Innovation on the Digital Economies and Sustainability of the Global Communities

Hiroshige Tanaka*

Faculty of Chuo University, Japan

Submission: September 02, 2019;; Published: September 20, 2019

*Corresponding author: Hiroshige Tanaka, Faculty of Chuo University, Tokyo Japan

How to cite this article:Hiroshige Tanaka. Hiroshige Tanaka. Ann Soc Sci Manage Stud. 2019; 4(2): 555635. DOI: 10.19080/ASM.2019.04.555635

Abstract

The development of digital economies induces the corporation to employ knowledge about personal behaviors of consumption for the sales strategies and distributional policies. The behavior of consumers immediately can reflect on the supply system. The orthodox theories of organizations mainly focus on efficiency in the supply systems. To explore improvement of informational connection between the production and the consumption, this paper provides an integrated theory of market organizations and external economies. By utilizing the analytical method that stakeholders are divided into three groups; inside, outside and external stakeholders, we make the following results. Digital economies in the centralized scheme develop rules of market transactions and sustainable governance of market economies and save the overproduction globally. The digitalization improves efficient use of global resources. However, centralized schemes of the corporation could not solve the problems of diversification effectively. A decentralized scheme should displace the centralized system to make present economic and social systems sustainable.

Keywords: Sustainable governance; Centralized scheme; Decentralized scheme; Outside stakeholders; External stakeholders; Transaction costs

Introduction

Innovation of ICT triggers to restructure globally economies and societies. ICT can develop the efficient connection between consumers and producers. By analyzing the large volume of consuming behavior of residents the corporation can provide goods and services for consumers efficiently. The revolution in the production and distribution of goods and services should affect inevitably the processes of communication and could reform the economic and social systems in large scale. Even if the corporation could improve integrated managements by using the innovation of ICT, the reform based on market solutions possibly brings about external negative effects to cause welfare losses on the global communities. We must construct sustainable mechanism to decrease the global welfare losses.

In general, the globalization since the last couple of decades on the 20th century has been propelled by enlarging market economies to be provoked by the neoliberalism economic theory. In addition to this globalized economies, innovations of ICT facilitate many corporations to manage the global markets efficiently. The corporation employs knowledge about personal behavior of consumption for the sales strategies and distributional policies. The behavior of consumers immediately reflects on the supply system. The theories of organizations funded by Coase [1], Williamson [2] and other researchers focus on efficiency in the supply systems1. We argue that improving informational connection between the production and the consumption needs to integrate theories of market organizations and external economies.

It is the corporations in the centralized scheme that have developed and constructed the globalized economies. The multinational corporations as the main agents of the globalism seek to maximize profits in their own centralized schemes or in their horizons. Since the new industrial revolution can reduce costs of services and resources in intermediate transaction, the corporations are probable to raise the profits. However, the organizations in the central scheme are supposed to obtain the valuable information for themselves but to correspond on only the part of the reginal needs2. In enlarging global communities, the centralized schemes cannot respond to expanding needs of residents sufficiently. Tanaka [3] makes clear that the fourth industrial revolution brings differentiate impact on regions in the decentralize framework. Tanaka [4] provides the theoretical framework to approach comparative analyses between centralized and decentralized schemes. This previous investigation demonstrates that the decentralized scheme should displace the centralized scheme. It is observed globally in the centralized scheme that the innovation of ICT has been changing the system of economies and societies revolutionary. It is appropriate that we analyze positively this fundamental change in the global communities.

In this paper, we provide a theoretical framework to analyze revolutionary changes brought by the innovation of ICT and evaluate the impact of the changes by the comparison with sustainable scheme of the decentralization. This paper utilizes the new classification of stakeholders, inside, outside and external stakeholders that corporations should communicate with. The outside stakeholders obtain ordinary communication with the corporations. The inside stakeholders aim to gain more benefits from the corporations than the market transactions. The external stakeholders cannot take the market transactions with the corporations efficiently to achieve their interests. The corporations have propelled globalization of economies but brought the enlargement of external stakeholders as well as the expansion of markets. The digital innovation lowers transaction cost and enhances facility of markets. Presently, some inside and external stakeholders move into the outside stakeholders. The outside stakeholders increase more relatively than other stakeholders.

The main results are summarized in the 3 Propositions. If the market rules are reformed to improve sustainability of community, Proposition 1 suggests that the centralized scheme approaches to sustainable community. Proposition 2 makes clear the impact of the reform of market for sustainability as follows. The accumulation of external stakeholders is probable to cause a social welfare loss such as diversity of the community. Because the centralized scheme leaves many external stakeholders without appropriate communication, centralized scheme is vulnerable for many global problems. Proposition 3 compares the effects on the stakeholders between the centralized and decentralized scheme. The innovation of the digital economies restrains overproduction in the centralized scheme. Decentralized scheme raises the payments on the outside and the inside stakeholders and lowers the payment for the inside stakeholders. Consequently, Decentralized scheme should be displaced into the centralized scheme to solves diversified problems effectively.

This paper is organized as follows. In 2 innovation of digitalization is assumed to impact on economies in the centralized scheme. To explain clearly the transformation of digital economies we employ three types of stakeholders. The object function of corporation is constructed according to transaction costs with stakeholders. The section 3 discusses that digitalization improves the stakeholder participation. The section 4 demonstrates that the corporation in the centralized scheme contribute insufficiently on the regions. The section 5 proceeds two results regarding overproduction and diversification of economies by comparative analyses between the centralized and decentralized corporations.

A Theoretical Model of Sustainable Regional Governance

Tanaka [6] formulates the theoretical model to explore sustainable regional governance in the globalized economies. In enlarging global communities, the centralized schemes cannot respond to expanding needs of residents sufficiently. The regional requirements on sustainability have been different variously in many issues. To achieve sustainability social and economic organizations should be constructed in decentralized systems to construct enough communication with stakeholders. We explore the performance of the corporation by using the mathematical model as follows. The fundamental this model are derived from a framework of the method of Tanaka3 in the decentralized system. The corporation performs production activity x and obtains the net private profit Π(x). It brings relations with n stakeholders4. It takes the payment ti for the stakeholder i . The summation of ti for all stakeholders is written by 1 ( n ). i i t t= = Σ The stakeholder i takes the evaluation ( , ) i i v x t for the corporation and effort i y the communication or transaction with the corporation. The stakeholders are classified into the positive and negative stakeholders5. The positive stakeholders present increasing evaluation of the corporation with production x. The negative stakeholders exhibit deceasing evaluation on the corporation production x. In the mathematical expression (1) i and j present preciously the positive and negative stakeholders.

To simplify the comparative analyses, we expand the fundamental model to apply in the centralized scheme. The corporations in the centralized scheme are assumed to utilize the integrated network of supply and demand stakeholders. They are concerned with the stakeholders in their networks. The stakeholders in the network of the corporation are divided into the inside and outside stakeholders. The inside stakeholders such as alliance members and stock owners obtain stronger or more intimate connections with the corporation than the outside stakeholders. The outside stakeholders are defined to have relations with the corporation through the market transactions6. Since the inside stakeholders become more likely to be trusty and united with the corporation, they could engage privileged and exclusive contacts in the network. They obtain positive marginal net benefit regarding the production of the corporations. However, marginal costs of the outside stakeholders are compensated in the transactions of the network. The outside stakeholders evaluate the transaction by negative marginal value to express the marginal costs. In the digital economies the outside stakeholders increase the payment for digital knowledge or cloud service. The innovation of digital economies decreases the transaction cost of the outside stakeholders and changes the structure of the stakeholders7.

This theoretical model takes differential weights to the inside and outside organizations. The network organized or managed by the corporation has been extending the global communities. Increasing gaps between the estimated benefit of the corporations in the network and the net social benefit brought by it in the global communities bring about global crises. The fact that the corporation in the centralized scheme is supposed not to include net benefits of the external stakeholders in the evaluation of performance reveals evidently a cause of crisis. By comparing with the centralized scheme, the corporation of the decentralized system is obliged to decide the production and payments for stakeholders by the communication mechanism with stakeholders to be potentially concerned. In the decentralized scheme, the weighted evaluation of every stakeholder affect decision of the corporation without exception.

The previous discussion makes certain that the schemes classify stakeholders in different contexts. The centralized corporation is assumed to perform efficiently by focusing on not all but only a part of stakeholders intensively. We formally write that the inside and the outside stakeholders in the centralized scheme are noted by 1, ..., ni and ni +1, ..., nc. It is possible that the corporation in the decentralized scheme has a communication with greater n stakeholder than c n in the centralized scheme ( ) c n > n . To simplify the mathematical analysis, this paper defines the relation between the inside and the outside stakeholder and the positive and the negative stakeholder by employs Assumption

Assumption 1

Inside stakeholders consist of positive stakeholders. And outside stakeholders satisfy the definition of the negative stakeholders.

Many investigations about market failures exhibit that the external stakeholders include some positive and negative stakeholders8. Assumption 1 states that the centralized corporation communicates with restricted member of stakeholders exclusively as follows. The inside stakeholders take net benefit not by way of market transactions. For example, some major shareholders in the inside stakeholders might happen to receive unexpected benefits or losses from fluctuating stock price of the relevant corporation. The outside stakeholders receive the compensation for the cost of production and exchange by the market payment.

The new industrial revolution propelled by innovation of ICT changes the constitution of the inside and the outside stakeholders. As the evolution of ICT technologies decreases the cost to obtain information and knowledge from outside stakeholders, decreasing market prices prompt to enlarge the positive stakeholders in the market transactions. The transformation of the market structure has moved the border of the stakeholders. The emergent development of the sharing economies in the car and travel industries could transfer some inside and external stakeholders into outside stakeholders9. The corporation in the centralized scheme would like to keep efficient communication with the selected stakeholders but might not solve actively many global problems related with the external stakeholders. As the external stakeholders should owe the excess cost from the deteriorating global problems, they require the corporation and other stakeholders to decline the serious problems. The inside and the outside stakeholders could share the opportunities on communication for sustainable governance. The corporation has impacts on the external stakeholders by production activities and offers some payments occasionally such as compensation and subsidy but is not willing to share the evaluation scheme with the external stakeholders formally. Because the corporation in the centralized scheme seems not to construct sustainable communities cooperatively with stakeholders, voluntary effort y by the stakeholders to contribute sustainable global communities is expected to promote activation of communication scheme significantly. By summarize previous discussion, we state the following Assumption 2 to make clear the situation around stakeholders’ participation on the centralized corporation.

Assumption 2

Enlarging market economies and innovation of intelligent industries increase external stakeholders and outside stakeholders relatively greater than inside stakeholders for the corporations. Using mathematical notation, globalization and digital revolution of economies increase nc and n for a constant i n .

The failure of the centralized scheme can be explored by a comparative analysis between the centralized and the decentralized schemes. In the first, we formalize theoretically the objective function NBC by net benefit of the centralized system10 in the expression (2). Δγ denotes an increment of the outside stakeholders brought by innovation in digital economies.

β (x) and γ ( y) denote weights of evaluation for the inside and outside stakeholders When denote the index of digital environment, rigorously we have a notationγ ( y + e) . As is assumed to be a parameter controlled out of the system, γ ( y + e) is abbreviated to γ ( y) in this paper. The corporation obtains more accurate evaluation of the inside stakeholders or organizations from intimate communication than market relations. The corporation obtains the information to evaluate needs of the outside stakeholders accurately from the transactions of markets. Among n stakeholders, the centralized corporation does not communicate directly with external stakeholders 1,..., . cn + Δγ + n However, the external stakeholders could construct the scheme to affect market transactions of the corporation by reforming rules or legislations. In the scheme the corporation is obliged to solve formally some sustainability problems concerned with external stakeholders. Consequently, the efforts of external stakeholders aim for the centralized corporation to contribute on sustainability of the communities. We define the transaction cost for the stakeholders by using , , , i o e C C C as follows. When the weight for the stakeholder is equal to one in the expression (2), we need not take the transaction cost with the stakeholder. If the corporation takes the transaction costs with the inside, the outside and the external stakeholders by , , , i o e C C C he transaction costs are written by

The connection between the corporation and the inside stakeholders becomes stronger beyond the market relation. The corporation is assumed to share larger interest with the inside stakeholders than with outside stakeholders. The communication gapes in the marketplace are possible to bring the risk at sustainability of global communities. By using effort i y , any stakeholders i seeks to improve the sustainability condition of markets surrounding the corporation. When we employ the notation 1 n i i y y = = Σ we simply state the above argument by γ '( y) > 0

The inside stakeholder i(i = 1,..., ni ) obeys the trusty rule to be separated from the market practices. As rising production requires to enhance cooperative connection between the corporation and inside stakeholders, β (x) is an increasing function of corporationproduction (β '(x) > 0) It is assumed that β (x) is written to be independent of the total effort The sustainability in the centralized scheme depends on efficient communication between the three stakeholders and the corporation. The effect of communication is analyzed formally by using coefficients β (x) and γ ( y) , When the inequality 1 > (β (x) > γ ( y) holds for all x, y. The corporation maximizes net benefit function (2) with , ( 1, , ). i x t i = … nc The first order conditions of maximization are written by (3), (4), (5).

To compare with (4) and (5), the contribution of the corporation on the external stakeholders is expressed formally by

Tanaka [4] discusses the implication of the expression (3) as follows. (3) exhibits the production condition for the corporation to maximize estimated net social benefit. To obtain social optimal rigorously the right hand of (3) should express the total social marginal evaluation with the performance of the corporation. However, the value does not include the marginal evaluation of the external stakeholder. Since the performance of the corporation in the centralized scheme is based on the incomplete calculation, the expression (3) is possible to explore causes of instability and diversities to increase the social welfare losses in the global communities. In the centralized system, the corporation can influence welfare of the external stakeholders but is not obliged to provide publicly open communication and positive contribution on them. On other hand, the corporation in the decentralized mechanism is defined to accept open communication and positive contribution on them publicly. Theoretically, to prevent the failures brought by the centralized scheme many corporations should be displaced in the decentralized scheme. This shift of the scheme will be expected to make more effort i y of any stakeholder i efficiently.Within the framework of centralized scheme, the stakeholder participation can transform, even if inefficiently, the corporation actually to prevent welfare losses in the global communities.

Stakeholder Participation

The stakeholder participation is considered theoretically to be a key factor to achieve sustainable global communities in the both schemes of the centralized and the decentralized. We provide a theoretical foundation on the stakeholder participation for sustainable governance. Stakeholder i is assumed to spend effort i y to improve sustainable governance of the corporation.

In the previous section, we discuss that the centralized corporation concerns mainly evaluations of the inside and the outside stakeholders. The corporation attempts decisively to enhance the evaluation of inside and outside stakeholders. On the other hand, the evaluation of the external stakeholder does not appear explicitly on the objective function of the corporation (2). The incomplete system of communication is probable to cause an excess burden on the external stakeholders as well as the inside and the outside stakeholders11. In the centralized scheme, to reduce the excess burden of social cost the stakeholders can make the corporation more sustainable by reforming legislative and voluntary performances. Stakeholders aim to improve sustainable performance of the corporations by enhancing communication between the corporation and stakeholders. The three stakeholders are assumed to share a common target to make the corporation more sustainable. The stakeholder i makes effort i y to maximize the summation of the weighted evaluation of stakeholders by the corporation and the net benefit of the external stakeholders. The social value to be maximized is described by the expression (7).

Using the expression (7) we can explore the framework that the stakeholders construct sustainable and centralized schemes cooperatively. Differentiation of the expression (7) with effort i y exhibits the optimal effort for each type. We assume that the scale of outside stakeholders is determined exogenously by digitalization index e. The relation 0 i d dy Δγ = is obtained for all i . In the first the inside stakeholder obtains the optimal condition of effort written by (8).

The outside stakeholder in the connection of market has the optimal effort stated by (9).

The external stakeholder brings the optimal effort expressed by (10).

The right hands of (8), (9) and (10) mean the marginal value of outside stakeholders with net benefit of effort for sustainability and are supposed to be decreasing. The above three conditions exhibit that the three stakeholders proceed differently to the optimal efforts for sustainability. The ways to be effective for the corporative governance depend on the features of communication between the corporation and the stakeholders. The direct communication with the corporation is available for inside stakeholders. The outside stakeholders attempt to improve their net benefits of efforts by changing the way of transaction with the corporation. The external stakeholders use the methods to enhance activities for sustainability by utilizing the market scheme. The three types of effort take different effects to promote social and economic sustainability12

In the centralized scheme the external stakeholders attempt to reform the market condition to improve sustainability of the corporation and communities. Firstly, the external stakeholders could improve the social impact of the corporation by enhancing management systems for sustainability. The innovation of ICT increases the inside stakeholders with sharing information and declines market prices brought by decreasing transaction costs. It lowers the barrier separating from the market and prompts the flows of the other stakeholders into the outside stakeholders. Secondary, growing market economies enhance the contribution of the external stakeholders to restore sustainable communities. In the centralized scheme three stakeholders attempt that market transactions become to be more faire and transparent. The effort to construct sustainable scheme of the corporation is focused mainly on the governance reform of market transactions.

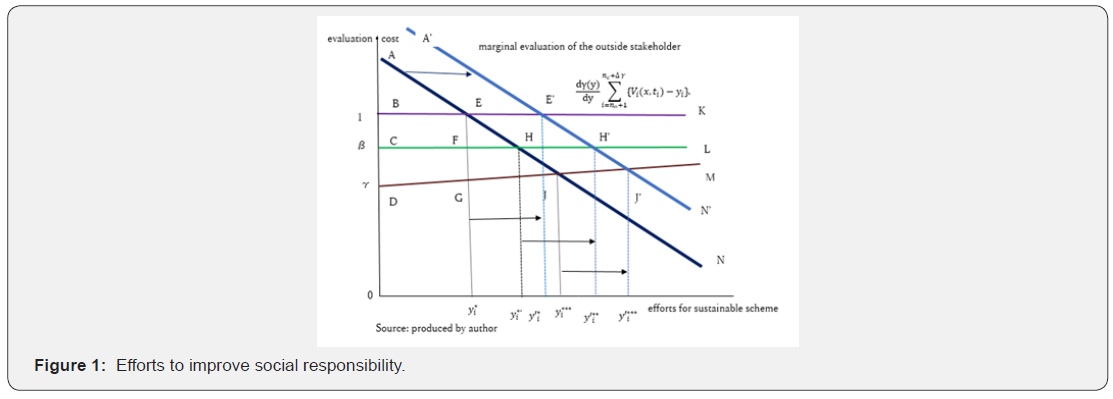

The marginal evaluation of the outside stakeholder written by the right side of the expression (8), (9), (10) is depicted graphically by curve AN in (Figure 1). The function γ ( y) stated by the left side of (9) is shown by the curve DM to increase regarding i y 13. According to Assumption 2, the increase of to raises the value of

Proposition 1

The digital revolution in the globalized economies develops the sustainable scheme to reform the market transactions. The sustainable scheme for the centralized corporation takes the three stakeholders to promote efforts cooperatively.

The Centralized Sustainable Scheme for Regional Analysis

In this section we explore theoretically the sustainable regional policies in the globalized and digitalizing economies by investigating mainly the implication of (4), (5) and (6). When the stakeholders are supposed to indicate regions or municipalities, this theoretical model explains how the corporation should contribute on the regions or communities to be sustainable. Although the centralized corporation has produced and supplied products in many related regions, it makes influence differentially on local regional communities. It is assumed that every region is classified into inside, outside and external stakeholders according to the relation with the corporation. To simplify the notation the three types of region are denoted as inside, outside and external regions. The corporation evaluates the performance in the inside regions more than in the market estimation. Consequently, the corporation is willing to provide more social services in the main sites of business. If the region is included in the inside stakeholders, the corporation decides the regional contribution or payment according to (4).

The corporation evaluate its activity in the outside regions according to market values such as amounts of production, sales and employments. The corporation provides the contribution or the payment for the outside region according to (5). The corporation burdens negative externalities on the external regions. The external region obtains the contribution from the corporation according to the rule indicated by (6). The corporation in the centralized scheme may not intends to contribute the external regions positively. As the marginal evaluation with payment or contribution on the region is supposed to decrease, the inequality 1 1 β (x) γ ( y) < implies that the corporation differentiates regional contributions on the order of the inside related regions, outside related regions and external regions. The centralized corporations could enlarge the markets globally but differentiate the regional contributions such as taxes and employments. Consequently, the system dominated by the centralized corporations is probably to raise diversification in the global communities. We describe Proposition 2 to summarize the discussion in this section.

Proposition 2

Without sustainable framework the centralized system of corporation provides insufficient contribution on the outside and external regions and raises diversification of the region in the global communities.

Failures of the Centralized Scheme and Sustainable Global Governance

In the previous section we argue that the corporation in the centralized scheme brings market failures in the global communities13. The corporation in the centralized scheme could not succeed providing efficient public communication for all stakeholders but only take selective response according to types of stakeholders. This communication gaps might cause the global problems14. Enlarging global economies prompted by progress of digital economies make the global problems more serious. Practical initiatives for sustainability suggest that decentralized schemes provide more effective solution for the global problems15. The theoretical model provided by the method of Tanaka presents a typical framework of decentralized system.

We introduce the model briefly. The corporation does not only

calculate the evaluation of all stakeholders and but also conceive

compulsory social cost such as required regulation, tax and penalty

by the region or stakeholder. The regional initiatives are stated

by the mathematical model. The stakeholder i requires the corporation

to achieve the target 0) ( i α

> 16. And the target i α

is used as

the basis to calculate payments or penalty of the corporation. In an

incentive mechanism, the corporation is obliged to pay more penalty

as the evaluation by the stakeholder deviates from the target

i α

. The incentive tax or payment for the stakeholder i is written

by the cost function

> for the positive

variable ( ( , )) i αi −Vi x ti

> for the positive

variable ( ( , )) i αi −Vi x ti

The objective function that the decentralized corporation maximizes is written by

As the sustainable scheme brings faire weights on all evaluation by stakeholders, (11) takes identical altruistic coefficient δ ( y) for all stakeholders17. (11) includes evaluation ( , ) i i V x t of the external stakeholders (i = nc + 1, ..., n). We obtain optimal conditions by differentiating (11) regarding the variables, x, t1,...., tn.The optimal conditions with the first order differentiation of (10) are exhibited by (12) and (13). We explore the sustainability that the decentralized scheme could achieve by classifying all stakeholders into positive stakeholders (i = 1, ..., n) and negative stakeholders (i = n1 + 1, ..., n). ( ) i i i d d v φ α − is referred as risk coefficient.

The previous sections demonstrate that innovation of ICT in the centralized scheme induces the reform between the outside and the external stakeholder by changing the transaction costs. Although the construction of stakeholders in the centralized scheme becomes to be altered in the new industrial revolution, the reform of the stakeholders is not assumed to influence the composition of the positive and negative stakeholders. We assume that the decentralized scheme enhances communication between the corporation and stakeholders higher than the centralized one. It is written by the mathematical expression (14).

The first term in the right hand of (3) exhibits that globalizing corporation obtains benefit from scale of economics. Since the negative stakeholders consist of outside and external stakeholders, the negative stakeholders in the decentralized scheme (12) become greater than outside stakeholders in the centralized scheme (3). The second term in the right hand of (12) turns to be greater than the second term the right hand of (3). Globalized markets bring many external stakeholders to burden the excess social cost. The lager global markets the corporation obtains, the more marginal social costs external stakeholder evaluates. However, the centralized scheme could not calculate the evaluation by the external stakeholders in the optimal condition (3). It means that the gap between the second terms in the right side of the expressions (3) and (12) is enlarging [29,30].

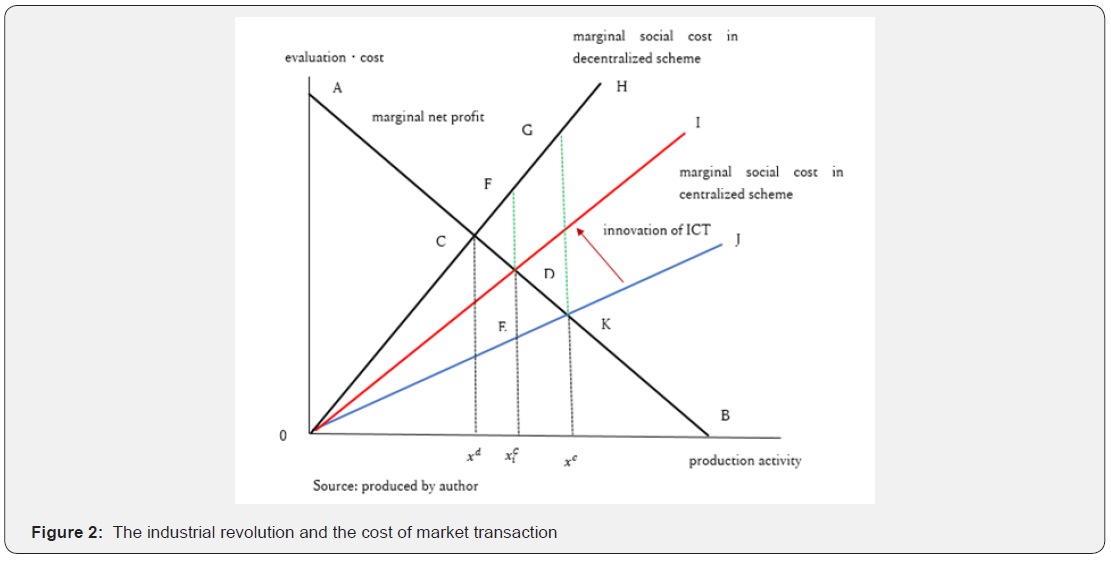

Tanaka [4] describes the above discussion by the linear model simply. This paper follows the approach by reforming (Figure 2) constructed Tanaka [4] but explores the performance of stakeholders to be defined by the market relations. The marginal profit is depicted by the curve AB. In the centralized scheme marginal social costs evaluated of stakeholders is expressed by the curves 0I and 0J. In (Figure 2), digitalization of economies presents the curve 0J to shift into the curve 0I. In the decentralized scheme the social cost is exhibited by the curve 0H. (12) contains the evaluation of many external stakeholders as the negative stakeholders that are excluded from the calculation of (3). In the first global and digital economies increase external stakeholders and the gap between evaluated social costs of centralized and decentralized schemes. The enlarging gap raises the divergence of the productions of the two schemes xd xc .

The social welfare loss caused by the over production to be written with area of the triangle CKG brings various problems in the global communities. In the second the innovation of ICT develops a new industrial revolution. Platformers can provide various organizations and individuals business and living devices at the same time. If the digital economies decrease transaction cost of markets, greater numbers of outside stakeholders are probable to join in market transactions. In this case the expression demonstrates that the curve 0J of the marginal social cost turns around to the curve 0I. The new industrial revolution reforms the structure of the centralized scheme that increase of the outside stakeholder improves sustainable governance. This change restrains the over production and reduces social welfare loss by the area of the trapezoid FDKG. It is ensured that the development of digital economies promotes the transformation of external stakeholders into outside stakeholders. However, global economies related with digital economies have yielded many external stakeholders to bring great social welfare losses. Even if digital economies are expected to prevent social welfare losses from accumulating, the centralized schemes accompany many serious global problems caused by the social welfare loss presented by the area of the triangle CEF as a whole (Figure 2).

In the previous sections the centralized scheme is supposed to increase external stakeholders and presents the social welfare loss with the area of the triangle CDF in (Figure 2) in comparison of the decentralized scheme. The social welfare loss implies diversification among stakeholders by comparative analyses of (4), (5) and (13). (Figure 3) exhibits that the corporation provides differentially contributions for stakeholders. From theoretical investigation we write marginal evaluations of outside and inside stakeholders by the curve FI and AN. As the external stakeholders could not receive enough contribution, their benefits provided by the contribution are defined by 0. (4) and (5) indicate the inside and outside stakeholders to receive the benefits of from the contribution of the corporation by * j t and * i t . If the risk coefficient of inside stakeholder j is smaller than the coefficient of the outside stakeholder stake stakeholder i, we obtain the inequality

In the centralized scheme (4) shows that the marginal social cost of the corporation on the inside stakeholder is written by the curve CD. (5) indicates the curve BK for outside stakeholders. The previous inequality reverses the curves CD and BK to C’D’ and B’K’. In the decentralized scheme the benefits by the contribu tion for outside and external stakeholders are stated by ** j t . The benefit from contributions of inside stakeholders is denoted by ** i t . In thecentralized scheme the diversities of benefits in the inside stakeholders are exhibited by * * i j t − t with the outside stakeholders and by ** i t . with the external stakeholders. In the decentralized scheme the diversities shrink to * * i j t − t between the positive and the negative stakeholders, the above investigation is summarized in Proposition 3.

Proposition 3

Revolution of digital economies prevents overproduction of global economies in the centralized scheme. Decentralized scheme solves diversified problems effectively.

Concluding Remarks

The digital economies are expected to reconstruct many industries by integrating the production and consumption activities more closely. The new industrial revolution could not only provide profitable services but save inefficient utilization of resources. Improvement of manufacture on demand and sharing business need not a large amount of stocks required in the ordinal manufacture and distribution. However, the efficient economies are possibly to lead the diversified communities though the competition of markets. The industrial revolution could not construct social system that correspond effectively to the social needs. Digital economies make many connections in communications to become market transactions. For example, the corporation utilizes research engine in the internet as the means of selling. This paper explores that global economies have developed largely on the bases of centralized systems but have brought social welfare losses and discusses also that a decentralized system could decrease the social welfare losses of regions in global economies.

This paper provides the theoretical approach on compound organizations to combine supply and demand sides. This analysis should investigate various types of transaction cost. However, the impacts brought by digital economies on inside stakeholders are not considered completely in this paper.

References

- Coase RH (1937) The Nature of the Firm. Economica 4: 386-405.

- Williamson OE (1975) Markets and Hierarchies: Analysis and Antitrust Implications -A Study in the Economics of Internal Organization, The Free Press, New York, USA.

- Tanaka H (2018) Mechanism of Sustainability and Structure of Stakeholders in Regions. Financial Forum 7 (1): 1-12.

- Tanaka H (2019) Rehabilitation of the Decentralization in the Centralizing Process of Global Communities. Journal of Global Issues and Solutions 19(3).

- Hodgson GM (1999) Evolution and Institutions: On Evolutionary Economics and the Evolution of Economics, Edgar Elgar Publishing limited, Chelteham, UK.

- Tanaka H (2017) Sustainability of Global Communities and Regional Risk Governance. Asia Pacific Journal of Regional Science 1: 639-653.

- Tanaka H (2004) Kigyo no Syakaiteki Sekinin no Keizai Riron (Japanese) [Theoretical Analysis for Corporate Social Responsibility]. Chikyuu Kankyu Report (Japanese) Global Environmental Policy in Japan. 9: 1-9.

- Tanaka H (2009) The Sustainable Framework for Climate Change and the Financial Crisis2008-2009. Long Finance and London Accord, The institute of Economic Research, Chuo University. 134: 1-18.

- Tanaka H (2012) Social Responsibility, Social Enterprise and Social Innovation in the Stakeholder Communities,” Long Finance and London Accord. pp.1-16

- Tanaka H (2016a) Cooperative and Competitive Urban Municipality Policies in the Tokyo Area to Target Transforming Community Needs. Long finance and London Accord. pp.1-19.

- Tanaka H (2016c) The Sustainability Theorem in the ESG Mechanism.Long Finance and London Accord. pp.1-29.

- Becker GS (1983) A Theory of Competition Among Pressure Groups for Political Influence. Quarterly Journal of Economics 98(3): 371-400.

- Becker GS (1985) Public Policies, Pressure Groups, and Dead Weight Costs. Journal of Public Economics 28(3): 29-347.

- Rifkin J (2014) The Zero Marginal Cost Society: The internet of Things, The Collaborative Commons, and The Eclipse of Capitalism. St. Martin’s Press, New York, USA.

- Williamson OE (1986) Economic Organization: Firms, Markets and Policy Control. Wheatsheaf Books, Bringhton, UK.

- McAfee A, E Brynjolfesson (2017) Machine, Platform, Crowd Harnessing our Digital Future, W.W. Norton & Company, New York.

- Parker GG, MW Van Alstyne, SP Choudarry (2016) Platform Revolution: How Network Markets are Transforming the Economy and How to Make them work for you, W.W. Norton & Company, New York, USA.

- Arrow KJ (1973) Social Responsibility and Economic Efficiency. Public Policy 6(2): 303-317.

- Tirole J (2001) Corporate Governance. Econometrica 69(1): 1-35.

- UNEP FI, UN Global Compact (2016) Principles of Responsible investment Annual Report 2016.

- Roubini N, S Mihm (2010) Crisis Economics: A Crash Course in the Future of Finance. Penguin Press, New York, USA.

- Becchetti L, C Borzaga (2010) The Economics of Social Responsibility: The world of social enterprises, Routledge, London.

- Tanaka H (2016b) The Finance System as Global Public Goods and the Regeneration of Global Communities,” Long Finance and London Accord. pp.1-12.

- Tanaka H (2016d) Global Community Governance, Research Papers No 5, The institute of Economic Research, Chuo University, Japan.

- GSIA (2019) Global Sustainable Investment Review 2018, GSIA; Global Sustainable Investment Alliance 2017. USA.

- Andreoni J(1990) Impure Altruism and Donations to Public Goods: A Theory of Warm -Glow Giving. Economic Journal 100: 464-477.

- Russell D Roberts (1984) A Positive Model of Private Charity and Public Transfers. Journal of Political Economy 92:136-148.

- Tanaka H (1998) Redistribution Tax under Non-benevolent Government. Public Choice 3(4): 325-345.

- Richardson HW, C Nam (2014) Shrinking Cities: A Global Perspective. Routledge, London and New York.

- WilliamsonOE(1996)Industrial Organization. An Elgar Critical Writings Reader, Cheltenham,UK.