Abstract

Research aligns well with current trends in hospitality and tourism, particularly in the context of digital transformation and post-pandemic recovery. The rise of ghost restaurants or ghost kitchens, also known as virtual or cloud kitchens, has significantly transformed the global restaurant industry. Unlike traditional dining establishments, ghost kitchens operate exclusively for food delivery, utilizing online platforms to meet the growing demand for convenient and efficient meal options. This article explores the historical development of ghost kitchens, their business models, and their rapid expansion during the COVID-19 pandemic, which acted as a catalyst for their global popularity.

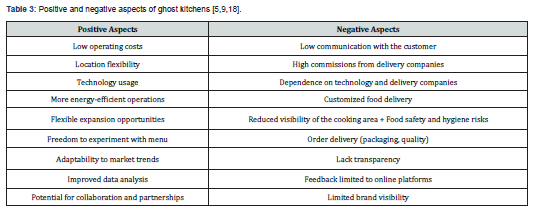

Through document analysis and interviews, the study identifies the positive aspects of ghost kitchens, including cost efficiency, flexibility in location, and adaptability to market trends. However, it also highlights key challenges such as limited customer interaction, dependency on technology, and concerns surrounding food safety and transparency. The article concludes by emphasizing the importance of regulatory frameworks, public awareness, and sustainable practices to enhance the potential of ghost kitchens while addressing their limitations.

Keywords: Ghost kitchens; Cloud kitchens; Hospitality industry; Restaurant innovation; Business models

Introduction

In recent years, the foodservice industry has rapidly developed, and with this development, a new concept of foodservice businesses has emerged – "ghost restaurants or ghost kitchens," also referred to as "cloud kitchens" or "dark kitchens." This concept signifies significant changes in food preparation, distribution, and consumption methods. Unlike traditional restaurants, a ghost kitchen operates solely through online platforms, primarily focusing on the growing demand for food delivery services.

A ghost kitchen is a food service business model that operates exclusively for food delivery, rarely allowing customers to pick up their orders themselves. These types of restaurants do not offer a physical dining area and work through food delivery platforms [1]. This business model has become increasingly popular during the COVID-19 pandemic when operations in various industries, including the foodservice sector, were restricted [2].

This type of foodservice business is widespread and relevant because starting such a business requires lower initial capital, operational costs are significantly lower compared to traditional restaurants, and profits are higher [3]. This is due to the smaller staff size, lower rent costs, as the premises can be located in less populated areas, and savings on decor, design, equipment, and technology. Research objective: to explore the positive and negative aspects of the development of ghost restaurants and their importance in the food and beverage industry. Research tasks: (1) analyze scientific and literature sources; (2) describe the differences between ghost restaurants and traditional restaurants.; (3) develop the methodology; (4) analyze the positive and negative aspects of ghost restaurants; (5) collect information and provide conclusions.

Literature Review

The literature review is thorough, providing a historical perspective on food delivery services and the evolution of ghost restaurants. It highlights the role of COVID-19 as a catalyst for this business model and identifies key differences between ghost restaurants and traditional restaurants. The global and regional trends discussed are well-supported by statistical data from credible sources like Statista, but the inclusion of more localized insights would strengthen the relevance for Latvia [4]. In the past five years, due to the COVID-19-induced pandemic, there has been a surge in investments in ghost restaurants, with venture capitalists investing billions in companies such as DoorDash (USA) and UberEats (USA), which specialize in food delivery services and are among the largest food delivery platforms in the world. This influx of capital has enabled many new businesses to open ghost restaurants, with lower overhead costs compared to traditional restaurants [5].

In 2020, when traditional restaurants had to adapt to the situation and find solutions to serve customers due to the pandemic, delivery companies became more popular because the company was still making a profit even when the company's internal operations were closed, which accelerated the development of ghost restaurants, as food service restrictions forced many restaurants to rely solely on delivery orders [6,7]. Ghost restaurants are a theoretically new concept that has been studied relatively little so far, as it only achieved its rapid growth during the Covid pandemic.

Due to the COVID-19 pandemic and strict restrictions, food delivery emerged as one of the most significant trends in the world in 2020 and 2021 [8]. According to Statista 2023 data, they predict that ghost restaurant models will cover 50% of all food services worldwide by 2030 [9,10]. Referring to data published by Statista in 2024, they show that the online food delivery market was worth more than $1 trillion in 2023, of which $640 billion was generated in the grocery delivery segment and $390 billion in the food delivery segment, and it is also predicted that by 2028, the online food delivery market will generate revenues that will reach $1.8 trillion [11].

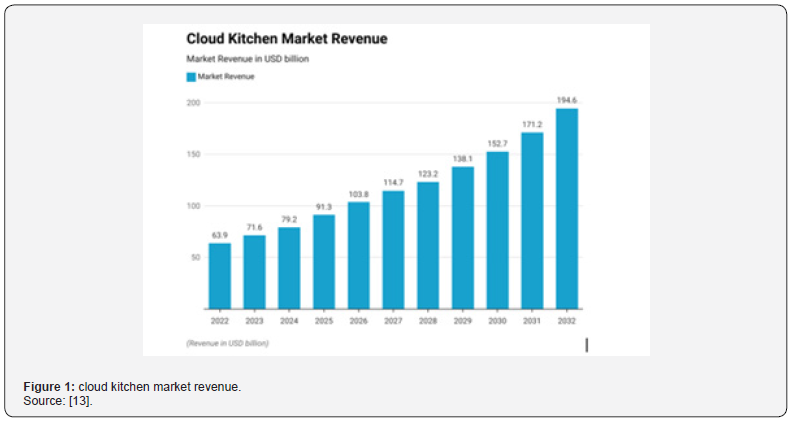

By 2029, the market will exceed 138.1 billion USD, (Figure 1) surpasses 150 billion USD by 2030, and reach an impressive 171.2 billion USD by 2031. The growth trend is expected to accelerate, with the market reaching 194.6 billion USD by 2032, indicating the increasing significance of ghost restaurants in the global foodservice industry [12]. Analyzing the leading food delivery platforms, Zomato emerged as the most widely downloaded online food delivery application globally in 2023, with over 52 million downloads. Uber Eats secured the second position, with over 41 million downloads worldwide. Notably, in 2019, Uber Eats reported that more than 50% of its total orders were sourced from ghost restaurants [13].

Materials and Methods

Research was carried out in 2024. Research place: Riga, Latvia.

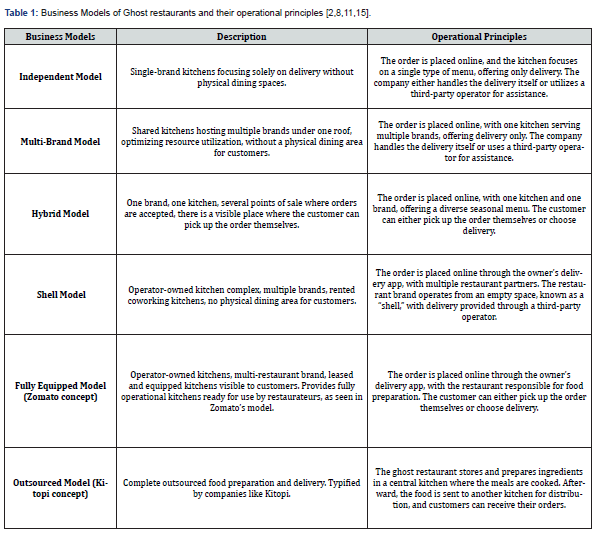

This study employed a combination of document analysis and semi-structured interview to explore the role of ghost restaurants in the restaurant industry, focusing on their business models, development, and operational challenges. The author clearly defines the objectives: to analyze the positive and negative aspects of ghost restaurants and their impact on the food industry Table 1.

The theoretical part of research is based on scientific articles and literature, industry reports, and statistical databases on ghost restaurants and their operational models. These sources provided insights into the business practices, and market trends of ghost restaurants. Notable references included industry analyses, such as those by Statista and reports on the impact of COVID-19 on the hospitality sector. Specific focus was given to global trends and their application to local markets like Latvia.

Semi-structured interview with a representative of the Latvian Food and Veterinary Service were conducted to collect qualitative data. The interview comprised 14 questions focusing on licensing procedures, hygiene standards, and monitoring practices for ghost kitchens. Due to logistical constraints, the interview was conducted via email on April 22, 2024.

Results and Discussion

6.1. Ghost kitchens business models: The study identified six distinct business models employed by ghost restaurants, each offering unique operational advantages with the most recent being the “Kitopi” outsourcing business model [2,8,11,15]. These different models allow ghost kitchens to adapt to customer needs and market demands, providing a wide range of choices for customers and ensuring an efficient business model [14].

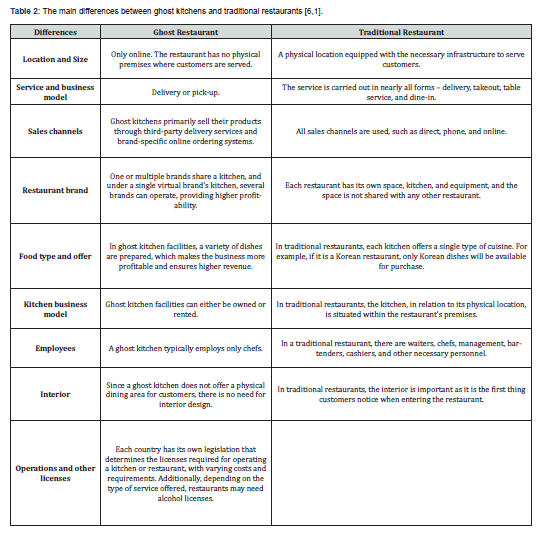

6.2. Comparison between ghost kitchens and traditional restaurants: The main difference between ghost kitchens and traditional restaurants is that ghost kitchens provide food services through delivery, mediated by third-party platforms, and do not offer a physical dining area for customers. Additionally, ghost kitchens are smaller in size as they do not require a fully equipped dining hall. One of the key distinctions is that ghost kitchens typically lack front-of-house staff, meaning financial savings are made on service personnel and additional labor-related costs [15]. A comparative analysis revealed several key differences between ghost kitchens and traditional restaurants Table 2.

Ghost kitchens and traditional restaurants primarily differ in their operational models, execution methods, sales channels, brand structure, food offerings, kitchen business models, staff composition, the significance of interior design, and required licenses. In ghost kitchens, food is primarily offered through delivery or takeout using third-party delivery services, and the space is shared by multiple brands. In contrast, traditional restaurants offer a more diverse range of services and menu options, and the spaces are individually tailored to the specific needs of each restaurant. Despite these differences, ghost kitchens face challenges, such as dependency on third-party delivery platforms, lack of visibility, and lower customer trust compared to traditional establishments.

6.3. Interview analysis: The interview with the Food and Veterinary Service representative provided valuable insights into the regulatory challenges of ghost restaurants in Latvia.

The term "ghost restaurant" is not legally defined, making it challenging to monitor and regulate these establishments. However, there is a need for regulation to ensure responsible development and integration within the industry. There is a lack of data on the number of legally operating ghost kitchens in Latvia. This creates challenges for monitoring and understanding the scope of this sector and its impact on the food service industry. Without such data, it is difficult to assess the influence of these establishments and develop effective policies to address potential risks they may pose to public health and safety. The lack of data in this area highlights the need for further research [16-18].

While ghost restaurants must adhere to the same hygiene standards as traditional restaurants, monitoring is challenging due to the absence of physical storefronts. Businesses that comply with hygiene standards will build trust and a sense of security with customers. If customers are aware that the restaurant is a ghost restaurant and it is registered with the Food and Veterinary Service, this can foster customer loyalty and enhance the business’s reputation, which is essential for building a successful enterprise in the foodservice industry. These results collectively illustrate the dual nature of ghost restaurants as both a disruptive innovation in the restaurant industry and a business model requiring greater transparency and regulatory oversight for long-term success Table 3.

Conclusion

Although several ghost kitchens have been observed in Riga, the lack of statistical data indicates that the concept of ghost kitchens is new within the Latvian foodservice industry. Customers do not have access to information about the operation of foodservice businesses that exist only in the virtual space, which constitutes a form of misinformation. Therefore, it is necessary to first develop proper terminology and collect statistics on the presence of ghost kitchens to establish transparency.

Based on the research objective, the positive aspects of ghost kitchens identified are flexibility to experiment with menus, reduction in operating costs compared to traditional restaurants, location flexibility, more energy-efficient operations, higher growth potential for businesses, faster startup time, flexible expansion opportunities, adaptability to market trends, improved data analysis. The negative aspects of ghost kitchens are low communication with customers, high commission fees from delivery companies, food safety and hygiene risks, dependence on technology, limited brand recognition, delivery issues (food presentation, quality), lack of transparency, feedback limited to online platforms. Limitations of this study is constrained by a lack of robust primary data and limited statistical information on ghost kitchens in Latvia. Expanding the empirical scope through surveys or additional interviews could address these gaps. Moreover, a comparative analysis with international practices would enhance the study’s global relevance.

References

- Beniwal T, Mathur VK (2021) Cloud Kitchen: a profitable venture. International Advanced Research Journal in Science, Engineering and Technology 8(10):50-54.

- Bhatia N (2021) Why does your restaurant need a cloud kitchen business model?

- Crawford L (2024) The history of virtual restaurants and where it is headed.

- Da Cunha DT, Hakim, MP, Alves M, Vicentini MS, Wiśniewska M (2024) Dark kitchens: Origin, definition, and perspectives of an emerging food sector. International Journal of Gastronomy and Food Science 35(1).

- Dephna (2023) Dark Kitchen business model and benefits.

- Dzierlatka J (2024) What is a ghost kitchen? A beginner’s guide.

- Ghazanfar, U, Kaluvilla BB, Zahidi F (2023) The post-COVID emergence of dark kitchens: a qualitative analysis of acceptance and the advantages and challenges. Research in Hospitality Management 13(1): 23-30.

- Hakim MP, Libera VMD, Zanetta LD, Stedefeldt E, Zanin LM, et al. (2023) Exploring dark kitchens in Brazilian urban centres: A study of delivery-only restaurants with food delivery apps. Food Research International 170 (112969).

- Luus Industries Pty Ltd (2023) Dark Kitchens: What are they and why invest in one? Luus.

- Jiang Y, Balaji, Lyu C (2024) Cultivating initial trust in ghost kitchens: A mixed-methods investigation of antecedents and consequences. International Journal of Hospitality Management 119 (103727).

- Linga Pos (2024) Restaurants’ Business Model is Changing: Benefits of Cloud Kitchens in a post-COVID-19 world.

- Meydan Free Zone (2023) Kitopi: UAE’s Fastest-Growing unicorn - Meydan Case Study.

- Pangarkar T (2023) Cloud Kitchen Statistics: Unique Delivery System. Market Scoop.

- Poon WC, Tung SHE (2022) The rise of online food delivery culture during the COVID-19 pandemic: an analysis of intention and its associated risk. European Journal of Management and Business Economics 33(1): 54-73.

- Singh A (2020) Laying your table from the cloud: Cloud kitchens are here and reviving restaurant industry | SME Futures. SME Futures.

- Statista (2024) Market size of the global online food delivery sector 2017-2028, by segment.

- Statista (2024) Most downloaded food delivery apps worldwide 2023.

- Southwest Merchant Service (2023) Ghost Kitchen concept: Pros and Cons of having one. Southwest Merchant Services.