Value Chain Performance in the Niamey Dairy Basin (Niger)

Yahoussa Gambo1* and Malam Maman M Nafiou2

1Yahoussa Gambo, National Institute of Agronomic Research of Niger (INRAN)

2Malam Maman M Nafiou, Faculty of Economics and Law of AbdouMoumouni University of Niamey

Submission: March 24, 2018 ; Published: May 09, 2018

*Corresponding author: Yahoussa Gambo, National Institute of Agronomic Research of Niger (INRAN), BP: 429 Niamey-Niger, Email: gamb.houss12@gmail.com

How to cite this article: Yahoussa G, Malam M M N. Value Chain Performance in the Niamey Dairy Basin (Niger). Dairy and Vet Sci J. 2018; 6(1): DOI: 10.19080/JDVS.2018.05.555677

Abstract

This study represents one of the chapters of the thesis work on the milk value chain in the Niamey dairy basin. 534 actors in the value chain were surveyed represent 40% of actors dealing with milk collection centers in the dairy basin. The data was analyzed with Excel 2013 and SPSS version 17 software. In the Niamey milk basin, producers are the actors with the highest marketing margins (11.2%). The collectors and distributors have a margin of 10% and 8% respectively. Processors are the most disadvantaged of all the other players with a marketing margin of 4.1%. Dairy production is performing well despite some imperfections and dysfunctions observed at the level of production and at the level of the rest of the value chain. For 1 FCFA spent in the production, a net gain of 1.44 FCFA is obtained.

Keywords: Value Chain; Milk; Dairy Basin; Niamey; Stakeholders; Food security; Gross margins; Income; Investment; Net gain; Livestock; Intermediate consumption; Miscellaneous taxes; Pastoral; Urbanization

Introduction

"Agriculture remains an essential tool for sustainable development and the fight against poverty” (World Bank, 2008). The agricultural sector is an essential characteristic of the rural world and can play a special role in the development of this environment. Agriculture is the main driver of the rural economy, for developing countries, or even the only one for those who do not have large mineral resources. It contributes significantly to national income, exports, employment or investment [1]. The supply and demand of agricultural products are reflected in uncertain and unstable market prices, which are often low-paying for producers [2]. According to Argenti [3], a better integration of food producers in the market can stimulate national production by more profitable cost prices, while reducing prices to the consumer.

In Niger, the agricultural sector in general and livestock in particular, plays a major role in the socio-economic life of Nigerien women. It is the main source of income for rural households in Niger [4]. In all species, livestock contributes 15% to income generation in Niger and 25% to meeting the food needs of rural households [5]. It is practiced by about 87% of the active population as a main or secondary activity after agriculture [6]. Exclusively it is exercised by 20% of the Nigerien population [7]. Livestock contributes about 11% of gross domestic product (GDP) and contributes 35% of agricultural GDP [8]. Population growth and rapid urbanization have resulted in a high demand for animal products, particularly milk. The immediate consequence is the fall in the purchasing power of the population but also the invasion of national markets by imported products, costing less than local products. As an illustration, from 2008 to 2011, Niger imported 7224.5 tons of milk powder equivalents at a cost of US $ 23.309 million [9]. Since 2007, milk powder prices have almost tripled. Thus, their accessibility has become more difficult for some sections of the population. The supply of cities but also rural centers in milk has become critical [10].

In Niger, milk is an essential component of the diet of pastoral and agro-pastoral populations. It plays a special role in the food security of populations Ousseini [11] and is a regular source of income. Local milk is produced in different agro-ecological zones of Niger and according to different systems. Compared to imported milk, local milk has additional benefits for processing. It is valued for its organoleptic qualities, and is paid 1.5 to 3 times more than milk reconstituted from imported milk powder [12]. With the creation of collection centers and collection networks, milk has become a business center. It mobilizes a large number of stakeholders, and is the subject of major industrial investments (collection center, mini-dairies, and dairies) based on forecasts of rapid growth in urban consumption. The present work aims to analyze the performance of the value chain in the Niamey dairy basin

Methodology

Market Margin and Operating Income Analysis

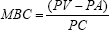

The performance indicators of the milk value chain that we will use in this work are: gross marketing margins (MBC), gross operating profit or profit and value added among the various direct actors in the value chain. MBCs are relative values that are calculated by relating the price differences to each segment of the marketing chain (gross margins) and the prices paid by final consumers.

Where PV represents the selling price, PA represents the purchase price and PC represents the consumer price. The assessment of wealth and its distribution will go through the financial analysis that determines mainly value added but also profit, ratio value added / intermediate consumption, ratio profit / total expenditure and return on investment (profit / investment).

Recall that the net operating income (RNE) expresses the economic gain (or loss) taking into account the investments made beforehand, that is to say given the resources that the agent had to immobilize previously (RNE = RBE - Depreciation). This indicator has not been addressed in this work as the actors in the milk value chain in the Niamey dairy basin do not forecast the value of depreciation in their expenses. Therefore, the depreciation value is zero, hence the RNE = RBE). In other words, the gross operating profit represents operating profit once deducted from the value of production all operating costs of the year: intermediate consumption, labor, financial expenses and taxes.

RBE = VA - (Compensation of work + financial expenses + Miscellaneous taxes)

Value-Added Analysis

The added value was calculated according to the methodology recommended by Germaine et al. In 2016 and enriched by other considerations of Fabre (1994). Throughout the different production chains, there are flows of inputs and outputs. Inputs are divided into goods and services which are factors of production either (i) totally transformed during a period: these are the intermediate inputs (IC), or (ii) partially used during the period. Their total degradation through the production process is done over several periods: these are the investments to be amortized over a renewal cycle.

he intermediate consumptions and CA the value of the product (turnover) at each ofLet CI be the value of the intermediate consumptions and CA the value of the product (turnover) at each of the links. By subtracting the value of the IC from the value of the outputs (CA), we obtain the value that the agent considered added to the initial value of the intermediate inputs by the production / transformation process. The VA Value Added is therefore defined by the equation:

(Value added) = (Total value of sales) - (Value of intermediate goods)

VA = CA - CI

According to Adegbola et al. [13], the VA at the level of commercial agents (collector, processor, wholesaler- transformers, collector, wholesaler and retailer) is calculated by the difference between the selling price and the cost price:

VA = PV - PR

With PR = Purchase price + transaction fees

Transaction costs consist of transportation costs, handling fees and other expenses incurred by the agent during the transaction of the product studied.

Strengths, Weaknesses, Opportunities and Threats Analysis (SWOT)

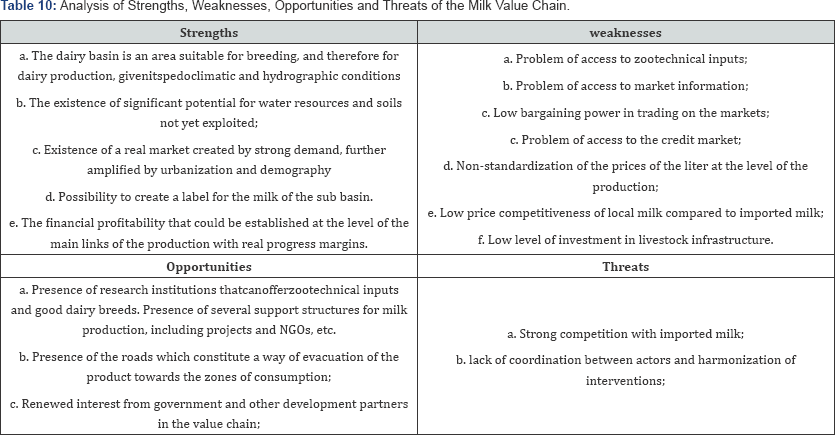

The SWOT analysis is a tool for analyzing the strategic context. It identifies the internal strengths and weaknesses of a system or entity, its opportunities for change, and the threats that may affect its purpose or compromise the achievement of its objectives. This analysis is based on the various interviews and surveys with stakeholders (producers, farmer organizations, collectors, processors, traders, etc.). This analysis made it possible to identify strategic options for improving or promoting the milk value chain in the Niamey dairy basin.

Analysis of Farm Structures

It consisted in characterizing the farms on the basis of the following indicators: the types of farms and the level of specialization that provide information on the number of cows used for milk production, the production system (farming system) and the means technical production. At the bottom of this analysis of farm structures, an analysis of the rental labor force that provides information on the source of the wage labor force and its use in the different activities of dairy production.

Analysis of the Financial Performance of the Milk Value Chain in the Niamey Dairy Basin

The accounts of the actors

The analysis of the accounts of the actors makes it possible to classify in a table the jobs on the one hand and the resources on the other hand. In addition, these actors' jobs are classified on the one hand as intermediate consumption, that is to say the goods that were destroyed in order to obtain the final good and on the other hand the wealth created by the activity at the level of individual (operating income) and the economy in general (wages, interest, taxes, rent, renting services, etc.) (Table 1).

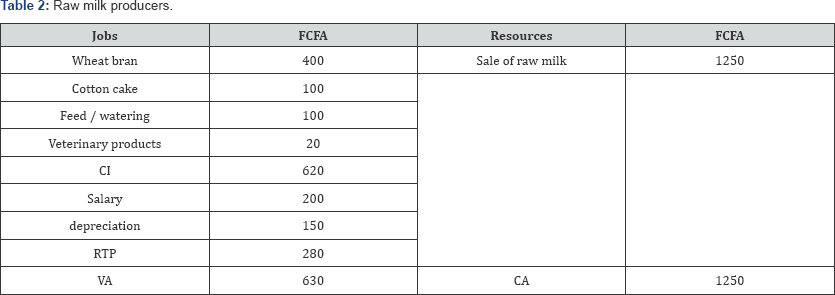

Producers account

Producers are the first actors in the value chain. They are the holders of dairy cows and burn through these dairy resources to lead to milk. Table 2 shows the operating account of producers of raw milk. The acquisition cost of dairy cows is not considered, we have relied on the charges that disappear since the only ones involved in the calculation of added values (Table 2).

The added value is 630CFA / 5litres of raw milk produced at 126FCFA / liter The transformation thus increased 31% of the wealth of the producers concerned. In addition, the operating income of the latter is 280 FCFA for the 5 liters of milk produced.

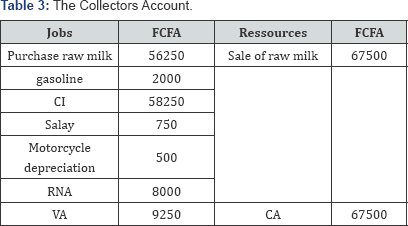

Accounts of collectors and pocessors

(Table 3) In the Niamey dairy basin, collectors move to the level of producers to look for milk for an average value of 250 FCFA / liter. They resell it at the level of collection centers / transformers at 300FCFA per liter. Thus, for the daily collection of 225 liters of raw milk, the collector has an added value of 9259FCFA or 41.11 CFA per liter. It has net income of activity 8000FCFA per day.

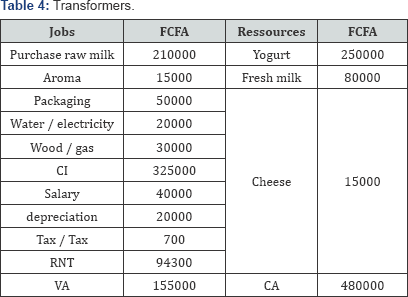

Transformers Account

In the Niamey dairy basin, processors are the collection centers and the big dairy industries. For reasons of access to real costs, we stopped the account at collection centers (Table 4). Thus, for a daily conversion of 700 liters, the center realizes an added value of 155000FCFA or 221,42FCFA / liter. It realizes a net income of transformation of 94300FCFA the day.

The Distributors Account

The wealth created by the retailers distributing processed milk is 100,000 CFA francs for the marketing of 650 liters of yoghurt and 200 liters of fresh milk (Table 5). By reporting the activity to the liter of milk, it achieves an added value of 142.85FCFA with a net daily marketing income of 40000FCFA.

Marketing Margins According to the Market

MBCs measure the share of the final sales price (end-user price) captured by a particular actor in the value chain. MBCs are obtained by the ratio of the difference between the selling price of the actor and its purchase price and the consumer price (price paid by the final consumer). Since the producer is the largest player in the value chain, we have considered its total cost of production as the purchase price (Table 6).

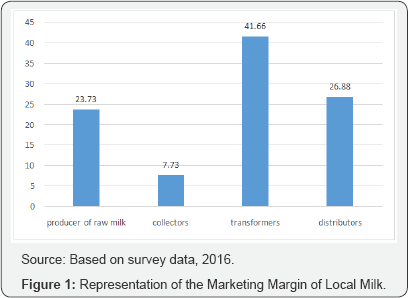

In the Niamey milk basin, producers are the actors with the highest gross marketing margins (11.2%). The collectors and distributors respectively have a margin of 10% and 8%. Processors are the most disadvantaged of all the other players with a marketing margin of 4.1% (Figure 1).

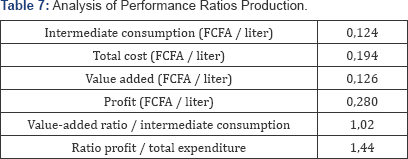

Performance Ratio Calculations

The financial results below show a positive added value for all stakeholders. With added values of 221.42FCFA / liter, processing activity is the one that creates the most wealth in the milk value chain compared to 142.85 for distributors and 126 for producers and 41.11 for collectors. These results show that processors are the actors that create most of the wealth in the milk value chain of the Niamey dairy basin because they provide the highest percentage of total value added. But these results are justified by the power of milk to increase volume after processing despite the high level of use of intermediate consumption during processing. The profit or the net operating profit is also positive for all the actors. These results reveal that processors have the highest net gain at 134.71FCFA.litre against 57.14CFA / liter for distributors and 56 and 35.56FCFA / liter respectively for producers and collectors.

Given the important role of producers in the sector and based on the objective of the study, we will analyze various performance indicators of the production of raw milk in the Niamey dairy basin (Table 7).

In addition, the calculations of two different profitability ratios have been estimated. The ratio of value added to intermediate consumption was positive, as was the ratio of profit to total expenditure. The latter measures net productivity of total production costs. Thus, for 1 FCFA spent, a net gain of 1.44 FCFA is obtained. It follows that milk production performs well despite some imperfections and dysfunctions observed at the level of production and at the level of the rest of the value chain.

The Economic and Social Performance of the Milk Value Chain in the Niamey Dairy Basin

Economic analysis of the value chain is an important element of decision-making on development strategies. Economic analysis of the value chain is the evaluation of performance in terms of economic efficiency. It focuses on the evaluation of: (i) the overall value added produced by the value chain and the actions of the different stages, (ii) production and marketing costs (or transaction costs) at each link in the chain of custody Chain and the cost structure along the links in the chain and (iii) the performance of the actors (use of productive capacity, productivity and profitability).

Distribution of Added Value.

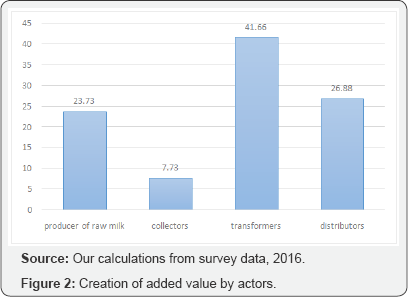

Along the milk value chain of the Niamey Dairy Basin, a new wealth is created and measured by the value added, which results from the value of the resulting product minus the wealth that had to be destroyed (“consume”) to produce it. The distribution of value-added in the value chain determines the distribution of wealth between actors in the chain. The actors with high added value are those who hold the considerable share of the wealth of the chain. The value added was obtained from the deduction to the value of the production (sales receipts) of all the expenses except that of the salary, the rent, the financial expenses and the taxes. (Figure 2) shows the distribution of value added along the milk value chain of the Niamey Dairy Basin [14-16].

The value of the wealth created by the milk value chain for 1 liter of milk produced is 531.38 FCFA. Of this value, the transformation generates 41.66%, followed by the distribution which generates 26.88% and the production which represents 23.73%. Among processors, the high value added is due to the high cost of the services purchased, while for the distributors it is due to the transaction costs incurred and the net gain of the actor. Added value consists of two important categories: wealth at the individual level that is, for the benefit of the actor himself and at the level of the community. At the individual level, the added value created for the actor himself is the amount of his net operating income. At the collective level, activity has created wealth for other sectors of the economy. These are mainly labor-paid wages, financial interest paid, taxes and other rented or purchased services (such as processing equipment, etc.). It appears that the production of milk is the activity which contributes more to the local economy in a general way, paradoxically; the producers derive profits from the sale the penultimate of all the actors given the low prices of sale to which they yield their product. Their net operating income is 56 CFAF / liter against 57.14; 35.56 and 134.71FCFA / liter respectively for distributors, collectors and transformers. Thus, the results of this study confirm several empirical cases that farmers do not reap large benefits in the value chain (FAO, 2012).

Social Performance

Starting from the pricing methods in different markets of the milk value chain, we found that urban traders have greater bargaining power than other actors. In most cases, it is they who set the price at which they must take the product from the producer and the price at which they sell the product to other actors. This is one of the reasons for their high added value in the value chain. This strong bargaining power of urban wholesalers is explained by their strong financing capacity. The latter give credit to producers and in exchange the producer after production is obliged to sell the product at the price imposed by the merchant. But still, the trader being based in the consumption zone holds the necessary information on the market price. The producer, on the other hand, does not have sufficient information on the market price, this informational aspect makes that the trader is better placed for the fixing of the price.

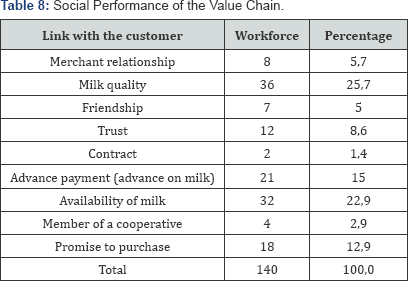

Certain social and economic values link the actors to each other. There are, for example, the market relations, the quality of the milk, the friendship, the trust, the contract, an advance payment, the availability of milk, membership in a cooperative or only the promise to purchase(Table 8).

25,7% of the actors confirmed not to be bound by other actors, for them the operation of purchase or sale of the milk is not conditioned by any social factor, only the market and the will of the actors enough. For 22.9% of the actors it is the availability of the milk which links them, 15% of actors are bound by advance payments of milk whereas for 12.9% the promise of purchase is the only link. It is observed that producers are the most vulnerable actors operating in an uncertain environment based on informal relations and relationships.

Competitiveness of the Value Chain and SWOT Analysis

Price / quality competitiveness: In a context like the environment in which the environment of the milk value chain is turbulent, marked by the injection of technological innovations that make the products stand out, it is important to be able to situate its product in terms of its competitiveness compared to other similar products on the market. Given the lack of data for analyzing the comparative advantages of the value chain, we analyze competitiveness in terms of cost, price and quality. The analysis of production costs revealed that the production costs of a liter of processed milk is exorbitant compared to those of milk powder. Processing one liter of raw milk costs more than twice as much as imported milk powder. But the local market is flooded mainly by products resulting from the processing of milk powder from Asia (Vietnam, Thailand) and Europe. Apart from the fact that imported milk from these countries costs less than local milk, it has extrinsic qualities that are larger than local milk. We can thus conclude that local milk produced in the Niamey dairy basin is less competitive compared to imported milk [17-20].

According to the results of the analysis of the demand for milk, local milk cannot yet meet the requirements of consumers who are currently enjoying products that evolve towards more quality and practicality. Unfortunately, as mentioned, the limiting factors of production such as health and nutrition, do not allow the product to meet the growing demand every day. Milk production in the Niamey dairy basin is more oriented towards a single category of purchaser (the SOLANI milk company) because of its difficult transformation character. In addition, raw milk processing still poses enormous problems with the processes. Existing dairies prefer imported milk powder and with low cost.

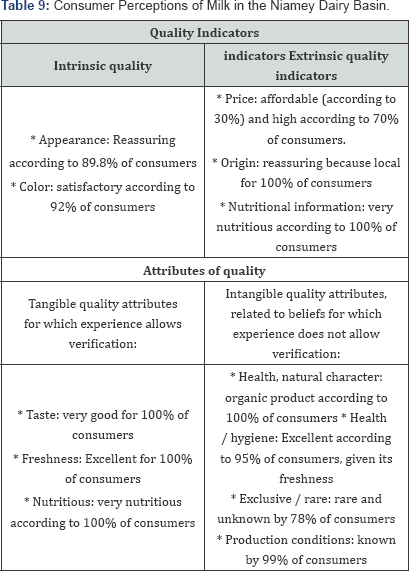

The competitiveness of local milk depends on consumers' perception of this product. Thus, the results of our 2016 surveys have been used to address this aspect. Local milk is characterized by a number of defects, but also by a number of qualities. It should be noted that local milk is characterized by households according to experience with the product. This sometimes justifies the contradictory characterization of the product among consumers. Our senses can betray us, not reflect the truth, not all individuals have the same thresholds for sensing stimuli. Attitudes are also formed by experience with the product. The confrontation of the consumer with the supply generates a “consumer experience” The emotional component is essential and leads to questioning the values that the consumer derives, not from his purchase, but from his consumer experience (Table 9). For 89.8% of consumers, local milk is reassuring and has a satisfactory color. Moreover, its intrinsic qualities remain indisputable: it is fresh for 100% of consumers, a very good taste (100%), healthy (95%), but low competitiveness compared to price (70% find it expensive) being given that it is a local product.

Constraints at the Level of Actors in the Milk Value Chain: Constraints related to the promotion of the milk value chain are examined in terms of production constraints (rudimentary technology, high cost of production, low productivity, lack of credit, low input use, etc.), transformation (technology rudimentary, low productivity, inadequate quality, etc.), marketing (price structure, difficult access to markets especially for producers, unstable and uninspired prices, lack of financial means, lack of information on market opportunities and quality etc.) and constraints related to consumption (difficulty of supply, problems of consumption habits, etc.).

Constraints Related to Production: Several constraints affect milk production in the Niamey dairy basin. The major constraints most commonly cited by producers are: the difficulty of access to credit, the insufficiency of zoo technical inputs, animal health and the inaccessibility of production areas to motorized collectors for the purchase of milk. The impassability of roads. The high cost of zoo technical inputs, the small size of the farms, the land insecurity that limits the grazing areas are also constraints faced by milk producers in the Niamey dairy basin.

Constraints Related to Transformation: Several constraints have been listed by the actors of this link. In prioritizing these constraints the main ones are: Lack of adequate equipment for processing, Electrical energy problems such as untimely power cuts and the high cost of energy / use of generators that cost fuel. Lack of or difficulty in accessing credit to buy equipment and increase processing. Lack of rolling stock for the delivery of the finished product Manual packaging of the finished product. Much of the transformation is done with traditional utensils that are not very appropriate. As a result, the entire production chain is manual. Local milk is of very good quality and is appreciated by the urban population (Table 9).

Marketing Constraints: Lack of financial means or credits is the major constraint most commonly cited by traders. The lack of cold equipment, market taxes are the constraints generally raised by traders. The lack of specific packaging (labeling) for local milk has also been listed. Counterfeit ways, indeed, some traders use milk powder to shape local milk. This sometimes involves the trust of some consumers.

SWOT Analysis

(Table 10) summarizes the strengths, weaknesses, opportunities and threats in the milk value chain of the Niamey Dairy Basin.

Strategic Options

In order to develop the local milk value chain in Niamey's dairy basin, meeting the expectations of consumers, it is important to remove the main bottlenecks that are located on all links in the chain, with a particular focus on the link in the production chain. Raw milk that has a productivity deficit. The strategic actions according to the links are summarized as follows:

At the Production Level

The objectives being to produce quantities that can guarantee the food security of the population, dairy producers are the actors on whom we must pay particular attention. The table of technical and functional analysis indicates some failures observed in the head of this actor.

The cost of animal feed The establishment of a quality batch control system for livestock feed will ensure geographic access (the distance the producer must travel to reach the point of purchase of the feed), physical access (lack of out of stock), qualitative access (food available to farmers must be nutritionally sound) and financial or economic access (funding and cost of food to the peasants). The actions to be implemented to ensure these types of accessibility are: (1) capacity building for research for livestock feed improvement activities, (2) capacity building of cooperatives for livestock production and marketing of livestock feed, (3) make the consultation framework responsible for the milk platform functional.

Animal health: it is essential to strengthen the fight against diseases, the use of quality zoo technical products for certain situations, the popularization of rodenticides and the protection of birds.Financing milk production: It appears essential to facilitate access to formal credit to reduce the loan credit that is common and annihilates the efforts of producers. For this, producers should also join into strong and credible organizations that can cover them. Producers throughout the dairy basin need to come together and form a unique producer structure.

In view of the difficulties of access to livestock inputs for producers, with the support of research and extension services, zoo technical input shops should be established in intensive production areas. For their operation and in a spirit of sustainability, these shops should be financially supported initially by an external partner who would give the starting capital (industrial by-products, veterinary products). Invest in the value chain of crop residues for the production of livestock feed. Subsequently, these shops should be managed by young rural entrepreneurs under the control of groups or strong associations of producers who would supply to the authorized services (example INRAN).

At the Transformation Level: Many of the constraints cited by milk processors and the main ones among them are the problems of electrical energy such as cuts and high energy prices and the lack of or lack of access to credit for buy equipment and increase production. Given the quality of the utensils, the manually of the entire processing chain, this work is laborious. These constraints affect the profitability of milk. An improvement in the quality of local milk requires combined actions at the level of production and processing with consequent support for research and advisory / training structures. In addition, the impassability of runway numbers, especially during the rainy season, the absence of cold equipment, limit access to different markets for dairy products.

In view of what is described here, it is necessary to: - Promote the availability and access of these actors to solid and modern processing materials. - Facilitate access to essential energy at low prices: since the price of oil depends more on the global market than domestic, it is necessary to develop solar energy in light of the enormous availability of solar radiation. - The promotion of local milk by labeling the qualities of local milk is one of the wishes of consumers. Indeed, the improvement of the packaging would consist in packaging the different product ranges (fresh milk, yoghurt). The presentation is an important determinant of the extrinsic quality of the product and partly reassures the consumers of the intrinsic quality of the product and significantly influences the choice of consumers. Thus, the promotion of local milk will have to go through the quality of the packaging of the product as well as the geographical indications, the labeling, the information of production and nutritional as well as the system of bar-code for the traceability. The local milk packaging should contain the following information: the place of production and processing, the name of the manufacturer, the year of manufacture, the net weight, the type of milk (cow's milk), the nutritional values, etc. . . .

At the level of marketing : The following strategies have been proposed by the milk traders

a) Facilitate access to low-interest credit for traders who agree to work under the conditions set by law

b) Establishment of a partnership or agreement with dairy farmers for a regular supply of raw milk. Both types of actors would find an interest provided that the legal framework can guarantee the consolidation of such contracts.

c) Improve the preservation and packaging of the product with adequate equipment because milk is very perishable given our weather conditions.

d) Support the promotion of local milk. For that, the good qualities of local milk appreciated by the consumers should be labeled.

Development of Transversal Strategies

In addition to the strategies proposed above, we believe that these two cross-cutting elements should be strongly supported:

Strengthen the Capacities of Producers, Processors and Traders Organizations: As shown in the analyzes, grouping together would make it easier for producers to access certain services and services (credit, training, feeding of livestock, etc.). However, a significant number of cooperatives in the study area have been identified, which are essentially characterized by a lack of specialization, immaturity and overlap. Aprolan and other NGOs are already supporting these cooperatives but currently additional support for the structuring and management of these cooperatives still seems necessary for dynamic cooperatives.As far as processors are concerned, for the moment they do not have the same organization as observed at the level of cooperatives. The strategy here will be to strengthen the organizational, technical and financial capacities of producers, processors and collectors.

Access to Credits and Adapted Financing: Financing milk production remains a central concern. It is transversal because it is expressed throughout the entire sector The current situation of financing the dairy sector remains marked by the difficulties with which a main strategy is formulated: "to focus on access to credit and sustainable financing of milk production ". In this context, the participation of the private and public sector is essential. It will mainly be a question of facilitating the access of breeders to micro finance structures that exist through the implementation of guarantee bonds for example. Management mechanisms involving professional organizations from all points of the value chain are sufficient guarantees for better financial management. To do this, it is necessary to consider a capacity building program in the financial management of value chain actors.

References

- Fontan C (2006) L'outil filiére agricole pour le développement rurale. Centre d'économie du développement. IFReD-GRFS-Université de bordeaux IV.

- Lothore A, Delmas P (2009) Acces au march e et commercialisation de produits agricoles. Valorisation d'initiatives de producteurs. Inter reseau- developpement rural.

- Argenti O (1998) Programme approvisionnement et distribution alimentaires des villes. Extrait de le bulletin reforme agraire, colonisation et cooperatives agricoles, 1997/2.

- FAO (2015) Site web AQUASTAT. Organisation des Nations Unies pour l'alimentation et l'agriculture. Site consulte le [2015/12/17].

- RGAC (Recensement de l'Agriculture et du cheptel Resultats definitifs, production animale, repartitions regionales (2007).

- RHISSA Z (2010) Revue du secteur de l'elevage au Niger. FAO/SFW: Republique du Niger, pp. 115.

- MRA.Document cadre de relance pour le secteur de l'elevage: etat des lieux, axes d'interventions et programmes prioritaires. Ministere des Ressources Animales, Niamey, Niger, 2003, 122 p.

- SDR. Strategié du Developpement Rural. Ministere des Ressources Animales: Niamey-Niger (2003).

- FAOSTAT. Donnees de production par région (2013).

- VEILLARDP L'élevage paysan doitrepondre alademandeafricaine. defissud, 2011, 98 : 14-16.

- Ganda IdeOusseini B, Jalloh 2, Pil S, Renard O (2016) : Les centres de collecte de lait au Niger Pour une dynamique territoriale au service des eleveurs.

- Guillaume DuTEURTREet CC (2013) Etude relative a la formulation du programme d'actions detaille de developpement de la filiere lait en zone UEMOA.

- Adégbola PY, Sodjinou E (2003) Etude de la competitivite de la riziculture beninoise

- Rapport définitif, Porto-Novo.

- Banque Mondiale (2008) World Development Report 2008: Agriculture for Development. Washington DC, USA

- Duruflé G, Fabre P, Yung JM (1988) Les effets sociaux et economiques des projets de developpement rural, manuel d'evaluation, Ministere de la Cooperation.

- Germaine Furaha Mirindi, Cadeau Rushigira Felly, Christian Mugisho Kanyama et Neema Chiza (2016) Analyse de la chaine de valeur du riz dans la plaine de la ruzizi (R.D.Congo). Rapport, p. 82.

- Guillaume Duteurtreet Christian CORNEAUX (2013) Etude relative a la formulation du programme d'actions detaille de developpement de la filiere lait en zone UEMOA.

- Scarpa r, rutok se, kkristjanson p, radeny m, drucker ga, rege oej.

- http://gafspfund.org/sites/gafspfund.org/files/Documents/Niger_7_ of_7_Agricultural%20Strategy_SDR_Niger_2003.pdf