Financial Performance Key Value Situation by Crude Oil Price Fluctuation

Khorshidi Mohammadreza1* and Adrian Tantau2>

The Bucharest University of Economic Studies, Romania

Submission: September 19, 2018;Published:March 13, 2019

*Corresponding author: Khorshidi Mohammadreza, The Bucharest university of Economic Studies, 14623 Perthshire rd. Houston, Texas, USA

How to cite this article: Khorshidi M, Adrian T. Financial Performance Key Value Situation by Crude Oil Price Fluctuation. Ann Rev Resear. 2019; 4(5): 00123 555646. DOI: 10.19080/ARR.2018.04.555646

Abstract

Crude oil price always plays a major role in International Oil Companies (IOCs). Shareholders of IOCs are affected directly by crude oil price fluctuation and it’s important to know how to appraise effects of crude oil price on quality of earnings which is the adjusted index to evaluate each company’s financial situation. The quality of earning is a financial factor, which could support financial performance, so evaluating this factor by crude oil price and appraise correlation between them could clarify business model comportment while the market upraises or downward. The key value which should appraise in IOCs business model is the financial performance which has significant dependency on the quality of earning [1]. Furthermore, as our data is collected from New York Stock Exchange (NYSE) and OTC market stock exchange (OTCMKTS), required data were arranged based on GAAP financial standard. Objectives of this research are Evaluating financial performance as a key value in IOCs by appraising crude oil price effects on quality of earning in NYSE and OTCMKTS stock exchange companies’ oil and gas sector. The methodology of this research is using Pearson correlation coefficient and regression to test quantitative data which is derived from the stock exchange.

Keywords:Oil price; Business model; International oil companies; Key value; Financial performance; Quality of earning; Financial health

Introduction

Business model and business model innovation have various definition in which industry or firm is considered. One of the earliest definitions of a business model which was proposed by Tapscott, Ticoll, and Lowy [2], concentrate on supply chain and delivery channel that includes supplier and distributors, infrastructure and commerce service providers and finally customers as the most crucial object which receives value. Later, another aspect of the business model was introduced by Rappa [3], which focused on revenue generating and the importance of its position in firm’s value chain. These models’ comprehensive definition could be derived from developed business model by Osterwalder et al. [4], which considered a typology that classifies business model elements into nine building blocks, namely value proposition, customer segments, channels, customer relationships, revenue streams, cost structure, key resources, key activities and key partnerships. This article objective is evaluating business model from its financial aspect which is revenue stream and could be appraised by the quality of earning index that could achieve from firm’s financial statement. Financial performance of each company has correlation by the quality of earnings ratio [1], this correlation is because the quality of earning is a pure financial ratio and illustrates whether earning of a company is manipulated or not. This index is a financial index to support financial performance of each company and omit any effects which come from investing or financing activity to appraise the rate of companies’ primary business activity on its earning. The quality of assets is also one of the crucial factors which could support financial performance but, in this article’s, scope is the quality of earning and its correlation by crude oil price.

There are many specialists which have defined the earnings quality but until now there is no definition of a large acceptance. This concept has many faces such as earning persistence, smooth earnings, magnitude of accruals, income-increasing accruals, absolute value of discretionary or abnormal accruals, and the extent to which accruals map into cash flows [5-7]. In this article, we rely on Libbet et al. (2009), to achieve the quality of earnings ratio based on cash from operating activity. The quality of earnings ratio measures the portion of income that was generated in cash.

Crude oil price fluctuation push International Oil Companies (IOCs) to adjust their business activities to constantly deliver desired value to their customers and keep or develop their revenue stream based on a market situation. IOCs’ financial statement evaluation could route us to find out financial aspect of the business model situation while crude oil fluctuated even downward or uprise. Our target market niche is IOC’s which are in the stock market and we could be derived their financial statements from their stock market. Our selected time series is 10 years, which had started from the 1st quarter of 2007 and continued to the 3rd quarter of 2016, to cover two price hike periods and two sharp downward situations. The first downward was related to the 2008 recession after first price hike happened. The second decline was also related to lack of crude oil supply and demand equilibrium when crude oil could reconstruct its price after the recession. As Figure 1 illustrated, in this period, crude oil experienced the high peak around $140 and the least price around $30, therefore all probable conditions have happened on this market and IOCs had to adjust their business to deliver value to their customers and their shareholders.

Methodology

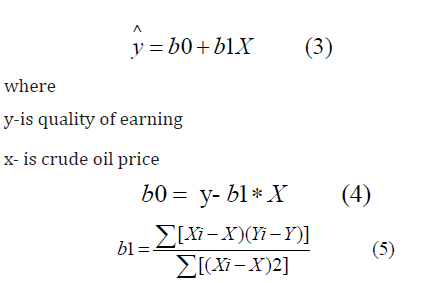

The required data which should evaluate in this chapter to illustrate financial performance as a business model key value, have chosen based on its definition which is generating revenue without manipulating the financial situation. On the other end, using assets and fundamental business activities, like using companies share repository to inflate non-operational revenue and then generate the profit margin could be considered. The quality of earnings ratio a pure coefficient that avoid any manipulated profit by which assets other than primary assets [3]. It could also evaluate the financial health of a company which is not within the scope of this chapter. Therefore, the best factors to measure could be considered as the quality of earning which is measured by operating income or cash flow from operations. To obtain a precise value for the quality of earning, quality of earnings ratio could be utilized. According to the textbook “Financial Accounting” by Robert Libby, Patricia AL & Daniel GS [8], this ratio can achieve by obtaining the rate of cash from operation to net income. Quality of earning = (Cash from tha operation )/(net income) (1) where cash from the operation – comes from the annual cash flow statement net income-comes from the annual income statement

This ratio shows cash income and total income correlation. A ratio less than one reveals a low earnings quality. That is, the company may be overstating its true earnings. A ratio greater than 1 is indicative of the company’s strong ability to finance its business activities through its operating cash flow [8].

Based on Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standard (IFRS), there are three main sectors in cash flow statement which reports overall cash flow from any activity of a company. They are cash from operating activity, cash from financing and cash from investing which as their name obviously portray their objectives, cash from investing and financing are non-operating income which generated by a company rather than its primary business activities. The reason for choosing the quality of earning factor, as its definition state, is that this factor illustrates revenue from the operation which comes from companies’ primary business activities and any financial manipulation is not involved in this factor. Therefore, we could assume that quality of earning is a pure factor to show real firm’s business activity and could support our research regarding effects of crude oil price fluctuation on IOCs financial performance to enrich our research results.

Source: NYSE and OTCMKTS

IOCs which their fundamental data has been used in this chapter are in New York Stock Exchange (NYSE) and OTC market stock exchange (OTCMKTS). Both stock markets are in the United States and all extracted data are in USD currency to appraise precise results. Table 1 is the list of companies with their activity field and other fundamental information.

For our test, fundamental financial data has extracted from NYSE and OTCMKTS via amigobulls.com website. As we mentioned earlier, cash from operating activity from cash flow statement and net income from income statement were extracted in a 10-year time series which has split into four quarters each. The time series has started from 1st quarter of 2007 to 3rd quarter of 2016. Although at the time which we have done this chapter, 4th quarter of 2016 is also should be reported by companies, some companies like CGG, Eni, Gazprom, Lukoil, and Transocean have not reported their 4th quarter of 2016 yet. Therefore, the end of the time series is the 3rd quarter of 2016. All financial statements support Generally Accepted Accounting Principles (GAAP), which is the standard of reporting financial statement and ruled by the U.S. Securities and Exchange Commission (SEC).

Crude oil price is considered as an independent variable and operating income as dependent variable which relies on crude oil price and Pearson correlation coefficient is using to evaluate the correlation between variables as both variables are quantitative.

The regression test is also used to show us with which degree we could predict statistic performance.

IBM SPSS tool was selected to evaluate results, as it provides a simple, easy to follow, and non-mathematical approach to understanding and using quantitative methods and statistics [9].

The complementary analyzing method, which is used in this chapter, is Minimum Spanning Tree (MST) to find out which IOCs’ quality of earning has better correlation with crude oil price and eventually had a better adjustment and support its primary business activity than other financial methods.

Some researchers during last decade had studied on financial aspects of a business model which relied on the correlation matrix. Most of them relied on Mantegna’s research in 1999 and his progress during following years based on correlation matrix and different types of MST method and also a Planar Maximally Filtered Graph (PMFG) which was utilized in analyzing correlation matrix. For instance, Coletti in 2016 in his article regarding comparing minimum spanning trees of the Italian stock market using returns and volumes, utilized MST method to analyze different methods of calculation correlation matrix like Pearson Correlation Coefficient (PCC) of log-return, correlation of symbolized log-returns, log-returns and traded money and finally combination of log-returns with traded money. Some researchers utilized MST method to obtain a reliable portfolio based on the achieved graph in compare with Markowitz method. In this case, MST method was a better choice as Markowitz method was underperformed to obtain a reliable portfolio selection.

The spanning tree is a subgraph, if it includes all vertices of the graph. There is only one shortest path among all spanning trees in a graph which is finite, and each edge has a positive real number as its value. The shortest path is unique. Above explanation could illustrate by a matrix in mathematics. The matrix contains values of edges or edge length and the value of edges which connect edge i to edge j, illustrated by aij. In this matrix aij=aji and all aii and ajj values are zero. One of the outcomes of the spanning tree is that the complementary analyzing method, which is used in this chapter, is minimum spanning tree to find out which IOCs’ quality of earning has better correlation with crude oil price and eventually had a better adjustment to support its primary business activities than other financial improvement methods.

To achieve MST, first, we should calculate correlation matrix which could obtain by Pearson correlation coefficient test and then draw MST by one of its method. Its notion is that building a graph with n vertices and n-1 edges while avoiding any loops. When we consider stocks in graph vertices and link them to find out the correlation which comes from correlation coefficient, as edges, we could map financial market data by MST method [10]. Minimum spanning tree has various methods for calculation. One of the most relevant and common methods is Kruskal’s method. In this method, if we consider the graph as G, when we want to start the calculation, the shortest edge should consider for the start point. The next stage is choosing another shortest edge among all vertices which connected to the previous edge and continue this procedure till we don’t have any other edge. The resulted path or spanning tree is a minimum spanning tree of the graph G. in all those procedures, there is a crucial tip which should be considered. When we want to choose the next shortest edge, we should notify that previous edges with the next chosen edge, should not form a loop.

If we consider the resulted minimum spanning tree as T, and the connected graph with n vertices as G, following results could achieve based on Kruskal’s theory and those statements are equivalent which we could have a various interpretation by obtaining T as minimum spanning tree.

• T is a spanning tree of G

• T is a maximal forest in G (a forest is a graph without any loops)

• T is a minimal connected spanning graph of G

• T is a forest with n-1 edges

• T is a connected spanning graph with n-1 edges

The appropriate algorithm is Kruskal’s algorithm, it’s a state of MST to draw a weighted graph while final graph includes all vertices and connect them by required edges which total edge’s weights are minimum. In this algorithm, loops are not allowed. We should choose shortest or minimum weight edge to avoid making any loops with other edges which already chosen [11].

MST has many applications for computer networking and clustering to its recent decade’s noteworthy application in the financial market. The first famous MST usage in the financial market is the method which Mantegna in 1999 used to find an arrangement based on economical classification in the US stock market as a hierarchical structure in the financial market. Later than, in 2003, Chakraborti worked on asset trees or asset graphs in financial market by using MST and similar to Mantegna’s method. This graph is known as dynamic asset graph. Caldarelli in 2004 by utilizing correlation coefficient notion and time series effect on the returns of stocks which traded in the stock market, focused on the network of equities in the financial market. Tumminello, Di Matteo and Mantegna in 2005 introduced a tool for filtering information in a complex system by concentrating on correlation coefficient matrix and Gower’s metric distance and forming a Planar Maximally Filtered Graph (PMFG). Another research also in 2005 worked on the notion of MST which is correlation network among currencies by Mizuno and Takayasu. In 2006, also a research on currencies constructed by Naylor, Rose and Moyle. They worked on the topology of foreign exchange markets using hierarchical structure methods which concentrate on 44 currencies in a 6-year time series. Mantegna et al. introduced their new overwhelming research in 2008 which was about correlation, hierarchies, and networks in financial markets by concentrating on Single Linkage Cluster Analysis (SLCA) and Average Linkage Cluster Analysis (ALCA). In 2010, Kenett, and Shapira introduce a new tool to analyze dynamics of stock market correlation. The last important research, which could rely on, was done in 2010 again by Mantegna and his colleague. It was about dominating the financial sector revealed by partial correlation analysis of the stock market [12].

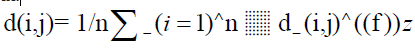

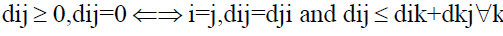

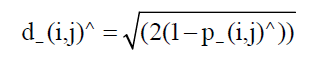

In this research, MST with focusing on the correlation matrix of quality of earning coefficient is using to analyze selected stock market companies which are in the oil and gas sector. The correlation matrix is generated by Pearson Coefficient Correlation (PCC) method and companies assumed as vertices while values of matrix considered edges which used Gower’s metric distance function. It states that distance measures are between 0 and 1. Assume two points as i and j, distance is illustrated by d(i,j) from the correlation matrix.

Where i and j are points (companies) and n is the total number of points (companies) and

and by calculating nodes distance by its following metric formula and generate correlation matrix which comes from PCC method

Where i and j are points (companies) and p is the correlation between points (companies) all vertices should be connected at least by an edge otherwise we cannot use the minimum spanning tree method to obtain the shortest path in the graph [13].

Analysis

Both of crude oil price and quality of earnings ratio are quantitative, so the required test is Pearson Correlation Coefficient and has done by IBM SPSS version 22. As we need two series of data to run the test and make a conclusion, we should achieve normalize quality of earning data to use it as dependent variable while crude oil price uses as the independent variable. The hypothesis of this test are as follows:

H0: Crude Oil price and quality of earning are dependent

H1: Crude Oil price and quality of earning are independent

First, all achieved data from Cash flow statements and income statements of selected companies’ financial statements were imported in SPSS and as a separate variable, quality of earning was calculated by dividing cash flow from operation activity to net income. The ratio shows the rate of primary activity of each company to net income which comes from all types of activity of a firm [14].

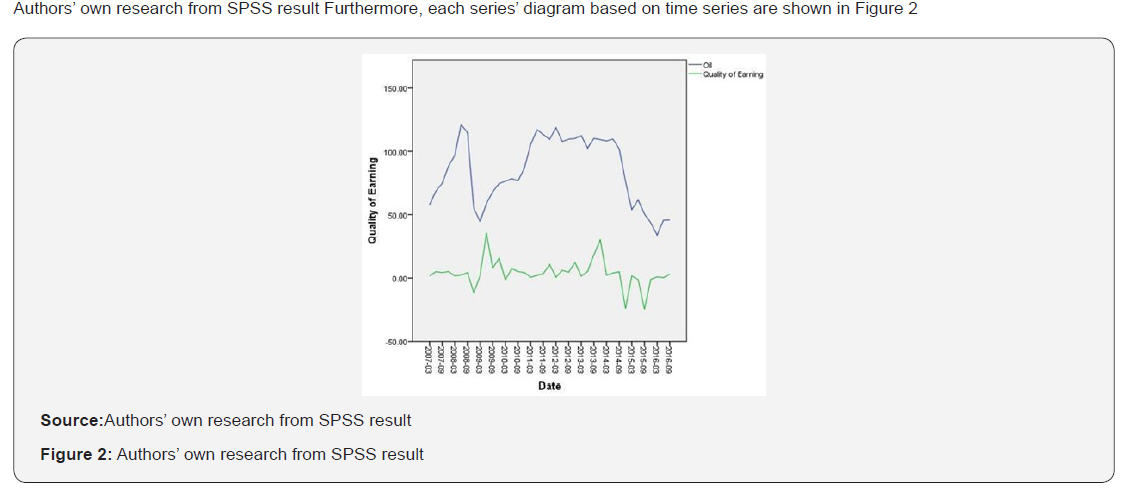

Second, Pearson Correlation coefficient test has done on the mean of both crude oil price in 39 quarter from 1st quarter 2007 to 3rd quarter 2016. Following are the table of descriptive statistics of research variable which are crude oil price and quality of earnings ratio. It shows that crude oil price has $87.36 range and has a minimum $33.84 price while its maximum was $121.20 Table 2 & Figure 2.

Source: Authors’ own research from SPSS result

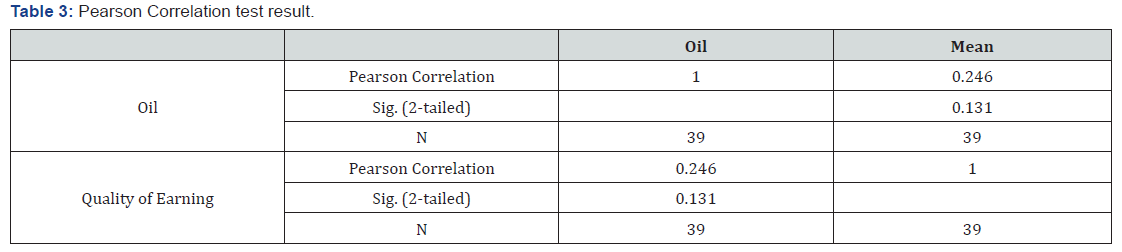

The test result shows us that the P value is 0.131 which states that both variables are dependent. Therefore, Crude oil price and quality of earning are dependent, and quality of earning could predict moderately by crude oil price with %24.6 which is regression β value. The correlation table is shown in Table 3.

The Figure 3 is regression scatterplot which states the correlation between crude oil price and quality of earnings ratio in 10 years. This plot is also stated a positive correlation between crude oil price and Quality of earning even though it is not a strong correlation [15].

As the quality of earning has chosen to appraise financial performance key value situation with crude oil price fluctuation, above test results, illustrated that financial performance has a positive correlation with crude oil price and IOCs’ financial performance has a dependency to the crude oil price. It means that in the market slow down situation, IOCs have lesser financial performance and they might compensate the decline of their primary business activity by other strategies like income from investing or income from financing. On the other hand, when the crude oil price goes up, financial performance is also growing which illustrated that IOCs are busy with their primary business than thinking to income from investing or financing.

Minimum spanning tree Analysis

After analyzing the quality of earning by PCC method and evaluating their situation in an almost a decade time series by crude oil price, the correlation matrix which has already obtained, let us appraise our data by networking and clustering MST method. It helps us to achieve the reliability situation among selected dataset.

Our analysis depends on the classic financial networking and clustering analysis which referred to Mantegna method by obtaining MST graph from the correlation matrix. It is done on sixteen selected companies which are in the oil and gas sector and the time series include 39 quarter, from the first quarter of 2007 to the third quarter of 2016. The MST graph with Kruskal’s algorithm is illustrated in Figure 4. Each node is connected to another node by its weight which comes from the correlation matrix and is shown beside each arrow. As numbers are in the scientific mode, and the graph is printed by MATLAB software, numbers with more than 5 decimals are shown in the scientific notation.

Values in the graph show the level of reliability. The more distance value illustrates the more reliability. The result illustrates that Statoil has more connection in the graph with other companies which could interpret to have a more reliability in the graph than others. The total has unreliable linkage with Schlumberger and Shell, while it has reliable linkage with Weatherford which has a reliable linkage with Exxon. Eni, on the other end, has reliable linkage with shell and unreliable linkage with ENSCO.

Moreover, Statoil is the highest degree node with the most reliable linkages with other companies in the oil and gas sectors. Therefore, in the case of quality of earning coefficient, our analysis state that Statoil, the Norwegian integrated oil, and gas company, is the most reliable company among our selected 16 companies which are in this field and sector. After Statoil, we could address Weatherford, The US Oil, and Gas Field Machines and Equipment company. It has more reliable linkages in comparison with CGG, Eni, or ENSCO which all have two linkages with others.

Conclusion

Evaluating financial aspect of the business model which could come from appraising related business model key value to find out its situation by financial factors is the main objective of this research. Related key value as mentioned earlier in this chapter is the financial performance which supports financial health of a company and portrays companies’ financial situation with their primary business activity while omitting any other activities which could be done and support earning by investing or financing. The related financial ratio that is equivalent to financial performance is the quality of earnings of each company. Financial information of sixteen companies was gathered from their financial statement and precisely, from the income statement and cash flow statement, then the quality of earnings ratio was calculated by dividing cash from operating activity to net income. Its correlation by crude oil price was appraised by Pearson correlation coefficient algorithm and related scatter graph simultaneously. The result states that IOCs’ quality of earning has positive correlation with crude oil price which is high when crude oil price is high, and IOCs are doing their primary business other than financing or investing or any non-operating activities, in the other hand IOCs’ quality of earning is low when the market is low, and IOCs had to compensate their lack of income by doing any non-operating activity or financing and investing.

To recap, we achieved that financial performance has the positive correlation with crude oil price in an almost one-decade time series. The more crude-oil price tends selected oil and gas companies to the more quality of earnings and eventually, the more financial performance, and vice versa.

Moreover, by MST networking analysis and Kruskal algorithm we find out that Statoil, the Norwegian integrated oil, and gas company have the most reliable linkages with other companies, and it is the highest degree node in the MST graph. It means that the Statoil is the most reliable company by appraising the financial performance factor. The second reliable company could be Weatherford which has more reliable linkage than CGG, Eni, and ENSCO. They are in the next reliability degree after Weatherford.

References

- Campbell R, Harvey (2012) Access to Liquidity and Corporate Investment in Europe.

- Tapscott, Ticoll, Lowy (2000) Harnessing the Power of Business Webs.

- Michael Rappa (2003) BUSINESS MODELS ON THE WEB.

- Osterwalder A, Pigneur Y (2010) Business Model Generation: A Handbook for Visionaries, Game Changers, and Challengers. John Wiley & Sons.

- Dechow P, Weili G, Schrand C (2010) Understanding earnings quality: a review of the proxies, their determinants and their consequences. Journal of Accounting and Economics 50(2-3): 344-401.

- Dichev ID, Graham JR, Harvey CR, Rajgopal S (2013) Earnings quality: Evidence from the field. Journal of Accounting and Economics 56(2-3): 1-33.

- Eliwa Y, Haslam J, Abraham S (2016) The association between earnings quality and the cost of equity capital: Evidence from the UK. International Review of Financial Analysis 48: 125-139.

- Robert Libby, Patricia AL, Daniel GS (2009) Financial Accounting by McGraw-hill. p. 667.

- Burns RP, Burns R (2008) Business research methods and statistics using SPSS.

- Mantegna RN (1999) Hierarchical structure in financial markets. Eur Phys J B 11(1): 193-197.

- Amigobulls Inc (2017) Financial statements.

- Murillo C, Erasmo G, John RG, Campbell RH (2012) Access to Liquidity and Corporate Investment in Europe during the Financial Crisis. Review of Finance 16(2): 323-346.

- Federal Reserve Bank of St. Louis (2017) Economic Data.

- IFRS Foundation (2017) Global Standards for the world economy.

- (2000) U.S. Securities and Exchange Commission. International accounting standards.