Comparative Analysis of Some Selected Domestic Commodities Using Four Methods of Price Index (A Case Study of Taraba State for Period Of 2008-2016)

Okorie Charity Ebelechukwu*, Gladys Andrew and Ben Johnson

Department of Mathematics and Statistics, Federal University Wukari, Nigeria

Submission: May 26, 2018; Published: April 24, 2019

*Corresponding author: Okorie Charity Ebelechukwu, Department of Mathematics and Statistics, Federal University Wukari, Taraba State, Nigeria

How to cite this article: Okorie C E, Gladys A, B Johnson. Comparative Analysis of Some Selected Domestic Commodities Using Four Methods of Price Index (A Case Study of Taraba State for Period Of 2008-2016). Biostat Biometrics Open Acc J. 2019; 9(4): 555766. DOI: 1 10.19080/BBOAJ.2019.09.555766

Abstract

This research work focuses on the use of price indices to compare prices of some selected domestics commodities in Taraba state. Secondary data were collected, from the Statistical year book, Taraba State. The data were analyzed using Lapierre’s, Paasches, Wabash’s and Kelly’s price indices. In the analysis we observed that there was an increase of about 5.7% in prices of commodities in 2010 also an increase in prices of about 86.31% in 2016 and a little decreases in prices of commodities in 2009, 2011 to 2015.

Keywords: Index; Price; Comparative; Commodities; Domestic

Abbrevations: CPI: Consumer Price Index; COLI: Cost-Of-Living Index; NSA: New Stochastic Approach; PI: Price Index; HO: Null Hypotheses

Introduction

Whenever a comparative study has to be made the use of index number are very essential, the need for index number has made great impact in almost every phase of our economic activities. Bowley (1899), appears to have been the first to suggest the use of this index. The index number is a ratio or an average of ratios expressed as a percentage. In an index number two or more time period are involved. One of which is the base time period. The value at the base time period serve as the standard point of comparison. In order words, index number is nothing more than a relative number which express the relationship between two figures where one of the figure is used as a base. According to the Spiegel [1]: “An index number is a statistical measure, designed to measure changes in a variable, or a group of related variables with respect to time, geographical location or other characteristics such as income, profession, etc.” According to Patternson: “ In its simplest form, an index number is the ratio of two index numbers expressed as a percent. According to Tuttle: “Index number is a single ratio (or a percentage) which measures the combined change of several variables between two different times, places or situations”. We can thus say that index numbers are economic barometers to judge the inflation (increase in prices) or deflationary (decrease in prices) tendencies of the economy. They help the government in adjusting its policies in case of inflationary situations. A price index is a measure or function that summarizes the change in the prices of many products from one situation 0 (a time period or place) to another situation 1.

The need for index number has made itself feet in almost every phase of our economic activities. The consumer price index (CPI) is designed to measure changes in the level of retail prices paid by consumers. In our economic life it has shown changes in prices of commodities produced and most important changes in cost of living. Here index are devices, which have become vital factors in deciding and analyzing our modern economic activities. The consumer price index consequently may be used as a measure of inflation. A component of the consumer price index that is the commodity group indicate the degree of price changes in the various segment of the consumer price index. One should keep in mind that an index number is considered good or bad according to how well it measures.

Statement of the problem

The prices of the essential commodities have been changing from time to time and from year to year, thereby posing problems to consumers as well as the government. This is because consumers do not eat the way they used to eat as a result of the increase in prices which affect demand of the commodities and government also do not obtain enough income from the sales of these commodities.

Scope and limitation of the study

This research work is solemnly concerned with the study and comparison of some selected food commodities in Taraba State.

Aim and objectives of the study

The main aim of this work is to determine the state of the commodities in Taraba State with respect to prices.

Objectives

• To measure and compare the wholesale price index of some selected (domestic) commodities in Taraba state.

• To determine whether the price of the commodities are increasing or decreasing.

• To compare and determine the models that is/are good for price index.

Sources of data collection

Secondary data were collected from the statistical Year Book, from the department of Statistics Taraba State Planning Commission, Taraba State and from the sales invoice of some traders taken at random from some market in Taraba State.

Hypotheses testing

HO = there is no significant difference in the price of the selected domestic commodities.

HI = there is significant difference in the price of the selected domestic commodities.

Decision rule

Do not accept the null hypotheses if the price of the commodities is not the same in each year, that is there is significant difference in the price of the selected domestic commodities in each year otherwise accept HO

Review of related literature

An index number is an economic data figure reflecting price or quantity compared with a standard or base value. The base usually equals 100 and the index number is usually expressed as 100 times the ratio to the base value. In economics, index numbers generally are time series summarising movements in a group of related variables. In some cases, however, index numbers may compare geographic areas at a point in time. An example is a country’s purchasing power parity. The best-known index number is the consumer price index, which measures changes in retail prices paid by consumers. In addition, a cost-of-living index (COLI) is a price index number that measures relative cost of living over time. In contrast to a COLI based on the true but unknown utility function, a superlative index number is an index number that can be calculated. Thus, superlative index numbers are used to provide a fairly close approximation to the underlying cost-of-living index number in a wide range of circumstances. ‘Index numbers are devices for measuring differences in the magnitude of a group of a related variable [2];

Index numbers are statistical devices designed to measure the relative change in the level of variable or group of variables with respect to time, geographical location etc. In other words these are the numbers which express the value of a variable at any given period called “current period “as a percentage of the value of that variable at some standard period called “base period ”. Index numbers were design to study the change in the price level or the purchasing power of money but today there is hardly any field which index numbers are not used. In present day situation such as changes in production, consumption, exports, imports, national income, cost of living, incidence of crimes, number of road accident, inter-firm comparison and a very wide variety of other fields are being studies with the help of index numbers. Rowwan [3] in his book “Output, inflation and growth”, an introduction to macro- economic” stated that prices index number simply expressed the price of any given year as ratio of the prices in some chosen base year in which the price index is taken to be 100 (or unity). Aimed with this estimate we can then deflate the value estimate of any year by dividing them by the index number of prices in that year and multiply by 100.

An Economist Afolabi [4] examines in his book “monetary economics” stated that the price index enables us to know the rise or fall in the general level of prices. If we are concerned with only the goods and services that the household s buys, the price index becomes “cost of living index” which shows the rate of price increases as it affects people’s welfare. If, for example, the index shows an increase of 50% without any increase in money income, people’s welfare would have deteriorated almost half. By using index numbers we can for example compare food or other cost in a city during one-year with those of previous years, or we can compare steel part. Although mainly used in business and economics, index number can be applied in many other fields. In education for example we can use index umbers to compare intelligence of students in different locations for different years. Many governmental and private agencies are engaged in computation of index numbers or indexes, as they are often called, for purpose of forecasting business and economic conditions, providing general information etc.

Thus, we have wage indexes, production indexes, unemployment indexes and many others. Perhaps the well known-known is the “cost of living index or consumer price index” prepared by National Bureau of statistics. In many labour contracts there appears certain escalator clauses which provide automatic increases in wages corresponding to increases in the cost of living index. Peter von der Lippe [5] used new stochastic approach (NSA) to study price index so as to promote a better understanding of price index (PI) formulas by viewing them as regression coefficients. Lind et al. [6]. An index expresses the relative changes in value from one period to another or index number measure the change in particular items (typically a product or service) between two time period and a number that expresses the relative change in price, quantity or value compared to a base period Levine et al [7]; Index number measures the value of an item (or group of items ) at another point in time.

Research Methodology

Research methodology in this project shows the close and careful scientific study in calculating the price index of the prices of some selected (domestic) commodities [8].

Models

The possibility of using an index number as an aggregate measure of price changes in several commodities seems to have been recognized in the eighteenth century, but deliberate theoretical discussions did not begin until the middle of the nineteenth century. For the purpose of this project, the following models should be applied and the results from them compared in order to determine the situation of the prices of the selected commodities. They include;

Lapser’s formula: A lapser’s price index is a special case of weighted aggregate indexes which always used a base year period. Base year quantities are used as weights.

Lapser’s Formula

Where o q = quantity used or weight in base year. This formula was devised by french economist laspeyre’s in 1871.

Where,

Li(WPI)= lapser’s weight price index where the base time period, quantity are reasonable or normal weight apply to all time period the lapser’s is aid to be appropriate. Paasches formula: a paasches price index is also a special case of weighted aggregate indexes which always used current or given year period.

Where, pi (WPI )= paasches weighted price index where the base time period quantity are reasonable or normal weight to apply to all time period the paasches is said to be appropriate. Change in price between time periods for a collective of heterogeneous items that represent a complete set associated with a recognizable corporate entity or population.

Where, n q = quantity used or weight in the current year. This formula was devised by german statistician paasches in 1874.

Waasch’s: A waasch’s suggested the geometrically crossed weighted aggregates for calculating the index number instead of arithmetically crossed weighted aggregates. This index also satisfies the time reversal test

Kelly’s: This formula, named after Truman L.Kelly requires the weight to be fixed for all the index, for all the period and is also sometime known as aggregative index weights and is given by the following formula:

Development of the model

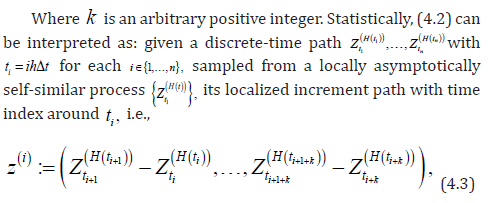

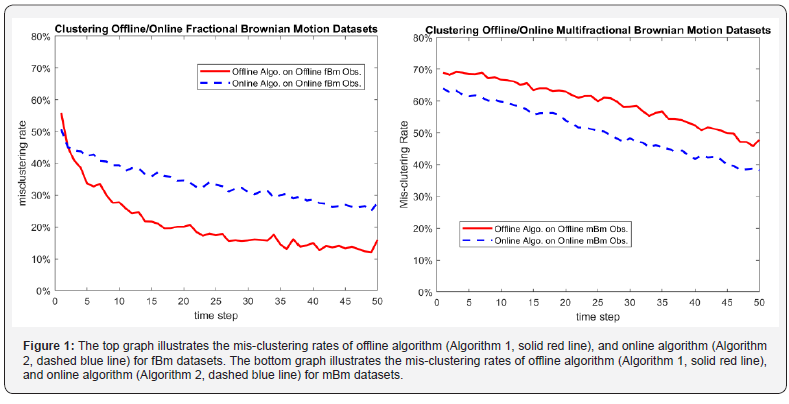

Prices of commodities in Nigeria have been observed to be unstable. There is always a change in prices from year to year and as such consumers find it difficult to predict the cost of commodities in the near future as observed from our model below in Figure 1 [9].

Source of data and presentation

The data for this work were collected from both primary and secondary sources. The primary source was collected through market survey of the selected commodities and the secondary source was collected from the Taraba State Statistical Year book. Both the primary and the secondary data cover a period of nine years that is from 2008-2016. The table showing the summary of the data from the five selected commodities [10](Table 1).

Results and Discussion

The selected methods of computing price index were used to calculate price index with the data collected and the results obtained are stated below

Result s of the analysis

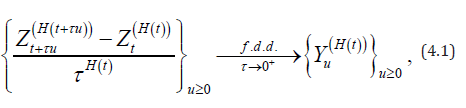

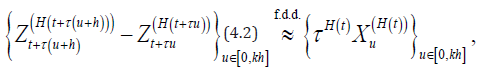

are the summary of result from Laspeyres, paache’s, waach’s and Kelly’s index number (Figure 2)(Table 2 &3).

Discussion

The results in table 3 show that, using laspeyre’s, waache’s, paache’s and Kelly’s in 2009 there is decrease in the price of commodities with -32.8%, 2010 an increase of 5.7% , 2011 decrease of -39.3%, 2012 a decrease of 21.91% ,2013 a decrease of 22.3%, 2014 a decrease of -23.33% ,2015 a decrease of -6% and 2016 an increase of 86.31% [11-14].

Hence from the above table the price of commodities in Laspeyre’s, waache’s, paache’s and Kelly’s as from 2009,2010,201 1,2012,2013,2014,2015 and 2016. There is a small decrease in the price but in 2010 a small increase and 2016 the increase is high.

From the results there is decrease in price from 2009,20011 to 2015 but from 2010, 2016 there an increased in price, therefore we do not accept the null hypotheses (HO) i.e there is significant difference in the prices of the selected domestic commodities. Based on the summary table above, there is an increase in price of commodities by 5.7% for using Laspeyres, Paasches waaschs, and Kelly’s in 2010 and 86.31% for using Laspeyres, Pa’asches, Waaschs and Kelly’s in 2016 and little decrease in prices of commodities by Laspeyres, Pa’asches, Waaschs and Kelly’s in 2009, 2011 to 2015.

Conclusion

The use of Laspeyres, Paasches, Waasche’s and Kelly’s for indices of the selected five domestic commodities gives, from 2010 and 2016 an increase of prices but from 2009-2015 a little decrease in the results, however there is general trend of increase and a little decreases prices under the four indices, it is very difficult to tell which of the method is better than the other [13].

Recommendation

In order to arrest this ugly trend of increase in price of commodities in all sectors of economy especially the essential commodities (e. g food stuff), it is a collective task for all and sundry which should not be left alone to the government of the day. It is the civil responsibility of all of us to join hands with the government to reduce this ugly situation, private entrepreneur must not be left out of the task of combating increase in prices to make our future generation bright [14].

We have the following recommendations.

I. The down ward trend of naira must be looked into and put a realistic level of exchange in the price of commodities.

II. Transportation problem has to be addressed with seriousness, so that farm produce could reach the consumer at the required time.

III. Grass roots farming must be given serious consideration with the provision of technical know, how like fertilizer, tractors, pesticide herbicides, improved seeds and seedlings etc, agricultural loans should be given to farmers so as to boost food production in the local government.

IV. Government should provide sufficient funds in order to purchase farm products from the local farmer and resale them back at a reasonable price when the need arises. This is because middle men are always exploiting the farmers at their detriment and if not checked, farmers will lost courage in gearing their effort and resources toward agriculture since the output cannot command good price.

V. Competent bodies are normally setup, like the income analysis agencies and the price intelligent agencies and productivity board which will include mostly professionally skilled to take care of the division in the local government.

VI. Government should now fix their own price of the commodities so that people will not fix their own price anyhow.

References

- Spiegel MK (1961) Statistics Pp. 340-350.

- Diewert WE (1973) Index Numbers", In: Eatwell John, et al. (Eds), The New Palgrave: A Dictionary of Economics, 2: 767-780.

- Rowan DC (1968) Output, inflation and Growth, Macmillan education Ltd London, UK, Pp 39-41.

- Afolabi (1999) Monetary Economics”, Heineman educational books, UK.

- Peter von der Lippe (2014) The Stochastic Approach to Index Numbers: Needless and Useless. MPRA 1-13.

- Lind Michael, Wathen (2010) Statistical Techniques Business in Economics, (4th Edn) pp 565-598.

- Levine Stephen Krehbiel, Berenson (2005) Statistics for Managers. Fifth edition.

- Arora PN (2007) Comprehensive Statistical Method, Ram Nagar Delhl-110055, India.

- Brofenbrenner SG (1988) “Macro Economics”, Houghton Miffin, USA, pp 121-124.

- (2016) "Index Investing: What Is an Index?".

- (2016) GDP deflator and measuring inflation".

- Moulton Brent R, et al (2000) "Price Indices". In: Newman Peter, et al. (Eds), The New Palgrave Dictionary of Money and Finance, 3: 179-181.

- Michael Albert (2013) Executive Compensation and Firm Leverage.