To Study and Compare the Security Features Present In Canadian, Dubai And Indian Cheque And Limitation With Suggestions

Bhavya Sharma*, Aman Sharma and Shipra Rohatgi

Department of Forensic Sciences, Amity University, India

Submission: July 04, 2018;Published: July 12, 2018

*Corresponding author: Bhavya Sharma, Department of Forensic Sciences, Amity University, Amity Education Valley, Panchgaon, Manesar Gurugram, Haryana-122413, India, Tel: 919810711930; Email: bshama.sharma8@gmail.com

How to cite this article: Bhavya S, Aman S, Shipra R. To Study and Compare the Security Features Present In Canadian, Dubai And Indian Cheque And Limitation With Suggestions. J Forensic Sci & Criminal Inves 2018; 9(5): 555773. DOI:10.19080/JFSCI.2018.09.555773.

Abstract

The cheque is an alternative to cash and eminently used practice for the financial transaction by banks globally. Eventually being such an immensely used document, there are cases reported regarding crime, forgery, alterations, and disguise. The cheque is an authentic document embedded with security features under the direction of the authorities and guidelines of a particular country. Security features are the vital line of defines against the cheque frauds. There are several security features embedded in the cheque, few of them are watermarks, logo, Serial number, account number, bank name and these features can be visible under normal or different light sources and instruments. The present study of the security features focuses on the examination and comparison of modern Indian cheque (Punjab National Bank), Canadian cheque (Canada Trust) and Dubai cheque (Emirates NBD). Enduringly studying the security features of three different countries, it can be concluded that in Indian cheque ample numbers of security features are present, while Dubai cheque has acceptable and exclusive security features which are not found in other country cheques. Although in Canadian cheque security features are less when compared to Indian and Dubai cheque. With an escalation in technology, it is becoming relatively accessible for the culprit to conduct a crime using a cheque for financial benefits. Thus, it requires amendment of advance security feature which is discussed in the suggestions.

keywords: Cheque; Security Features; Examination; Comparison; Counterfeiting

Introduction

The cheque is a document that orders the bank to pay a specific amount of money from the holder’s account to the person whose details are drafted on the cheque. The cheque is one of the most prevailing documents of the bank whose chances of being counterfeited is maximum, therefore in order to prevent counterfeiting the cheque are being embedded with security features. Cheque is an instrument in writing containing an unconditional order, addressed to a banker, signed by the person who has deposited money with the banker, requiring him to pay on demand a certain sum of money only two or to the order of a certain person or to the bearer of instrument [1]. Section 13 of Negotiable Instruments Act, 1881 (Act no. 26 of 1881) of Indian constitution states that a negotiable instrument is a promissory note, bill of exchange or a cheque payable either to payee or to a bearer and Section 6 of this Act exclusively defines a cheque as a bill of exchange drawn on a specified banker, and not expressed to be payable otherwise than on demand [2]. The cheque is essentially considered as the bill of exchange that is manufactured in order to make money transactions without having cash in hand [3].

Common Security Features:

Security features are the features which are embedded in the cheques at the time of manufacturing & printing which secure it from counterfeiting. The security features make a paper endorse, for example- passport, Pan Card, Voter Id, Aadhar card, currency, cheque etc. So, the size, shape, and nature of the security feature are required to be meticulously embedded in the cheque (Figure 1). There are a number of security features in a cheque that can be visible under normal lighting conditions and usually help a layman to identify and find the difference between genuine and fraudulent cheque [4]. The type and amount of security features embedded in a cheque may differ among countries and bank. In general, common security features that imply in a cheque are as follow:

General Features

a. Cheque Design: Every bank has its own design, logos, and background printing. Every cheque had printed general information about the bank such as bank name, branch address, holograms and bank logo. It generates difficulty for a layman to comprehend between the genuine and fraudulent cheque, if the cheque is designed in a cinch manner it can be easily counterfeited.

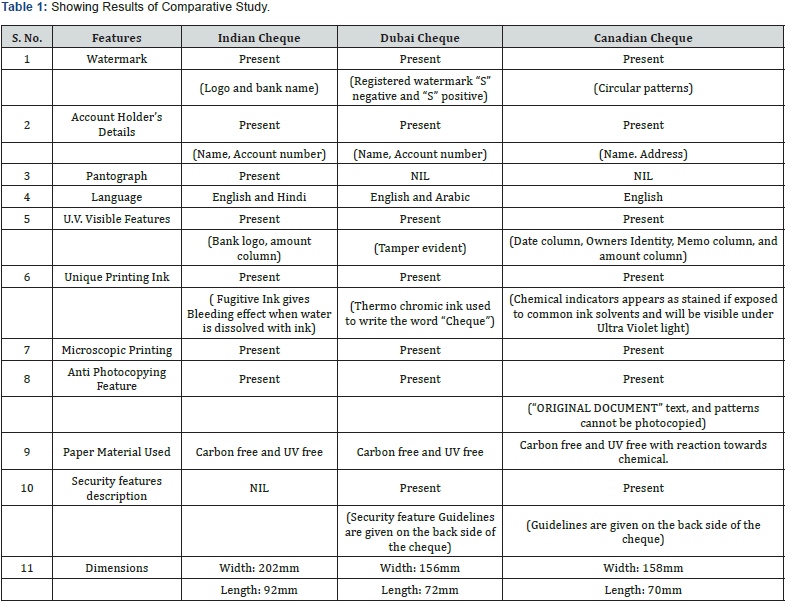

b. Uniform Dimensions: Dimensions play a very significant role in order to secure a cheque. In Indian Cheque, the length of a standard cheque is 202 mm and the width is 92 mm. In Canadian Cheque, the dimensions are as length is 70mm and width is 158mm [5]. While in Dubai cheque the length of the cheque is 72mm and width is 156mm. For other countries, dimensions may vary accordingly.

c. Paper Quality: As per concern of security features in a cheque main concern is to secure the paper otherwise it can be deceit easily. The GSM (gram per Square meter) of paper depends on the guidelines issued in each country. The paper used for manufacturing of Indian cheque is carbon-free paper and UV free paper, which means that the paper when observed under the UV light, it would not give the fluorescent appearance. In replacement of which, UV visible features are incorporated in the paper during the manufacturing process.

d. Watermarks: According to the previous researches watermarks are considered as one of the best security features, as they cannot be counterfeited easily. There are variety and different combination of watermarks which can be observed in different bank cheques which are visible under various lights and instruments. During the study of Indian cheque (Punjab National Bank), it was observed that the watermarks were in the form of bank logo or bank name. While in Dubai cheque “S” negative and “S” positive watermarks were seen in horizontal and vertical order.

e. Unique Ink Printing: The cheque printing using inks and dye differs from the country to country. The bleeding effect is a common phenomenon in Indian cheque that is if water drops over the cheque the ink dissolve in water due to the presence of fugitive ink. In the Canadian cheque, chemical indicators are used in the paper which can only be visible just under the U.V light. While in Dubai cheque, there is printing of word “cheque” by thermochromic ink, under increasing and decreasing of temperature it changes colour.

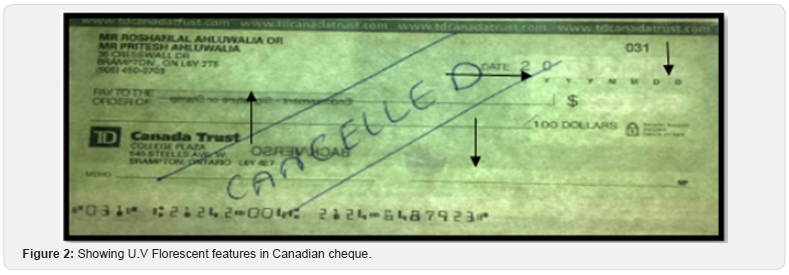

Ultraviolet Visible Features

Every cheque has U.V. Visible feature that is when the cheque observed under the U.V light source it gives fluorescent appearance (Figure 2). The U.V visible features embedded in a cheque vary from bank to bank. The fluorescent features in cheque can be in the form of bank logo, bank name, Rupee column, micro-lettering at the back, the amount in words and amount in figures, signature and beneficiary name. These are the most secure features and can be detected easily under the U.V light [6]. An apparent difference can be seen between the genuine and the fraudulent cheque when observed under the U.V light. In fraudulent cheque, the entire paper will turn blue fluorescent in nature, while in genuine cases it would not give florescent appearance for unifying and only specific features will appear as fluorescent.

Microscopic Features

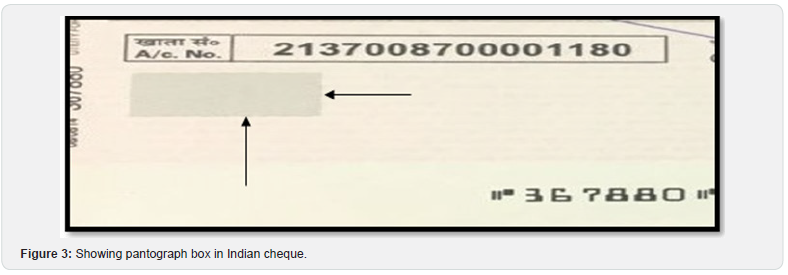

Modern Indian cheque has microscopic features which are located on entire paper or underneath the date columns, pay column, amount box, and rupee column. These features can be examined under the microscopes or can be recognized using a magnifying glass. So, if the cheque is photocopied or scanned these micro letters would not be legible (Figure 3). In Canadian cheque, microprinting is present on the back side which is depicted as “ORIGINAL DOCUMENT” and cannot be displayed on the photocopied cheque. In Indian cheque (of Punjab National Bank) “pnb cbs” is microprinted with slanted lines in the background of the cheque.

Void Pantograph

A rectangular box present on the cheque downwards to the account number column. This feature is only present in Indian cheque amid all. There is a unique arrangement of lines in the box Fwhich is based on the principle of steganography. In broad terms, if the genuine cheque will be photocopied then a cheque will show “VOID” or “COPIED” instead of a black space for filling of the amount [7]. The preeminent impediment is that it would not accord for laser machines with high inkjet quality, scanning machines or any other high-quality machine, so in such cases, no such marks of the void or copy will exist.

Materials and Methods

In the present study, Cheque from countries including Canada (Canada Trust), Dubai (Emirates NBD) and India (Punjab National Bank) was collected and the analysis, examination, and comparison were performed using the Ultraviolet light source at 365 nm, stereomicroscope at 40X and magnifying glass. A detailed examination of the security features embedded in the cheques of different countries was done and the comparison was made along with the area of improvement [8]. The result is depicted in Table 1 The conclusion is made on the basis of the presence of security features and limitation of security features present in the cheque.

Result

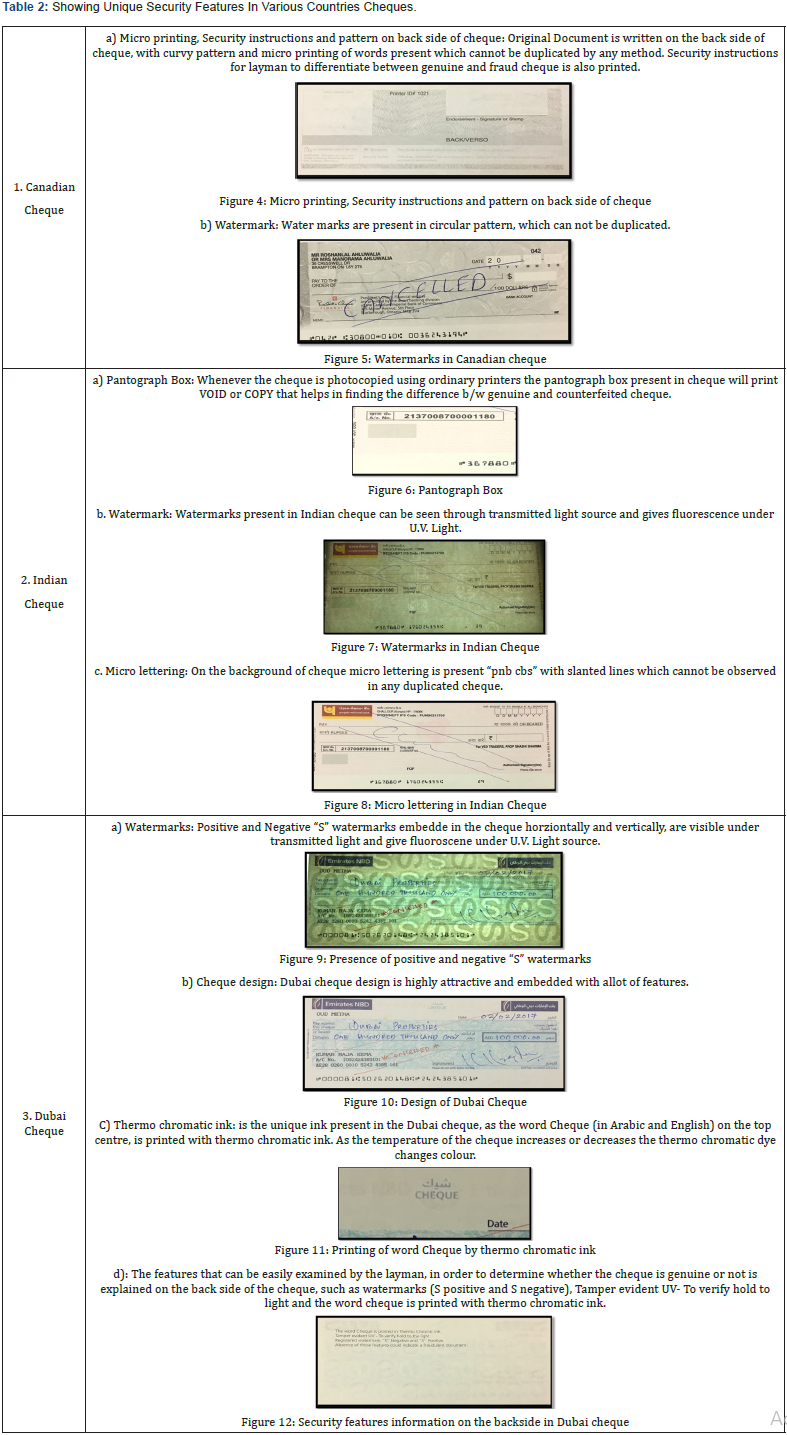

In the present study, the result can be demonstrated that the cheques are being highly secured with the help of various security features but still the chances of counterfeiting are possible (Table 2). There are various security features present in the cheque of different countries. The most common features encountered in the cheques were water watermarks, colour system, U.V visible features, microscopic printing. After the detailed analysis of Indian [9]. Dubai and Canadian cheques bear anti photocopying features in them. But in the term of size, Dubai and Canadian cheque were small as compared to Indian cheque. In India, security features in a cheque are issued by RBI, which remains the same for all the government and the private banks of India. Also, some of the security features can be contrasted among various banks; that may include watermarks, U.V features, etc. In Canada, CAP (Canadian Payments Association) issues the security features of the cheque. The security features are different from the business and the personal cheque and have their own specifications. In this presented study cheque used for examination is of Canada trust (TD) bank. In Dubai, security features of the cheque are issued by the Central bank of UAE. In this cheque register “S” negative and “S” positive watermarks are embedded which is the most exclusive feature which includes the S Positive and Negative watermarks, Thermo Chromatic ink printing, Size, Security features information printed for the layman to differentiate between genuine and fake cheque.

Discussion

In order secure crime against the cheque especially in a country like India, where still the highest financial transaction after cash depends upon the cheque the following suggestions can be introduced in the cheque.

Reduction of Cheque Size

The size of Indian cheque is quite large; thus, it is one of the reasons that cheque is getting counterfeited easily. If the size of the cheque is reduced, paper usage will be reduced, and that money can be utilized for the addition of more security features in a small sized cheque. Thus, it won’t be possible for a culprit to counterfeit the cheque easily.

Division of Cheque Issuing according to Amount

The cheque can be manufactured according to the amount limit. As in such a manner that cheque book for the transactions up to 99,000.00 (Ninety-Nine-Thousand) is separated (which will be considered as a small amount transaction) and for 1 lac to 10 lac and so on transactions (large amount transactions) separate cheque book should be issued.

Watermarks

As in Dubai cheque, in Indian cheque also there can be an increase in watermarks on the whole cheque which can be the ideal and the simplest way to encounter the counterfeited cheque for the bank staff and layman. Watermarks should be embedded in the cheque in such a manner that it should be visible on both sides of the cheque that can be observed under transmitted light.

Special Wax strip

A special wax strip can be introduced in the cheque. In order to fill the amount in cheque, the wax striped can be used which solidifies after a certain time. So that no alterations, erasures, obliterations can be done in order to counterfeit the cheque.

Smart Application for Cheque

A smartphone application can be developed by the bank which can be linked with the Aadhaar card of the account holder which will only be operated using fingerprint sensor, Iris prints or faces detection. It can be made in different languages. In order to use it, if account holder is issuing a cheque to another person or party, then account holder should open the bank app and fill all the information of the given cheque: which should include – Name, Contact & account details of party cheque to be issued to, Amount, date of issue, cheque series number, receivers and owners digital signature. So, that every time account holder is issuing the cheque to another party the details should be updated to the bank, which will reduce cheque based counterfeiting.

Conclusion

From the present study, it can be concluded that Indian cheque has a maximal number of security features. The solitary feature that Indian cheques have is a pantograph image which is present underneath the account number column. Due to this feature “VOID” or “COPIED” will appear in the pantograph box, if the Indian cheque is photocopied using any regular photocopy machine. But the result would not be same if laser printers or scanners are used. So, there is a chance of incorporation more securely advance features which need to be emphasized by the government of India for better and safe transactions in future. Also, there is fugitive ink printing which will give bleeding effect on the paper if the cheque comes in contact with any chemical (acid or alkaline). While considering Dubai cheque it also has an enormous amount of diverse security features, which mainly includes the S positive and negative watermarks, security feature guidelines, the word cheque printed using thermochromic ink which changes colour with an increase in temperature and the whole making of the cheque is highly appealingly. In Canadian cheque, the most exceptional security feature is the printed micro lettering and design on the backside of the cheque, which cannot be duplicated by any means, but still, there is a need to add more as Canadian cheque consists of the minimal amount of security features while comparing with Indian and Dubai cheque. Also, there should be more awareness among the layman to find the difference between the genuine and fraud cheque. It will help in the reduction of counterfeiting in cheque.

References

- Ellinger EP (1969) Travellers’ cheques and the law. The University of Toronto Law Journal 19(2): 132-156.

- Sople VV (2007) Legal Aspects of Marketing in India, New Age International.

- Sharma V (2011) Information Technology Law and Practice, Universal Law Publishing.

- (2017) Cheque printing standards In RBC royal bank site.

- Jose (2009) CL New security features for cheques from January 1, 18 September 2017. In Emirates 24 site.

- Ketan Patil, Navjot Kaur, Manish Malhotra (2017) Study of Genuine and Forged Indian Bank Cheques by Using Video Spectral Comparator-40, International Journal of Innovative Science Engineering & Technology 4(1): 139.

- Kalarani DBP, Narendhira kumar R (2015) Cheque Truncation System (Cts): An Overview”. Journal of Exclusive Management Science 4: 1-5.

- Moinuddin Mondal, Prajakta Harne (2014) Indian Bank Cheques Security Features PFSI.

- Jayadevan R, Kolhe SR, Patil PM, Pal U (2012) “Automatic processing of handwritten bank cheque images: a survey. Springer Verlag 15(4) : 267-296.