The Vulnerability of Laser Printing and Fugitive Ink as Security Features in Banking Cheques

Naulak Lian Paite1*, Sandeep Kumar Pathak2 and Sammo Bhattacharya3

1Assistant Director & Scientist C, Central Forensic Science Laboratory, India

2Forensic Professional, Central Forensic Science Laboratory, India

2Assistant Central Intelligence Officer, Central Forensic Science Laboratory, India

Submission:August 09, 2022;Published:August 23, 2022

*Corresponding author:Naulak Lian Paite, Document Division, Central Forensic Science Laboratory, Ministry of Home Affairs, Government of India, 30, Gorachand Road, Kolkata- 700014, West Bengal, India

How to cite this article:Naulak L P, Sandeep K P, Sammo B. The Vulnerability of Laser Printing and Fugitive Ink as Security Features in Banking Cheques. J Forensic Sci & Criminal Inves. 2022; 16(2): 555933 DOI:10.19080/JFSCI.2022.16.555933.

Abstract

Cheques are one of the most secured ways of financial transaction due to the various layers of security features introduced in the cheques. These security features were indissoluble for the criminals. Conventional cheque forgery included total duplication of the cheque wherein it was observed that the printing consisted of single process viz entirely laser or inkjet. Additionally forged cheques were devoid of any erasure and if present could be detected at ease with a stereo microscope. The E13Bfonts in the clear band were an area which the forger would consider untouchable because of the uniqueness of the fonts coupled with the magnetic properties of the ink used. However, it has been observed that this trend has undergone a paradigm shift with high level of complicacy introduced in the cheque forgery. The present study consists of the complicacies involved in a forged cheque especially the compromise in the security features. The worrying trend being the compromised fugitive inks used for security background as well as the E13B alteration which have been so carefully affected upon that it was near to being undetectable. A detailed analysis has been presented which is a cumulative compilation of the study of the various compromised security features available in a genuine cheque. This paper would provide an enlightening chapter in the forensic examination of recent trend in cheque forgery.

Keywords: Mechanical erasures; Security background printing; CTS 2010 Standards; Fugitive inks; E13BFonts; Clear band

Abbreviations: CTS: Cheque Truncation System; ICS: Image-based Clearing System; RBI: Reserve Bank of India; OCR/ICR: Optical/Image Character Recognition; (PCR/DCR): Print/Dynamic Contrast Ratio; MICR: Magnetic Ink Character Recognition; ANSI: American National Standards Institute

Introduction

Banking cheques has been a popular instrument used for financial transaction throughout the globe and due to its high usage have been a subject of interest for developer as well as white collar crime. Forgers have been able to duplicate the cheques for fraudulent withdrawal of money causing huge financial loss to the individual and the agency in general. These white-collar crimes have been a challenge to the law enforcement agency particularly to the Forensic laboratories. With the passage of time, these cheques have undergone a massive overhaul in terms of insertion of new security features. But with these improvements the forgers have also been able to upgrade themselves in the execution of crimes related to cheque forgery [1,2]. Hence, research work and study in this field needs a constant and continuous attention to be in the race to defeat the malicious work of the modern-day forgers. As a prelude to the case study presented in this paper, some of the security features available in cheques are hereby discussed particularly in Indian scenario. Cheque Truncation System (CTS) 2010 or Image-based Clearing System (ICS) is a project undertaken by the Reserve Bank of India (RBI), for faster clearing of cheques which is basically an online image-based cheque clearing system where cheque images are captured at the collecting bank branch and transmitted electronically [3]. As per the CTS-2010 Standards [4] some mandatory security features introduced in cheques includes Watermark (CTS-INDIA), VOID pantograph, Bank’s logo printed with invisible ink (ultra-violet sensitive ink), Optical/Image Character Recognition (OCR/ICR), Print/Dynamic Contrast Ratio (PCR/DCR) for mandating colours and background as well as fugitive inks for security background printing. Fugitive inks [5] are the special inks used for the background printing of value documents such as cheques for avoiding forgery or tampering. These inks have been developed to coat with a printed layer in the background of the cheques. Whenever, any tampering attempts are made in these areas to erase the matter on the security background, then tampering attempt leave a clearly visible marks i.e., colour fading, a colour change or disappearance, or a bleeding off appearing on the document.

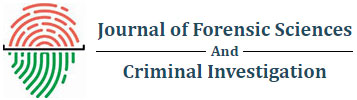

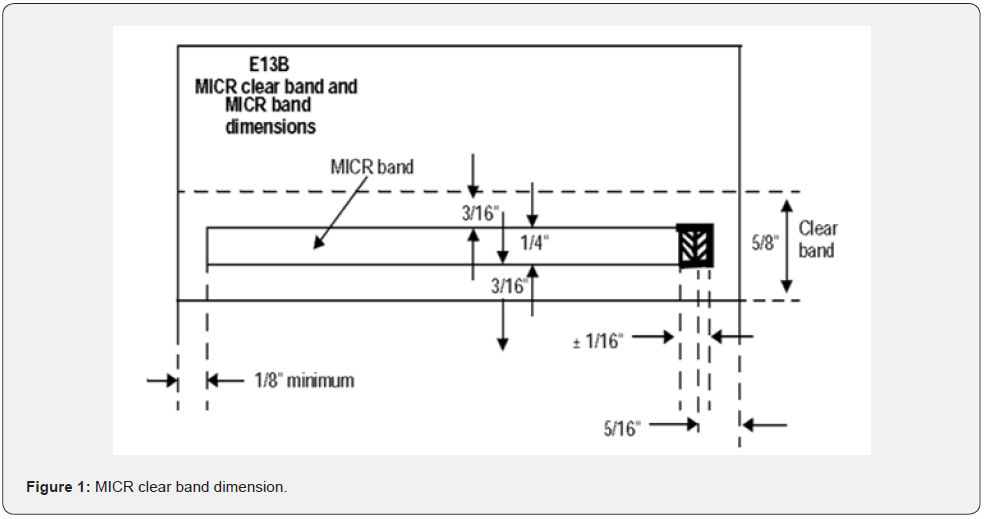

Laser Jet printing (fused toner) are used upon the security background for printing the details of the cheque such as Bank Detail, Account Number, Name of Signatory, etc, the laser printing has special printing characteristics which is characterised by the matrix arrangement of clear edges of the letters and characters with even concentration of toner and shiny appearance of fused toner. Any tampering by mechanical erasure or otherwise in the laser printing will affect the paper fibre surface and matrix arrangement of clear edges of the characters when examined under some magnification. Magnetic Ink Character Recognition (MICR) technology band or Clear band [6] consisting of special characters called E13B fonts printed with magnetic ink (toner based) was first introduced in four metropolitan cities Mumbai, Chennai, Delhi, and Kolkata under the management of RBI considering the standards of American National Standards Institute (ANSI) as a new security feature. The MICR line contains up to 65character positions. These positions are numbered and grouped into five fields, which are read from right to left (Figure 1). The E13B [7] fonts consist of unique design and the fonts have a specific dimension as prescribed by ANSI standards. All the E13B characters are designed on a 7 by 9 matrix of 0.013 inch/0.33 mm squares (Figure 2). The minimum character width is four squares (or 0.052inch/1.3mm) for the numbers 1 and 2. The maximum width is 0.091inch/2.3mm for the number 8, 0, and four special symbols. All characters except the symbols have a height of 0.117inch/3mm. This does not correspond to an exact point size usually specified for fonts but is between 8 and 9 points.

This paper is the result of an important study regarding illegal encashment of high value cheques by way of tampering in genuine cheques. In this study we have also examined some of the security features present in Indian cheques as mandated by the CTS 2010 standard which was compromised by the forger. The basics of laser printing which is fusion of the tonal particles in the paper fibre thus presenting a secured base which when attempted to erase would substantially disturb the background printing was also compromised. The study provides the methodology of the recent trends in cheque forgery in India and generates the corroborative and circumstantial evidence to be collected by a Forensic examiner for generating sufficient scientific data for opining the falsification in the genuine cheques by tampering the security features and ultimately provide the result for natural justice. Due to recent and complicated trend of tampering of the genuine cheques, the present case study is an important one for the overview of security features of cheques.

Materials & Methods

The paper involves study of tampered cheques vis-àvis genuine cheques under the available instrument such as Leica Stereomicroscopy, DocuCentre Expert, UV, and IR Light arrangements available in Document Division, CFSL-Kolkata.

Our study of cheque security features is based on two important features:

Study of features on paper surface: this study considered various security features containing

i. Study of paper fibre.

ii. Study of Security Ink (Fugitive Ink).

Study of features on clear band

i. Study of E13B fonts.

ii. Study of toner quality in the fonts.

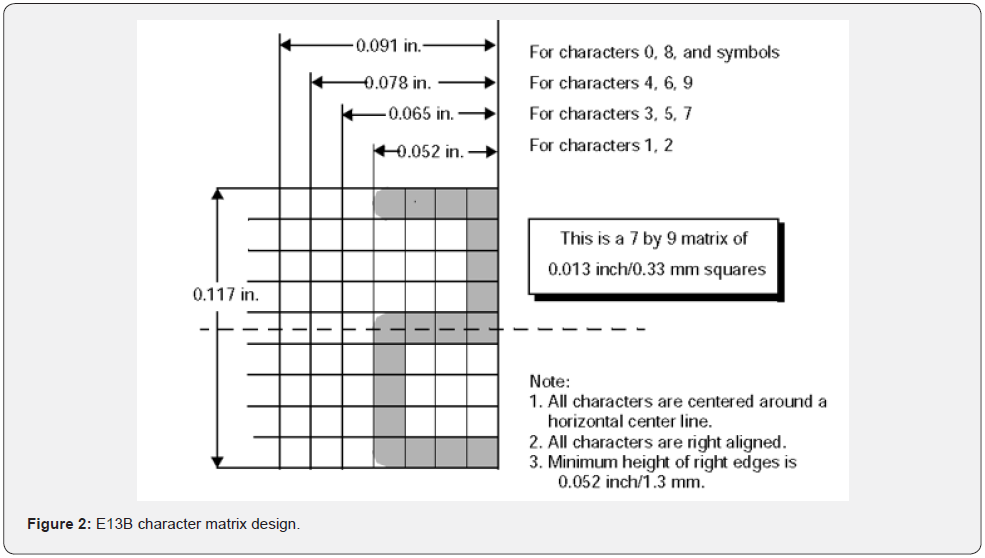

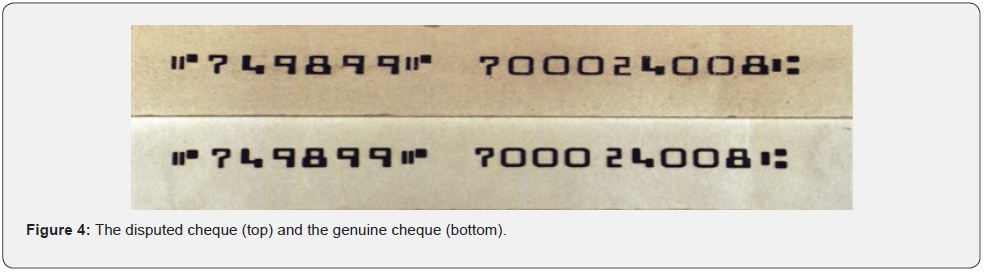

The positive point in this study was the availability of two cheques bearing the same cheque number, thus it was safely presumed that one of the cheques was a tampered one shows in (Figure 3 & 4). Before the actual examination of the manipulated cheque was undertaken, assumption of the methods that could have been utilized for the cheque manipulation was hypothesized and exercises relating to it were undertaken.

Some of the exercises with the observation are as listed below:

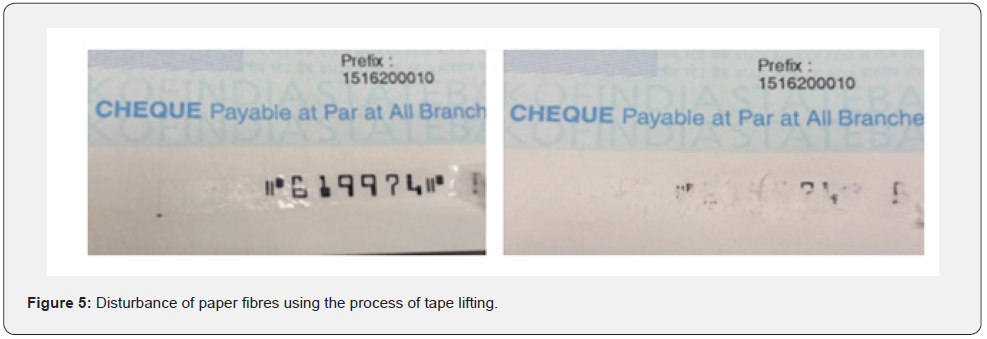

a) Tape Lifting: A cancelled cheque whose account inbox was pasted over with a transparent tape and the same was lifted carefully with an intent of erasing the laser printing by not disturbing the security background printing as well as the paper fibre (Figure 5).

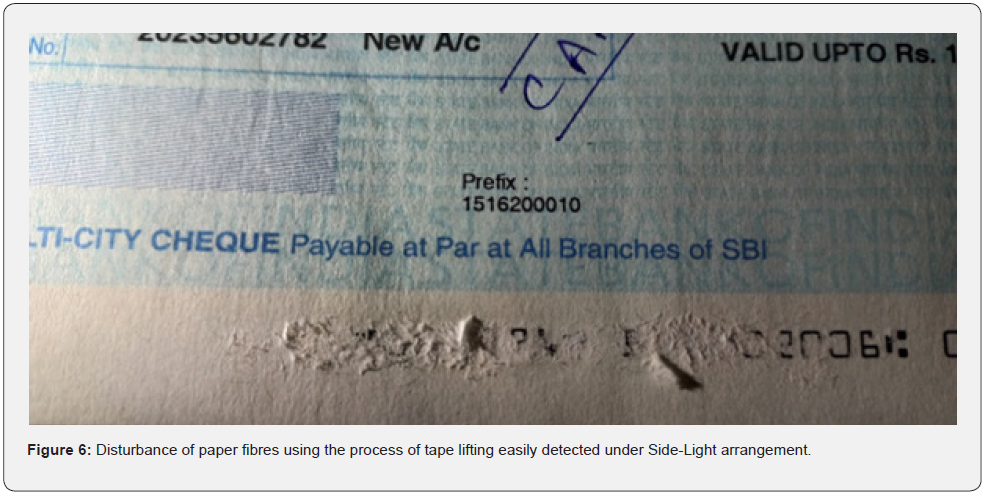

b) Repeated attempts even heating the taped portion gave us the result that on lifting that tape, some of the paper fibres are also lifted with the tape (Figure 6). Thus, this method could not establish the method used for the cheque forgery under discussion.

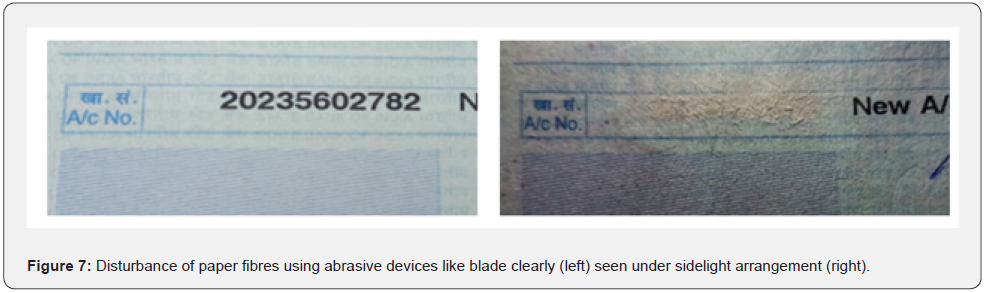

c) Mechanical Erasure of the Laser Printing: The laser printed portions of the cancelled cheque was carefully attempted to erase using very sharp edges like knife, blade and other mechanical devices. Careful and repeated attempts gave us the same result of distinct paper fibre disturbance which could be promptly detected. Thus, this method also could not establish the method used for the cheque (Figure 7).

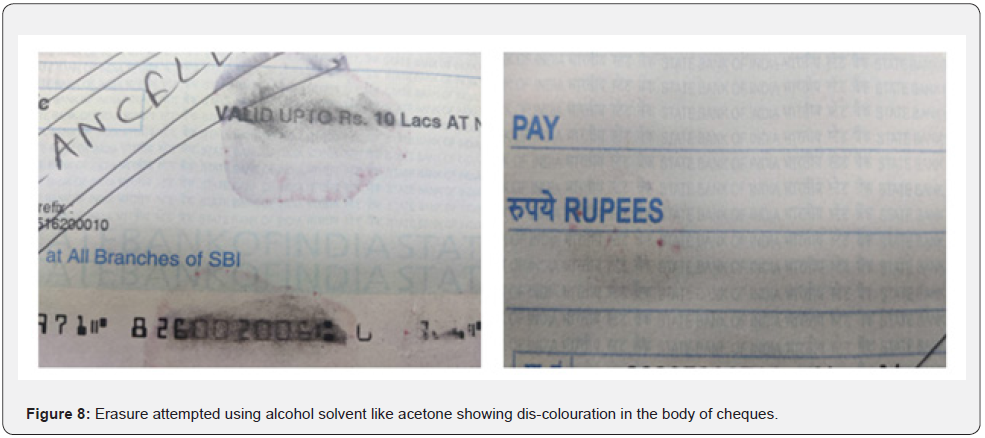

d) Erasure using Chemical solution: Chemical erasure such as Acetone (<99% purity) was used for erasing the laser printed portions including the MICR band. It was observed that on application of the solvent, tonal spreading has been observed on the erased portion. The security printing involving fugitive inks also reacts with the solvent thus causing dis-coloration as well as appearance of red dots in the area of erasure (Figure 8). This led to the conclusion that forgery under this method could also be detected easily.

Examination of security features of various tampered cheques

Study of paper fibre

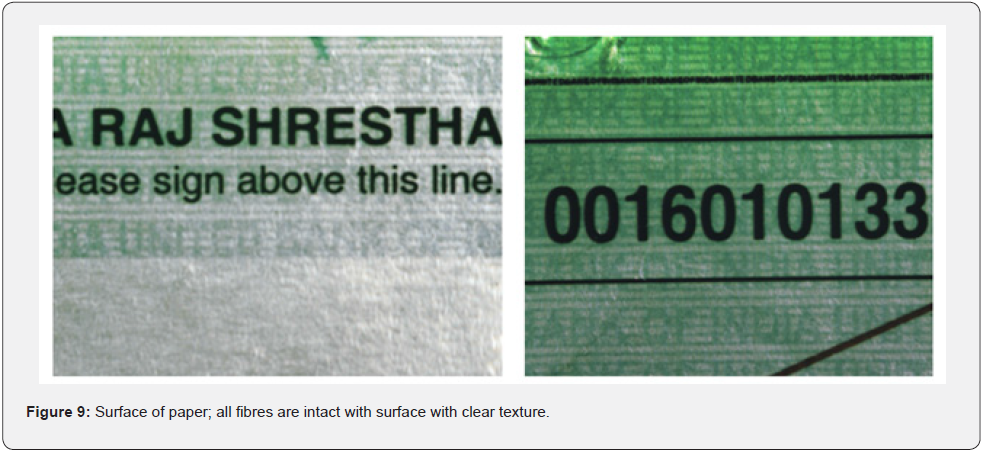

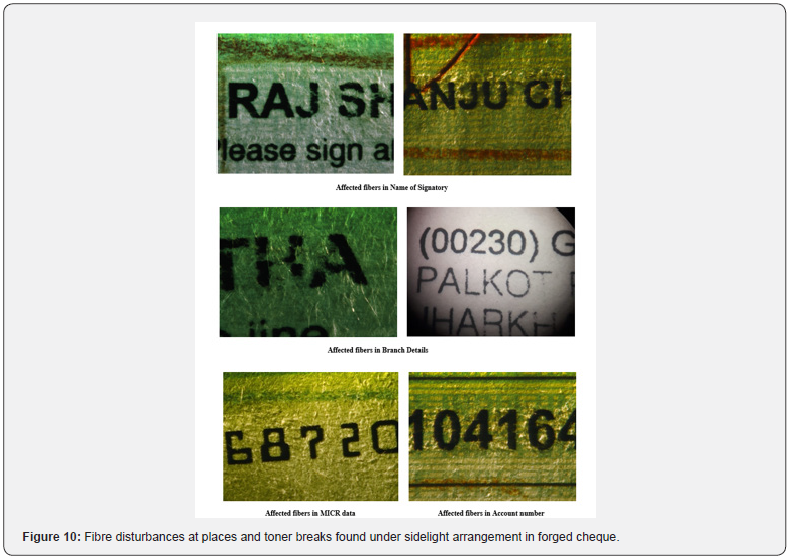

The main characteristic of a genuine cheque includes evenly distributed paper fibres and a smooth surface which is a result of complex pulping and manufacturing process. Cheque surface are printed in one operation and the entire surface have an unique texture and smoothness. All fibres are tightly joint with each other during the manufacturing process; and after the completion of printing of the cheques they remain intact until and unless some misappropriate/ tampering process is applied over the surface (Figure 9). The application of any external agent in the form of mechanical erasure over the fibre surface of the cheques for purpose of removing it disturbs the density as well as the smoothness of the cheque fibres. Uproot of fibres occur and the same can be easily detected under the sidelight arrangement (Figure 10).

During the study of various manipulated cheques, fibre disturbance have been observed in the vulnerable areas particularly that of Account Number, Branch name, Payee Section and MICR (E13B Font) band.

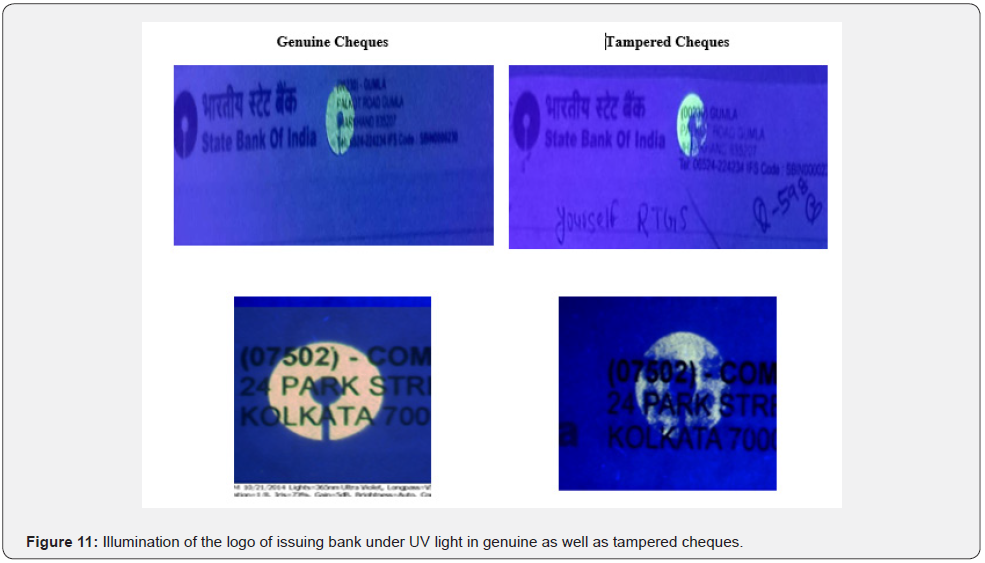

Study of UV feature

As per requirement of CTS 2010 standards, a logo of the issuing Bank is inserted in the paper making process which is visible only under UV light illumination. A clear and even illumination of the above-mentioned logo is visible in this case in a genuine cheque as illustrated in Figure 11. However, the mechanical erasure employed by the forger in removing the tonal particles from the body of the cheque although done with precision do affect the paper fibres and consequently the UV fluorescent inks present in the fibres of the cheque. The tampered cheque when observed under UV light (365nm) were found to have UV fluorescent logo but the illumination when observed carefully were defective due to absence of some of the fluorescent fibres removed in the process of erasure (Figure 12)

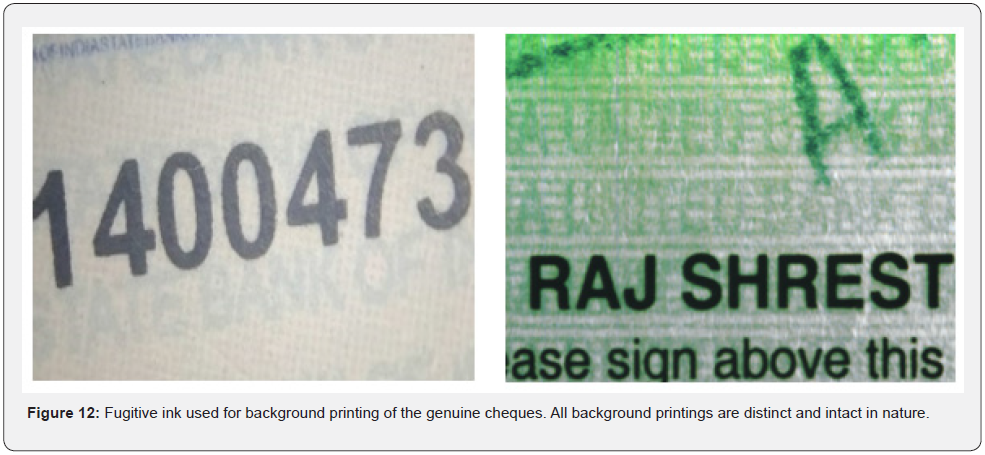

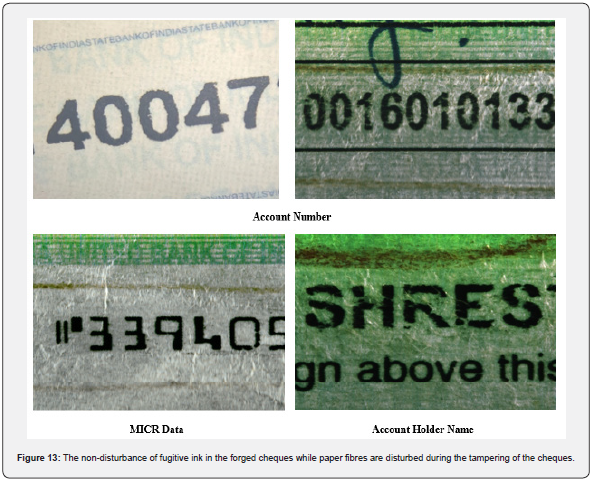

Study of security ink (fugitive ink)

Fugitive ink used for printing the security background in cheques has been said to be one of its best features. It is like solvent sensitive ink which will run or smudge in case of any form of alteration. Whenever, any chemical erasure or any liquid may apply over the surface, then it will starts running and the printed area gets smudged automatically, fade in nature and visible by naked eye (Figure 13).

The iota of confusion in this study stems from the study of the fugitive ink appearing on the security background of manipulated cheques. Although tampering was observed on the upper laser printing, the security background consisting of fugitive inks remained elusive to the erasure. A slight fibre disturbance was observed under high magnification, but the concept of fugitive ink disappearance or dis-colouration due to the erasure could not be distinctly observed (Figure 14).

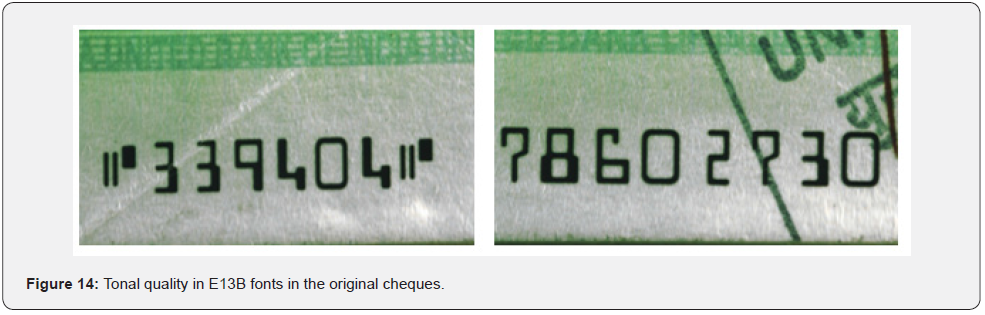

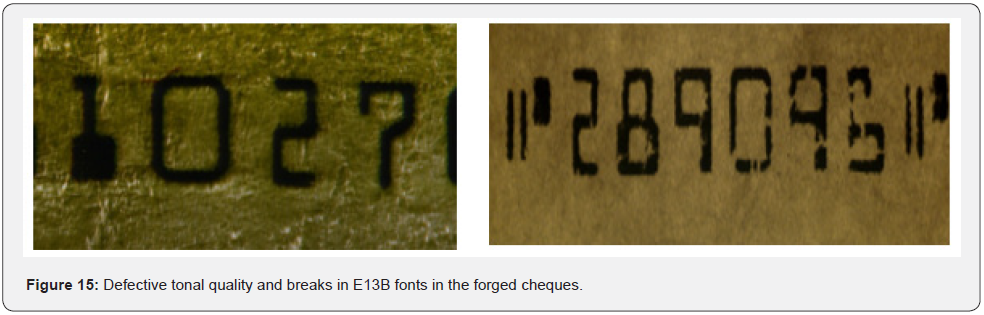

Study of E13B fonts

E13B fonts are characterized by their unique font design as well as their specific size. The inks although laser printed, have magnetic properties and they can be identified by the Magnetic Ink Character Recognition (MICR) reader machines.

The two major observation in the study of E13B fonts in the forged cheque can be described as below:

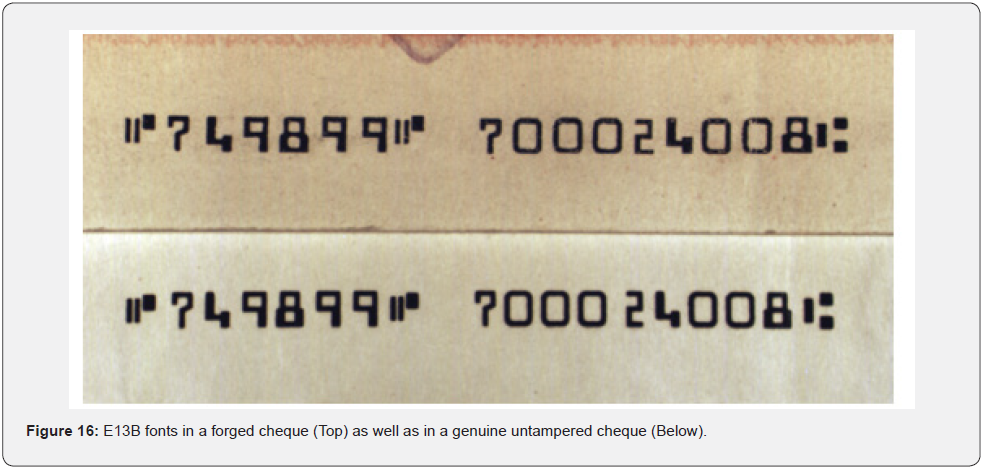

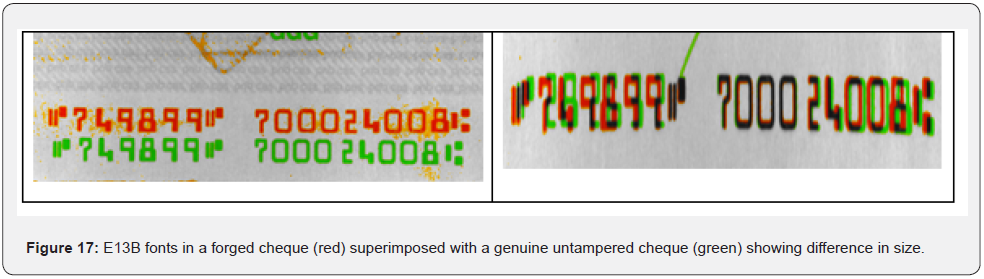

i. The font design in the forged was very similar to that of the genuine cheques indicating that the machine used for printing the cheque could be a typical cheque printer (Figure 15). However, the quality of printing in terms of tonal concentration as well as edge sharpness was of inferior quality. Some breaks in the toner in the characters have also been observed (Figure 16).

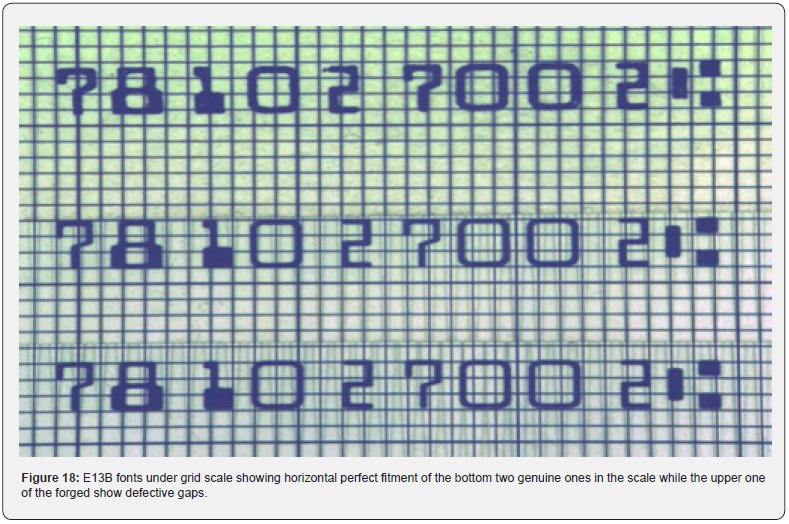

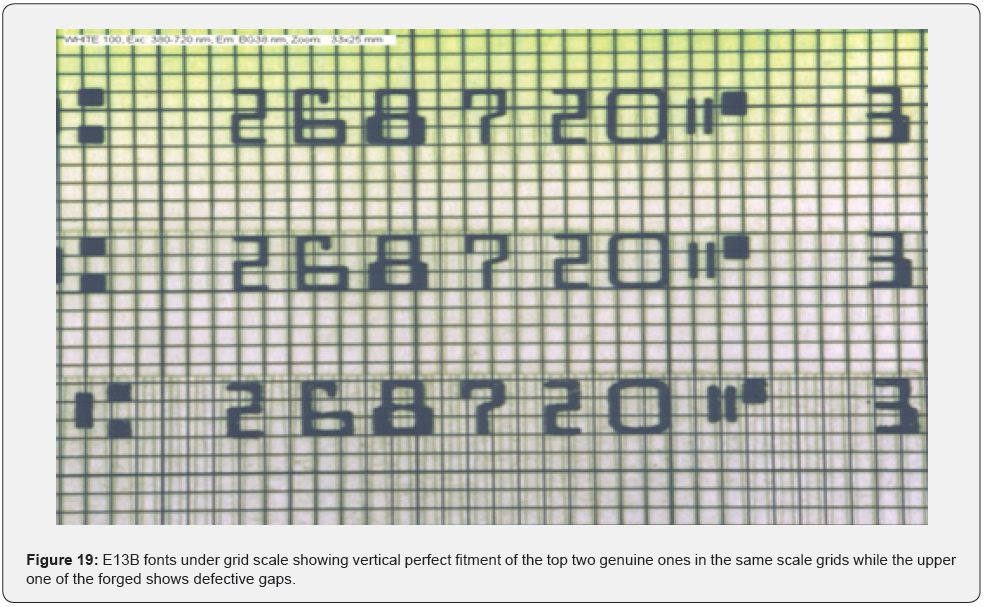

ii. The significant shift that was observed was in the size of the E13B fonts [7]. A scale containing measured boxes was employed for measuring the fonts. The cumulative effect of the size difference between the forged and genuine cheque could be observed vertically and horizontally. However, the specification as envisaged by the American National Standard Institute (ANSI) as well as Reserve Bank of India (RBI) which in enforced in Indian cheques could be seen when the genuine cheque were compared with one another for E13B font size and found to be in perfect harmony (Figure 17-19).

Results & Discussion

i. Cheque forgery have resulted a quantum shift from the conventional delicacy to a more advanced form in which a genuine cheque is tampered so as to retain the security features available in it. By conventional duplicity, it is implied a genuine cheque being scanned and printed by high end printers to the cosmetic looks are preserved and the preliminary examination is surpassed. However, with more awareness being provided to the Cheque passing authorities, this duplicity is easily detected as they are devoid of the security features.

ii. Basic security features such as security background printing using fugitive inks as well as the printing of E13B fonts in the clear band have been found to be compromised. The laser printing employed for customized printing such as Bank branch, account number, E13B fonts and other details have been erased with high precision making it difficult for naked eye to detect it.

iii. The worrying trend is the fugitive ink which are designed to be disturbed on a slight symptom of erasure are intact in these forged cheques leading to the hypothesis that only mechanized instrument which can provide very minute level of detection are employed for erasing the customized laser printing.

iv. A localized cheque printing machine of low quality might have been utilized for printing the E13B fonts in the clear band. The E13B fonts available in the forged cheques have the design as genuine ones but with lesser perfection. The sizes of these fonts do not conform to the specifications as laid down by ANSI standards (International) and RBI standards (India). The toner used in printing of these fonts are also believed to be devoid of magnetic properties.

Conclusion

From the study it has been observed that the recent trends in cheque forgery involves the following process:

i. Procurement of a genuine cheque of a particular Bank whose branch, account number, MICR data may be different. This cheque being genuine have all the security features intact in them.

ii. The careful erasure of all the customized laser printing present in these cheques and insertion of forged data of the account to be withdrawn.

The forged cheques when presented passed the UV test as the logo of the issuing Bank illuminates as it is present. Other overt features such as security background printing, laser printing could not be easily detected by the naked eye due to the high precision of the toner erasures.

References

- Shang S, Memon N, Kong X (2014) Detecting Documents Forged by Printing and Copying. EURASIP Journal on Advances in Signal Processing 140.

- (2015) Master Direction on Frauds, Reserve Bank of India, Circular.

- Deebika M, Rathna I, Vairam Sujitha M (2018) Fraud Detection in Cheque Truncation System (CTS). International Journal of Management, Technology and Engineering 8(11): 1650-1660

- (2010) Annexure to Circular.

- The Printing Ink Manual. In: RH Leach, RJ Pierce (Eds.), (5th edn), 341: 0835292.

- (2014) Mechanised Cheque Processing Using MICR Technology - Procedural Guidelines Department of Information Technology, Reserve Bank of India.

- (2003) Generic MICR Fundamentals Guide Document design 4.1-4.27.