Driving Change: Unveiling the Impact of Gender Diversity, Corporate Social Responsibility and Green Innovation on Corporate Governance

Nesrine Dardouri* and Mounir Smida

Faculty of economics and management of Sousse, University of Sousse, Tunisia

Submission: January 05, 2024;Published: January 17, 2024

*Corresponding author: Nesrine Dardouri, Faculty of economics and management of Sousse, University of Sousse, Tunisa, Email: nesrine.dardouri91@gmail.com

How to cite this article: Nesrine Dardouri* and Mounir Smida. Driving Change: Unveiling the Impact of Gender Diversity, Corporate Social Responsibility and Green Innovation on Corporate Governance. Rec Arch of J & Mass Commun. 2024; 1(1): 555551. 10.19080/RAJMC.2024.01.555551

Abstract

In this article, we explored the moderating impact of green innovation, gender diversity, and corporate social responsibility (CSR) on corporate financing. This study used 50 manufacturing firms in the European Union (500 observations) for the period 2010-2022 for this purpose. The study aims to understand how these factors influence the relationship between financial indicators and corporate financing decisions. The article first delves into the concept of green innovation, highlighting its significance in the current business landscape. Furthermore, the paper discusses the potential financial benefits of green innovation, such as increased profitability and improved access to financing. Gender diversity is then examined as another variable that can potentially influence corporate financing decisions. The author argues that a diverse workforce, particularly in terms of gender representation, can lead to better decision-making, greater innovation, and improved financial performance. Corporate social responsibility is also analyzed as an essential aspect of businesses’ approach to financing. The research presents empirical evidence on the moderating effects of green innovation, gender diversity, and CSR on corporate financing. The findings suggest that these factors can significantly influence the relationship between financial indicators (such as profitability, leverage, and liquidity) and firms’ financing decisions. The study concludes by emphasizing the importance of considering these moderating variables in future research and in corporate financing strategies.

Keywords: Corporate financing; Gender diversity; Green innovation; Corporate social responsibility; Business community

Abbreviations: CSR: Corporate Social Responsibility; FGLS: Feasible Generalized Least Squares; EU: European Union; FEM: Fixed Effects Model; GMM: Generalized Moment Method; EA: Environmental Awareness; ATO: Asset Turnover; GD: Gender Diversity; EU: European Union;

Introduction

In today’s rapidly changing business landscape, companies are increasingly being scrutinized not only for their financial performance, but also for their commitment to sustainable practices and social responsibility. As businesses seek ways to align their operations with these evolving expectations, green innovation, gender diversity, and corporate social responsibility (CSR) emerge as crucial factors that can shape corporate financing decisions. This article aims to explore the moderating impact of these three key components on corporate financing, shedding light on their ability to attract diverse sources of funding, enhance financial performance, and generate long-term value. Understanding how green innovation, gender diversity, and CSR influence corporate financing not only offers critical insights for businesses but also sets a foundation for a more sustainable and inclusive future.

Our fundamental objective is supported by agency theory where we find an explanation of the link between green innovation and corporate financing [1,2]. Based on previous research, we find that Li et al. (2017) demonstrated that a strict rule of green innovation within companies can lead to a reduction in information asymmetry and increase the means of financing companies. Furthermore, the reputation of innovative green strategies for business financing has been recognized by several authors [3,4]. However, favorable association has not been analyzed by any study. Thus, the question that arises at this time: What are the factors that lead to this advantageous association considering green innovation strategies that can positively influence business financing? To achieve our primary objectives, this study integrates several techniques, such as fixed effects to handle unobservable heterogeneity, generalized method of moments (GMM) model to resolve endogeneity difficulties, and feasible generalized least squares (FGLS) as a robustness test. The European Union (EU) has made significant strides in recognizing the interplay between corporate finance, green innovation, gender diversity, and corporate social responsibility. As a region committed to sustainable development, the EU places great emphasis on fostering environmentally friendly practices and technologies across its corporate landscape. This commitment has not only fostered green innovation but has also highlighted the importance of gender diversity in the corporate sector. So, working on the EU is the subject of our main contribution. The EU acknowledges that gender balance within organizations leads to better decision-making, increased financial performance, and enhanced corporate social responsibility outcomes. By promoting gender diversity, the EU encourages a more inclusive and equitable business environment that can improve corporate governance and contribute to sustainable development. Moreover, the EU’s corporate finance policies have played a pivotal role in driving green innovation and sustainability initiatives. Encouraging sustainable investments, allocating funds towards green projects, and establishing frameworks for corporate social responsibility reporting have all contributed to the integration of environmental and social considerations in the business strategies of EU companies. This holistic approach to corporate finance not only supports the transition towards a greener economy but also ensures that corporate social responsibility and gender diversity are prioritized. Overall, the relationship between corporate finance, green innovation, gender diversity, and corporate social responsibility in the EU has created a foundation for sustainable growth and responsible practices within its business community. For the rest of our study, it is divided as follows: a detailed literature review is found in section 2. The research methodology is found in section 3. Our results are presented and discussed in section 4. Finally, the conclusion is presented in section 5.

Literature revue

In recent years, the European Union (EU) has witnessed a growing interplay between corporate financing, green innovation, gender diversity, and corporate social responsibility (CSR). Corporations within the EU are increasingly recognizing the strategic value of integrating sustainability practices in their operations, driven by a combination of financial and ethical motives. One significant aspect of this shift is the reliance on innovative financing models that prioritize environmentally friendly projects. By actively seeking out investments that contribute to the development of clean technologies and renewable energy sources, EU companies are not only mitigating their environmental impact but also tapping into the vast potential for long-term profitability in the fast-growing green economy. Simultaneously, the EU has been committed to promoting gender diversity within corporate sectors. Recognizing the underrepresentation of women in leadership positions, the EU has implemented measures to ensure that companies prioritize gender equality in their boardrooms. This diversity is not only a response to social progress and equal opportunities but has also demonstrated positive impacts on financial performance and decision-making. By actively incorporating women’s perspectives and talent, EU companies are reaping the benefits of enhanced creativity, innovation, and overall organizational effectiveness. As CSR gains increasing importance globally, the EU remains at the forefront of promoting responsible business practices [5,6]. Companies operating in the EU are expected to adhere to strict sustainability standards and social obligations, extending well beyond financial objectives. This entails engaging in philanthropic activities, reducing environmental footprints, upholding human rights, and promoting fair labor practices. Through this commitment, corporations demonstrate their dedication to the societal values and expectations of the EU, fostering trust and long-term relationships with stakeholders.

In summary, the relationship between corporate financing, green innovation, gender diversity, and corporate social responsibility has become deeply interconnected within the European Union. By integrating these components into their business strategies, EU companies are embracing socially and environmentally conscious practices that not only contribute to a sustainable future but also foster financial growth and resilience.

Theoretical and empirical literature exploring the relationship between corporate finance, green innovation, gender diversity, and corporate social responsibility in the European Union has gained substantial attention in recent years (Li D (2018), Liao Z (2018), [7]. Theoretical frameworks suggest that corporate finance plays a crucial role in promoting green innovation and corporate social responsibility initiatives. Access to funding and financial resources allows firms to invest in environmentally sustainable technologies, implement green practices, and contribute to social welfare [8], He, L et al. (2019); [4]. Additionally, studies highlight that gender diversity within corporate boards and leadership positions enhances corporate social responsibility as diverse perspectives and experiences lead to better decision-making and accountability. Empirical evidence supports these theoretical assertions, indicating a positive association between corporate finance and levels of green innovation and corporate social responsibility practices in European firms. Moreover, gender diversity within these firms has demonstrated a positive influence on corporate social responsibility, with female leadership often associated with more sustainable and socially responsible practices. Overall, the existing literature promotes the importance of corporate finance, green innovation, gender diversity, and corporate social responsibility in the European Union, illustrating their interlinked nature and their potential to contribute to sustainability and ethical business practices.

Based on the literature review, we have formulated 5 research hypotheses.

Hypothesis 1 (H1): A green innovation strategy affects firm financing.

Hypothesis 2 (H2): Corporate social responsibility affects corporate financing.

Hypothesis 3 (H3): Corporate social responsibility helps to moderate the relationship between green innovation and corporate financing.

Hypothesis 4 (H4): Gender diversity can also contribute to corporate financing.

Hypothesis 5 (H5): The link between green innovation and corporate finance is positively related to gender diversity.

Empirical methodology

We used panel data because they are generally associated with endogeneity difficulties [9,10]. The endogeneity problem is characterized as a relationship between the error term and the explanatory variables that leads to distorted and unreliable results [11]. Endogeneity bias is also induced by imprecise inferences and inconsistent assessments, which can lead to confusing results and incorrect theoretical interpretation [12]. Despite this, most researchers working with panel data have not addressed the issue of endogeneity. In addition, several published studies on panel data ignore questions of endogeneity [13,14].

In this regard, controlling endogeneity issues has been used by some researchers. We find, for example, those who proposed a set of statistical strategies to reduce endogeneity errors in panel data [15]. To begin with, the third factor effect and control factors have been shown to be able to be used to resolve endogeneity issues. Second, they confirmed that problem solving can be done through the shifts of the planned variables. Finally, the resolution of this problem can be done by the instrumental variable’s technique. We can also handle observable and unobservable effects in panel data using a lagged explanatory variable method. Fourth, introducing the unobservable heterogeneous effect in panel data with a fixed effects model is a good idea. Finally, the generalized method of moments (GMM) can be a tool to manage endogeneity. Several other researchers have endorsed the GMM method to solve this problem [16,17]. Accordingly, to properly evaluate this study, we used a fixed effects model and a GMM model.

Fixed Effects Model (FEM)

The analysis of how the independent and dependent variables interact within the entities was carried out through the fixed effects model. This issue can potentially lead to erroneous results, so it needs to be resolved. Through the fixed effects model, we can solve the problem in this scenario [11]. Disadvantages can also be presented over time by panel data, which can lead to biased or unfair results. Therefore, solving the time-invariant problem can be done through the fixed effects tool. The main problem is that panel data exhibits unobservable heterogeneity [18]. According to Wintoki MB [17], the explanatory variables are strictly endogenous, implying that there is no relationship between them. According to Schultz EL et al. [18] the fixed-effects tool is the most effective way of eliminating unobservable heterogeneity. So, we’re going to use this fixed-effects tool to remove timeinvariant problems and unobservable heterogeneity from panel data (Gujarati ND et al. (2012) and [19]. In econometric analysis, the fixed-effects model is also known as a static panel model, as it never allows the lag of the dependent variable to be replaced by the independent variable [17]. Following this evaluation, the fixed-effects model was used to analyze the data.

Generalized Moment Method (GMM)

The GMM methodology, also known as the dynamic panel model, was created by Arellano and Bond [20] for the analysis of panel data. The causal association between variables evolves over time. For empirical studies in economics and finance using panel data, the GMM model is considered essential [21]. The GMM approach is considered the most effective way of solving these problems when conducting empirical research on exogenous or endogenous components. The method is also particularly well suited to obtaining reliable equation evaluations [16].

Most studies have used a fixed-effects model or a first-difference test to account for unobservable heterogeneity (Gujarati ND et al. (2012) and [19]. The GMM technique also includes the ability of the first difference test to cover unobservable variation in panel data [17] and Ullah S et al. (2018). In general, the GMM technique uses lags of predicted variables. Consequently, according to Wooldridge JM (2015), these lags are a powerful tool for dealing with endogeneity in panel data. So, according to Javeed SA [21], the GMM model uses “internal modifier data” to deal with endogeneity. Internal data modification is a statistical situation in which the previous value of a variable is subtracted from its current value. This concept is particularly useful for reducing the number of observations required and improving the control of the GMM approach. The GMM model is the best technique for reducing endogeneity from panel data because it adds special effects for the evolution of the coefficients [17] and Ullah S et al. (2018)). Finally, the GMM model was used to solve panel data problems to obtain robust results.

The following equations were created to study the impact of green innovation on corporate financing, with the moderating effects of CSR and gender diversity:

[Corporate_Finance]_(i,t)=α_1+β_1 [GI]_(1i,t)+γ_1 X_(i,t)+μ_(i ,t) (1)

[Corporate_Finance]_(i,t)=α_2+β_2 [CSR]_(2i,t)+γ_2 X_(i,t)+μ_ (i,t) (2)

[Corporate_Finance]_(i,t)=α_3+β_3 [GD]_(3i,t)+γ_3 X_(i,t)+μ_ (i,t) (3)

[Corporate_Finance]_(i,t)=α_4+β_4 [GI]_(4i,t)+β_5 [CSR]_ (5i,t)+β_6 [GI*CSR]_(6i,t)+γ_4 X_(i,t)+μ_(i,t) (4)

[Corporate_Finance]_(i,t)=α_5+β_7 [GI]_(7i,t)+β_8 [GD]_ (8i,t)+β_9 [GI*GD]_(9i,t)+γ_5 X_(i,t)+μ_(i,t) (5)

Where [Corporate Finance] _(i,t) reflects the financing of companies i in year t, The green innovation strategy revealed by the [GI]_(i,t) : [CSR]_(i,t) denotes a company’s corporate social responsibility. [GI]_(i,t) denotes gender diversity. [GI*CSR] _(i,t) represents the interaction between green innovation strategies and corporate social responsibility. [GI*GD]_(i,t) describes the interaction between green innovation strategies and gender diversity companies i in year t. X_(i,t) represents the vector of control variables for company i in year t ; μ_(i,t) the error term ; α_n the constant ; n = 1 ; β_m, γ_n. Estimated coefficients: m = 1, 2, 3, 4, 5, 6, 7, 8, 9.

Data description

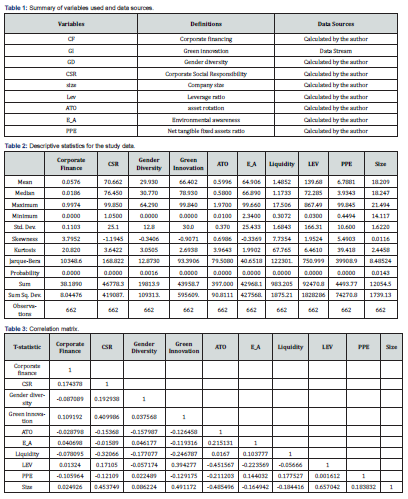

The empirical work is based on annual data for the period from 2010 to 2022. In this study, listed companies in the European Union are selected as research samples. Through their research in corporate finance, Mulatu et al [22] found that fair and equitable variable selection has distinct ramifications on outcomes. The ratio of long- and short-term borrowings to total assets was used as a measure in this study of corporate finance given which is the dependent variable. According to Javeed SA [21], accurate and fair measurement of variables yields positive results in empirical studies. In general, companies that invest in exclusive rights are engaged in green innovation strategies. Accordingly, based on the work of Cai X et al. (2020) and Lim S [23], we used green innovation as the dependent variable in our model. Feng et al. [16] stated that an accurate measure of corporate social responsibility (CSR) yields more reliable results. Carroll AB [24] showed that there are several CSR measurement indices that have been developed by several research studies, most of which address similar elements such as human rights, state rights, stakeholder rights, community rights and others. On a large scale, a CSR index has been constructed based on minority rights such as caste, tribe, child feeding and intermarriage, as well as corporate annual reports with CSR disclosure. In addition, environmental considerations such as hazardous gases were also analyzed. Another study calculated CSR in Korea and a CSR index was created around five indicators: staff training and education; company charitable activities; audit and environment; customer trust; and environmental commitment [25]. Thus, we have taken corporate social responsibility as a second independent variable in our model (CSR). Finally, the third and last independent variable in this study is Gender Diversity. The proportion of women on the board is used to calculate the gender diversity of the board. According to Yasser et al [26], Hyun et al [27], and Kassinis et al [28], this assessment of gender diversity is important and has been used in previous studies. Many control variables were incorporated in this study to obtain better results. Among all the control variables in corporate finance, firm size is the most important (size). For empirical studies in corporate finance, the size of the company is important, although the results differ depending on the sector. In most corporate social studies, firm size has a significant and favourable impact [11]. For example, to begin with, the natural logarithm of total assets is used to determine firm size [15]. In addition, Fang et al. [29] pointed out that, for corporate finance and environmental studies, liquidity plays an important role as a control variable. Roy et al [30] also supported the role of liquidity in corporate social practices. We have therefore used it as a second control variable (Liquidity). Therefore, to determine liquidity, the ratio of a company’s current assets to its current liabilities is calculated. Furthermore, Sayilgan et al [31] stated that for corporate finance studies such as capital structure, the PPE ratio plays an important role. Therefore, the net PPE ratio is calculated by dividing the total sales of the firm by the net PPE [11]. Fourth, asset turnover as a control variable supports empirical studies, particularly on corporate finance [32]. Thus, asset turnover (ATO) is calculated as the ratio of total sales to total assets. Finally, this study used environmental awareness (E_A) as a control variable to support the outcomes of corporate social practices (Li HL et al. (2019)). The leverage ratio (Lev) is also incorporated for its potential impact on corporate finance [33]. Thus, the leverage ratio was used as a control variable. Finally, environmental consciousness is calculated by dividing the total number of employees by the amount of money spent by the company on landscaping and other green reasons. (Table 1)

Results and Discussions

Given the research objectives, this study is applied and quasiexperimental in nature. A multiple linear regression equation was used for data analysis and hypothesis testing. All required data was extracted from actual data of listed companies for the European Union. Eviews 12 software was used to analyse the data. Before analysing these variables using the econometric model, we will present a descriptive study of the annual data covering the period from 2010 to 2022. Descriptive statistics for corporate finance, green innovation, corporate social responsibility (CSR), gender diversity (GD) and control variables are presented in Table 2. This table shows the mean, median, maximum and inimum values for each variable, as well as the standard deviation and probability.

Table 3 presents the results of the Pearson correlation test. This presents the results of the Pearson correlation analysis, which reveals the association between corporate finance, corporate social responsibility, green innovation, and gender diversity. Most factors show a positive relationship. Similarly, all the control variables show a positive relationship.

Table 4 shows the results of the link between green innovation and corporate finance, with the moderating effects of corporate social responsibility and gender diversity. These results show that corporate social responsibility can play a moderating role in the relationship between green innovation strategy and corporate financing. The results also show that gender diversity has a positive and significant impact on corporate finance with the fixed-effects and GMM models, respectively. These results also support the hypothesis that gender diversity is an important mediator for increasing firm financing using a green innovation strategy.

The results that show the link between green innovation strategy and corporate finance are illustrated in Table 5, with the moderating effects of corporate social responsibility and gender diversity. The interaction values of green innovation strategy and corporate social responsibility (GI*CSR) with the fixed effects and GMM models are shown in Table 4. Finally, these data show that corporate social responsibility (CSR) plays a moderating role in the relationship between green innovation strategy and corporate finance. However, the interaction values of green innovation strategy and gender diversity (GI ∗ GD) with the fixed effects and GMM models, respectively are represented by model 5. These results also support the final objective of this work, according to which gender diversity is an important mediator for increasing financing for companies using a green innovation strategy.

Table 5 presents the link between corporate social responsibility and corporate finance, the association between gender diversity and corporate finance, the moderating role of CSR in the link between green innovation strategy and corporate finance, and the moderating role of CSR. Model 4 represents CSR and model 5 represents gender diversity. Thus, the two models represent the IM*CSR interaction and the IS*GD interaction respectively. Consequently, all these results from the fixed-effect model and the GMM corroborated desirable conclusions. The results of this study show that the first hypothesis green innovation strategies stimulate corporate finance. Several previous studies support these claims such as Grewatsch S et al. [4] and Liao Z [3]. These results could be attributed to the financial support of key stakeholders. For example, according to Friedman RS [34] and Qin Y (2019), corporate investment in patents and other green practices can improve corporate finance. Furthermore, stakeholder theory justifies the results of our study. Firms in developing countries are motivated to engage in social practices to expand their operations in the international market [11]. These corporate practices attract more shareholders, which can improve corporate financing activities. According to Porter [35], companies that implement green practices generate innovation and gain popularity in the market.

According to Javeed and Latief [11], corporate green business objectives are key to corporate finance. Green innovation has the power to improve business value and future returns, and banks will lend more as they meet the requirements of green development proposals and green credit policies; therefore, mainstream investors should increase their investments. In addition, the results of this research show that corporate social responsibility is an effective tool for increasing corporate finance. In this context, several previous studies, such as Dhaliwal DS et al. [36] and Cheng JCC et al [37], have confirmed the favourable relationship between corporate social responsibility and corporate finance. This finding shows the positive impact of CSR on corporate finance. According to the results, the adoption and implementation of CSR methods that lead to improved CSR performance led to an increase in organisational finance. Improved CSR performance reflects a company’s commitment to its stakeholders, based on mutual trust and collaboration. Moreover, agency theory also supports these results, as managers will take a sequence of decisions to maximise their interests. In this scenario, according to Jensen CM [2], to minimise information asymmetry and agency concerns, CSR publications can be used as an observation tool.

Furthermore, the results support that green innovation strategy and corporate finance have a positive relationship with corporate social responsibility. Previous research has shown that companies that perform well in terms of CSR are more likely to publicly disclose their CSR initiatives by producing sustainability reports. These practices increase shareholder confidence in companies’ green practices, which will automatically make a significant contribution to company financing. Theoretically, both stakeholder and agency theories conceptually support this link [1,2]. According to Hill LCW [38], if companies and stakeholders have a positive relationship, they will be able to obtain the resources needed to finance the companies. Corporate social responsibility can not only help a company solve environmental problems, meet public needs, and encourage social growth, but it can also help improve financial decisions [39].

In addition, Cheng, Yang and Sheu [37] demonstrated that transparency of CSR performance influences financing decisions by reducing capital constraints, among other things. Companies that focus on CSR can enhance their ability to innovate green practices [40]. Therefore, our results support the role of CSR as a moderator of the association between green innovative strategies and corporate finance. Furthermore, this study indicates that gender diversity is beneficially associated with corporate finance. Our results suggest that female executives are more aligned with shareholders’ interests as they choose a higher proportion of corporate finance improvements. Because of their pervasive effect on the decision-making process, women directors can improve financing decisions and other developments [41]. A board of directors is at the heart of corporate governance. In Europe, around 30.6% of listed companies have women on their boards, which means that their role in corporate governance should not be ignored. In addition, the inclusion of women directors on boards reduces opportunistic management behaviour and information asymmetry, which influence lenders’ estimates of the borrower’s ability to repay debt with interest and offers organizations with mixed boards a lower cost of debt [42].

In this context, agency theory has corroborated these findings in theory. According to agency theory, a gender-diverse board is more likely to effectively monitor the performance of executives, as diversity improves funding decisions [43,44]. In addition, corporate finance has a positive relationship with gender diversity. As women’s environmental preferences may be stronger than men’s, mixed boards are more likely to engage in environmental innovation than their industry peers. However, women board members need to hold at least two seats, firstly to have a positive impact on the company’s environmental innovation, and secondly, as increasing the representation of women on boards can increase the likelihood of green innovation. Our results revealed that gender diversity can lead to the development of green market growth, which will also improve company financing. Furthermore, agency theory relates to the role of gender diversity in theory [2]. Furthermore, Harjoto and Rossi [47] also reported that female directors help companies engage in innovative green methods to resolve agency conflicts. Many researchers have highlighted the value of gender diversity in improving innovative green operations and corporate finance such as Carter DA et al, Carter AD, and Boukattaya S [43,44,46]. According to Harjoto MA et al [47] and Post C et al [48], the participation of female directors has also been confirmed as an essential element of green innovation strategy and corporate finance.

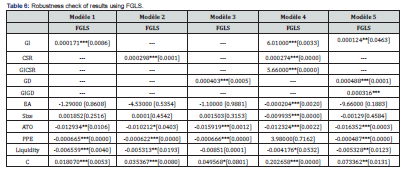

Table 6 presents the relationship between green innovation and corporate finance, the relationship between corporate social responsibility and corporate finance, the relationship between gender diversity and corporate finance, the moderating role of CSR in the relationship between green innovation and corporate finance, and the moderating role of gender diversity in the relationship between green innovation and corporate finance. Consequently, the results of the FGLS approach justified the conclusions of all the results found in the fixed effects model and the GMM [49-63].

Conclusion

Environmental concerns have received much attention in developing countries (Answer KM, et al. (2018)). Accordingly, this research demonstrates how corporate green initiatives can reduce negative impacts while improving corporate finance. The relationship between green innovation strategy and corporate finance is examined in this study, with the role of corporate social responsibility and gender diversity. This study selects manufacturing companies in the European Union from 2010 to 2022. This study first concludes that green innovation techniques contribute to boosting corporate finance after applying the fixed effect and the GMM model. Companies that invest more in pollution management programs generate more inventive products and raise more funds because this improves their image and reputation in the eyes of stakeholders and society. So, this research looked at the direct impact of corporate social responsibility on corporate finance. Consequently, the results of this study showed that corporate social responsibility improves corporate finance by strengthening the interests of shareholders.

In addition, the results of this study revealed that corporate social responsibility contributes to increasing the favourable association between green innovation strategy and corporate finance. In addition, gender diversity was also used in this research. Similarly, this study examined the direct influence of gender diversity on corporate finance. As a result, gender diversity stimulates corporate finance. Thus, gender diversity contributes to a more favourable relationship between green innovation strategy and corporate finance. As a result, policy makers, governments, owners, business leaders and investors in both emerging and established countries will benefit from this research. To begin with, companies need to implement creative and social green practices to eliminate or reduce environmental problems, which will improve their reputation in the eyes of the public. To improve their performance, governments and stakeholders should put pressure on companies to adopt environmentally friendly practices and promote gender diversity. Our results have shown that CSR is a valuable tool for environmental and social activities, as well as for corporate finance. Consequently, major shareholders should put pressure on management to improve business innovation by implementing CSR practices. The study also highlighted the relevance of gender diversity in improving sustainable business practices. To increase business finance, every government and policymaker should encourage women to work in business. Women are more likely to engage in social practices, so they should be represented on boards of directors and sustainability committees. In addition, the study’s recommendation encourages business leaders to engage in social practices. Green innovation strategies are more socially responsible than those that are not. Because there has been little research on green innovative strategies and corporate finance, this study focuses on the role of green creative strategies in social development. Sustainable development also helps to alleviate environmental problems.

References

- Friedman RL, Manly SP, McMahon M, Kerr IM, Stark GR (1984) Transcriptional and posttranscriptional regulation of interferon-induced gene expression in human cells. Cell 38(3): 745-755.

- Jensen CM, Buckley WM, Lanier RG, Struble GL, Prussin SG, et al. (1976) A cryostat for forming solid krypton or xenon targets for use in capture gamma-ray experiments. Nuclear Instruments and Methods 135(1): 21-25.

- Yuan S, Liao Z, Huang H, Jiang B, Zhang X, et al. (2020) Comparison of the indicators of psychological stress in the population of Hubei province and non-endemic provinces in China during two weeks during the coronavirus disease 2019 (COVID-19) outbreak in February 2020. Med Sci Monitor 26: e923767.

- Grewatsch S, Kleindienst I (2017) When does it pay to be good? Moderators and mediators in the corporate sustainability–corporate financial performance relationship: A critical review. J Business Ethics 145: 383-416.

- Calza F, Profumo G, Tutore I (2016) Corporate ownership and environmental proactivity. Business Strategy Environ 25(6): 369-389.

- Nicholson JD, LaPlaca P, Al-Abdin A, Breese R, Khan Z (2018) What do introduction sections tell us about the intent of scholarly work: A contribution on contributions. Indust Market Manage 73: 206-219.

- Zhang L, Hu W, Cai Z, Liu J, Wu J et al. (2019) Early mobilization of critically ill patients in the intensive care unit: A systematic review and meta-analysis. Plos One 14(10): e0223185.

- Yang C, Liu Z, Zhao D, Sun M, Chang EY (2015) Network representation learning with rich text information. In IJCAI 2111-2117.

- Bhagat S, Bolton B (2008) Corporate governance and firm performance. J Corp Finance 14(3): 257-273.

- Dittmar H (2007) The costs of consumer culture and the “cage within”: the impact of the material “good life” and “body perfect” ideals on individuals” identity and well-being. Psychological Inquiry 18(1): 23-31.

- Javeed SA, Latief R, Jiang T, San Ong T, Tang Y (2021) How environmental regulations and corporate social responsibility affect the firm innovation with the moderating role of Chief executive officer (CEO) power and ownership concentration? J Cleaner Production 308: 127212.

- Li YH, Yu CY, Li XX, Zhang P, Tang J, et al. (2018) Therapeutic target database update 2018: Enriched resource for facilitating bench-to-clinic research of targeted therapeutics. Nucleic Acids Res 46(D1): D1121-D1127.

- Antonakis J, Bendahan S, Jacquart P, Lalive R (2010) On making causal claims: A Review and Recommendations. Leadership Quarterly 21(6): 1086-1120.

- Hamilton BH, Nickerson JA (2003) Correcting for endogeneity in strategic management research. Strategic organization 1(1): 51-78.

- Lu L, Bao J, Huang J, Zhu Q, Mu C, et al. (2016) Recent research progress and prospects in tourism geography of China. J Geograph Sci 26: 1197-1222.

- O’Brien SM, Feng L, He X, Xian Y, Jacobs JP, et al. (2018) The Society of Thoracic Surgeons 2018 adult cardiac surgery risk models: part 2-statistical methods and results. Ann Thorac Surg 105(5): 1419-1428.

- Wintoki MB, Linck JS, Netter JM (2012) Endogeneity and the dynamics of internal corporate governance. J financial Economics 105(3): 581-606.

- Schultz EL, Tan DT, Walsh KD (2010) Endogeneity and the corporate governance-performance relation. Aust J Manag 35(2): 145-163.

- Wooldridge JM, Wadud M, Lye J (2016) Introductory econometrics: Asia pacific edition with online study tools 12 months. Cengage AU.

- Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Review Economic Studies 58(2): 277-297.

- Javeed SA, Latief R, Lefen L (2020) An analysis of relationship between environmental regulations and firm performance with moderating effects of product market competition: Empirical evidence from Pakistan. J Cleaner Production 254: 120197.

- Adamu R, Mulatu MS, Haile SI (2003) Patterns and correlates of sexual initiation, sexual risk behaviors, and condom use among secondary school students in Ethiopia. Ethiopian Med J 41(2): 163-177.

- Lim L, Wei Y, Lu Y, Song J (2016) ALS-causing mutations significantly perturb the self-assembly and interaction with nucleic acid of the intrinsically disordered prion-like domain of TDP-43. Plos Biol 14(1): e1002338.

- Carroll AB (1979) A three-dimensional conceptual model of corporate performance. Acad Management Rev 4(4): 497-505.

- Kansal M, Joshi M, Batra GS (2014) Determinants of corporate social responsibility disclosures: Evidence from India. Adv Account 30(1): 217-229.

- Yasser QR, Al Mamun A, Ahmed I (2017) Corporate social responsibility and gender diversity: Insights from Asia Pacific. Cor Soc Responsibil Environ Manag 24(3): 210-221.

- Daley GQ, Hyun I, Apperley JF, Barker RA, Benvenisty N, et al. (2016) Setting global standards for stem cell research and clinical translation: the 2016 ISSCR guidelines. Stem cell reports, 6(6): 787-797.

- Kassinis G, Panayiotou A, Dimou A, Katsifaraki G (2016) Gender and environmental sustainability: A longitudinal analysis. Corpor Soc Responsibil Environ Manage 23(6): 399-412.

- Fang F, Oosterlee CW (2009) A novel pricing method for European options based on Fourier-cosine series expansions. SIAM J Scientific Comput 31(2): 826-848.

- Carare RO, Engelhardt B, Perry VH, Kalaria R (2022) In memoriam, Roy Weller (1938-2022). Acta Neuropathologica 144(5): 803-806.

- Sayilgan G, Karabacak H, Kucukkocaoglu G (2006) The firm-specific determinants of corporate capital structure: Evidence from Turkish panel data. Invest Manag Financ Innovat 3(3): 125-139.

- Patin JC, Rahman M, Mustafa M (2020) Impact of total asset turnover ratios on equity returns: Dynamic panel data analyses. J Account Busi Manage 27(1): 19-29.

- Kaul A (2012) Technology and corporate scope: Firm and rival innovation as antecedents of corporate transactions. Strateg Manage J 33(4): 347-367.

- Moore S, Friedman RJ, Singal DP, Gauldie J, Blajchman MA, et al. (1976) Inhibition of injury induced thromboatherosclerotic lesions by anti-platelet serum in rabbits. Thromb Haemost 35(1): 70-81.

- Lange FF, Atteraas L, Zok F, Porter JR (1991) Deformation consolidation of metal powders containing steel inclusions. Acta metallurgica et materialia 39(2): 209-219.

- Dhaliwal DS, Li OZ, Tsang A, Yang YG (2011) Voluntary nonfinancial disclosure and the cost of equity capital: The initiation of corporate social responsibility reporting. Account Rev 86(1): 59-100.

- Wu EL, Cheng X, Jo S, Rui H, Song KC, et al. (2014) CHARMM‐GUI membrane builder toward realistic biological membrane simulations. J Comput Chem 35(27): 1997-2004.

- Duncan DC, Hill CL (1996) Synthesis and Characterization of the Mixed-Valence Diamagnetic Two-Electron-Reduced Isopolytungstate [W10O32] 6-. Evidence for an Asymmetric d-Electron Distribution over the Tungsten Sites. Inorganic Chemistry, 35(20): 5828-5835.

- Silva JM, Cláudio RA, Sousa e Brito A, Branco CM, Byrne J (2006) Characterization of powder metallurgy (PM) nickel base superalloys for aeronautical applications. Mat Sci Forum 514: 495-499.

- Bocquet R, Le Bas C, Mothe C, Poussing N (2019) Strategic CSR for innovation in SMEs: Does diversity matter? Long Range Planning 52(6): 101913.

- Ruigrok W, Peck S, Tacheva S (2007) Nationality and gender diversity on Swiss corporate boards. Corp Gov: An Int Rev 15(4): 546-557.

- Xu T, Sattar U (2020) Conceptualizing COVID-19 and public panic with the moderating role of media use and uncertainty in China: an empirical framework. Healthcare 8(3): 249.

- Carter DA, D'Souza F, Simkins BJ, Simpson WG (2010) The gender and ethnic diversity of US boards and board committees and firm financial performance. Corporate Governance: Int Rev 18(5): 396-414.

- McEvoy JM, Doherty AM, Sheridan JJ, Thomson‐Carter FM, Garvey P, et al. (2003) The prevalence and spread of Escherichia coli O157: H7 at a commercial beef abattoir. J Appl Microbiol 95(2): 256-266.

- Harjoto MA, Rossi F (2019) Religiosity, female directors, and corporate social responsibility for Italian listed companies. J Business Res 95: 338-346.

- Boukattaya S, Omri A (2021) Impact of board gender diversity on corporate social responsibility and irresponsibility: Empirical evidence from France. Sustainability 13(9): 4712.

- Harjoto MA, Jo H (2015) Legal vs. normative CSR: Differential impact on analyst dispersion, stock return volatility, cost of capital, and firm value. J Busi Ethics 128(1):1-20.

- Post C, Byron K (2015) Women on boards and firm financial performance: A meta-analysis. Acad Manag J 58(5): 1546-1571.

- Brown JK (1976) Estimating shrub biomass from basal stem diameters. Canadian J Forest Res 6(2): 153-158.

- Chen Y, Shi F, Christodoulou AG, Xie Y, Zhou Z, (2018) Efficient and accurate MRI super-resolution using a generative adversarial network and 3D multi-level densely connected network. International Confer Medical Image Comput Comput-Assist Interven 91-99.

- Dhama K, Karthik K, Khandia R, Munjal A, Tiwari R, et al. (2018) Medicinal and therapeutic potential of herbs and plant metabolites/extracts countering viral pathogens-current knowledge and prospects. Current Drug Metabolism 19(3): 236-263.

- Du D, Zhu P, Wen L, Bian X, Lin H, et al. (2019) VisDrone-DET2019: The vision meets drone object detection in image challenge results. Proc IEEE/CVF Int Confer Comput Vision Workshops.

- Das A, Gkioxari G, Lee S, Parikh D, Batra D (2018) Neural modular control for embodied question answering. Confer Robot Learn p. 53-62.

- Elsayes KM, Hooker JC, Agrons MM, Kielar AZ, Tang A, et al. (2017) 2017 version of LI-RADS for CT and MR imaging: an update. Radiographics 37(7): 1994-2017.

- Huang HY, Lin YCD, Li J, Huang KY, Shrestha S, et al. (2020) miRTar Base 2020: updates to the experimentally validated microRNA-target interaction database. Nucleic Acids Res 48(D1): D148-D154.

- Romanello M, McGushin A, Di Napoli C, Drummond P, Hughes N, et al. (2021) The 2021 report of the Lancet Countdown on health and climate change: code red for a healthy future. Lancet 398(10311): 1619-1662.

- Semykina A, Wooldridge JM (2010) Estimating panel data models in the presence of endogeneity and selection. J Econometrics 157(2): 375-380.

- Solanki JD, Sheth NS, Shah CJ, Mehta HB (2017) Knowledge, attitude, and practice of urban Gujarati type 2 diabetics: Prevalence and impact on disease control. J Educ Health Promot 6: 35.

- Semykina A, Wooldridge JM (2010) Estimating panel data models in the presence of endogeneity and selection. J Econometrics 157(2): 375-380.

- Takala J, Hämäläinen P, Saarela KL, Yun LY, Manickam K, et al. (2014) Global estimates of the burden of injury and illness at work in 2012. J Occup Environ Hyg 11(5): 326-337.

- Xie LY, Fang TG, Tan JX, Zhang B, Cao Z, et al. (2019) Visible-light-induced deoxygenative C2-sulfonylation of quinoline N-oxides with Sulfinic acids. Green Chem 21(14): 3858-3863.

- Xu H, Chen W, Zhao N, Li Z, Bu J, et al. (2018) Unsupervised anomaly detection via variational auto-encoder for seasonal kpis in web applications. Proc 2018 World Wide Web Confer 187-196.

- Zhang J, Zhang X, Tang H, Zhang Q, Hua X, et al. (2018) Allele-defined genome of the autopolyploid sugarcane Saccharum spontaneum L. Nature genetics 50(11): 1565-1573.