Abstract

The policy of delivering government research and development (R&D) subsidies and their impact on innovation is still relevant and can be viewed from multiple angles. This article focuses on the impact of government R&D subsidies on the investment and achievements of innovation, as well as venture capital (VC). The research is focused on the China’s manufacturing industry over 2012 to 2016. A total of 2065 listed firms were selected for research purposes, which results in 10325 observations. Statistical tests, correlation, generalized method of moments (GMM) and panel negative binominal model were used for their verification. The research shows that there is dependence between government R&D subsidies and the investment and achievements of innovation. And government R&D subsidies can transfer good signal to venture capital was also proved. The research presented also provides evidence that government R&D subsidies contribute more to private firms.

Keywords:Government R&D subsidies; Innovation; Manufacturing industry; Venture capital; China

Abbreviations:GMM: Generalized Method of Moments; GDP: Gross Domestic Product; SIPO: State Intellectual Property Office; SOE: State Owned Enterprises

Introduction

When we look at the past, the original principle of delivering government R&D subsidies was because of market failure. The adverse effects of market failure include decreasing firms’ R&D expenses as well as patent applications [1]. In line with the above facts, delivering government R&D subsidies has become a global and national priority, not only to reduce firms’ R&D costs, but also to guide their R&D and improve the innovation performance [2]. Additionally, as another financing channel, venture capital can also increase patent allocations, productivity and accelerate the commercialization of technology [3,4]. The interaction between government R&D subsidies and venture capital is an important research topic according to a confirmed multiplied effect of firms’ innovation.

The world is expecting China to become the largest economic community, with achieving economic increasing path transition and industry graduation [5] which key point is innovation. However, because of high risk and uncertain return, the innovation faces inadequate investment [6]. So, China has recognized the importance of government R&D subsidies, with increasing R&D subsidies from 1.63 billion RMB in 1999 to 8.76 billion RMB in 2008 [7]. In developed countries (such as Germany and Italy), firms with subsidies do increase innovation [4,8,9].

Getting government R&D subsidies can transfer a positive signal about firms’ running to venture capital investors, increasing the chance of getting external funds [10]. In 1980s, Kortum and Lerner started to research the interaction venture capital and innovation. Then, some research proved the fact from different aspects, such as patent application and research employees [3,11-13]. Available international evidence indicates the venture capital has positive and significant impact on innovation [11,14].

Despite the evident presence of patent application research regarding the positive effects of government R&D subsidies, there is a lack of R&D expenses research dealing with the subsidies. And research concentrates on developed countries with stable economic and institutional environment. Seldom research focuses on developing countries, presenting dynamic and transition market. Lack of these studies is notably evident in emergency markets. Recognizing the high importance of this issue, this paper set as the estimation of the effects of government R&D subsidies on innovation investment and achievements as well as venture capital in China. And innovation research is also helpful for sustainability development.

From a methodological point of view, the contribution of this paper is to verify the impact of government R&D subsidies on two angles. First, government R&D subsidies increase both investment and achievements of innovation. Second, government R&D subsidies transfer signal to venture capital investors. Using listed companies’ date for the period of 2012-2016, the estimations confirm that government R&D subsidies can both increase firms’ R&D expenses and their patent applications nevertheless the ownership. And the subsidies can transfer signal to external funds, with firms getting venture capital funds. According to the official website of the National Bureau of Statistics of China, the manufacturing industry contributes roughly 30% to the national gross domestic product (GDP). China Manufacturing 2025 also points out the importance of translating Chinese economic motivation from manufacturing intensity to independent innovation. So, this paper takes manufacturing industry as the research sample, not only can promote its transition but also can promote national industrial graduation and sustainable development.

Materials and Methods

Sample and hypotheses

For the purposes of the research, data from 2065 listed companies in China’s manufacturing industry were collected, which results in 10325 observations. Among the 2065 firms, 1582 are private firms while 479 are state-owned firms. Four authoritative databases, Wind Information, CVSource, CSMAR and the State Intellectual Property Office (SIPO), provide the data. Specifically, Wind Information provides financial and accounting data of sample firms. These data include government R&D subsidies and leverage, etc. The information of venture capital is from CVSource. CSMAR and SIPO provide related patent data. Additionally, due to ensure the data in accordance of the time, data used in this paper all gathered from annual reports from 2012 to 2016. Finally, all the data makes up one panel data according to the firms’ codes and dates.

In order to evaluate the research, hypotheses were set which,

we think, best characterized the impact of government R&D

subsidies on innovation as well as on venture capital. Within

these hypotheses, we used the ownership as a comparison for the

impact of government R&D subsidies. There has present evidence

that corporate ownership can impact innovation [15], due to more

liberal laws and favorable economic policies [16]. The following

hypotheses were formulated:

Hypothesis 1a (H1a): Government R&D subsidies can

improve innovation (both in investment and achievements).

Hypothesis 1b (H1b): Government R&D subsidies contribute

more to innovation in private firms.

Hypothesis 2a (H2a): Government R&D subsidies transfer

positive signal to venture capital investors.

Hypothesis 2b (H2b): Government R&D subsidies transfer

more positive information to venture capital investors in private

firms.

Variables

Dependent variables

Considering the existing literatures, most research uses two variables to measure innovation: R&D expenses and patent. These proxies represent the investment and achievements of innovation respectively. R&D expenses measure firms’ innovation investment directly [17] and the impact of government R&D subsidies from the amount angle. Because R&D expenses cannot represent the quality of innovation, much empirical analysis uses data related to patent. Based on the study of Pender [18], this paper applied patent application as an indicator of innovation.

However, there are still some limitations of using patent applications. First, only some firms use inventions to apply patents and are willing to exposure patent information [19]. Second, due to firms’ characteristics, patent applications cannot represent achievements of innovation completely [20]. Although using patent applications has some weakness, it is still an appropriate measurement for achievements of innovation [21]. Another dependent variable is the venture capital rounds. According to the studies since 1980s, many scholars proposed that venture capital can promote innovation and firms’ competitiveness to a certain extent [11-13]. So, this paper selects venture capital rounds to measure the innovation as a complementary role for the R&D expenses and patent applications.

Explanatory variables

Government R&D subsidies is the explanatory variables in this paper. The government support firms’ innovation by announcing polices and providing subsidies [11]. Many scholars have proved government subsidies can improve firms’ innovation [17,22,23]. Further, the government subsidy is a proxy of the government investment to measure the utilization efficiency of funds. This paper uses government R&D subsidies as explanatory variable to do more related innovation research.

Control variables

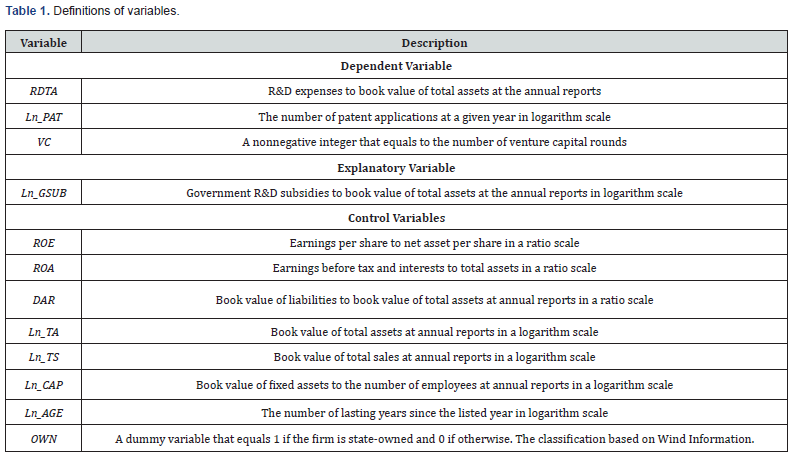

Considering previous studies, we also use some control variables to control the firms’ characteristics that can influence the effect of government R&D subsidies. We mark all variables for firm i and at time t. The control variables include firm age, leverage ratio, rate of return on equity, rate of return on assets, fixed assets intensity, sales growth, total assets and total sales. Table 1 delivers the descriptions.

First, firm age. Many scholars consider this variable in their research. Some scholars hold the view that mature firms have more capacity to support innovation [24]. Further, some scholars argue that government tends to choose start-up companies as subsidies receivers [9]. Thus, firm age is an essential factor in this research. Second, leverage ratio. Internal financial situations have effect on the innovation. Empirical study by Meuleman and Mesenteries [10] demonstrated that the leverage ratio negatively affects the innovation capacity of firms. Additionally, leverage is an important financial indicator which may influence the achievements of innovation [25]. Thus, we select leverage ratio as a control variable. Third, total sales and total assets these proxies represent the profitability and size of firm, are also important variables which can influence the potential innovation [25].

Finally, rate of return on equity (ROE) and rate of return on assets (ROA) are two important variables proxies for the profitability. Based on the research of Chemmanur and Tian [13], firms with high fixed assets rely more on innovation, indicating higher demand for subsidies. Moreover, subsidies are another vital determinant for the measurement of innovation. In the empirical analysis, Table 1 shows the definitions of variables.

Methodology

We apply generalized method of moments (GMM) model and Panel Negative Binominal model in the empirical test. Arellano and Bond in 1995 as well as Blundell and Bond in 1998 invented GMM model. It is a widely used method among the world. Dynamic panel data causes endogeneity and heterogeneity issues which add deviation in the results to some extent. GMM model involves the lag of dependent variable in the model to address those issues. Although GMM model may cause some distort issues, it has an obvious advantage compared with traditional methods, such as ordinary least square (OLS) regression and generalized least square (GLS) regression. GMM model includes additional instrument variable. Thus, GMM model becomes a main method to process dynamic panel data. This paper applies two-step GMM model to do the empirical research based on the study of Windmeijer [26]. Additionally, GMM model is not suitable for the research of the impact of government R&D subsidies on venture capital. Because the dependent research, venture capital rounds, is a nonnegative integer, we use Panel Negative Binominal model. The control variables are followed Guo and Jiang [27].

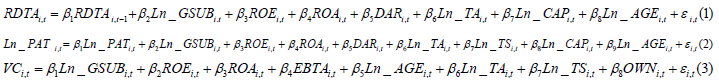

In this study, we establish three equations for the dynamic panel data to find evidence to support the hypotheses mentioned in the second part. Government R&D subsidies positively influence R&D expenses, especially in private firms: (1). Government R&D subsidies contribute more to patent applications in private firms: (2). Government R&D subsidies can transfer positive information to venture capital investors, particularly in private sector: (3).

Where i,t RDTA is the dependent variable, the government R&D subsidies divided by total assets of the firm in percentage scale. β is the correlation estimations of parameters. VCi,t a nonnegative integer, which represents the rounds of VC investment a firm got. Ln_GSUBi,t and Ln_CAPi,t refer to government subsidies and capital intensity for firm i at period t in logarithm scale separately. Ln_TAi,t and Ln_CAPi,t refer total assets and total sales in the end of fiscal year in logarithm scale, which measure the size and profitability of firms. ROEi,t, ROAi,t and DARi,tt denote rate of return on equity, rate of return on assets and leverage ratio for firm i at period t in percentage scale. OWNi,t is a dummy variable for ownership structure, which equals one if the firm is state-owned and zero if otherwise. Finally, c is the constant and εi,t refers to the random error term. Table 1 shows the definitions of variables.

Results

Descriptive statistics

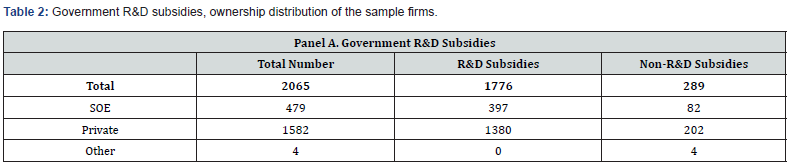

To have consistency with the situation of firms received government R&D subsidies and venture capital, Table 2 shows the distribution of the sample data. In Panel A, the data are classified by whether the firms are state-owned firms and have received government R&D subsidies. To be more specific, out of 2065 firms in this sample, firms are divided into two categories: state-owned enterprises (SOE), private enterprises according to the classification by Wind Information. Among all the firms, the firms with government R&D subsidies possess about 86% (1776 out of 2065 firms) of full sample. As for state-owned enterprises, this number reaches at 83% (397 out of 479 firms) approximately. Among all the private firms, the firms received government R&D subsidies account for about 87% (1380 out of 1586 firms). The difference between the percentage number of state-owned enterprises and private enterprises reveals that government plays an essential role in promoting the development of private enterprises.

Panel B reports that the number of non VC backed firms is higher than the venture capital backed firms of all the three samples (full sample, SOE sample, private enterprises sample). Firms with venture capital backed account for around 21% (432 out of 2065 firms) among full sample. The percentage of venture capital backed firms in SOE sample is 15% (74 of 479 firms) approximately while this number in private enterprises sample is 23% (358 out of 1582 firms). This difference shows the venture capital investors are more likely invest on private enterprises.

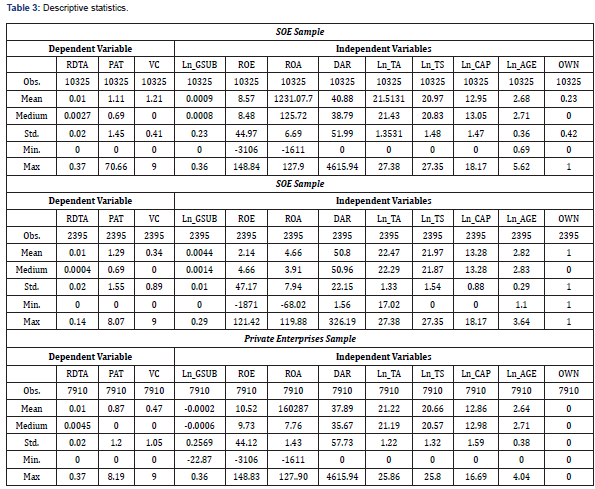

he descriptive statistics of variables that will be used in the empirical analysis is reported in Table 3. In this table, the statistics of full sample, SOE sample and private sample are presented. As for the full sample, the average of the dependent variable, R&D expenses, number of patent application and rounds of venture capital investment, are around 0.0131, 1.1075 and 0.2087, respectively. The averages for those in SOE sample are 0.01, 1.29 and 0.34 while in private sample are 0.01, 0.87 and 0.47. These numbers indicate a significant different innovation performance in different ownership structure. Additionally, as for independent variables, state-owned firms have more government R&D expenses but fewer venture capital rounds than private firms, indicating there may be a policy incline to state-owned firms and more profitability of private firms.

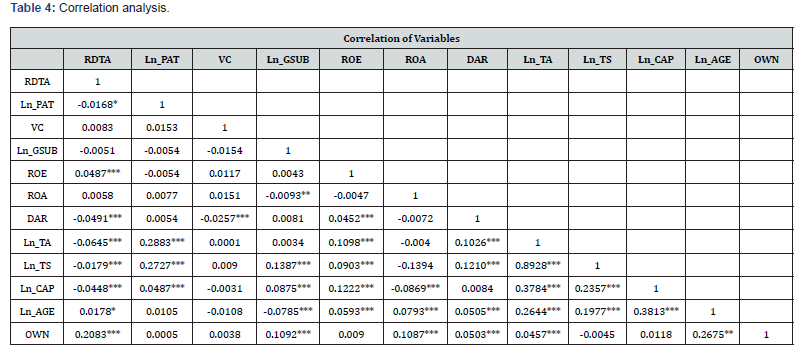

Correlation analysis

Table 4 shows the result of the correlation test for all variables that will be applied in the GMM model and Panel Negative Binominal model. 0.5 plays a role of benchmark to judge whether there is a high correlation between two variables. If the correlation between two variables is below 0.5, there is no multicollinearity in the model. It may affect the regression results if otherwise. From this table, it can be revealed that all variables are under 0.5 except for Ln_TS and Ln_TA. The possible reason why there is a high correlation between Ln_TS and Ln_TA is that the total sales represents the whole revenue of the enterprises at the end of the fiscal year and it is a part of the total assets in the annual reports. In the meanwhile, the fixed assets which are a part of total assets can increase with the growth of the total sales though purchasing property, plants and equipments. However, these two variables are not included in one function to avoid the multicollinearity issue.

Government R&D subsidies and innovation

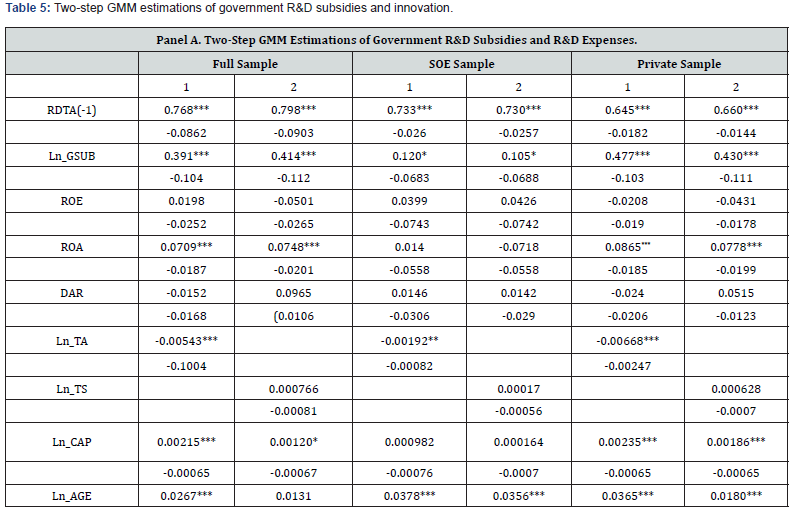

Table 5 shows the two-step GMM regression results for the impact of government R&D subsidies on innovation in China’s manufacturing industry. We express the results with different innovative measurements. R&D expenses represent the investment of innovation while patent applications represent the achievements of innovation.

In Panel A, the dependent variable is the R&D expenses divided by book value of total assets in the given year. The correlation coefficients of government R&D subsidies are all positive and statistically significant, indicating government R&D subsidies can improve the investment of innovation. Meanwhile, the correlation coefficients of the explanatory variable are quite different through the three parts in Panel A. This means the contribution of government R&D subsidies is not equal in firms with different ownership, and the promoting effect is more obvious in private firms than in state-owned firms.

In Panel B, the dependent variable is patent applications in the given year. The correlation coefficients of government R&D subsidies are all positive and almost statistically significant at 5% in three parts. This means government R&D subsidies have positive impact on firms’ patent applications. Comparing the results in the second and third parts, private firms’ estimator of government R&D subsidies is larger than state-owned firms’, revealing government R&D subsidies contribute more in private enterprises on the achievements of innovation angle. The empirical result is consistent with the previous studies [4]. To sum up, full sample in Panel A and Panel B supports H1a that government R&D subsidies promote innovation. Comparing sample of state-owned firms and private firms in Panel A and Panel B respectively, the results support H1b.

In addition, in Table 5, this research includes several financial and firm characteristics that may influence enterprises’ innovation. In Panel A, first part shows that enterprises with more rate of return on assets (ROA), more fixed assets per employee (CAP) can pay more on R&D expenses in the two regressions under the full sample. Besides the above findings, in the model excludes the total sales in logarithm scale (Ln_TS) firms with longer age (Ln_AGE) and more total assets (Ln_TA) reflect more obviously in R&D expenses when receiving government R&D subsidies. And the conclusions are similar in the second part and the third part. In Panel B, the control variables are related to firms’ patent applications. Firms with high rate of return on assets (ROA), more fixed assets per employee (Ln_CAP), longer lasting period (Ln_AGE), more total assets (Ln_TA) and more total sales (Ln_TS) can achieve more patent applications when accepting government R&D subsidies.

Government R&D subsidies and venture capital

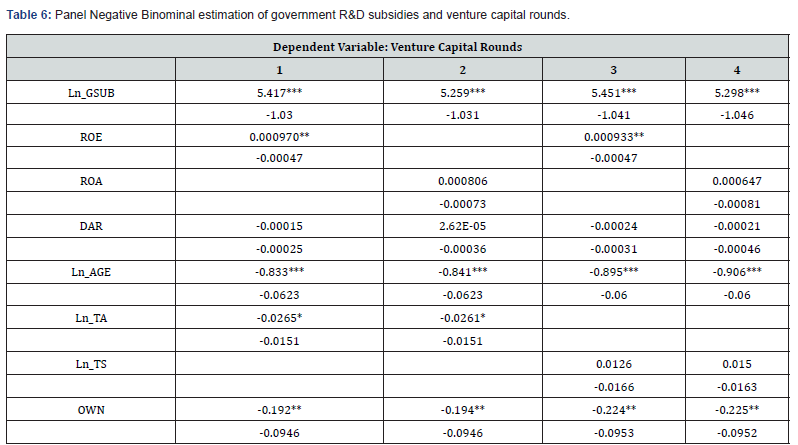

Because the dependent variable is nonnegative integer, equation (3) uses the Panel Negative Binominal model in this part. Table 6 illustrates the Panel Negative Binominal estimations of the effect of government R&D subsidies and venture capital rounds.

The correlation coefficient of the main explanatory variable, government R&D subsidies, is positive and statistic significant at 0.01 level, implying the government R&D subsidies can transfer positive information to venture capital investors. This result is consistent with the early research conclusion of Lerner [28] and support the H2a.

Notes: this table shows the Panel Negative Binominal estimations of the impact of government R&D subsidies on venture capital rounds in China’s manufacturing industry. The sample period is from 2012 to 2016. See Table 1 for detailed variable definitions. Standard errors are reported in the parentheses, and ***, **, and * denote statistical significance at the 1%, 5%, and 10% level, respectively.

In order to support the second hypothesis in this paper, the regression includes a dummy variable to measure the firms’ ownership. The correlation estimators of the ownership are all negative and statistically significant at 5% level. This shows the private firms can get more rounds of venture capital when getting government R&D subsidies. In other words, it means the effect of transferring signal is more obvious in private firms. The conclusion supports H2b.

Additionally, in order to control the effect of firms’ characteristics and financial statistics on venture capital, regressions in this part add some control variables like before. Most estimators are negative and consistent with the study by Guo and Jiang [27]. Other estimator indicate younger firms and less total assets have high chance to get more rounds of venture capital when getting government R&D subsidies. In the third regression, the correlation coefficient of the rate of return of equity (ROE) is positive which means firms with high profit can get more venture capital investment. The opposite results between rate of return on asset (ROA) and rate of return on equity (ROE) may mainly because the rate of return of equity is more relative to the venture capital investor (venture capital investors are shareholders of the firms and share the return on equity) [28].

Discussion

This paper examines two hypotheses through empirical test. This part gathers main findings. First, the government plays an essential role in China’s manufacturing industry, especially in the economic transition stage. This means government R&D subsidies significantly improve firms’ R&D expenses. Most previous studies have found the fact based on evidence from developed countries with stable economic and institutional environment [23,29]. To do further research, this paper also examines the impact of government R&D subsidies on R&D expenses in different ownerships. Form the empirical analysis, the conclusion that government R&D subsidies increase more R&D expenses in private firms can be made. This is consistent with the study of Gorg and Strobl [17]. The probable reason is that private firms undertake profits and losses by themselves; they are more conservative in choosing running strategies than state-owned firms when facing the high risk of innovation [6]. So, getting government R&D subsidies means private firms can share risk with the government and get more funds for innovation, they definitely increase R&D expenses. National policies protect stateowned firms, their profits and losses backed on the state. So, they have active running strategies and adequate funds for innovation. Thus, considering this part focuses on the difference.

Second, besides the promotion on R&D expenses, this paper also proves the effect of government R&D subsidies on firms’ patent applications. And this paper also researches this influence in China’s manufacturing industry for further study with different ownerships. This paper finds that government R&D subsidies have more positive effect on patent applications in private firms [1,15]. The main reason is the different running purpose between private firms and state-owned firms. Private firms pay more attention on the profits and losses while state-owned firms focus on the social influence and stability of the whole market. Therefore, private firms can invest subsidies in projects that are beneficial to themselves which results in high effectiveness of using funds.

Third, considering the view of previous papers that government subsidies have positive effect on venture capital [30,31], we also focus on this transfer effect between government R&D subsidies and venture capital.

For further research, different ownerships are included. According to the research of Guo & Jiang [27], state-owned firms have low chance to get venture capital investment. The results of the empirical analysis provide evidence that government R&D subsidies can transfer positive signal to venture capital investors. And this effect is more significant in private firms. This may because the running purpose of venture capital investors. They are eager to maximum the profit. So, comparing state-owned firms, private firms pay more attention to the profits of investing R&D expenses which means high effectiveness of using venture capital funds.

Conclusion

This research presents three main findings. First, the empirical test shows that government R&D subsidies have positive effect on the investment and achievements of innovation in China’s manufacturing industry. Furthermore, considering different ownerships, it finds that private firms tend to invest more R&D expenses rather than state-owned firms when getting government R&D subsidies. Second, consistent with findings in the existing literatures, this paper reports that government R&D subsidies have positive impact on the achievements of innovation in China’s manufacturing industry. On the other hand, government R&D subsidies also promote the competitiveness of firms and economic growth of the China’s manufacturing industry, even the whole economic growth in China. Last, this paper examines the impact of government R&D subsidies on venture capital and provides evidence that government R&D subsidies can transfer positive signal to venture capital investors. We also divide firms into two groups by ownership: state-owned firms and private firms for further research. This effect is more significant in private firms. We find all firms can benefit from getting government R&D subsidies. To be more specific, getting government R&D subsidies can make firms invent more patents with lower cost. These findings have important implications for Chinese government future strategies to promote innovation. These also provide research ideas on how to allocate government subsidies more effectively and how to promote the national economic growth as well.

This paper also shows that government plays an essential role in innovation, especially in the economic transition stage. The results concluded from empirical tests have proved government R&D subsidies definitely increase the investment and achievements of innovation and private firms benefit more. It is also necessary for government to balance the status of private firms and state-owned firms for the purpose of potential innovation and national economic growth. While maintaining the running and development of state-owned firms, the nation should also formulate policies and regulations to promote the development of private firms. Meanwhile, government R&D subsidies also encourage venture capital investors to invest more in firms which can further promote innovation. Moreover, it is worthy to continuously focus and invest on China’s manufacturing industry, especially in the stage of innovation promoting development. However, because of the different influence on venture capital investment between private firms and stateowned firms, we need to further discuss the balance of subsidies and other external investment.

Limitations of this study are mainly related to the data availability. First, because of the incomplete data of existing databases, some variables, such as patent citation, the number of researchers and revenue of sales on new products, which are more related to the research, cannot be applied in the study. Further studies can focus on the above variables that can provide more comprehensive and more specific measurements for innovation. Second, the unwillingness of firms to disclose the information related to venture capital investment and patent applications cause incomplete of the CVSource and State Intellectual Property Office (SIPO).

References

- Hall BH (2002) The Financing of Research and Development. Oxford Review of Economic Policy 18: 35-51.

- Kang KN, Park H (2012) Influence of Government R&D Support and Inter-firm Collaborations on Innovation in Korean Biotechnology SMEs. Technovation 32(1): 68-78.

- Link AN, Ruhm CJ, Siegel DS (2013) Private Equity and the Innovation Strategies of Entrepreneurial Firms: Empirical Evidence from the Small Business Innovation Research Program. Managerial and Decision Economics 35: 103-113.

- Bronzini R, Piselli P (2016) The Impact of R&D Subsidies on Firm Innovation. Research Policy 45(2): 442-457.

- Brandt L, Van Biesebroeck J, Zhang Y (2012) Creative Accounting or Creative Destruction? Firm-level Productivity Growth in Chinese Manufacturing. J Dev Econ 97(2): 339-351.

- Hottenrot H, Lopes-Bento C (2014) (International) R&D Collaboration and SMEs: The Effectiveness of Targeted Public R&D Support Schemes. Research Policy 43(6): 1055-1066.

- Hong J, Hong S, Wang LB, Xu Y, Zhao DT (2015) Government Grants, Private R&D Funding and Innovation Efficiency in Transition Economy. Technology Analysis & Strategic Management 27: 1068-1096.

- Almus M, Czarnitzki D (2003) The Effects of Public R&D Subsidies on Firms’ Innovation Activities. Journal of Business & Economic Statistics 21: 226-236.

- Czarnitzki D, Lopes-Bento C (2014) Innovation Subsidies: Does the Funding Source Matter for Innovation Intensity and Performance? Empirical Evidence from Germany. Industry and Innovation 21: 380-409.

- Meuleman M, Maeseneire WD (2012) Do R&D Subsidies Affect SMEs’ Access to External Financing? Research Policy 41: 580-591.

- Kortum S, Lerner J (2000) Assessing the Contribution of Venture Capital to Innovation. The RAND Journal of Economics 31(4): 674-692.

- Hirukawa M, Ueda M (2011) Venture Capital and Innovation: Which Is First? Pacific Economic Review 16: 421-465.

- Chemmanur TJ, Tian X (2012) 'Preparing' the Equity Market for Adverse Corporate Events: A Theoretical Analysis of Firms Cutting Dividends. Journal of Financial and Quantitative Analysis 47(5): 933-972.

- Bertoni F, Croce A, D'Adda D (2010) Venture Capital Investments and Patenting Activity of High-tech Start-ups: A Micro-econometric Firm-level Analysis. Venture Capital 12(4): 307-326.

- Lee E, Walker M, Zeng C (2014) Do Chinese Government Subsidies Affect Firm Value? Accounting, Organizations and Society 39: 149-169.

- Wang J (2013) The Economic Impact of Special Economic Zones: Evidence from Chinese Municipalities. Journal of Development Economics 101: 133-147.

- Gorg H, Strobl E (2007) The Effect of R&D Subsidies on Private R&D. Economica 74: 215-234.

- Peneder M (2010) The Impact of Venture Capital on Innovation Behavior and Firm Growth. Venture Capital 12(2): 83-107.

- Hall L, Bagchi-Sen S (2002) A Study of R&D, Innovation, and Business Performance in the Canadian Biotechnology Industry. Technovation 22(4): 231-244.

- Chemmanur TJ, Loutskina E, Tian X (2014) Corporate Venture Capital Value Creation and Innovation. The Society for Financial Studies 27(8): 2434-2473.

- Hall BH, Jaffe A, Trajtenberg M (2005) Market Value and Patent Citations. The RAND Journal of Economics 36(1): 16-38.

- Lach S (2002) Do R&D Subsidies Stimulate or Displace Private R&D? Evidence from Israel. The Journal of Industrial Economics 50(4): 369-390.

- Gonzfilez X, Jaumandrea J, Paz C (2005) Barriers to Innovation and Subsidies Effectiveness. The RAND Journal of Economics 36(4): 930-950.

- Sørensen JB, Stuart TE (2000) Aging, Obsolescence, and organizational Innovation. Administrative Science Quarterly 45(1): 81.

- Czarnitzki D, Ebersberger B, Fier A (2007) The Relationship between R&D Collaboration, Subsidies and R&D Performance: Empirical Evidence from Finland and Germany. Journal of Applied Econometrics 22(7): 1347-1366.

- Windmeijer F (2005) A Finite Sample Correction for the Variance of Linear Efficient Two-step GMM Estimators. Journal of Econometrics 126(1): 25-51.

- Guo D, Guo Y, Jiang K (2016) Government-Subsidized R&D and Firm Innovation: Evidence from China. Research Policy 45(6): 1129-1144.

- Lerner J (1999) The Government as Venture Capitalist: The Long-run Impact of the SBIR Program. The Journal of Business 72(3): 285-318.

- Duguet E (2004) Are R&D Subsidies a Substitute or a Complement to Privately Funded R&D? Review Economic Policy 114: 245-274.

- Colombo MG, Groce A, Guerini M (2013) The Effect of Public Subsidies on Firm’s Investment-cash Flow Sensitivity: Transient or Persistent. Research Policy 42(9): 1605-1623.

- Kleer R (2010) Government R&D Subsidies as a Signal for Private Investors. Research Policy 39(10): 1361-1374.