Abstract

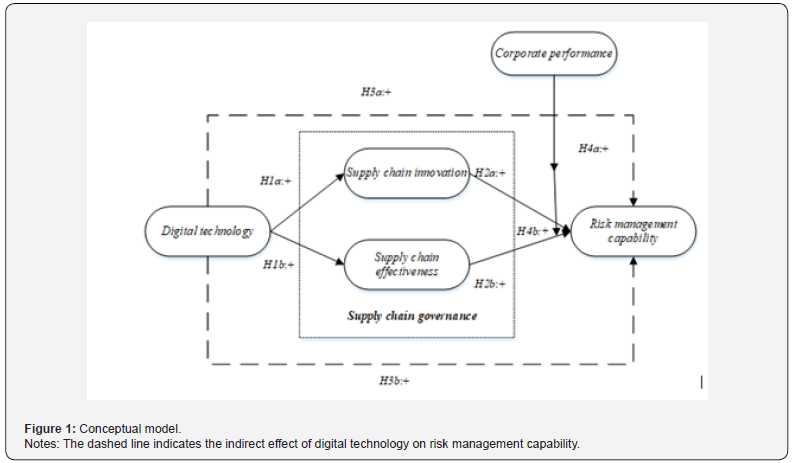

Research on supply chain has been flourishing over the past decades. However, the performance of food supply chains facing various disruptions show a lack of resilience and sustainability. To fulfill this objective, we use entropy weight method (EWM) for variable construction based on our questionnaire data of Chinese small and medium enterprises (SMEs) in food manufacturing industry. And then our study tests a moderated mediation model that considers that considers supply chain governance as a mediator between digital technology and firms’ risk management capability, and corporate performance as a moderator in the relationship between supply chain governance and risk management capability. Our findings suggest that digital technology is positively related to supply chain governance, represented by supply chain innovation and supply chain effectiveness. Digital technology has a positive indirect effect on risk management capability through supply chain governance. Corporate performance strengthens the positive effect of supply chain governance and the positive indirect effect of digital technology on risk management capability. Our study enriches understanding of firms’ risk management capability and supply chain governance in the digital era by empirically confirming that digital technology brings opportunities to the operating transformation. In addition, our study contributes to the supply chain digitalization literature by empirically validating the role of digitalization in promoting inter-organizational technological activities and operating activities.

Keywords:Entropy Weight Method (EWM); Food supply chain; Digital technology; Risk management capability; Supply chain governance; Corporate performance

Introduction

As digital technology has advanced, firms are engaged on a process of digital transformation. They have profoundly revolutionized their business activities and significantly changed their supply chain governance processed and practices [1, 2]. One of the most remarkable changes is the upgrading of the supply chain systems used by manufacturers to transact with trading partners. Digitalization driven by new technologies is one of the hottest topics in the era of Industry 4.0 [3], attracting the attention of both practitioners and scholars. In the Industry 4.0 era, digitalization with the aim of improving operational efficiency and supply chain governance [1], can significantly transform or promote supply chain innovation activities and effectiveness [4]. However, the majority of studies stop at discussing the technological implications of digitalization, without digging deeper into the subsequent consequences of these technological activities [5].

In this study, the biggest difference between our paper and other literatures lies in the processing of questionnaire data. Most studies based on questionnaire data use factor analysis method. This method causes data loss due to exclude some questions from variable construction. Accordingly, we use entropy weight method (EWM) for variable construction. It is a useful information weight model which has been extensively applied in similar studies [6-8]. In the standardized original data matrix, the degree of variation indicates the amount of information involved in each construct, and EWM evaluates constructs by measuring the degree of differentiation. The greater the data variation of the construct, the more information can be derived, thus a greater weight is given to the indicator in this construct. According to literature, EWM is a reliable and effective tool in decision making [8-10] for several reasons. First, it has no strict restriction on the observation of data, data distribution and the number of constructs, and requires only the monotonic performance of numerical constructs to reflect the size. Second, it avoids the subjective interference of human factors on weights of constructs, thus improving the objectivity of the evaluation [8]. After deciding the main method, we then investigate how digital technology affects risk management capability through supply chain innovation and effectiveness. Supply chain innovation and supply chain effectiveness are two representative perspectives of supply chain governance. Supply chain innovation represents the innovation activities engaged and new technologies employed in the supply chain, whereas supply chain effectiveness represents the speed of integrating resources. We are also interested in how corporate performance moderates the relationships between digital technology and risk management capability. This inquiry sheds light on the ongoing debate of firms’ maximum profits and innovation activities funds. In the digital age, it is important to investigate whether a mechanism is effective in inducing risk management capability arising from digital technology using.

Research on supply chain resilience has been flourishing over the past decades with significant achievements made. For instance, supply chain resilience strategies, including alternate inventory, enhancing security, encouraging fund supply, postponement, building relationship with supplier, demand forecasting, and information sharing have been proposed and tested in various contexts [11]. A resilient supply chain can mitigate risks and reconstruct the supply chain after experiencing disruptions. Despite important achievements, the sudden arrival of the COVID-19 pandemic in late 2019 and the massive disruptions it caused to the global supply chain warns that our supply chain is yet to be resilient enough.

For instance, food suppliers could not sell their food products out to restaurants and pubs because of the lockdown measures those countries had to impose. At the same time, at the other end of the food supply chain, customers started to have panic buying behaviors out of fear and anxiety for food shortages. Consequently, food distribution was interrupted with a lack of food for some and food waste for the others.

There are three main reasons for our study to focus on the food supply chain. Firstly, food plays an important role to daily lives for human being [12]. The nature of food product is different from other consumer goods such as electronics as it concerns the life and health of the humankind and other living creatures, without which a good future cannot be developed. This is also emphasized by SDGs and its sub-targets. Secondly, the current food supply chain shows an urgent need for improvement in resilience and sustainability. The current food supply chain is not resilient enough when facing uncertainties such as agricultural shortage, which result in hunger and inequality. Food distribution is unfair where some people have more than needed and others struggle to meet basic needs. For instance, the UK wasted 9.5 million tons of food in 2018 [13], while over 8 million people in other parts of the world were living in hunger [14]. Thirdly, sustainable food systems can thus help maintain food security and they are productive and resilient to climate change and natural disasters [15]. It is important to ensure food access and quality to all including the poor and the vulnerable by having resilient food production systems when disruptions happen so that people can live healthier lives [16].

The rest of the paper is organized as follows. Section 2 presents a thorough review of relevant theories and develops hypotheses. Section 3 then provides a detailed description of the method employed in this study and Section 4 reports the results of the analysis. Section 5 discusses the main findings and the contributions of the study.

Literature Review and Hypothesis Development

The effects of digital technology on supply chain governance

Digital Technology is an organizational effort to improve business performance or create new business models through new digital technologies [17]. In normal as well as in turbulent environments, these digital technologies show a promising role in supporting organizational and supply chain processes and achieving superior performance.

With the wide application of digital technology in the field of supply chain, many scholars have discussed the effects of digital technology from different perspectives [18,19]. Previous studies have formed the framework of digitalization effect, including effect on supply chain structure, governance, and information interaction among participants [20,21]. In the last decade, manufacturing firms have been exploring how to use emerging digital technologies, e.g., big data analytics, artificial intelligence and blockchain, in their production and supply chain operating [22,23]. These technologies are seen as promising means to improve supply chain functions, such as procurement, logistics, scheduling and planning [24].

Digital technology has three main effects. First, digital technology promotes information sharing among different entities in the supply chain. [25] point out that big data technology can help improve the visibility of supply chain information, make supply chain decisions more intuitive and transparent, and better predict the uncertainty of supply and demand [25,26] find that blockchain, as a shared distributed database, can promote information sharing in the supply chain, reduce the degree of information asymmetry in the supply chain, and improve the cooperation efficiency of all participants in the supply chain [26]. Second, digital technology improves the traceability of supply chain information. The existing research mainly focuses on the discussion how to use blockchain to improve product traceability and ensure product quality and safety. [27] believe that blockchain has endowed commodities with real traceability in the whole supply chain, reduce the possibility of product fraud and counterfeiting, and has a positive impact on reducing costs and improving efficiency [27]. The research of Behnke & Janssen [28] shows that blockchain technology realizes the information visualization of the whole process of food from raw material procurement to sales, which helps to establish a food quality and safety traceability system of the whole chain and ensure food safety [28]. Last, digital technology has improved the trust between different entities in the supply chain. The decentralized characteristics of digital technology such as blockchain enable the supply and demand sides to get rid of the trust relationship that can only be established by relying on personality or a third party under the traditional mode, realize “trust transaction without trust”, and effectively solve the agency problem in the supply chain management. The research of Korpela et al. [29] shows that the information integration functions of blockchain can reduce the occurrence of information distortion and opportunistic behavior of deception among members [29].

Specifically, big data analytics contributes to supply chain flexibility by effectively processing, visualizing and analyzing data, and thereby supporting data-driven decision-making, accurate understanding of the supply chain’s current state and predicting future changes, and faster adaptation to the changing environment [30-32]. The use of artificial intelligence, which is also significantly data-dependent, can contribute to supply chain agility by providing both flexibility and cost-efficiency through machine learning [33]. The decentralized nature of blockchain has the potential to make the supply chain more efficient, transparent, visible, traceable, flexible, and sustainable [34-36]. Blockchain ensures data quality and security, as all transactions are recorded in real time and cannot be altered [37]. Visibility is thus enhanced with boosted availability of high-quality supply chain information [38].

As Faruquee et al. [39] point out, supply chain governance requires capabilities such as innovation and effectiveness, which can be realized through the synergistic effects among various digital technology [39]. The development of these capabilities requires extensive market information, which is what digital technologies can deliver. From a supply-side perspective, Yang et al. [5] find a positive effect of digital technology on supply chain governance from the visibility aspect [5].

In sum, modern digital technologies, with their distinct

functions, provide companies with various benefits that

complement each other. Digital technology, characterized by

the adoption of a large portfolio of digital technologies, can

contribute to the predictive and responsive processes of supply

chains, enhancing ultimately supply chain governance, including

supply chain innovation and supply chain effectiveness in various

environmental conditions. Based on this, this paper puts forward

the following hypotheses:

H1a. Digital technology is positively related to supply chain

innovation.

H1b. Digital technology is positively related to supply chain

effectiveness.

The effects of supply chain governance on risk management capability

Enterprises with good supply chain governance can promote them to establish close relationships with suppliers and customers, strengthen information sharing, and reduce conflicts and risks [40]. Some studies also show that higher supply chain management can help improve the utilization of enterprise assets and reduce operating costs, thereby improving enterprise performance and improving risk management capabilities [41-43]. And a good supply chain interaction is conducive to enhancing the external expectations for the improvement of enterprise performance. Schwieterman et al. [44] discuss the impact of supply chain relationship on the credit rating of IPO enterprises from the perspective of supplier and customer portfolio characteristics [44].

According to the information theory, firms can reduce their bargaining power through single information flow, centralized resource allocation and high dependence on supply chain participants. However, these bargaining channels increase the risk of supply chain interruption [45] and the firm credit [46]. Therefore, improving supply chain governance can disperse information flow, reduce enterprise resource dependence, mitigate supply chain interruption risk and credit risk contagion effect, thus improving their ability to cope with environmental changes and mitigating the risk effect brought by economic policy uncertainty.

The existing literatures support that enterprises can generate

revenue and improve performance by improving supply chain

management, thus reducing enterprise risk. Therefore, as

important mechanisms through which supply chains maintain a

dynamic fit between information processing capacity and needs,

innovative and effective supply chains are able to perpetuate a

high level of performance in stable as well as in uncertain times,

improving risk management capability. Therefore, this paper puts

forward the following hypotheses:

H2a. Supply chain innovation is positively related to risk

management capability.

H2b. Supply chain effectiveness is positively related to risk

management capability.

Based on hypotheses 1 and 2, this study proposes that digital technology indirectly impacts risk management capability through two types of supply chain governance, namely supply chain innovation and supply chain effectiveness.

Literatures have discussed that the adoption at high intelligent technology level can help firms respond faster to the changing environment and facilitate the risk management [47,48]. Digital technology has significantly improved the operation efficiency of the supply chain, reduced the potential risks that may arise from various factors, and enhanced the capability of the risk management.

As organizational information processing theory suggests, organizations and supply chains need to increase their capacity for information processing because they operate in an increasingly uncertain environment [49]. With a dynamic fit between the capacity and need for information processing, the organization or supply chain can execute tasks successfully. Digital technologies can help organizations and supply chains to quickly adjust their information processing capacity to match the changing need and improve the risk management capability. Digital technology can not only bring new financing methods to enterprises, but also reduce the degree of information asymmetry, and further promote the formation of cooperative relationships in the supply chain, so as to improve the ability of enterprises to cope with environmental changes, resist risks, and mitigate adverse effects under economic uncertainty.

In other words, digital technology, as an input for the

exchange relationship, affects risk management capability which

is regarded as an output of the relationship, by influencing the

exchange process (i.e. supply chain innovation and supply chain

effectiveness). In sum, digital technology indirectly impacts risk

management capability through supply chain innovation and

effectiveness. Therefore, we propose the following hypotheses:

H3a. Digital technology has a positive indirect impact on risk

management capability through supply chain innovation.

H3b. Digital technology has a positive indirect impact on risk

management capability through supply chain effectiveness.

The moderating effect of corporate performance

According to dynamic capability theory, corporate performance, are expected to help firms to adjust operational resources and gain competitive advantages in the unexpected external environment [50]. These moderating effects occur because corporate performance change how supply chain governance is experienced and perceived by both parties, and these changes in experience and perception can influence the manufacturer’s confidence and capability to behave better under uncertainty [51,52]. We propose that corporate performance strengthens the role of supply chain governance inducing strong risk management capability.

Corporate performance moderates the effect of supply chain governance in two ways. First, corporate performance and supply chain governance are inseparable. Supply chain governance is one of a firm’s abilities to respond to emergencies [53]. High-level supply chain governance is an appearance of strong corporate performance, suggesting firms are good at transmitting information, perceiving the external environment, and coordinating the operation under uncertain ability [54]. The risk of emergencies has a relatively severe impact on firms’ operations in terms of supply and demand [55,56]. The purpose of each participant in the supply chain is to improve performance [57].

Corporate performance reflects a superior and unique way to

coordinate, deploy, and allocate resources [58]. Therefore, strong

corporate performance contributes to supply chain governance to

produce a marked effect on risk management capability. Second,

even though the manufacturer may not recognize the value of

supply chain governance, corporate performance can hinder the

manufacturer from neglecting supply chain governance. Good

corporate performance can provide benefits for supply chain

participants, fostering a cooperative, trustful and reciprocal

atmosphere among them. Current literature has shown that

Studies have shown that this atmosphere is an effective governance

mechanism [59]. And then good corporate performance forces

firms to pay more attention to supply chain governance, which

can enhance the impact of supply chain governance on risk

management capability. Therefore, we propose the following

hypotheses:

H4a. Corporate performance strengthen the relationship

between supply chain innovation and risk management capability

such that the relationship is more positive when corporate

performance is better.

H4b. Corporate performance strengthen the relationship

between supply chain effectiveness and risk management

capability such that the relationship is more positive when

corporate performance is better.

To summarize, we propose a moderated mediation model that includes digital technology, supply chain innovation, supply chain effectiveness and risk management capability, as shown in Figure 1.

Methodology

Questionnaire and data collection

A survey-based quantitative approach is adopted to test the hypotheses, and the survey instrument is developed based on established measurement scales. First, literature related to the key concepts in our research model was carefully reviewed to identify valid survey items, based on which an English version of the questionnaire was created. As the target respondents are mainly Chinese-speaking, a back-translation method involving two bilingual researchers [60] was applied to the survey instrument. Specifically, a researcher translated the questionnaire into Chinese, and the Chinese version was then translated back into English by another researcher. Based on discussions and mutual agreements, minor revisions were made to the Chinese version of the questionnaire to avoid any possibility of confusion among respondents. Second, the questionnaire was reviewed by three industrial and five academic experts, based on which further minor modifications were made to ensure clarity of questions and the face validity of the survey instrument. Lastly, a pilot study was conducted with 10 respondents before the survey was launched officially. After reviewing the received responses and feedback, several minor linguistic adjustments were made to ensure the readability, interpretability, and structural accuracy of the questionnaire.

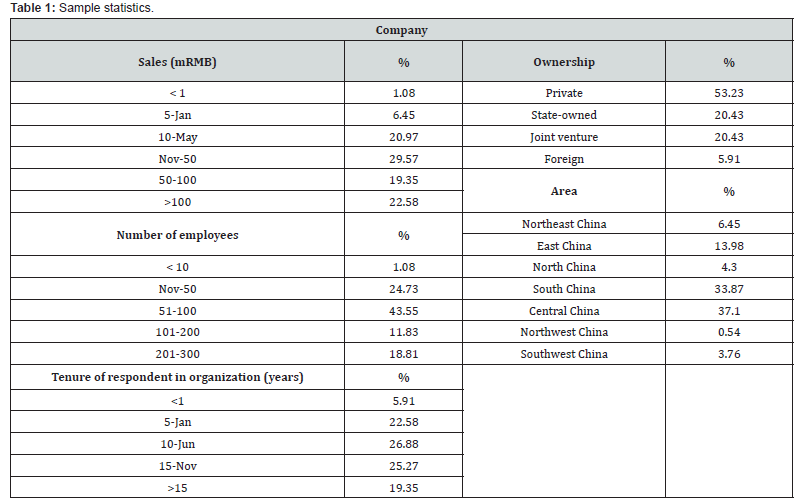

In addition to questions related to the constructs, general questions, on employee size and annual revenue and ownership are also included in the questionnaire and treated as control variables in data analysis. Theoretically, large firms tend to possess more resources, for example in the form of qualified personnel and tacit knowledge [61].

We collaborated with a professional market research company in China to collect data. Such professional support is a popular alternative to traditional approaches and has been increasingly used in recent studies of supply chains and operations management [31,62,63].

With the help of the research company, the questionnaire was emailed to a total of 300 randomly selected Chinese SMEs in food manufacturing industry. 215 responses were returned, among which 186 were complete and considered valid, representing a response rate of 62%. Table 1 shows the statistics of the sample. Various firms of different sizes from different areas are included. The sample also covers a variety of ownership types (private, state-owned, joint venture and foreign). In terms of firm size measured by employee number, there is a sizable representation (43.55%) of firms with 51 to 100 employees and almost one-fourth of responses are from firms with 11 to 50 employees (24.73%). Most of the participants have been at their firm for more than five years, suggesting that they are knowledgeable about the subjects included in the questionnaire [64,65]. 3.2. Variable Construction.

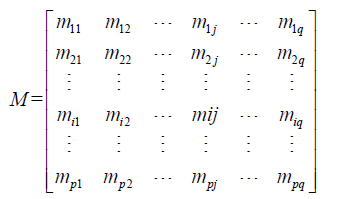

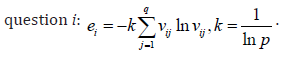

This part displays entropy weight method (EWM) for variable

construction. EWM is an evaluation approach to determine

weights of each item in a construct. To perform EWM, we first

need to decide the objectives and define the decision matrix, and

then to calculate the standardized decision matrix, probability

of the attribute/response, the entropy value of the attribute/

response, degrees of divergence (information contained) in each

response and the entropy weights. This procedure is performed in

the following steps:

i. Decide the objectives. In this study, risk management

capabilities, digital technology and supply chain governance are

the objectives.

ii. Define the decision frequency matrix. Formulate a

matrix

for each of the above indices, where p represents the number of questions, q the answer scale (equals to 7 in this paper), and mij the frequency of answer j to question i.

iii. Normalize the frequency matrix. We then calculate

the proportion of each answer of question i which represents:

, and use vij

to calculate the information entropy of

, and use vij

to calculate the information entropy of

v. Calculate the entropy weights. The entropy weight for

question i can be represented as

The resulting item weights for the constructs are shown in Appendix A.

Notes: *** p<0.01, ** p<0.05, * p<0.1.

Notes: Standard errors are in parenthesis. *** p<0.01, ** p<0.05, * p<0.1.

Results and Discussions

Descriptive statistics and correlations

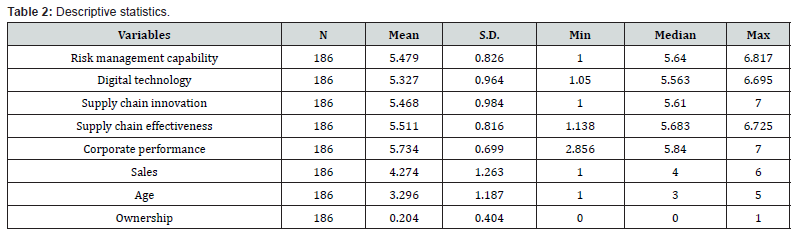

Table 2 presents the descriptive statistics of the variables. The mean value of Risk management capability is 5.479. The minimum, median and maximum are 1.000, 5.640 and 6.817, respectively. The mean value of variable Digital technology is 5.327 and the minimum, median and maximum are 1.050, 5.563 and 6.695, respectively. The mean value of variable Supply chain innovation is 5.468 and 1.000, 5.610 and 7.000 are the values of minimum, median and maximum. And the average of variable Supply chain effectiveness is 5.511, and the minimum, median and maximum are 1.138, 5.683 and 6.725, respectively. This means sample firms frequently use digital technology in supply chains. The mean value of variable corporate performance is 5.734. The minimum, median and maximum of the above variable are 2.856, 5.840 and 7.000. As for control variables, the mean value of Sales, Age and Ownership are 4.274, 3.296 and 0.204, respectively.

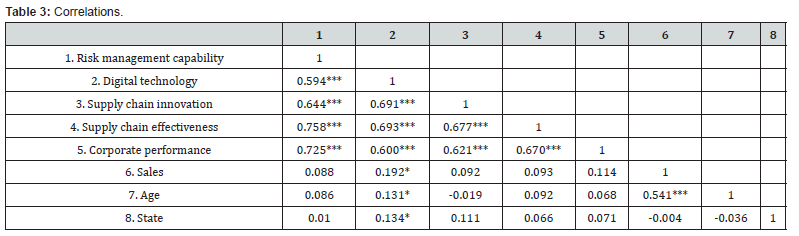

Table 3 reports the correlations of the above variables. The correlation coefficient between Digital technology and Risk management capability is positive and significant at 1% level. This finding shows that Digital technology is positive relates to Risk management capability. The mediators, Supply chain innovation and Supply chain effectiveness, have positive and significant correlation coefficients with Risk management capability and Digital technology. These correlations show that supply chain governance have strong positive relation with the above two kind variables.

Non-response bias

Following Armstrong & Overton [66], non-response bias is assessed by comparing firm characteristics of early responses and late responses. There are 94 and 92 responders in the early and late subsamples, respectively. T-test results show no significant differences between early and late responses in terms of firm annual revenues, birth years and ownership type. In addition, we also do T-test for digital technology, supply chain innovation, supply chain effectiveness, risk management capability and corporate performance. No significant differences are found in the T-test results (p=0.245, p=0.131, p=0.182, p=0.243, p=0.409, respectively). Therefore, non-response bias is not a serious concern in our research [67].

Hypothesis testing

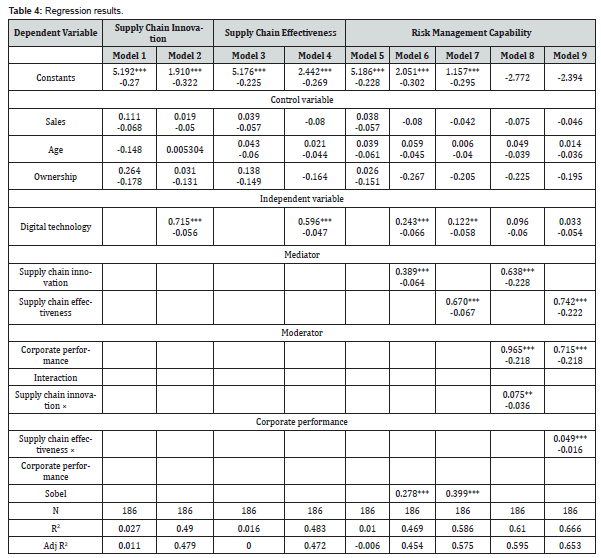

We used Stata 17.0 to test our hypotheses using the OLS regression technique. Table 4 summarizes the regression results. The results of Model 2 and Model 4 indicate that digital technology is positively related to supply chain innovation (b=0.715, p<0.001) and supply chain effectiveness (b=0.596, p<0.001). Therefore, H1a and H1b are supported. The results of Model 6 demonstrate that supply chain innovation is positively related to risk management capability (b=0.389, p<0.001), and the results of Model 7 report that supply chain effectiveness is positively related to risk management capability (b=0.670, p<0.001). Therefore, H2a and H2b are also supported. The results of Model 6 and Model 7 also prove that digital technology has a positive indirect effect on risk management capability through supply chain innovation (Sobel=0.278, p<0.001) and supply chain effectiveness (Sobel=0.399, p<0.001). Therefore, H3a and H3b are supported. The results of Model 8 and Model 9 indicate that corporate performance strengthen the positive effect of supply chain innovation on risk management capability (b=0.075, p<0.05) and the positive effect of supply chain effectiveness on risk management capability (b=0.049, p<0.001). Therefore, H4a and H4b are supported.

Test for endogeneity

Firms that have strong capabilities of supply chain are more likely to engage in digitalization, indicating a potential reverse causality issue. We addressed this endogeneity concern using instrumental variables approach and conducting a two-stage least squares (2SLS) regression. An instrumental variable should have a strong relationship with the independent variable (i.e. digital technology) but no relationship with the error term. We choose the firms’ foreign exchange and regional education level as our instrumental variables for digital technology. The variable foreign variable refers to the natural logarithm of one plus the number of firms’ overseas exchange in the past three years. The variable education level is the natural logarithm of one plus the number of schools of firms’ location province. We use the ivreg2 command of Stata to conduct the analysis. The results are shown in Table 5. The first-stage result indicates that foreign exchange and education level are positively related to supply chain governance (b=0.410, p<0.01; b=0.197, p<0.1). The post estimation shows that foreign exchange and education level are effective instrumental variables for digital technology (Anderson test p<0.01, Cragg-donald wald F statistic=26.477). In the second stage, supply chain innovation and supply chain effectiveness are regressed on the predicted value of digital technology obtained from the first stage and the control variables. The results indicate that predicted digital technology is positively related to supply chain innovation and supply chain effectiveness (b=0.800, p<0.01; b=0.485, p<0.01), consistent with the OLS results. These results suggest that the relationship between digital technology and supply chain governance is not unduly affected by endogeneity issues.

Conclusion

From the current volatile business environment, our study empirically investigates the role of the digital technology using in enhancing risk management capabilities of enterprises belonged to food manufacturing industry. An analysis of data collected from Chinese SMEs suggests that the use of digital technology in supply chain of firms, which is, in this paper represented by big data analytics, artificial intelligence and blockchain, has a significant positive effect on supply chain governance, which in turn enhance firms’ risk management capability. Further, corporate performance strengthens the positive effect of supply chain governance and the positive indirect effect of digital technology on risk management capability. This paper has important theoretical contributions and practical implications.

This paper contributes to the supply chain governance literature by providing a different data processing method and fulfilling the lack of resilience and sustainability of food supply chains. Our study has two remarkable combinations of methods, referring to the combination of information science and management and the combination of questionnaire and qualitative method. Based on these combinations, we investigate the underlying processes of digital technology and how they work with risk management capability of firms. Accordingly, our study contributes to the digital technology literature by empirically investigating the effect of digital technology beyond the organizational boundary, to the supply chains. Our study also offers important management insights. The digital era provides new opportunities for radical innovation in firms’ and supply chains’ ways of generating and delivering value. Therefore, companies are advised to actively use digital technology. Especially in the current business environment, where unprecedented events have disrupted the physical supply chain, managers are urged to utilize digital tools to maintain a smooth information chain.

Funding

This research was funded by the Nanjing Soft Science Project under Grant No 202403026.

References

- Holmstrom J, Holweg M, Lawson B, Pil FK, Wagner SM (2019) The digitalization of operations and supply chain management: theoretical and methodological implications. J Oper Man 65(8): 728-734.

- Ritter T, Pedersen CL (2020) Digitization capability and the digitalization of business models in business-to-business firms: past, present, and future. Ind Market Manag 86: 180-190.

- Eller R, Alford P, Kallmünzer A, Peters M (2020) Antecedents consequences, and challenges of small and medium-sized enterprise digitalization. J Bus Res 112: 119-127.

- Li Y, Dai J, Cui L (2020) The impact of digital technologies on economic and environmental performance in the context of Industry 4.0: A moderated mediation model. Int J Prod Econ 229: 107777.

- Yang L, Huo B, Tian M, Han Z (2021) The impact of digitalization and inter-organizational technological activities on supplier opportunism: The moderating role of relational ties. Int J Oper Prod Man 41(7): 1085-1118.

- Qu W, Li J, Song W, Li X, Zhao, Y, et al. (2022) Entropy-Weight-Method-Based Integrated Models for Short-Term Intersection Traffic Flow Prediction. Entropy 24(7): 849.

- Rao R, Yadava V (2009) Multi-objective optimization of Nd: YAG laser cutting of thin superalloy sheet using grey relational analysis with entropy measurement. Opt Laser Technol 41(8): 922-930.

- Feng J, Gong Z (2020) Integrated linguistic entropy weight method and multi-objective programming model for supplier selection and order allocation in a circular economy: A case study. J Clean Prod 277: 122597.

- Chen CH (2021) A Hybrid Multi-Criteria Decision-Making Approach Based on ANP-Entropy TOPSIS for Building Materials Supplier Selection. Entropy 23(12): 1597.

- Tsui CW, Wen UP (2014) A Hybrid multiple criteria group decision-making approach for green supplier selection in the TFT-LCD industry. Math Probl Eng, pp. 709872.

- Chopra S, Sodhi MMS (2004) Managing risk to avoid: supply-chain breakdown. MIT Sloan Manage Rev 46: 53-61.

- Holweg C, Teller C, Kotzab H (2016) Unsaleable grocery products, their residual value and instore logistics. Int J Phys Distr Log 46(67): 634-658.

- Lords library. Food Waste in the UK.

- Global Hunger Continues to Rise, New UN Report Says.

- Fanzo J, Bellows AL, Spiker ML, Thorne-Lyman AL, Bloem MW (2021) The importance of food systems and the environment for Nutrition. Am J Clin Nutr 113(1): 7-16.

- Vogliano C, Murray L, Coad J, Wham C, Maelaua J, et al. (2021) Progress towards SDG2: Zero hunger in Melanesia–a state of data scoping review. Glob Food Secur 29: 100519.

- Fitzgerald M, Kruschwitz N, Bonnet D, Welch M (2014) Embracing digital technology: A new strategic imperative. MIT Sloan Manage Rev 55: 1-12.

- Fairchild AM (2005) Intelligent Matching: Integrating Efficiencies in the Financial Supply Chain. Supply Chain Manag 10(4): 244-248.

- Ng ICL (2014) New Business and Economic Models in the Connected Digital Economy. J Revenue Pricing Ma 13: 149-155.

- Omran Y, Henke M, Heines, R, Hofmann E (2017) Blockchain- driven Supply Chain Finance: Towards a Conceptual Framework from a Buyer Perspective. IPSERA: 26th Annual Conference of the International Purchasing and Supply Education and Research Association.

- Templar S, Hofmann E, Findlay C (2020) Financing the End-to-end Supply Chain: A Reference Guide to Supply Chain Finance, Kogan Page Publishers.

- Addo-Tenkorang R, Helo PT (2016) Big data applications in operations/supply-chain management: a literature review. Ind Eng 101: 528-543.

- Caputo A, Marzi G, Pellegrini M (2016) The internet of things in manufacturing innovation processes: Development and application of a conceptual framework. Bus Process Manag J 22(2): 383-402.

- Arunachalam D, Kumar N, Kawalek JP (2018) Understanding big data analytics capabilities in supply chain management: Unravelling the issues, challenges and implications for practice. Transport Res E Log 114: 416-436.

- Wang G, Gunasekaran A, Ngai EWT, Papadopoulos T (2016) Big data analytics in logistics and supply chain management: certain investigations for research and applications. Int J Prod Econ 176: 98-110.

- Wang YL, Singh M, Wang JY, Rit, M (2019) Making sense of blockchain technology: how will it transform supply chains? Int J Prod Econ 211: 221-236.

- Biswas K, Muthukkumarasamy V, Tan WL (2017) Blockchain based wine supply chain traceability system. The Science and Information Organization. Future Technologies Conference. Vancouver: IEEE, pp. 56-62.

- Behnke K, Janssen, MFWHA (2020) Boundary conditions for traceability in food supply chains using blockchain technology. Int J Inform Manage 52: 101969.

- Korpela K, Hallikas J, Dahlberg T (2017) Digital supply chain transformation towards blockchain integration. BUI T, SPRAGUER. Proceedings of the 50th Hawaii International Conference on System Sciences. Honolulu, HI: HICSC, pp. 4182-4191.

- Koot M, Mes, MRK, Iacob ME (2021) A systematic literature review of supply chain decision making supported by the Internet of Things and Big Data Analytics. Comput Ind Eng 154: 107076.

- Faruquee M, Paulraj A, Irawan, CA (2021) Strategic supplier relationships and supply chain resilience: Is digital transformation that precludes trust beneficial? Int J Oper Prod Man 41(7): 1192-1219.

- Dennehy D, Oredo J, Spanaki K, Despoudi S, Fitzgibbon M (2021) Supply chain resilience in mindful humanitarian aid organizations: the role of big data analytics. Int J Oper Prod Man 41(9): 1417-1441.

- Toorajipour R, Sohrabpour V, Nazarpour A, Oghazi P, Fischl, M (2021) Artificial intelligence in supply chain management: A systematic literature review. J Bus Res 122: 502-517.

- Wamba SF, Dubey R, Gunasekaran A, Akter S (2020) The performance effects of big data analytics and supply chain ambidexterity: The moderating effect of environmental dynamism. Int J Prod Econ 222: 107498.

- Kamble SS, Gunasekaran A, Subramanian N, Ghadge A, Belhadi A, et al. (2021) Blockchain technology’s impact on supply chain integration and sustainable supply chain performance: evidence from the automotive industry. Ann Oper Res 327: 575-600.

- Nandi ML, Nandi S, Moya H, Hale K (2020) Blockchain technology-enabled supply chain systems and supply chain performance: a resource-based view. Supply Chain Manag 25(6): 841-862.

- Baharmand H, Maghsoudi A, Coppi G (2021) Exploring the application of blockchain to humanitarian supply chains: insights from Humanitarian Supply Blockchain pilot project. Int J Oper Prod Man 41: 1522-1543.

- Williams BD, Roh J, Tokar T, Swink M (2013) Leveraging supply chain visibility for responsiveness: The moderating role of internal integration. J Oper Man 31(7-8): 543-554.

- Faruquee M, Paulraj A, Irawan CA (2021) Strategic supplier relationships and supply chain resilience: Is digital transformation that precludes trust beneficial. Int J Oper Prod Man 41(7): 1192-1219.

- Uzzi B (1996) The sources and consequences of embeddedness for the economic performance of organizations: The network effect. Am Sociol Rev 61(4): 674-698.

- Schumache RU (1991) Buyer structure and seller performance in US manufacturing industries. Rev Econ Stat 73(2): 277-284.

- Snyder CM (1996) A dynamic theory of countervailing power. The Rand J Econ 27(4): 747- 769.

- Patatoukas PN (2012) Customer-base concentration: Implications for firm performance and capital markets. Account Rev 87(2): 363-392.

- Schwieterman MA, Goldsby TJ, Croxton KL (2018) Customer and supplier portfolios: Can credit risks be managed through supply chain relationships? J Bus Logistic 39(2): 123-137.

- Ang E, Iancu DA, Swinney R (2016) Disruption risk and optimal sourcing in multitier supply networks. Manage Sci 63(8): 2397-2419.

- Jacobson T, Von Schedvin E (2015) Trade credit and the propagation of corporate failure: An empirical analysis. Econometrica 83(4): 1315-1371.

- Schoenherr T, Speier-Pero C (2015) Data science, predictive analytics, and big data in supply chain management: current state and future potential. J Bus Logistic 36(1): 120-132.

- Wood LC, Reiners T, Srivastava HS (2017) Think exogenous to excel: alternative supply chain data to improve transparency and decisions. J Logistic Res Appl 20(5): 426-443.

- Galbraith J (1973) Designing complex organizations, Reading, Mass, Addison-Wesley Pub Co, USA.

- Zhu C, Du J, Shahzad F, Wattoo MU (2022) Environment sustainability is a corporate social responsibility: Measuring the nexus between sustainable supply chain management, big data analytics capabilities, and organizational performance. Sustainability 14(6): 3379.

- Rokkan AI, Heide JB, Wathne KH (2003) Specific investments in marketing relationships: Expropriation and bonding effects. J Marketing Res 40(2): 210-224.

- Wang Q, Li Ross JJWT, Craighead CW (2013) The interplay of drivers and deterrents of opportunism in buyer–supplier relationships. J Acad Market Sci 41: 111-131.

- Ceptureanu EG, Ceptureanu SI (2019) The impact of adoptive management innovations on medium-sized enterprises from a dynamic capability perspective. Technol Anal Strateg Manag 31(10): 1137-1151.

- Cepeda G, Vera D (2007) Dynamic capabilities and operational capabilities: A knowledge management perspective. J Bus Res 60(5): 426-437.

- Kleindorfer PR, Saad GH (2010) Managing Disruption Risks in Supply Chains. Prod Oper Manag 14(1): 53-68.

- Alsaad A, Mohamad R, Taamneh A, Ismail NA (2018) What drives global B2B e-commerce usage: An analysis of the effect of the complexity of trading system and competition pressure. Technol Anal Strateg Manag 30(8): 980-992.

- Sahebjamnia N (2020) Resilient supplier selection and order allocation under uncertainty. Sci Iran 27(1): 411-426.

- Helfat CE, Winter SG (2011) Untangling Dynamic and Operational Capabilities: Strategy for the (N)ever-Changing World. Strateg Manag J 32(11): 1243-1250.

- Wang Q, Huo B, Zhao X (2020) What makes logistics integration more effective? Governance from contractual and relational perspectives. J Bus Logis 41(3): 259-281.

- Bhalla G, Lin LY (1987) Crops-cultural marketing research: A discussion of equivalence issues and measurement strategies. Psychology & Marketing 4: 275.

- Grant RM (1996) Toward a knowledge-based theory of the firm. Strateg Manag J 17(S2): 109-122.

- Autry CW, Grawe SJ, Daugherty PJ, Richey RG (2010) The effects of technological turbulence and breadth on supply chain technology acceptance and adoption. J Oper Mana 28(6): 522-536.

- Revilla E, Saenz MJ (2017) The impact of risk management on the frequency of supply chain disruptions: a configurational approach. Int J Oper Prod Man 37(5): 557-576.

- Flynn BB, Huo B, Zhao X (2010) The impact of supply chain integration on performance: a contingency and configuration approach J Oper Man 28(1): 58-71.

- Zhao X, Huo B, Selen W, Yeung JHY (2011) The impact of internal integration and relationship commitment on external integration. J Oper Man 29(1-2): 17-32.

- Armstrong JS, Overton TS (1977) Estimating nonresponse bias in mail surveys J Marketing Res 14(3): 396-402.

- Preacher KJ, Hayes AF (2008) Asymptotic and resampling strategies for assessing and comparing indirect effects in multiple mediator models. Behav Res Methods 40(3): 879-891.