Revolution of Applied Fiscal System and Its Impact on Foreign Investment in Oil and Gas Sector in Indonesia

R Atasi1 and I Angela2*

1Department of Geological Engineering, Bandung Institute of Technology, Indonesia

2Department of Metallurgy and Materials Engineering, University of Indonesia, Indonesia

Submission: December 16, 2019; Published: January 09, 2020

*Corresponding author: I Angela, Department of Metallurgy and Materials Engineering, University of Indonesia, Indonesia

How to cite this article: R Atasi, I Angela.Revolution of Applied Fiscal System and Its Impact on Foreign Investment in Oil and Gas Sector in Indonesia.Insights Min Sci technol.2020; 1(5): 555574. DOI:10.19080/IMST.2020.01.555574

Keywords: Oil and gas; Fiscal; Economy; Production Sharing Contract; Cost recovery; Gross split

Introduction

Indonesia has long adapted the contracting scenario for petroleum cooperation contracts involving international oil and gas companies as the second party to participate in oil and gas production through production sharing contract (PSC) scenario since it was first introduced in 1966. PSC is very popular amidst countries with less reservoirs and is adapted in Ecuador, Equatorial Guinea, India, Algeria, and other countries [1]. In this scenario, gross revenue made once oilfield is put into production is preliminarily cut by 20 % for First Tranche Petroleum (FTP) furthermore subtracted by the operational cost. The remaining balance is referred as equity to be split (ETS) which then will be divided between the oil and gas company and the host government by the ratio stipulated in the contract [2]. Indonesia applied 70-30 and 85-15 ratio (state-to-contractor) for revenue resulted from gas and oil production, respectively. All profit gained by the oil and gas companies is furthermore subject to 10 % income tax as governed in the applicable law.

On January 16, 2017, Indonesia implemented a novel Gross Split PSC model in which gross production is to be split between the state and contractors, without a mechanism for the contractors to recover operating costs. The base split for the state-to-contractor is 57-43 and 52-48 for oil and gas, respectively [3]. It is important to emphasize that in this mechanism, the operational capital as well as production risk are all to be contractors’ responsibility. However, oil and gas industry in Indonesia undergoes a significant setback due to maturity of the basin which results in declining contribution to national income as observed during 2014-present. Big names of the upstream industry such as Total E&P and Vico that have operated for more than 40 years in Indonesia have terminated their contract during 2017-2018 in relevance to the higher risk-higher cost scenario which they assume will result from the new fiscal framework combined with the mature – less commercially attractive – marginal fields. This trend is continued by Chevron (to stop their operation in 2020) and British Petroleum, and possibly other contractors currently operating in Indonesia. The displayed cases allow us to hypothesize that the Gross Split PSC offered by the host government is not favored by international operators which will be discussed further.

Discussion

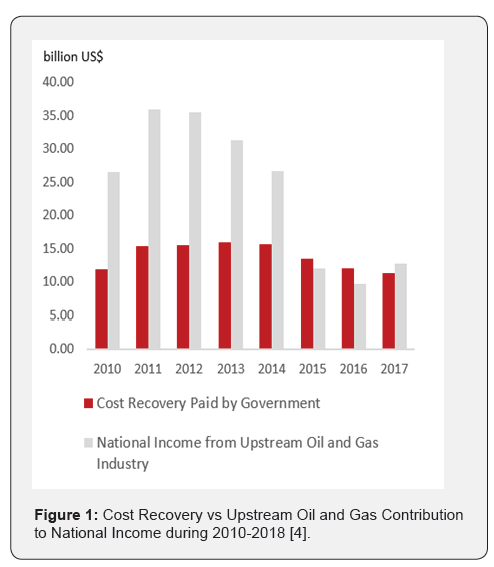

Figure 1 [4] shows the cost recovery payment made by the Indonesian government and the national income from upstream oil and gas sector during 2010-2017. Though being profound for its popularity in both Indonesia and other major oil producing country such as Egypt and Iran, a notable disproportion between sum of cost recovery to be paid by the government and the net national income from upstream oil and gas industry was observed during 2015-2017. The decline in production and global oil price altogether explain government’s inability to compensate the cost recovery payment. This may be one of many reasons for the sudden establishment of Gross Split PSC model aside from the country’s socio-political issue. The Gross Split PSC model was first proposed to eliminate skepticism on the traditional PSC (one involving cost recovery mechanism) which was thought to be misused for money laundering and other illegal practices in Indonesia as found revolving in the media.

Should no major discoveries be made, Indonesia’s oil and gas production will continue to decline, with predicted production level of just 480,000 bbld by 2020 [5]. This unpromising commercial future and the increasing revenue cutoff through tax (as resulted from the application of Gross Split PSC scenario) followed by the relatively ‘high cost’ environment for oil and gas production in Indonesia compared to other jurisdictions, cause international oil companies to withdraw from operating in Indonesia. Pertamina, the national oil and gas company of Indonesia is then responsible for undertaking the responsibility of sustaining the operation. This will not only result in additional adjustment cost but also reduced investment.

While industrial reaction towards the application of the new fiscal model is tending to a negative sentiment, the Gross Split PSC is equipped with variable (technical variables e.g. location, depth, reservoir type, H2S and CO2 content, and compliance to local content requirements) and progressive (the level of Indonesian Crude Price and gas price, and cumulative oil and gas production) components which are expected to be modified accordingly to increase foreign interest and regain investment from international oil companies. These components are the determining factor to cause nominal shift of the base split between government and contractor, with a maximum of 5 % under conventional circumstances.

References

- Dongkun L, Na Y (2010) Assessment of fiscal terms of international petroleum contracts. Petrol Explor Develop 37(6): 756-762.

- Dankwa K, Ishmael A (2014) The optimal petroleum fiscal regime for Ghana: An analysis of available alternatives. Int J for Energy and Policy 4(3): 400-410.

- Jones D (2017) Indonesia’s New Gross Split Production Sharing Contracts for the Oil & Gas Industry. Jones Day Commentary Publication.

- Center of Statistics of Republic of Indonesia.

- Roach B, Dunstan A (2018) The Indonesian PSC: the end of an era. J World Energy Law and Business 11: 116-135.