard, the goal of this article is to demonstrate a long-term empirical relation between international trade and economic growth. Many countries have conducted empirical evidence on the influence of foreign trade on economic development and performance. We also provide an in-depth review of statistical or econometric methodologies in the literature that relate international trade and GDP growth and GDP growth, and the impact of international trade on Economic growth.

Methodology

We employ qualitative research to establish the long-term relationship between international trade and economic growth. Instead of developing a new data set using primary research techniques, we use secondary data from several sources, namely scholarly publications, books, government records, etc. To draw reliable study conclusions, this research design organizes, collects, and analyze these data samples.

Analysis

International trade permits nations to enlarge their marketplaces and get entree to products that would then be inaccessible nationally. As a consequence of global trade, the marketplace is becoming more aggressive. As a consequence, prices become much fairer, resulting in a decreased cost product for the customer. International commerce fostered the development of the international economy. In the worldwide trade, market forces, and thus prices, impact and are affected by world politics [3]. Political reform in Asia, for instance, might consequence in an upsurge in work expenses. This might surge the production cost for an American shoe firm operating in Malaysia, bringing about an increase in the value funded for a couple of shoes bought at a native mall by an American consumer.

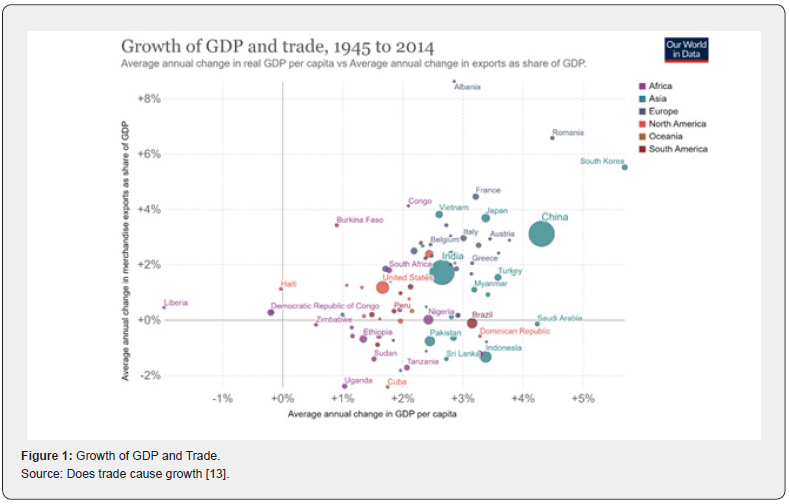

To study the effect of international trade and economic growth, several studies use the econometric model of the form

whereby  is the log difference of the gross domestic product

per capita (GDP), is the international trade variable and

is the log difference of the gross domestic product

per capita (GDP), is the international trade variable and  is exogenous variable, and

is exogenous variable, and  is the error term. In the next sections,

we cover several theoretical studies that include international

trade and exogenous variables to study their effect on economic

growth.

is the error term. In the next sections,

we cover several theoretical studies that include international

trade and exogenous variables to study their effect on economic

growth.

Imports and Exports

A commodity that’s also provided to the foreign arena is an export, even though a commodity that’s also accepted from the foreign arena is an import. Imports and exports are considered for in the present version unit of a firm’s financial statements.

Richer nations can create excellent use of their assets, including labor, knowledge, and finance, cheers to international commerce. Land, labor, finance, and knowledge, among many other factors, are unique resources and environmental assets in separate jurisdictions. This permits some nations to yield the very similar invention more cost-effectively, i.e. quickly and at a lower cost. As a consequence, they might be capable to market it for fewer than other nations. If a nation becomes unable to produce a product efficiently, it can gain it by partnering with a nation that can. This is considered to be a specialization in a global line of work.

For instance, due to their comparative advantages, either England or Portugal have promoted specialization and exporting in the past. Portugal has several wineries and can generate lowcost wines, while England’s pastures are plentiful with sheep, enabling it to manufacture low-cost cloth. Each nation would ultimately appreciate these realities and cast off capability to develop the more costly product nationally in favor of export. Over history, England clogged selling wine and Portugal refused to sell cloth. Both nations concluded that this was to their greatest advantage to stop releasing this stuff at home-based rather than commerce for them [4].

Comparative Advantage

These two countries learned that focusing on items in which they have a modest advantage allows them to yield more. In this example, the Portuguese would focus exclusively on winemaking, whereas the English will focus exclusively on cotton cultivation. Every country may currently produce 20 specialist production plants each year and export the very same amount of both. As a result, in each nation, both of these products are now more accessible. We can understand that the prospective process of making both commodities is more than the price of specialization for both countries.

Comparative advantage contrasts with absolute advantage. Absolute advantage results in indisputable profits from specialization and commerce solely when every supplier has an advantage in making a good. If a company does not have an absolute advantage, it will never sell something. Those countries with a comparative advantage, on the other hand, profit from commerce although they will not have a strong absolute edge.

Background of Comparative Advantage

The model of comparative advantage is recognized by David Ricardo, an English political economist. Even if it has been recommended that Ricardo’s instructor, James Mill, devised the theory and sneaked it into Ricardo’s book on the back of a napkin, comparative advantage is addressed in Ricardo’s 1817 book On the Principles of Political Economy and Taxation [5].

As we’re seeing, comparative advantage notably illustrates how specialized and trading focuses on the comparative advantages benefits both England and Portugal. In this situation, Portugal was capable of making wine at a minimal price, while England was capable of creating cloth at a minimal price. As per Ricardo, every nation would finally grasp these principles and stop seeking to make more luxury products.

Another more notable instance of comparative advantage is China’s competitive advantage over the US States in the type of economy labor. China produces simple commodities at a significantly lower price. In specialized, capital-intensive labor, the United States has a competitive advantage. American labor provides advanced items or speculation chances with the reduced opportunity overhead. Expertise and commerce along these principles help each nation.

Protectionism has largely failed, and the concept of comparative advantage can partly clarify why. When a nation leaves a global trade deal or applies tariffs, this could lead to an instant resident advantage in the shape of more occupations. This is seldom a long-term remedy to a trading issue, though. That nation will eventually be at a deficit in contrast to its neighbors, who can still produce these items at a lower economic cost [6].

Other Possible Benefits of Trading Globally

Worldwide commerce not only boosts productivity but also assists nations in integrating into the worldwide industry, which supports FDI (FDI). In theory, countries will be capable of growing more effectively and competitively as a result of this. FDI is a way for the receiving state to attract foreign capital and expertise. It creates jobs and, in principle, raises the gross domestic product (GDP). FDI helps a firm to continue expanding, leading to much more revenue for the owner.

Free Trade

The free trade hypothesis is easier for the two to understand. This process is denoted to as laissez-faire economics. With a laissez-faire method, there are no trade boundaries. The key dint is that worldwide supply and demand features will guarantee that manufacturing runs smoothly. As a consequence, there is no requirement to take any steps to defend or encourage trade and prosperity because free markets will require control of everything.

Protectionism holds that global trade restriction is required to ensure that markets function properly. As per assumptions of the model, market imperfections may suffocate the relevance of world commerce, and they target to dominate the economy appropriately. Tariff barriers support, and restrictions have been the most frequent types of protectionism. These methods are established to solve any global economic imbalances [7].

International firms can help a country way to generate and purchase commodities by allowing for specialization and, as a result, more efficient resource usage. Global trade inconsistency, according to opponents of trade liberalization, remains, placing emerging economies in danger. One thing is for sure: the world economy is always evolving. As a consequence, its participants must develop as well [8].

Contribution of International Trade to Economic Growth

Foreign trade expands the marketplace for a country’s products. Exports have the potential to boost productivity growth and serve as an economic driver. The development of a nation’s overseas trade could resurrect a stagnant economy and bring it down the route to stability and prosperity.

As a consequence of economies of scale, the increased international need may lead to large manufacturing and a cheaper cost structure. Economic growth may contribute to enhanced utilization of designed levels and, as a consequence, cheaper costs, resulting in more and more economic growth. Increasing exports could lead to more job opportunities. Higher export possibilities may also suggest fundamental investment in the country, which will aid in its economic growth.

Some of the key ways that international trade contributes to economic growth are as follows:

i. The primary purpose of international trade is to identify methods of getting capital equipment imports, which are necessary for the design process to take place.

ii. Trade allows knowledge to move more smoothly, leading to increased productivity and a short-term value-added.

iii. Foreign trade creates compression for dramatic alteration through (a) competitive import pressure, (b) competitive export market density, and (c) better resource allocation.

iv. Exports allow for greater capacity utilization, leading to economies of scale, as well as the separation of production patterns from domestic demand and increased experience with the use of new technologies [9].

v. Most employees’ well-being increases as a result of international commerce. It does so in at least four distinct: (a) enhanced export markets translate into better incomes; (b) even though staff members are also clients, commerce offers them with obvious rewards through imported goods; (c) commerce enables staff to be more effective as the price of the items they generate increases; and (d) commerce rises transfer of technology from manufacturing to developing nations, resulting in a demand for even more qualified workers in receiving countries.

vi. Increasing trade liberalization has been connected to alleviating poverty in most emerging countries. As philosopher Arnold Toynbee phrased it, “civilization has developed through mimesis,” or copying or simple imitation.

In brief, trade encourages more efficient use of various areas’ resource endowments and enables customers to obtain goods from trustworthy sources, hence boosting economic wellbeing.

Criticism of Comparative Advantage

What is the reason for the lack of open trade between nations? Why are some people disadvantaged at the cost of everyone else when there is free trade? There are several reasons for this, the most prominent of which is “rent-seeking,” as defined by economists. Rent-seeking happens when a group of people band together and lobby the government to safeguard their interests.

Suppose that American shoemakers comprehend and sympathize with the notion of free commerce, but that they also perceive that inexpensive foreign shoes will undermine their narrow benefits. Even if switching from shoe manufacturing to computer manufacturing would boost productivity growth, no one else in the shoe industry needs to waste their career or even see their wages diminish in the short term [10].

This ambition may lead to shoemakers lobbying for special tax concessions or more responsibilities on foreign footwear. Arguments abound for protecting American jobs and preserving a time-honored American craft; yet, these protectionism regulations would render American labor worse efficient and American consumers impoverished in the long run.

Challenges

Modernization and trade create new opportunities, but they often bring with them new obstacles. For a variety of reasons, developing markets may find it challenging to remain competitive on a global basis.

i. Ineffective or unproductive transportation, logistic support, or border control systems;

ii. A lack of connectivity in telecommunication services, currency sector, and information systems;

iii. Difficult-to-navigate supervisory surroundings that quash new investment;

iv. Significant market gamers or cartels interact in monopolistic practices that drive creativity, efficiency, or marketplace growth.

The increasing sophistication of business has far-reaching consequences for the world’s deprived, who are routinely blocked it off international, national, and sometimes even regional farmers’ markets in large numbers. Poverty is typically entrenched in locations where accessibility to strong economic hubs is constrained. Local businesses and localities lose out on the opportunity to produce knowledgeable, competitive personnel since they aren’t linked to global supply chains and can’t change their items and talents as quickly [11]. Increased trade has implications for dispersion as well. While more economic advantages nations in the long run by increasing competitiveness and producing a lot of good opportunities in the export sector, salaries in import-competing enterprises may decline or some people may quit their livelihood.

Stronger Trade Policies Enable Economic Growth for All

Trade policy is one of the numerous economic instruments utilized in emerging countries to meet the needs of economic growth. The goals of a country’s trade strategy have traditionally been to increase exports while limiting the amount of foreign exchange available to the government.

The scientific data aids emerging economies in making sound policy choices on business and finance, as well as climaterelated concerns, which are important for sustainable growth and poverty alleviation. An international effort to reduce trade costs and help countries become more linked to the world economy. This achievement allows the nations to keep aiding other nations in formulating and executing meaningful reform initiatives alleviating poverty and promoting economic stability [12].

The goal of a country’s trade strategy is to maximize advantages from international trade by encouraging efficient and competitive domestic production activities in the context of a global multilateral trading system.

Is trade a catalyst for economic development?

At the cross-country level, there is a correlation between increased international commerce and economic growth. Some of the most often referenced research in this field employ longrun macroeconomic data to demonstrate evidence of a causal relationship: trade has been one of the factors driving economic expansion. Utilizing fundamental economic evidence, numerous significant papers in this field have looked at the causal interaction of different trade liberalization policies on business reputation within countries. These studies also suggest that greater corporate productivity has resulted from trade liberalization.

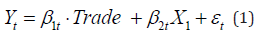

International trade and economic growth are strongly intertwined

The world economy has experienced consistent positive growth for the past half-century, which has now been complemented by the even quicker international trade growth. When we look into great nation data over the last half-century, we could see that there was a correlation between economic growth and international trade: nations with greater GDP growth both have increased rates of trade growth as a percentage of output. The graph below depicts this basic relationship, which plots the predicted yearly variation in real GDP per capita vs trade growth (average annual change in the value of exports as a percentage of GDP). Contest (businesses that perform poorly to innovation and lower charges were more likely to fail and just be supplanted with the assistance of much more businesses and institutions); Learning and innovation (companies that exchange advantage extra enjoys and publicity to increase and undertake technology and enterprise requirements from overseas competitors), and Economies of scale (companies that really can export towards the arena face high demand, and under the proper circumstances, they can perform at large scales where the fee per unit of product is low [13] (Figure 1).

A Theoretical Examination of Economic Growth

The relationship between international trade and economic growth has long captivated economists around the world, both conceptually and empirically. We’ve looked at three possibilities concerning international trade and economic performance below based on this approach. The monetarist trade theory argued that the only way for a state or nation to become wealthy and powerful is to limit service and product imports whilst promoting more export. The monetarists thought that by expanding exports whilst restricting imports, administrations would be able to achieve a beneficial trade balance, resulting in greater national affluence and, therefore, economic growth.

Despite growing theoretical proof of favorable links between change and growth in very many affluent countries, such associations have yet to be demonstrated in developing countries, especially in the developing world. Edwards [14] provides a complete summary of the important problems surrounding the link between transformation and economic growth, especially the continuing problems to obtain reliable markers of change the policy and precisely deciding the streams through which improved conditions allow growth, in their attempts to build such relationships. Additionally, according to the African Development Report [15], transformation is a potent tool for sharing the benefits of globalization both within the as well as between nations. Moreover, the relationship between growth and advancement is much more than a cause-and-effect relationship since economies alter and become more accessible as they develop [16].

Eliminating currency borders may also aid in the expansion of finance possibilities. Increased financing will lead to the development of emerging innovations, which will help the economic growth of the country. Expanding buyers and sellers possibilities, and therefore a business environment that appeals to multinational firms may help support such ventures. Nonetheless, the advantages of change are influenced by the manufacture, countryside, and qualities of the items that a nation creates and trades; the internal monetary laws that are enforced; and the bought and sold regime that is adopted. The comparative gain concept and the consequences of the transformation result in static and dynamic gains from transformation [17,18] (Figure 2).

According to Chen [19], Romer, Lucas, and Svensson claimed that period excess, as well as an outside stimulus, can cause an economic boom. To emphasize the position of technological innovation and information development, Grossman & Helpman [20] used endogenous boom forms of exchange. The model provides an endogenous long-run boom fee that links trade and boom by spreading era and expertise. According to the Rodriguez & Rodrik [21] claim that trade is linked to finance and the following boom. Taylor [22] proposed a simplified structuralist interpretation of currency coverage with financial boom, known as the gaps version, that explains why developing countries are growing at quite a negative rate. Jayme [23], who investigated data use in Brazil from 1955 to 1988, found that there was no clear link between exchange and growth. Nonetheless, Frankel & Romer [24] found that productivity for every capita increased by between 2 percentage points and 3percentage points for every percent increase in the exchange to Gross Domestic Product (GDP) proportion in the Asia and Pacific Economic Cooperation (APEC) countries, verifying the interrelationship between exchange and economic expansion. In a parallel analysis, Levine & Zervos [25] discovered a strong chain link between trade and growth for Central and Southern African countries. They have a look at discovered a high-quality sturdy correlation between financial boom and the proportion of funding in GDP.

Their research also demonstrates a important and positive relationship amongst the financing percentage and the change-to- GDP ratio. Ndulu & Njuguna [26] suggested a booming paradigm in which the structure factor was Gross domestic product and the independent variables were change and move coverage factors. Their findings revealed that change is linked to economic development, while macroeconomic factors like the actual trade rate, which affect exports and imports in a loop, have a important impact on financial growth. They also originate that financing has a direct influence on economic growth, but also that policy changes can hinder funding. Their research also demonstrated that, as little more than a result of change liberalization, transition openness is crucial in perceiving the incredible. According to Asam et al., (2002), the ratios of exports and output influence the boom’s size and power. Because exports are a crucial stream of income and a development engine, a robust export force fosters a tremendous multiplier effect within the financial system, with farreaching consequences. Ajmi AN et al. [27] used linear and nonlinear tests to find a cointegrating association between exporters and economic boom in South Africa, along with unidirectional causality from Gross domestic product to exports. They concluded that expanding employment and incomes inside the export zone, as well as technical innovation, can help enhance Economic growth.

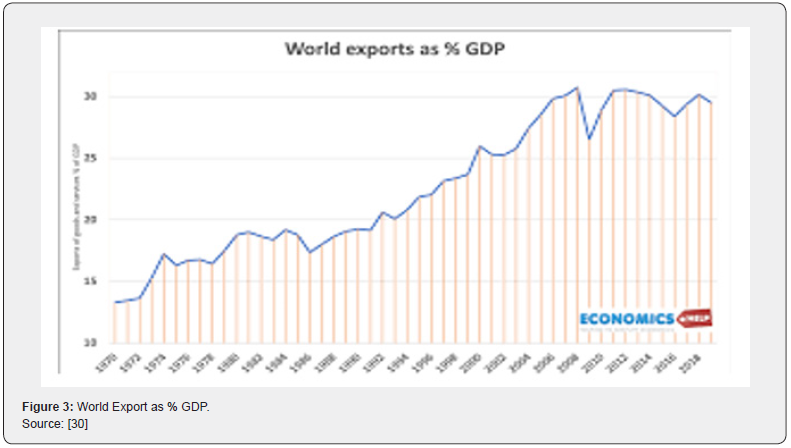

Imports are intrinsically related to economic growth, despite opposing implications on the supply side. Imports cause leakage on the demand side and stifle monetary development; nevertheless, import constraints can be alleviated by combining alternative liberalization with supply-side performance profits. The empirical data on the connection between imports and the financial boom, according to Mishra (2012), is mostly inconclusive. If rising GDP is frequently used to finance imports, growth would be stifled and monetary expansion will be harmed. Import growth also leads the domestic market for import substitution to decline, lowering funding and, in the long run, efficiency (Lim and others). Alternative openness is also another interesting matter in this study. Yanikkaya [28] found that alternate openness or boom may have had a large and extensive relationship. As an economic growth frees up (imports and exports as a small fraction of GDP) and participates more than that in global commerce, it will become a member of the international market and can reap the dynamic and static expansion of economic trade. The far more basic degree of integration, as according Yanikkaya [28], is the simple alternative ratios, which seem to be exports and imports divided by GDP, and research has suggested a huge and strong association with development. For example, Gries & Redlin [29] the usage of the alternate degree, imports and exports as a ratio of GDP as an openness degree, discovered a large courting among GDP boom and openness. The equal size is likewise the only castoff to degree alternate openness withinside the Penn World Tables [30] (Figure 3).

The income effect, the impact of the accumulation of capital, its consumer surplus, the wealth inequality impact, and the influence of the weighted elements are the five (5) important aspects of foreign trade that may affect economic growth, per the Corden Report (1985). These impacts are cumulative, which means that as the economy expands, the effect of trade openness on economic growth increases stronger. According to Chen, using global trade and other characteristics for explanatory variables to investigate the statistical relationship between the two variables could not only properly explain the relationship, but also reveal the degree to which independent variables affect dependent variables (2009).

Conclusion

The study’s purpose was to discover if there was a cointegrating correlation between Economic growth, which is also an endogenous quantity, and exogenous trade variable quantity and macroeconomic variables. The data demonstrated that cointegrating existed, viewing a long-term link between GDP and its regressors. The studies also revealed that to encourage trade and, eventually, economic expansion, a stable macroeconomic environment is essential. In a somewhat more economic cooperation environment, where the corporation may take advantage of foreign business and investment opportunities, the effect of trade-enhancing legislation is more effective. This shows that trade strategies aimed at reinstating global attractiveness and diversifying exports have the possible to produce and maintain profitable development for different economies throughout the long term [31].

Income activity, capital stock, labor, and trade liberalization all have a long-term relationship, according to the research. It was found that investment and trade liberalization boosted growth in the economy in together the short and long term. We also found that trade liberalization and investment development have a positive and significant relationship in stimulating economic development.

The consequences refuted our initial prediction that commerce will have a favorable connection with the log of GDP per capita, which was a good indicator of economic growth. We observed that, while commerce affects productivity, it may ultimately serve as an indicator of the already globalized nations after controlling for external factors that affect growth in the economy. We approached the problem after assessing the joint importance of environment and investment using high multicollinearity. In the recurring multiple linear regression models, the significant impact of savings on growth in the economy was consistent. The final model showed that the more money put into developing a domestic industry, the quicker the economy is booming [32].

Economic expansion is shaped by a myriad of variables, and for our study, we only considered the factors we consider important. To properly demonstrate the scope and impact of economic and commercial liberalization on productivity expansion, the model’s scope must be narrowed. Analyzing the nation’s economy and structure of the economy involves numerous variables, and restricting the field, whether by industry or in some other way, may show a more significant and nuanced connection between trade and investment [33].

However, a heavy reliance on foreign commerce could jeopardize fiscal stability and economic growth in terms of trade. The nation’s outward-oriented strategy should switch away from raw resources and semi-manufactured commodities and more towards high-value-added products to have a far higher effect on economic development. Furthermore, trade policy should promote capital-intensive businesses and the accumulation of human resources able to absorb advanced-country innovations [34-36].

Export has the potential to create jobs, boost productivity, transfer the level of technology, boost exports, and help developing nations achieve long-term economic growth. Even more, than before, nations at all development stages are looking for ways to use international commerce to help them develop. (UNCTAD). It has recently been recognized that global trade does not only result in cash inflow but also that international firms in the host nation can also assist local businesses. These advantages can take many forms, including improved advertising, administration, and production procedures. The role of technological advancement in economic growth has been emphasized in recent growth literature. The rate of development of emerging economies can sometimes be measured by their ability to adapt and use technology.

The purpose of the study was to examine if there was a cointegrating correlation between Economic growth and is an endogenous variable, and exogenous variables such as trading variables and macroeconomic factors. The data found a link, demonstrating a long-term association between GDP as well as its regression coefficient. The studies also revealed that to encourage trade and, ultimately, economic growth and an economically stable environment is essential. In a more open trade atmosphere, where enterprises may take advantage of trade and financial possibilities, trade-enhancing measures have a greater impact. This shows that trade policies designed to restore global competitiveness in a plan to enlarge and diversified exports can help emerging economies boost and accelerate growth.

References

- Asiedu KM (2013) Trade Liberalization and Growth: The Ghanaian Experience. Journal of Economics and Sustainable Development 4(5).

- Manwa F, Wijeweera A (2016) Trade liberalization and economic growth link: The case of Southern African Custom Union countries. Economic Analysis and Policy 51: 12-21.

- Abendin S, Duan P (2021) International trade and economic growth in Africa: The role of the digital economy. Cogent Economics & Finance 9(1): 1911767.

- Alola AA, Bekun FV, Sarkodie SA (2019) The dynamic impact of trade policy, economic growth, fertility rate, renewable and non-renewable energy consumption on the ecological footprint in Europe. Science of the Total Environment 685: 702-709.

- Amidi S, Fagheh Majidi A (2020) Geographic proximity, trade, and economic growth: a spatial econometrics approach. Annals of GIS 26(1): 49-63.

- Andabai P, MaryAnn N (2018) International Trade and Performance of the Nigerian Economy (1990-2017): A Causality Investigation. Research Journal of Finance and Accounting 9(4): 166-171.

- Gani A (2017) The logistics performance effect in international trade. The Asian Journal of Shipping and Logistics 33(4): 279-288.

- Babalola SJ, Mohd S, Ehigiamusoe KU, Onikola H (2019) Impact of foreign direct investment, aid, and trade on economic growth in Nigeria. The Journal of Developing Areas 53(4).

- Egyir J, Sakyi D, Baidoo ST (2020) How do capital flows affect the impact of trade on economic growth in Africa?. The Journal of International Trade & Economic Development 29(3): 353-372.

- Jensen JB, Quinn DP, Weymouth S (2017) Winners and losers in international trade: The effects on US presidential voting. International Organization 71(3): 423-457.

- Keho Y (2017) The impact of trade openness on economic growth: The case of Cote d’Ivoire. Cogent Economics & Finance 5(1): 1332820.

- Nathaniel SP (2020) Modeling urbanization, trade flow, economic growth, and energy consumption with regards to the environment in Nigeria. GeoJournal 85(6): 1499-1513.

- Our World in Data (2022) Does trade cause growth?.

- Edwards S (1993) Openness, Trade Liberalization, and Growth in Developing Countries Journal of Economic Literature 31(3): 1358-1393.

- UNDP (2012) African Development Report.

- Chatterji M, Mohan S, Dastidar SG (2013) Relationship between trade openness and economic growth of India: A time series analysis. SIRE Discussion Papers, Scottish Institute for Research in Economics (SIRE).

- Marrewijk C (2012) International Economics: Theory, Application, and Policy. Oxford University Press, Oxford.

- Siswana S, Phiri A (2020) Is Export Diversification or Export Specialization Responsible for Economic Growth in BRICS Countries? The International Trade Journal, pp.1-19.

- Chen H (2009) A Literature Review on the Relationship between Foreign Trade and Economic Growth. International Journal of Economics and Finance 1(1).

- Grossman GM, Helpman E (1990) Trade, Innovation, and Growth. American Economic Review 80(2): 86-91.

- Rodriguez F, Rodrik D (1999) Trade Policy and Economic Growth: A Skeptic's Guide to Cross-National Evidence. NBER Working Paper No. 7081.

- Taylor L (ed.), (1993) The Rocky Road to Reform: Adjustment, Income Distribution, and Growth in the Developing World, Cambridge: MIT Press.

- Jayme FG (2001) Notes on Trade and Growth. Textos para Discussão Cedeplar-UFMG td166.

- Frankel JA, Romer D (1999) Trade and Growth: An Empirical Investigation NBER Working Papers.

- Levine R, Zervos SJ (1993) What We Have Learned About Policy and Growth from Cross-Country Regressions. AEA Papers and Proceedings 83: 426-430.

- Ndulu BJ, Njuguna NS (1998) Trade policy and regional integration in Sub-Saharan Africa.: Paper presented at the IMF, African Economic Research Consortium Seminar on Trade Reform and Regional Integration in Africa, December 1- 3, 1997. - Washington, D.C: IMF Inst., Internat. Monetary Fund, No 1237: 239-277

- Ajmi AN, Ayeb GC, Balcilarc M & Guptad R (2013) Causality between Exports and Economic Growth in South Africa: Evidence from Linear and Nonlinear Tests. Working Paper Series University of Pretoria Department of Economics.

- Yanikkaya H (2003) Trade Openness and Economic Growth: A Cross-Country Empirical Investigation. Journal of Development Economics 72: 57- 89.

- Gries T, Redlin M (2012) Trade Openness and Economic Growth: A Panel Causality Analysis.

- Pettinger T (2019) The importance of international trade - Economics Help.

- Ohlan R (2017) The relationship between tourism, financial development, and economic growth in India. Future Business Journal 3(1): 9-22.

- Pascali L (2017) The wind of change: Maritime technology, trade, and economic development. American Economic Review 107(9): 2821-2854.

- Wiedmann T, Lenzen M (2018) Environmental and social footprints of international trade. Nature Geoscience 11(5): 314-321.

- Osei-Assibey K, Dikgang O (2020) International trade and economic growth: The Nexus, the evidence, and the policy implications for South Africa. The International Trade Journal 34(6): 572-598.

- Purnama PD, Yao MH (2019) The Relationship between International Trade and Economic Growth. International Journal of Applied Business Research 1(02): 112-123.

- Rahman MM (2021) The dynamic nexus of energy consumption, international trade and economic growth in BRICS and ASEAN countries: A panel causality test. Energy 229: 120679.