Digital Economic and Social Systems to be Featured by Stakeholders

Hiroshige Tanaka*

Professor Emeritus of Public Economics, Chuo University Tokyo, Japan

Submission: July 09, 2020; Published: July 30, 2020

*Corresponding author: Hiroshige Tanaka, Professor Emeritus of Public Economics, Chuo University Tokyo, Japan

How to cite this article:Hiroshige T. Digital Economic and Social Systems to be Featured by Stakeholder. Ann Soc Sci Manage Stud. 2020; 5(4): 555670. DOI: 10.19080/ASM.2020.05.555670

Abstract

Digital economic systems have integrated consumption and production totally and complexly in a centralized framework. Moreover, development of digital economies has revived significant problems of social security. No one can explore economic systems by separating social issues. To achieve sustainability in global societies we must obtain the design of blueprint for the global economic mechanism. This paper presents one theoretical framework to analyze the digital structure of economies to recreate more sustainable social system. Exploration on structural change of stakeholders involved by innovation of ICT leads to solve theoretically some complicated problems which occurred in the digitalization of economies and societies. Transaction costs of stakeholders are efficient indexes for an integrated analysis on the digitalization of economies and societies.

Keywords: Centralized Scheme; Covid-19; Digitalization of economies and societies; Innovation of ICT; Outside stakeholders; Transaction Costs of Stakeholders; Voluntary Provision of Efforts

Introduction

In 2020, Covid-19 pandemic makes locally and globally serious damages on economic and social systems. Digital economies have developed globally efficient economic and social systems. However, global transportation mechanisms unfortunately facilitate this serious disease to spread. To prevent the disaster from expanding, many counties and regions locked down integrated economic and social activities. Eventually, the pandemic easily has succeeded disturbing sophisticated system of digitalized economies and societies. Although development of digital technologies constructs efficient network systems of economies and societies, this network societies and economies appear to be vulnerable for risks of external economies. The digitalization of economies and societies has unprecedently evolved global economies. Many local economies are complexly connected with each other. If global system of economies and societies becomes at the peril of crises, it takes a great cooperative effort to correct the global problems. On the other hand, some digital technologies to be saved from infection of Covid19 contribute to social services. For example, remote works and digital transactions are prevailing in the crises. By experiencing this pandemic, the digitalization of economies and societies will transform but procced forward steadily. Although innovation occurs spontaneously, a cooperative scheme to share information and to coordinate behaviors is necessary to improve social welfare. To achieve sustainability in global societies we must obtain the design of blueprint for the digital economic mechanism. We should construct one theoretical framework to analyze the digital structure of economies to recreate more sustainable social system. This paper argues that exploration on structural change of stakeholders involved by innovation of ICT leads to solve theoretically some complicated problems that occurred in the digitalization of economies and societies. In the context of stakeholder structure, this paper presents an integrated analysis on economies and societies in the digital revolution. In decentralized framework Tanaka [1] explores a sustainable corporation to improve communication with two types, positive and negative, of stakeholders. In the 21th century innovation of ICT has shrunk large manufactural industries and raised new global industries.

Declining employees of manufactural factories and raising businesses in ICT industry fundamentally change the structure of stakeholders in regions1[2]. The new industrial revolution proceeds mainly in the centralized scheme but reforms indirectly connective relations in social communications and markets. Structural changes of stakeholders are supposed to feature diversification of economies and regions. Tanaka [3] explores that the comparative valuation by the two types stakeholders makes effective indication for sustainable global communities. When the digitalization of economies and societies prevails in global economies, we should make clear the condition that growing digital economies influence on sustainability of communities. Tanaka [4] argues that innovation of digital technologies raises outside stakeholders and that the unbalanced growth of stakeholders causes structural change of stakeholders. This structural change becomes one of the driving powers to propel the digitalization of economies and societies. The digitalization of economies and societies needs to expand traditional theories of industrial organization developed by Williamson [5-9] and others into theories of stakeholder structure. To provide a theoretical foundation on global industrial organization accompanies a new classification of transaction costs.

explored integrates various types of transactions developed by suppliers and consumers. This paper theoretically makes clear why innovation of ICT brings about revolutionary changes of global industries and provides a method of welfare analysis on digital economies. To feature the structural change of stakeholders indicates a significant index of social welfare in this industrial revolution. This paper is organized as follows. Section 2 features stakeholders to bring about the digitalization of economies and societies. To explore ramification of this industrial revolution we analyze comparatively centralized and decentralized social systems. Global economies are developed by basing on the centralized scheme and should be reviewed in the decentralized scheme. This section focuses on rapidly rising outside stakeholders brought by the digitalization of economies and societies. The outside stakeholders are assumed to correspond to negative stakeholders in the decentralized context. This revolution lowers the transaction cost regarding outside stakeholder. Section 3 demonstrates that every stakeholder contributes innovation voluntarily and that outside stakeholders make main force to propel the digitalization of economies and societies. Section 4 describes the transaction costs of stakeholders. The transaction costs explain a scheme that the corporation provides payments on stakeholders. Section 5 demonstrates theoretically that innovation of ICT increases absolutely and relatively outside stakeholders and that external stakeholders partially divide into inside and outside stakeholders. Section 6 suggests that transaction costs will be an effective approach to explore problems of Covid-19 pandemic.

Digital Economies and a Sustainable Social System

Digital economies are performing globally remarkable growth and expected to bring revolutionary changes on our communities. We should provide a theoretical method to explore sustainability of digital economies. Competition in markets dominates digital economies but mitigation of social losses from the revolution is brought by a framework of decentralization as follows.

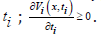

In the multi stakeholders communities, the production of the corporation and its payment for the stakeholder i are stated by x and ti . The stakeholder i (i = 1,...., n) is supposed to evaluate the performance of it by Vi (x, ti ) . This function is assumed to be increasing with

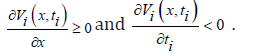

The centralized economic system is vulnerable to market and government failures to bring unsustainable economies and societies. To restore sustainability, we should insert a decentralized scheme into the vulnerable centralized system. Tanaka (2004) discusses sustainability in the decentralized system by dividing stakeholders into the positive and the negative stakeholders to be defined by

This paper theoretically explores how the digital revolution influences on sustainability by focusing on reconstruction of stakeholders. The corporation is supposed to perform production activity 𝑥𝑥 and to obtain the net private profit Π(x)in the market transaction. Innovation of ICT has evolved the market system. Generally speaking, the corporation provides goods and services to consumers in a one-way market transaction from supply to demand. Tanaka supposes that an innovation of ICT has been improving two-way communication in the framework of centralized schemes. To explore the innovation of communication system Tanaka [4] employs the approach to bring a classification of inside, outside, and external stakeholders. Economic activities of the corporation bring differentially social cost among stakeholders. To achieve sustainability the social system should allocate appropriately the social costs on the corporation. This classification makes clear that the corporation brings differentiated social costs to each type of stakeholders. In the transaction among the corporation and stakeholders’ particular contracts or trusts are possible to be used beyond market relations. These social costs make additional information to the market prices. To develop sustainability the corporation should take the payment 𝑡𝑡𝑖𝑖 for the stakeholder 𝑖𝑖 to complement ordinal market transactions. To analyze theoretically, Tanaka [4] classifies stakeholders as follows. The corporation ordinally contacts many stakeholders in the market and could make particular contracts supplementary with some stakeholders. The former stakeholder is referred as the inside stakeholder and the latter stakeholder is named as the outside stakeholder. The inside stakeholders include main customers, business partners and employees. Consumers or suppliers using internet2 [10] are supposed to exhibit a representative example of the outside stakeholders. The outside stakeholders are supposed to obtain less relevant interest and to be more occasional with the corporation than the inside stakeholders. The economic and social systems evolved by innovation of ICT bring social costs not only on the communities but also on the corporation. To survive rapidly changing digitalization of economies and societies the corporation should improve the evaluation of organization in both economic and social aspects. The social costs in the digitalization of economies and societies is partially burdened with transaction costs in the social systems. However, the corporation is not easy to conceive the transaction costs in ordinal activities. If we could formally evaluate transaction costs in the digital economies, they present a significant index on decrease of social loss or organizational efficiency. This classification of stakeholders facilitates to make clear the impact on the digitalization of economies and societies with a new terminology of transaction costs. In this paper we do not attempt to achieve general theory of the digital social system but only explore the social structural change in the digitalization by applying this method.

It is assumed that outside stakeholders are connected with the corporation mainly by networks of the internet. Development of digital technology enhances the quality of communication and enable the outside stakeholder to require a differentiate compensation for the transaction with the corporation. Markets of internet become to make possible to differentiate pricings of goods and services for particular transaction. While consumers in the shopping of internet market depend less on the limited corporations than the inside stakeholders such as employees, enlargement of internet services could take the outside stakeholders benefits yielding from lowering prices. That is, the innovation of digital technology makes the outside stakeholder obtain decreasing evaluation of the corporation regarding production x . To advance the reasoning of Tanaka [4] we rewrite the same Assumption 1 as before.

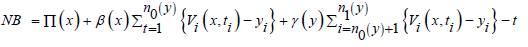

Assumption 1: Inside stakeholders consist of positive stakeholders. Outside stakeholders satisfy the definition of the negative stakeholders3 [11]. In the digitalization of economies and societies 𝑤𝑤e exhibit theoretically the objective function NB of net benefit by the expression (1)4. 𝑛 stakeholders are divided into inside stakeholders, 1…, 𝑛0, outside

stakeholders, 𝑛0 + 1, …, 𝑛1, and external stakeholders, 𝑛1 + 1, …, 𝑛. In the centralized scheme the corporation does not include the evaluation of the external stakeholders in the objective function. In the net benefit of the corporation β (x)and γ ( y) represent weights on evaluation of the inside and outside stakeholders . The corporation is assumed to share larger interest with the inside stakeholders than with outside stakeholders. Innovation of ICT can decrease this communication gapes between the corporation and the outside stakeholder. It is assumed that raising effort yi of any stakeholders i could improve communication environment surrounding the corporation. We simply express the above argument by γ ' ( y) > 0 Although Tanaka [4] provides optimal condition of yi , this paper explores how the innovation transforms the structure of stakeholders. Any inside stakeholder i (i = 1,..., n0 )might be supposed to enhance the trusty connection with the corporation as the production increases. β (x) is an increasing function of corporation production (β ' (x) > 0) .

It is assumed that is written to be independent of the total effort y . The structural efficiency of communication is analyzed formally by using coefficients β (x) andγ ( y) , when the inequality 1 > β (x) > γ ( y) holds for all x, y . Tanaka discusses that the corporation in the centralized scheme brings social welfare losses under the incomplete objective function. It is appropriate that we construct a decentralized scheme to restore sustainability. However, digital economies in the enlarging global economies cannot be stopped expanding in the centralized scheme and are not expected to be governed sustainably in a decentralized framework. We should explore a scheme to improve sustainability of digital economies in the centralized system. Since innovations of ICT in digital economies have expanded internet services, some previous external stakeholders are more possible to make transaction with the corporation and to turn into outside stakeholders. The innovation of ICT is expected to change the structure of stakeholders. When digital economies are enlarging, one type of stakeholder is easier to move into another type of stakeholder than before the digitalization of economies and societies. To discuss strictly structure changes of stakeholders brought by the digitalization of economies and societies, we explore the situation to be described as Assumption 2.

Assumption 2: Stakeholders can choose freely inside and outside stakeholder to accompany changing behaviors between negative and positive stakeholders. The external stakeholders are difficult to become to take behaviors of inside stakeholders because of legislative and institutional constraints. However, the digitalization of economies and societies removes some obstacles for external stakeholders to obtain the benefit from taking outside stakeholders5.

Innovation of ICT and Contribution of Stakeholders

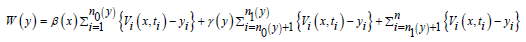

As the scale of global economies grows, both positive and negative stakeholders increase. According to the argument of Tanaka [3] social welfare losses increase under incomplete sustainable mechanisms. Tanaka [4] discuss that digitalization of economies and societies could only partially decrease the social welfare losses and get rid of the vulnerability of the global social system. To become more sustainable, we must construct an incentive scheme for the corporation to reduce the social welfare loss6[12]. The sustainable system of communication calculates social welfare by basing on the evaluation of all stakeholders and burdens the corporation a part of the social welfare loss. Tanaka [13-14] and (2017) demonstrate that the sustainable mechanism of communication is constructed by cooperation of all stakeholders. The sustainable network of communication is defined to be public goods and to be presented by total effort

Any stakeholder is assumed to make contribution yi to increase the social welfare brought by digital innovation. As the network of economies actually propels the digitalization of economies and societies, stakeholder i aims to maximize targeted social welfare of the corporation by using yi ,

As inside and outside stakeholders are supposed to intent their contributions to reflect on the corporation, expression (2) writes same coefficients β (x) andγ ( y) as (1). This objective function contains welfare of the external stakeholders that the corporation does not concern, because contributions all stakeholders yield innovation in the network society. To explore the influence of outside stakeholders on the innovation, we define welfare of outside stakeholders by

Noticing the

outside and external stakeholders are written by

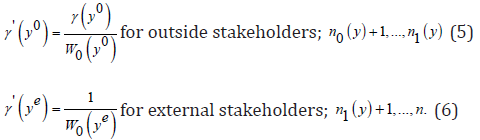

Feature of γ ( y) to be written in (2) and (3) described by network of economies and societies. The above (4), (5) and (6) imply that the three types of stakeholders obtain different optimal contributions 0, yi y , ye. That is, all stakeholders attempt voluntarily to contribute innovation with different targets. Contributions by stakeholders on innovation are featured by Assumption 3.

Assumption 3: Marginal weight for outside stakeholders γ ' ( y) is supposed to be decreasing with total contributions in innovation of ICT. The welfare of outside stakeholders depends on their targeted contribution. In a temporal decision making every stakeholder of (2) does not transfer into another type of stakeholder. The relations ;

Considering the inequality1 > β (x) > γ ( y) , we ensure that expressions (4),(5) and (6) bring the relation y0 > yi > ye holds. This expression is explained as follows. The external stakeholders obtain lesser interest with improving efficiency of communication network than other stakeholders but participate on contribution on communication to improve audit and legislation by using the internet. Inside stakeholders actively utilize the network and seek to improve innovation of ICT to raise productivity by using new technologies such as IoT8[16]. Outside stakeholders are involved extensively in the rising businesses such as Fin Tech. In the digitalization of economies and societies this inequality shows that outside stakeholders provide larger potential contribution for innovation than other stakeholders. Increasing outside stakeholders become more probable to promote innovation of ICT. This result ensures the implication expressed by Proposition 1.

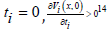

Proposition 1: All three types of stakeholders contribute collectively the revolution to improve digital economies with diversified motivations. However, the effort of outside stakeholders makes more contribution than other types of stakeholders on expansion of innovation of ICT. The growth of outside stakeholders is a vital factor to promote digitalization of economies and societies. Figure1 is presented to illustrate implication of Proposition 1. A down sloping curve AE depictsγ ' ( y) . Optimal solutions (4), (5) and (6) are showed by points C, D and B. By reminding that total effort y is summation of all efforts of stakeholders, the optimal conditions exhibit a cooperative solution of efforts. That is, the solution does not determine the share of effort brought by each stakeholder. Game theoretical approach could be applied to obtain definite effort of sharing. By using the above optimal conditions this paper describes the method to allocate efforts on stakeholders as follows. For y ; y ≤ ye (6) shows that all stakeholders provide effort to improve innovation of communication. For ye ≤ y ≤ yi , (4) makes sure that outside and inside stakeholders provide effort. For y ; yi ≤ y ≤ yo , (5) states that only outside stakeholders provide effort to improve innovation of ICT. Figure 1 exhibits clearly that marginal expansion of innovation of digital economies is promoted mainly by effort outside stakeholders. Consequently, innovation of ICT and digitalization of economies and societies are brought by the growth of outside stakeholders.

Transaction Costs and Structure of Stakeholders

Corporations in digital economies have become to combine firmly with global networks of economies and societies. It is supposed that the digitalization of economies and societies causes rearrangement of global industrial networks. Corporations should reform their own production networks to survive great fluctuations brought by the industrial revolution9[17]. Corporations must not only seek to achive maximization of private profit but also to pursuit integrated governance of inside and outside stakeholders. Integrated organizational governance of total structure of stakeholders could produce new businesses to promote digitalization of economies and societies. In 2010, Williamson suggests “the common view of contract as legal rules thus gives way to the more elastic concept of contract as framework10”. Evolution of digital economies accompanies improvement of the integrated governance on the corporation and expanding stakeholders. In particular, innovation of ICT develops temporal and various cooperation and evolves connection of stakeholders with internet services. Tanaka [4] suggests that the new concept of transaction cost presents a sensitive index to measure the performance of integrated corporate governance in digitalization. This paper enhances the theoretical foundation on this argument. Globalizing economies have expanded industrial and social organization of networks. Large international organizations seek benefits of networks but bring inevitably large amount of social costs at the same time. If the social costs are estimated to be uprising beyond a limit, efficient schemes to govern them should enhance significance to achieve sustainability. The famous Coase’s Theorem indicates that the transaction cost causes social welfare loss11[18].

Transaction costs are supposed inevitably to occur in digital networks of societies in different forms from traditional industrial organizations. As the digital networks are prevailing, we should make theoretical foundation on this transaction approach to digital network societies. It is assumed in this model that stakeholders could improve their welfare in the process of communication or transaction with the corporation. If the corporation accurately recognizes the evaluation of the stakeholders, they could achieve efficient communication with least transaction costs. In this theoretical analysis the weights for the stakeholder in the expression (1) present the index of efficiency in the communication mechanism. As the upper limit of the weight is assumed to be one

and to express the most efficient communication, it’s gap from one is defined as the transaction cost in the mechanism. As external stakeholders have not opportunities to contact continuously with the corporation, the transaction cost is assumed to be raised to upper bound one. The transaction costs have different values for three types of stakeholders and can analyze the feature of network system in the digital economies. Suppose that the corporation takes the transaction costs with the inside, the outside and the external stakeholders by , , 0 C C Ce i the transaction costs are defined mathematically by Ci ( x) = 1− β ( x) for inside stakeholders,

C0 ( y) = 1−γ ( y) for outside stakeholders,

Ce = 1− 0 for external stakeholders.

Centralized structure of production defined by (1) brings transaction costs as theoretical methods for digitalization of economies and societies. From the assumption β ' (x) > 0 decreasing transaction of inside stakeholders Ci (x) < 0 is derived. In particular, expanding production of global economies lowers the transaction cost of inside stakeholders. The inequality γ ' ( y) > 0 takes decreasing transaction cost of outside stakeholders with enlarging digital economiesC0' ( y) < 0 .

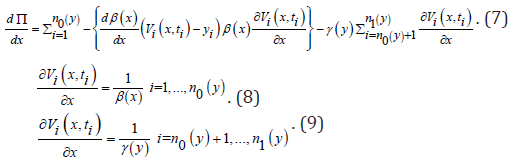

Innovation of ICT causes lowering transaction cost of outside stakeholders. And the transaction cost of outside stakeholders is assumed to be indifferent of production levels and to depend on innovation of digital economies. By featuring transaction cost functions in global and digital economies we can illustrate the structural changes of societies in the new industrial revolution12[19]. The fundamental reform of stakeholders could explain a mechanical design of the new industrial revolution. The theoretical model argues that the globalizing and digital economies have different impacts on each type of stakeholders. The stakeholders make different decisions according to their own interests. Consequently, their individual behaviors bring revolutionary reform on construction of stakeholders. The stakeholders are supposed to respond on the decision makings of the corporation. In the optimal expression of mathematics, the corporation maximizes net benefit function (1) with x, ti (i = 1,..., n1 ( y)). The first order conditions of maximization are written by (7), (8), (9)13.

To investigate completely organization of digitalization we should articulate behavior of the corporation for contributions on external stakeholder. The articulation ought to be comparable with (8) and (9). The contribution of corporation on external stakeholders i is expressed formally by

Digitalization of economies and societies

In this section, we investigate the mechanism that brings innovation of ICT a structural change of stakeholders. Expressions (8), (9), (10) explore theoretically mechanisms of industrial revolution in the context of stakeholder’s structure. This paper argues that stakeholders are classified into 3 types. As one type of stakeholders are supposed to obtain various evaluation on performance of the corporation, marginal evaluation of payment

Concluding Remarks

Tanaka [22-23] discuss that outside stakeholders to be swelled by digitalization of economies and societies have been reforming social network systems and global production and distribution mechanisms. As digital network systems have been developed, outside stakeholders raise influence on featuring the digitalization of economies and societies. By reminding that outside stakeholders are defined to belong to the negative stakeholder, performance of corporation to have grown in globalizing economies becomes to be more vulnerable or sensitive with factors to be uncontrollable by market mechanism. (Figure 2) of Tanaka [4] indicates a possibility that increasing outside stakeholders make production system more decentralized and lower production. A local issue might become more probably to cause global problems in the digital social system. In a short term, Covid-19 Pandemic declines the weight on evaluation of outside stakeholders and raises their transaction cost. For example, global networks have facilitated advanced digital technologies to distribute goods and services such as air transportation service of LCC but Pandemic is expected to raise transaction costs to break down global economics performance. In this case, social system proceeds on the opposite direction to the assumptions in Proposition 2. The line HH’ in (Figure 2) moves upwardly. The relative advantage of outside stakeholders regarding social surplus verses inside stakeholders lowers. In the sustainable framework such presented by such as Tanaka (2017) risk coefficient is expected to increase. Consequently, in the long perspective, decentralized economic systems partially will displace centralized system and global production system should be reformed sustainably.

References

- Tanaka H (2017) Sustainability of Global Communities and Regional Risk Governance. Asia Pacific Journal of Regional Science 1(2): 639-653.

- Baecker RM (2019) Computers and Society: Modern Perspectives, Oxford University Press, Oxford, UK.

- Tanaka H (2018) Mechanism of Sustainability and Structure of Stakeholders in Regions. Financial Forum, 7(1): 1-12.

- Tanaka H (2019b) Innovation on the Digital Economies and Sustainability of the Global Communities. Annals of social sciences & management studies, Juniper 4(2): 1-10.

- Williamson OE (1975) Markets and Hierarchies: Analysis and Antitrust Implication. The Free Press, New York.

- Williamson OE (1979) Transaction-Cost Economics: The Governance of Contractual Relations. Journal of Law and Economics, 22(2): 233-261.

- Williamson OE (1986) Economic Organization: Firms, Markets and Policy Control, Wheatsheaf Books, Brighton, UK.

- Williamson OE (1990) Industrial Organization. Edward Elgar Publishing, Cheltenham, UK

- Williamson OE (2010) Transaction Cost Economics: an overview. In Klein PG & Sykuta ME (eds.), The Elgar Companion to Transaction Cost Economics, Edward Elgar Publishing, Cheltenham, UK.

- Hindman M (2018) The Internet Trap: How the Digital Economy Builds Monopolies and Undermines Democracy, Princeton University Press, Princeton, USA.

- Cassiers I, Maréchal K & Méda D (2018) Post-growth Economics and Society: Exploring the Paths of a Social and Ecological Transition, Routledge, Abingdon, UK.

- Tirole J (2001) Corporate Governance. Econometrica, 68(1): 1-35.

- Tanaka H (2004) Kigyo no Syakaiteki Sekinin no Keizai Riron Japanese, Theoretical Analysis for Corporate Social Responsibility. Chikyuu Kankyu Report Japanese, Global Environmental Policy in Japan, 9: 1–9.

- Tanaka H (2016) The Sustainability Theorem in the ESG Mechanism. Long Finance and London Accord, pp,1-29.

- Oskam JA (2019) The future of Airbnb and Sharing Economy: The Collaborative Consumption of our Cities, Channel View Publications, Bristol, UK.

- Saulles (2017) The Internet of Things and Business, Routledge, Abington, UK.

- Choudrie J, Tsatsou P & Kruria S (2018) Social Inclusion and Usability of ICT-Enable Services, Routledge, Abingdon, UK.

- Coase RH (1937) The Nature of the Firm. Economica, 4(16): 386-405.

- Rifkin J (2014) The Zero Marginal Cost Society: The internet of Things, The Collaborative Commons, and The Eclipse of Capitalism. St Martin’s Press, New York.

- Tanaka (2020) Digital Revolution and Structural Reform of Stakeholders. Journal of Global Issues and Solutions, 20(2): 1-7.

- Paus E (2018) Confronting Dystopia: The New Technological Revolution and the Future of Work, Cornel University Press, New York, USA.

- Tanaka H (2019a) Rehabilitation of the Decentralization in the Centralizing Process of Global Communities. Journal of Global Issues and Solutions, 19(3): 1-18.

- Tanaka H (2019c) Sustainable Governance of Marine Stakeholders. Oceanography & Fisheries Open Access Journal, Juniper 11(1): 1-4.