Disclosure of Information About the Intellectual Capital of the Company in the Mining and Processing of Mineral Raw Materials: The Importance and Recommendations

Y I Ustinova*

Department of Informing-Analyzing and Accounting, Novosibirsk State University of Economics and Management, Russia

Submission: July 27, 2020; Published:October 19, 2020

*Corresponding author: Y I Ustinova, Department of Informing-Analyzing and Accounting, Novosibirsk State University of Economics and Management, Russia

How to cite this article: Y I Ustinova. Disclosure of Information About the Intellectual Capital of the Company in the Mining and Processing of Mineral Raw Materials: The Importance and Recommendations. Insights Min Sci technol.2020; 2(2): 555585. DOI 10.19080/IMST.2020.02.555585

Abstract

The article justifies the necessity to disclose information about the company’s intellectual capital in addition to traditional financial statements in order to provide investors and creditors of the company with an opportunity to adequately assess the company’s financial position and prospects for its future development. At the same time, the analysis of the works of Russian and foreign scientists examining the tasks solved in the report on intellectual capital, its composition and structure, their dependence on the company’s industry, its scope and specificity of activities, as well as the impact of the report on the perception of the company users of the report. Recommendations are formulated on the content of the report on intellectual capital, which most closely corresponds to the information needs of users of reporting and determines the favorable perception of the company’s prospects as a whole

Keywords: Intra-industry differentiation; Intellectual capital; Information limitations of traditional financial reporting, information needs of financial statements users; Intellectual capital report; A development strategy of the company

Introduction

To date, the analysis of multiple informational limitations of financial reporting in relation to intangible assets forces us to admit the insufficiency of traditional financial reporting to comprehensively reflect the intangible, intellectual resources of the company. As a result, users of financial statements, including investors and creditors, are deprived of the opportunity to adequately assess the company’s financial position, its solvency, profitability of its assets, investment attractiveness and prospects, which affects the company’s capitalization. Accordingly, in a competitive environment, such a state of affairs with the disclosure of the company’s intellectual resources in its financial statements may adversely affect the company’s sustainable development, especially in an unstable economic environment.

This issue acquires particular relevance in the context of intra-industry competition in an industry that has a fairly long history, when key market players have approximately equal material and technical levels, and it is intellectual capital that is the decisive factor in differentiation. One of the classic examples of such a situation is the industry for the extraction and processing of mineral raw materials. This industry is also characterized by the fact that the need for significant modernization of the production base determines the need for sources of financing, which, accordingly, imposes additional obligations on the company to organize communication with investors and creditors, including through regular reports. At the same time, the lack of information disclosed in traditional financial statements, recognized by both Russian and foreign researchers, requires the submission of additional information to users of the statements about intellectual capital, the volume, structure, the form of presentation of which are the subject of serious scientific discussions.

Purpose of the work

A comprehensive study of theoretical and practical recommendations for the disclosure of information about the intellectual capital of a company that meets the information needs of users of reports and determines their favorable perception of the company’s prospects as a whole.

Methodology

In the course of the research, the methods of comparative, logical analysis, typology and grouping, induction and deduction were used. The research was based on the results of the work of Russian and foreign scientists aimed at developing a concept and tools for reflecting information on intellectual capital in financial statements, which would allow users of the statements to form an adequate idea of the impact of this object on the company’s financial position in the future.

Results and Discussion

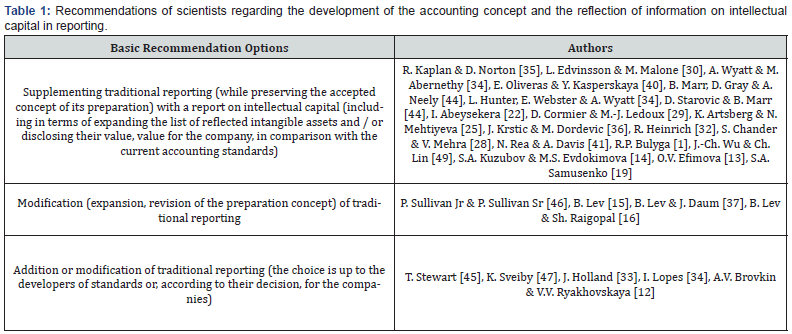

The analysis of the works of Russian and foreign researchers made it possible to perform a brief overview of the recommendations contained in them (Table 1). As can be seen from Table 1, Russian and foreign scientists propose a solution to the issue of incomplete reporting information on intellectual capital by complementing traditional reporting, or by revising the very concept of its preparation. Moreover, in practice, it was the first option that was most widespread. According to R.P. Bulyga, the formation of a special block of external reporting containing information on intellectual capital, is the main direction of modernization of the information coverage of the company’s activities in the UK and Continental Europe [1]. Moreover, it is precisely the lack of traditional reporting in terms of intellectual capital, according to F. Castilla-Polo and M.S. Ruiz-Rodriguez, explains the strategic advantage of voluntary disclosures in supplemental reports as long as the transparency achieved by such disclosures strengthens the reputation with internal and external stakeholders, supports the strategy of industry differentiation, reveals the company’s competitive advantages, increases its economic potential and attractiveness on the capital market [2].

Finally, in an industry with a fairly long history, when the key players in the market have approximately the same material and technical level, and intellectual capital is the decisive factor in differentiation, disclosure of information about it becomes one of the key conditions of intra-industry competition. The mineral extraction and processing industry is a classic example. This industry is traditionally capital-intensive; at the same time, investments in the development of intellectual capital provide companies with the opportunity to adapt in a rapidly changing environment [3,4].

The analysis of the results of empirical studies presented in the scientific literature allows us to conclude that the assessment of intellectual capital in the industry for the extraction and processing of mineral raw materials is carried out by means of: Questioning, assessment of quality indicators. For example, SWOT analysis as a basic assessment for developing a strategy for the formation and increasing the efficiency of using intellectual capital [5].

Quantitative methods. Among them are:

Integral financial estimates. Examples include

a) Tobin’s coefficient (the ratio of the market and book value of the company [4].

b) The index of intellectual capital (the ratio of the company’s market value to the book value of intellectual capital [6].

c) Added value of intellectual capital (total assessment of the efficiency of its elements [4,7,8].

d) The estimated cost of intellectual capital (as a result of the excess of the company’s profitability over the industry average profitability [3].

Assessment of non-financial factors of growth in the value of intellectual capital:

a) Indicators of the elements of intellectual capital [9].

b) A summary indicator that includes the wage fund, research and development costs, residual value of intangible assets, costs per employee [10].

At the same time, the above researchers received confirmation of the hypothesis that the growth of intellectual capital in extractive companies is closely related to the growth of their capitalization. In particular, according to the results of V. Dzenopoljac, obtained on the basis of the analysis of reporting data of oil and gas companies included in the 2016 Forbs global 2000 list for the period from 2000 to 2015, an increase in the estimated cost of intellectual capital by 1 percentage point leads to an increase in the company’s capitalization by 113 -157 million dollars. At the same time, 35% of the formed sample of companies did not disclose information about intellectual capital in general, and 65% of companies disclosed it only partially [3].

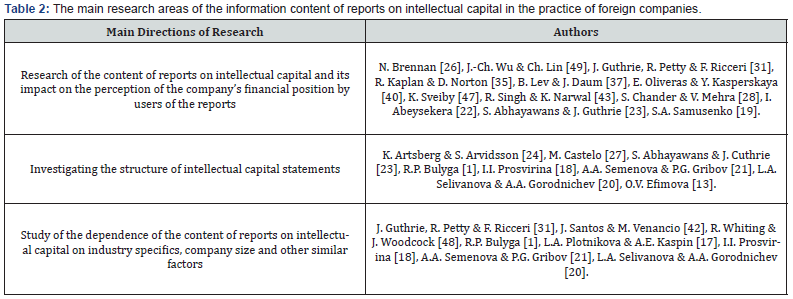

A study of the empirical material on foreign mining companies in general shows that they report less information on intellectual capital compared to other industrial companies, focusing more on external attributes (for example, business associations, priority contracts). Mining companies highly appreciate the importance of intellectual capital but suffer from a deficit of objective assessments and disclosure of information, as well as acceptable systems and structures for intellectual capital management [11]. Today, in practice, there is a constant work on overcoming information limitations in terms of intellectual capital by generating additional reports. Numerous works of foreign researchers are devoted to reviews of options for solving this problem (Table 2) [12-20].

As you can see from the Table 2, not only the structure and content of reports on intellectual capital, their dependence on industry specifics, but also their relationship with the perception of information by users of reports are of research interest [21-40]. The author’s analysis of the main trends prevailing in practice in the formation of reports on intellectual capital made it possible to establish that the optimal disclosure from the position of users of financial statements would be:

a) Information on the goals and strategies of the business, on target indicators of the financial condition and forecasts for their change.

b) Information about the key components of intellectual capital that ensure the development of the strategy, about the available and necessary resources for their effective use, about the potential risks associated with their use.

c) Analysis of sources of formation of intellectual capital, assessment of the independence of the organization in the aspect under consideration.

d) Classification of the components of intellectual capital.

e) Areas of application of intellectual capital (in the context of actual and potential use, ongoing and planned projects, stages of formation of the company’s value, etc.).

f) The efficiency of the use of intellectual capital: actual and expected.

g) Assessment of the components of intellectual capital (considering various options for its use), potential opportunities for their alienation and alternative use.

h) Analysis of market advantages provided by the intellectual property owned by the organization (as a component of intellectual capital).

i) Assessing the expected duration of these benefits, the risks that threaten them, and precautions.

j) Assessment of the required additional investments in intellectual capital and analysis of their effectiveness, etc.

Disclosure of this information seems to be a prerequisite for effective communication with investors and creditors of the company, a key parameter of its intra-industry differentiation, and its competitive advantage in the capital market. At the same time, cluttering up with unnecessary information, which users do not feel the need, entails a decrease in the efficiency and quality of the generated financial statements [41-50].

Conclusion

In general, it should be noted that overcoming the information deficit of traditional reporting in terms of intellectual capital becomes a fundamentally important issue when developing a company’s development strategy, maintaining and increasing its competitive advantages, incl. and within the industry, when assessing its profitability and investment attractiveness. At the same time, the study of theoretical and practical recommendations for disclosing information about the intellectual capital of a company provides an opportunity to create a report that best meets the information needs of users of the reporting and determines a favorable perception of the company’s prospects as a whole.

References

- Bulyga RP (2012) The concept of intellectual capital as a basis for increasing information transparency and reliability of the organization's external reporting. Innovative development of the economy 2(8): 170-176.

- CastillaPoloF, RuizRodriguez MC (2018) Intangible Assets Disclosures in the Olive Oil Differentiation Strategy: A Theoretical Review. Agricultural Research & Technology Open Access Journal. February14(1): 1-8.

- Dzenopoljac V, Muhammed Sh, Janosevic S (2018) Intangibles and performance in oil and gas industry. Management Decision.

- Putri NA, Gumanti TA, Fadah I, Supriyadi A (2017) Do Intellectual Capital, Corporate Social Responsibility, and Good Corporate Governance Affect Indonesia is Mining Companies Value? Accounting and Finance Review 2(2): 57-63.

- Garafieva GI, Avilova VV (2012) The role of swot-analysis in the development of a strategy for the development of intellectual capital (on the example of oil and gas chemical enterprises). Bulletin of Kazan Technological University. 3: 170-175.

- McGuire T, Brenner L (2015) Talent Valuation: Accelerate Market Capitalization Through Your Most Impotent Asset. Pearson Education Limited, Business & Economics p. 240.

- Buallay AM (2017) The relationship between intellectual capital and firm performance. Corporate Governance and Organizational Behavior Review 1(1): 32-41.

- Subaida I, Nurkholis N, Mardiati E (2018) Effect of Intellectual Capital and Intellectual Capital Disclosure on Firm Value. Journal of Applied Management 16(1): 125-135.

- Garanina TA (2010) Intangible assets and intellectual capital: the role in creating the value of the company. Bulletin of St. Petersburg University. 8(2): 78-105.

- Rizun M (2014) Intellectual Capital as a key factor of business processes at mining enterprises. Studia Ekonomiczne T 188: 145-156.

- April KA, Bosma P, Deglon DA (2003) IC measurement and reporting: establishing a practice in SA mining. Journal of Intellectual Capital 4(2): 165-180.

- Brovkin AV, Ryakhovskaya VV (2017) Intellectual capital: assessment, recognition and reflection in financial statements. Economy and Entrepreneurship 6(83): 400-407.

- Efimova OV (2017) Matrix approach to the formation and disclosure of information about resources in integrated reporting. Audit statements 3: 23-34.

- Kuzubov SA, Evdokimova MS (2017) Does the publication of GRI non-financial reports add value to the company? (on the example of the BRICS countries). Accounting. Analysis Audit 2: 28-36.

- Lev B (2009) Intangible assets: management, measurement and reporting. M Quinto-Consulting p. 240.

- Lev B, RaigopalSh (2016) FASB called for the transition to principles.

- Plotnikova LA, Kaspin AE (2006) Intangible assets: an overview of international experience and development prospects. International accounting 4: 30-38.

- Prosvirina II (2006) Intangible assets in financial reporting: problems and solutions. Economic analysis: theory and practice. 1: 26-34.

- Samusenko SA (2017) Accounting for capital as an information basis for compiling integrated reporting. Audit statements. 7: 62-71.

- Selivanova LA, Gorodnichev AA (2010) Enterprise research based on the monitor of intangible assets KE Sweibi. Baltic Economic Journal 4: 165-176.

- Semenova AA, Gribov PG (2011) Problems of forming a report on intellectual capital. Transport business of Russia 10: 56-57.

- Abeysekera I (2007) Intellectual Capital Accounting: Practices in a Developing Country. Routledge p. 224.

- Abhayawans S, Guthrie J (2014) Importance of Intellectual Capital Information: A Study of Australian Analyst Reports. Australian Accounting Review 24(1): 66-83.

- Artsberg K, Arvidsson S (2007) The effect of increasing EU regulation on disclosure practices on intangible assets. Working paper. Swedish Network for European Studies in Economics and Business р. 220.

- Artsberg K, Mehtiyeva N (2010) A literature review on Intangible assets. Critical questions for Standard setters. Working Paper. School of Economics and Management. June. p. 34.

- Brennan N (2001) Reporting intellectual capital in annual reports: evidence from Ireland. Accounting, Auditing and Accountability Journal 14(4): 423-436.

- Castelo M, Delgado C, Manuel S, Sousa C (2010) An analysis of intellectual capital disclosure by Portuguese companies. EuroMed Journal of Business 5(3): 258-278.

- Chander S, Mehra VA (2011) Study on Intangible Assets Disclosure: An Evidence from Indian Companies. Intangible Capital. 7(1): 1-30.

- Cormier D, Ledoux MJ (2010) The Influence of Voluntary Disclosure about Intangible Assets Reported in French Financial Statement: The Role Played by IFRS. Corporate Reporting Chair. p. 36.

- Edvinsson L, Malone MS (1997) Intellectual Capital: The proven way to establish your company’s real value by measuring its hidden brainpower. London: Platkus p. 430.

- Guthrie J, Petty R, Ricceri F (2006) The voluntary reporting of intellectual capital: Comparing evidence from Hong Kong and Australia. Journal of Intellectual Capital 7(2): 254-271.

- Heinrich R (2011) Valuation in Intellectual Property Accounting. UNECE Team of Specialists on Intellectual Property. Bishkek. p. 43.

- Holland J (2001) Financial institutions, intangibles and corporate governance. Accounting, Auditing and Accountability Journal 14(4): 497-529.

- Hunter LC, Webster E, Wyatt A (2005) Measuring Intangible Capital: A Review of Current Practice. Intellectual property Institute of Australia Working Paper 15(36): 4-21.

- Kaplan RS, Norton DP (1992) The Balanced Scorecard: Measures that Drive Performance. Harvard Business Review 70(1): 71-79.

- Krstic J, Dordevic M (2010) Financial Reporting on Intangible Assets - Scope and Limitations. Facta Universitatis. Series: Economics and Organization 7(3): 335-348.

- Lev B, Daum JH (2004) The dominance of Intangible Assets: consequences for enterprise management and corporate reporting. Measuring Business Excellence 8(1): 6-17.

- Lopes IT (2011) The Boundaries of Intellectual Property Valuation: Cost, Market, Income Based Approaches and Innovation Turnover. Intellectual Economics 1(9): 99-116.

- Marr B, Gray D, Neely A (2003) Why Do Firms Measure their Intellectual Capital? Journal of Intellectual Capital 4: 441-464.

- Oliveras E, Kasperskaya Y (2003) Reporting Intellectual Capital in Spain. Working Paper. UniversitatPompueFabra p. 21.

- Rea N, Davis A (2012) Intangible assets: what are they worth and how should that value be communicated.

- Santos JC, Venancio MT (2013) Intellectual Capital: Information Disclosure Practices by Portuguese Companies. RevistaUniversoContábil 9(2): 174-194.

- Singh RD, Narwal KP (2015) Intellectual capital and its consequences on company performance: a study of Indian sectors. International Journal of Learning and Intellectual Capital 12(3): 300-322.

- Starovic D, Marr B (2005) Understanding Corporate Value: Managing and Reporting Intellectual Capital. Chartered Institute of Management Accountants. Cranfield University. School of Management p. 28.

- Stewart TA (1997) Intellectual Capital: The New Wealth of Organizations. Doubleday. Currency, New York p. 125.

- Sullivan PH, Sullivan PH (2000) Valuing intangible companies. An intellectual capital approach. Journal of Intellectual Capital 1(4): 328-340.

- Sveiby KE (1997) The New Organizational Wealth: Managing and Measuring Knowledge-Based Assets. San Francsico: Berrett-Koehler pp. 123-148.

- Whiting RH, Woodcock J (2011) Firm characteristics and intellectual capital disclosure by Australian companies. Journal of Human Resource Costing & Accounting 15(2): 102-126.

- Wu JCh, Lin Ch (2013) A Balance Sheet for Knowledge Evaluation and Reporting. Management, Knowledge and Learning. International Conference June. Zadav, Croatia pp: 341-348.

- Wyatt A, Abernethy MA (2003) Framework for Measurement and Reporting on Intangible Assets. Working Paper. Intellectual Property Research Institute of Australia Melbourne 12(3): 36.